Preferred Dividends On Balance Sheet

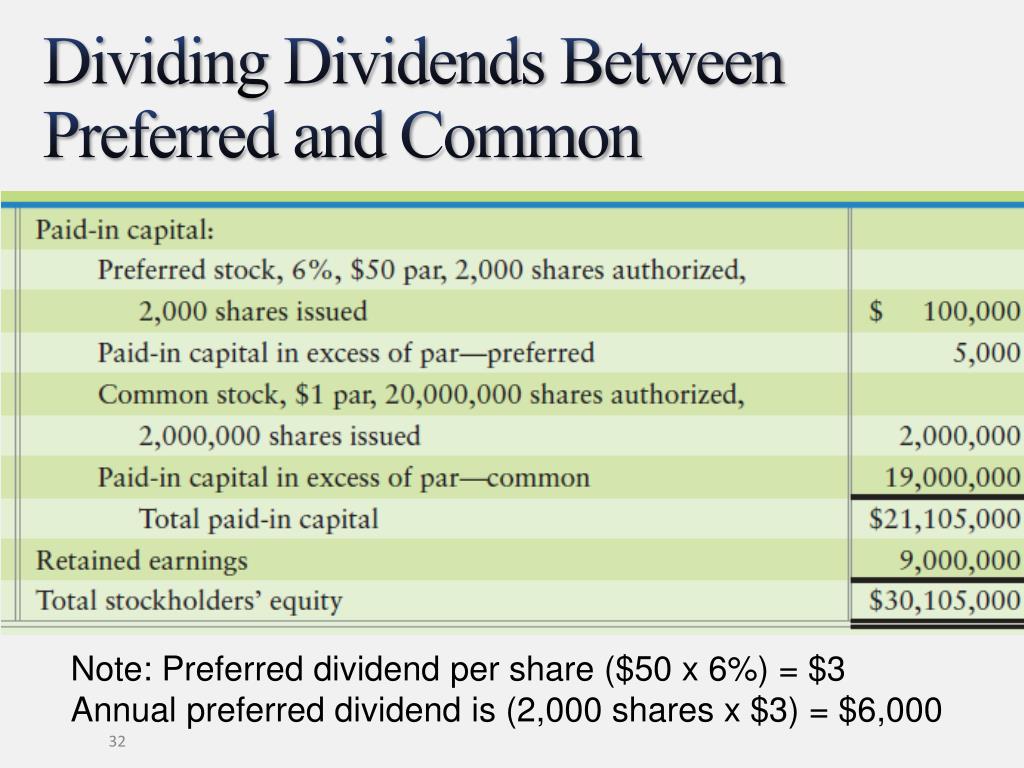

Preferred Dividends On Balance Sheet - Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share. If a company is unable to pay all dividends, claims to preferred dividends take. Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. The cash flow statement would show $9 million in dividends distributed. The preferred stock pays a fixed percentage of. As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in. Read more by the company to raise capital in the primary and secondary markets. For example, a 4 percent dividend on preferred stock with. Web they are recorded as owner's equity on the company's balance sheet. Web the income statement would show $10 million, and the balance sheet would show $1 million.

Web they are recorded as owner's equity on the company's balance sheet. Web the income statement would show $10 million, and the balance sheet would show $1 million. Web a preferred dividend is a dividend that is allocated to and paid on a company's preferred shares. The cash flow statement would show $9 million in dividends distributed. As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in. Read more by the company to raise capital in the primary and secondary markets. The preferred stock pays a fixed percentage of. Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share. If a company is unable to pay all dividends, claims to preferred dividends take.

For example, a 4 percent dividend on preferred stock with. If a company is unable to pay all dividends, claims to preferred dividends take. As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in. Read more by the company to raise capital in the primary and secondary markets. Web the income statement would show $10 million, and the balance sheet would show $1 million. Web a preferred dividend is a dividend that is allocated to and paid on a company's preferred shares. Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share. The preferred stock pays a fixed percentage of. The cash flow statement would show $9 million in dividends distributed.

Solved HEADLAND CORPORATION POSTCLOSING TRIAL BALANCE

Web they are recorded as owner's equity on the company's balance sheet. For example, a 4 percent dividend on preferred stock with. As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in. The cash flow statement would show $9 million in dividends distributed. The preferred stock pays a fixed percentage of.

