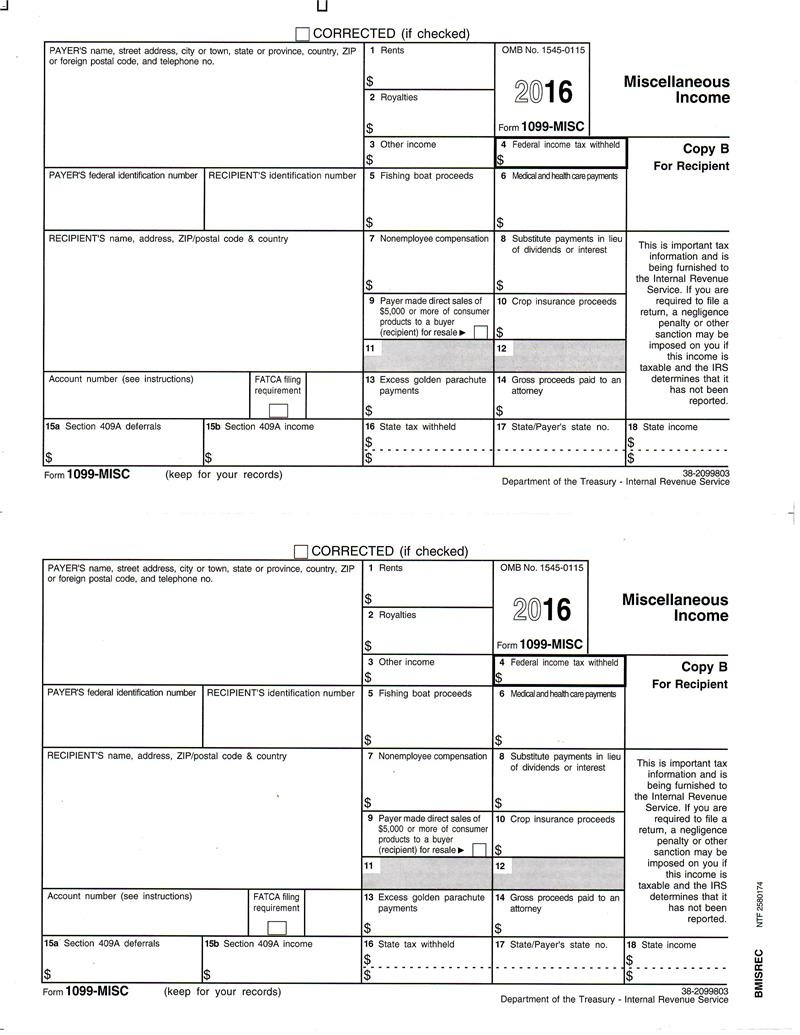

Printable 1099 Misc Forms

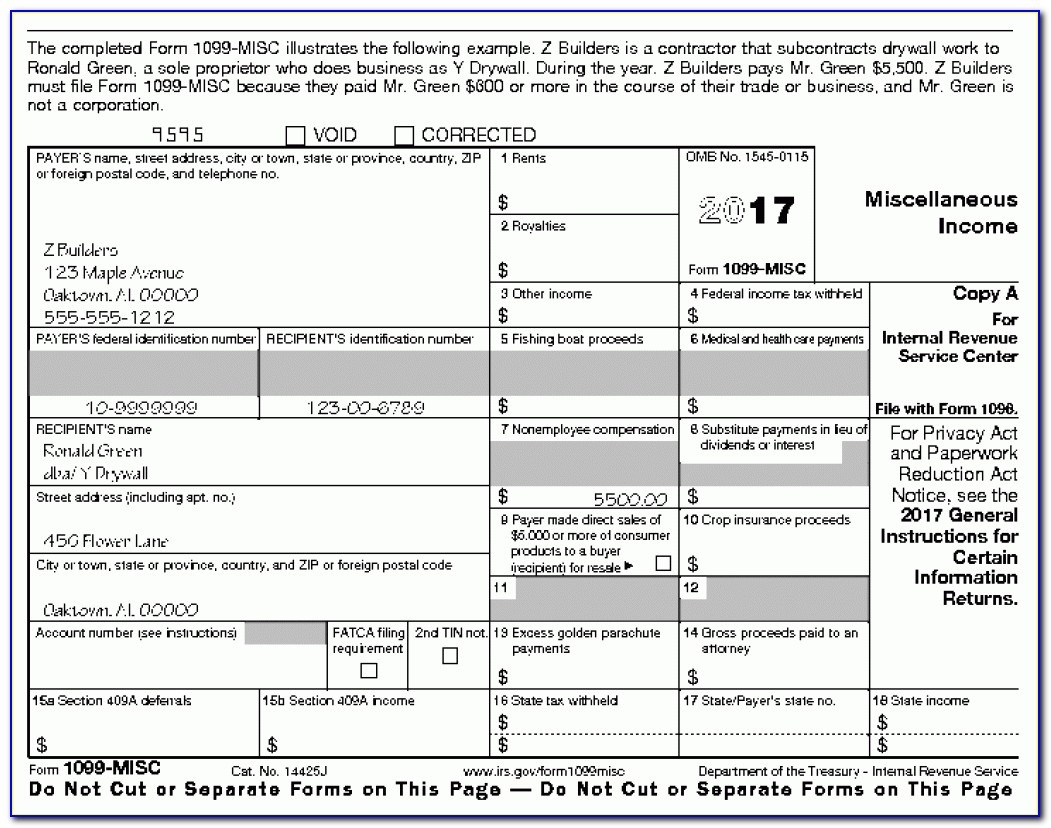

Printable 1099 Misc Forms - An amount shown in box 2a may be taxable earnings on an excess contribution. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Web copy 1 for state tax department www.irs.gov/form1099misc (if checked) copy b for recipient this is important tax information and is being furnished to the irs. Medical and health care payments. For distributions from a roth ira, generally the payer isn’t required to compute the taxable amount. Cash paid from a notional principal contract made to an individual, partnership, or. You must compute any taxable amount on form 8606. The second deadline is for filing 1099s with the irs. Web instructions for recipient recipient’s taxpayer identification number (tin). Web the first is that the recipient must receive the statement by january 31;

If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Web copy 1 for state tax department www.irs.gov/form1099misc (if checked) copy b for recipient this is important tax information and is being furnished to the irs. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). An amount shown in box 2a may be taxable earnings on an excess contribution. Cash paid from a notional principal contract made to an individual, partnership, or. Web instructions for recipient recipient’s taxpayer identification number (tin). Web the first is that the recipient must receive the statement by january 31; You must compute any taxable amount on form 8606. The second deadline is for filing 1099s with the irs. Penalties may apply if the form is postmarked after that date.

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). An amount shown in box 2a may be taxable earnings on an excess contribution. Cash paid from a notional principal contract made to an individual, partnership, or. Medical and health care payments. Penalties may apply if the form is postmarked after that date. Web instructions for recipient recipient’s taxpayer identification number (tin). Both the forms and instructions will be updated as needed. Web the first is that the recipient must receive the statement by january 31; Web copy 1 for state tax department www.irs.gov/form1099misc (if checked) copy b for recipient this is important tax information and is being furnished to the irs.

Form 1099MISC for independent consultants (6 step guide)

Cash paid from a notional principal contract made to an individual, partnership, or. Medical and health care payments. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Penalties may apply if the form is postmarked after that date. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification.