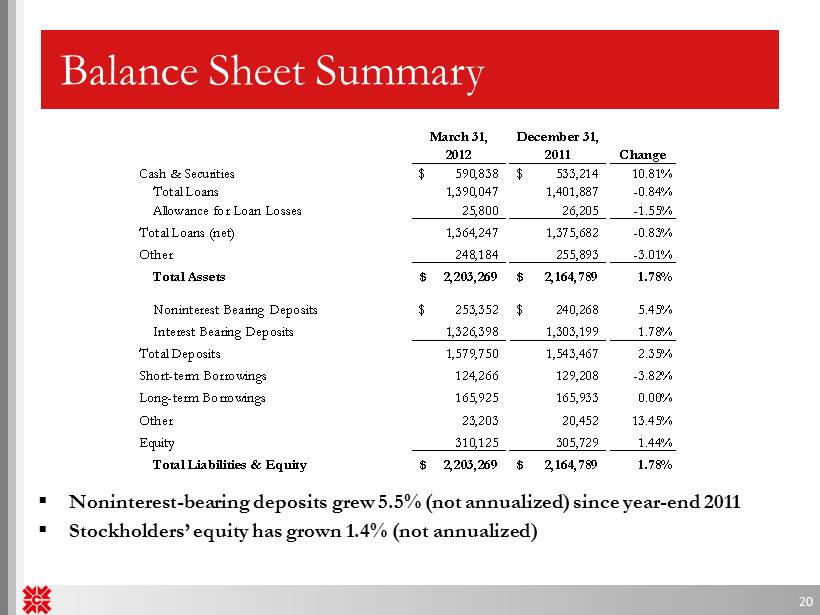

balance sheet example dividends DriverLayer Search Engine

Web the income statement would show $10 million, and the balance sheet would show $1 million. Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share. Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid.

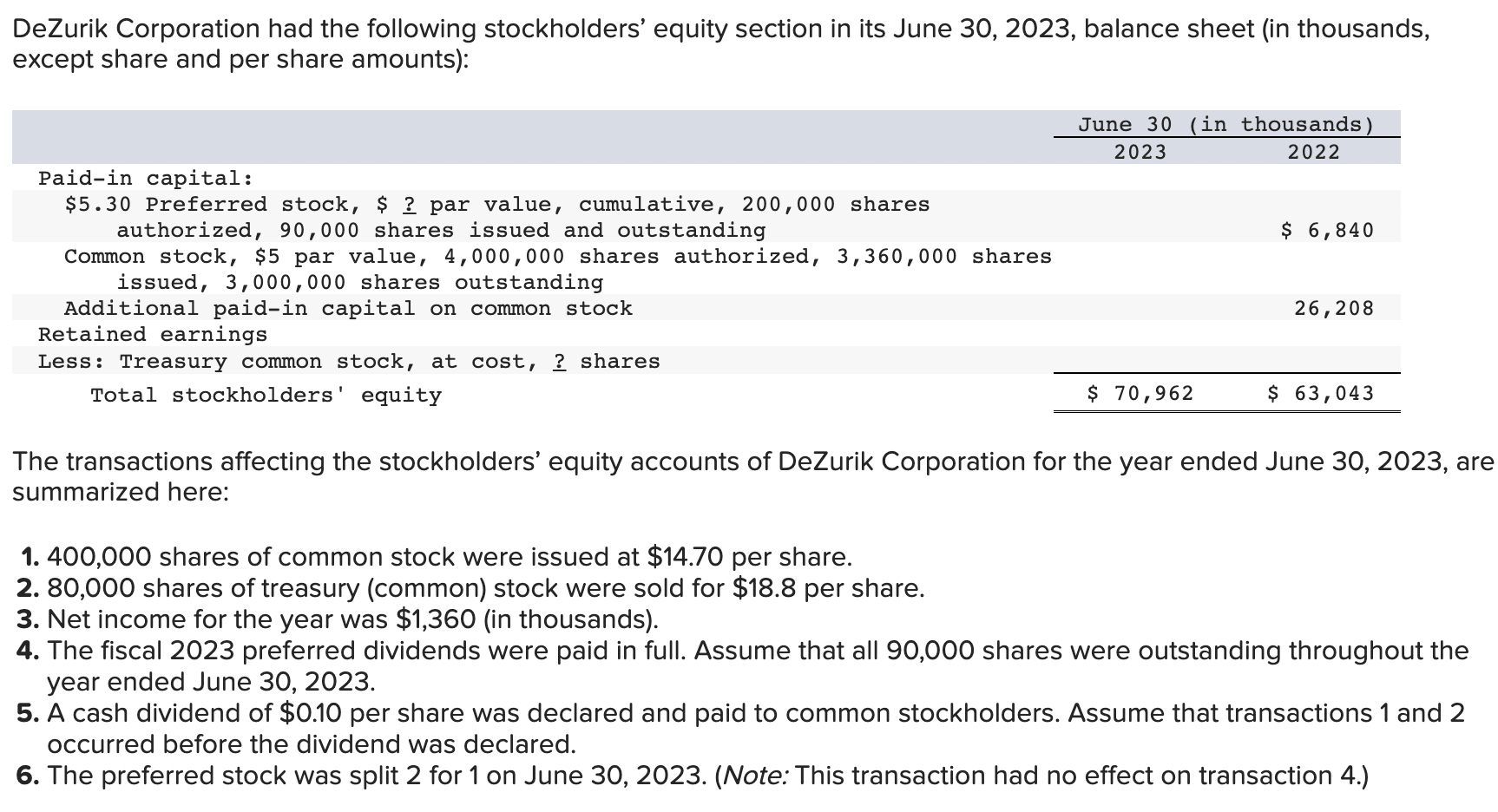

Solved DeZurik Corporation had the following stockholders’

Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. Web the income statement would show $10 million, and the balance sheet would show $1 million. The cash flow statement would show $9 million in dividends distributed. Web they are recorded as owner's equity on the company's balance sheet. For example, a.

What is share capital BDC.ca

Web the income statement would show $10 million, and the balance sheet would show $1 million. For example, a 4 percent dividend on preferred stock with. Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. The preferred stock pays a fixed percentage of. Web multiply the percentage (if no dollar value.

the balance sheet for tactex controls inc provincially incorporated in

For example, a 4 percent dividend on preferred stock with. Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. Web a preferred dividend is a dividend that is allocated to and paid on a company's preferred shares. The cash flow statement would show $9 million in dividends distributed. As a result,.

Dividend Recap LBO Tutorial With Excel Examples

If a company is unable to pay all dividends, claims to preferred dividends take. As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in. Web a preferred dividend is a dividend that is allocated to and paid on a company's preferred shares. Read more by the company to raise capital in the primary and.

2 Tandy Company was issued a charter by the state of Indiana on January

Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share. The cash flow statement would show $9 million in dividends distributed. Read more by the company to raise capital in the primary and secondary markets. Web the income statement would show $10.

Cost of Preferred Stock (kp) Formula + Calculator

If a company is unable to pay all dividends, claims to preferred dividends take. The cash flow statement would show $9 million in dividends distributed. For example, a 4 percent dividend on preferred stock with. Read more by the company to raise capital in the primary and secondary markets. Web the total value of the dividend is $0.50 x 500,000,.

Dividend Recap LBO Tutorial With Excel Examples

Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. The cash flow statement would show $9 million in dividends distributed. For example, a 4 percent dividend on preferred stock with. Web the income statement would show $10 million, and the balance sheet would show $1 million. Web they are recorded as.

Eligible Dividends

If a company is unable to pay all dividends, claims to preferred dividends take. Web the income statement would show $10 million, and the balance sheet would show $1 million. Read more by the company to raise capital in the primary and secondary markets. Web they are recorded as owner's equity on the company's balance sheet. For example, a 4.

Web The Total Value Of The Dividend Is $0.50 X 500,000, Or $250,000, To Be Paid To Shareholders.

The cash flow statement would show $9 million in dividends distributed. Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share. As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in. Web a preferred dividend is a dividend that is allocated to and paid on a company's preferred shares.

Web The Income Statement Would Show $10 Million, And The Balance Sheet Would Show $1 Million.

If a company is unable to pay all dividends, claims to preferred dividends take. For example, a 4 percent dividend on preferred stock with. The preferred stock pays a fixed percentage of. Read more by the company to raise capital in the primary and secondary markets.