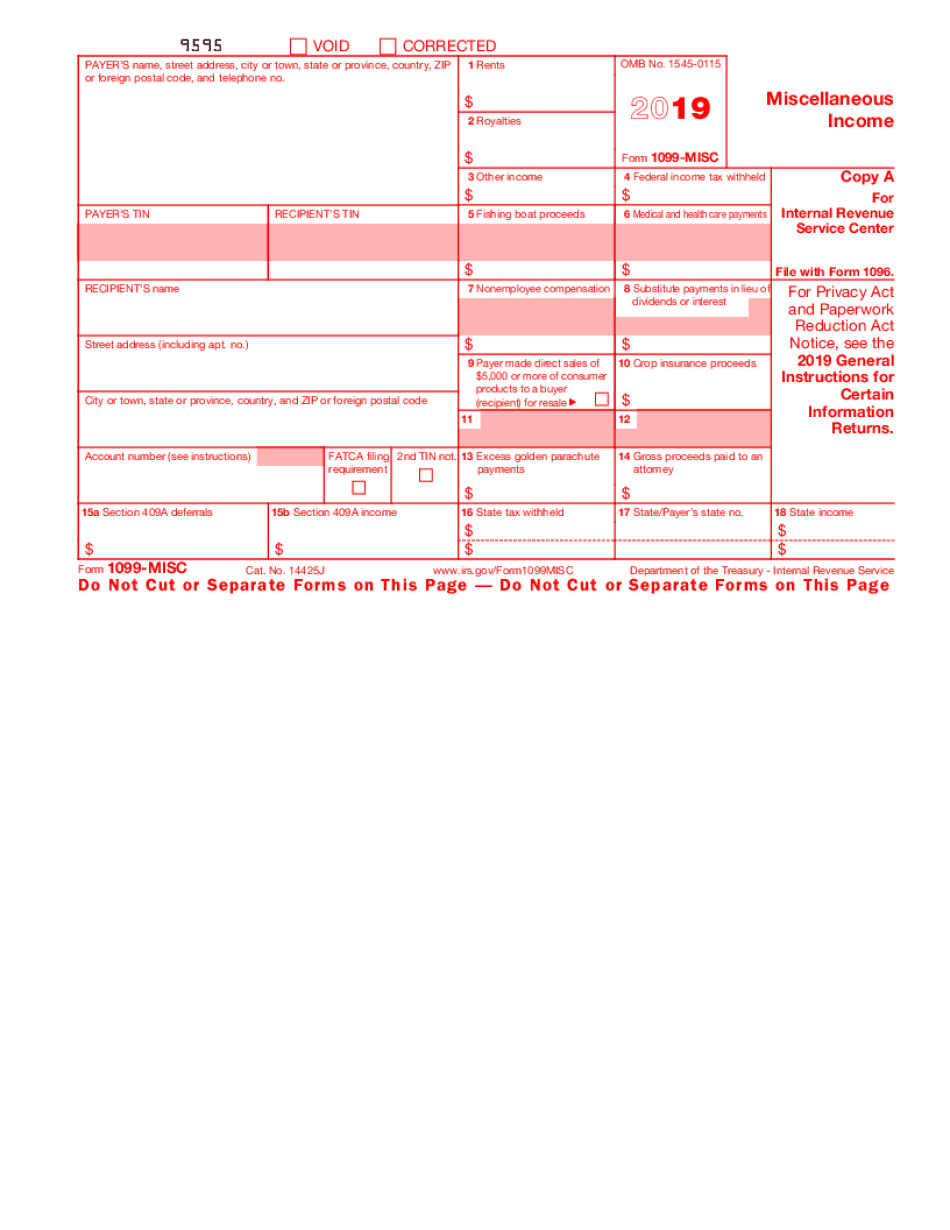

11 Common Misconceptions About Irs Form 11 Form Information Free

Both the forms and instructions will be updated as needed. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Web instructions for recipient recipient’s taxpayer identification.

1099MISC 3Part Continuous 1" Wide Formstax

Web instructions for recipient recipient’s taxpayer identification number (tin). Web copy 1 for state tax department www.irs.gov/form1099misc (if checked) copy b for recipient this is important tax information and is being furnished to the irs. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer.

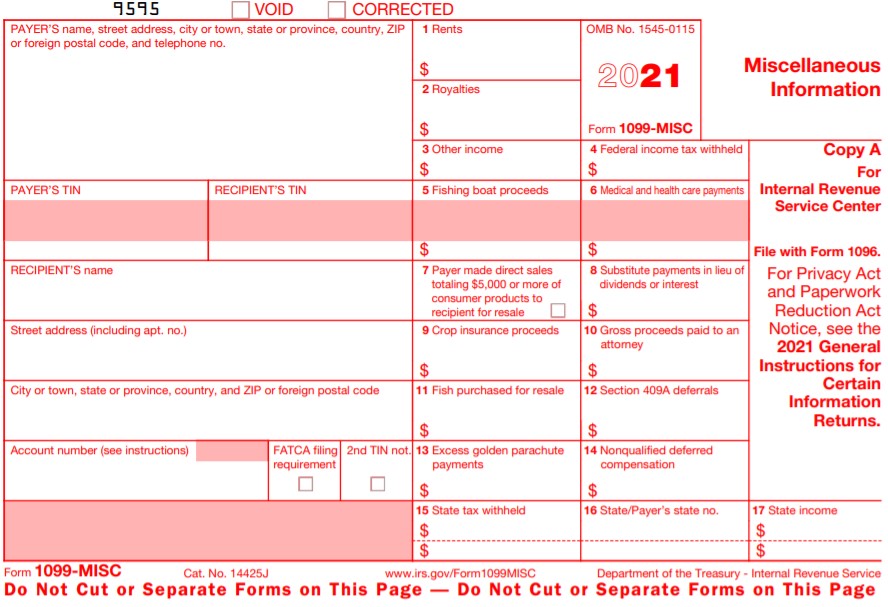

1099MISC Form Printable and Fillable PDF Template

The second deadline is for filing 1099s with the irs. Cash paid from a notional principal contract made to an individual, partnership, or. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Penalties may apply.

Free Printable 1099 Misc Forms Free Printable

Web instructions for recipient recipient’s taxpayer identification number (tin). An amount shown in box 2a may be taxable earnings on an excess contribution. You must compute any taxable amount on form 8606. For distributions from a roth ira, generally the payer isn’t required to compute the taxable amount. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

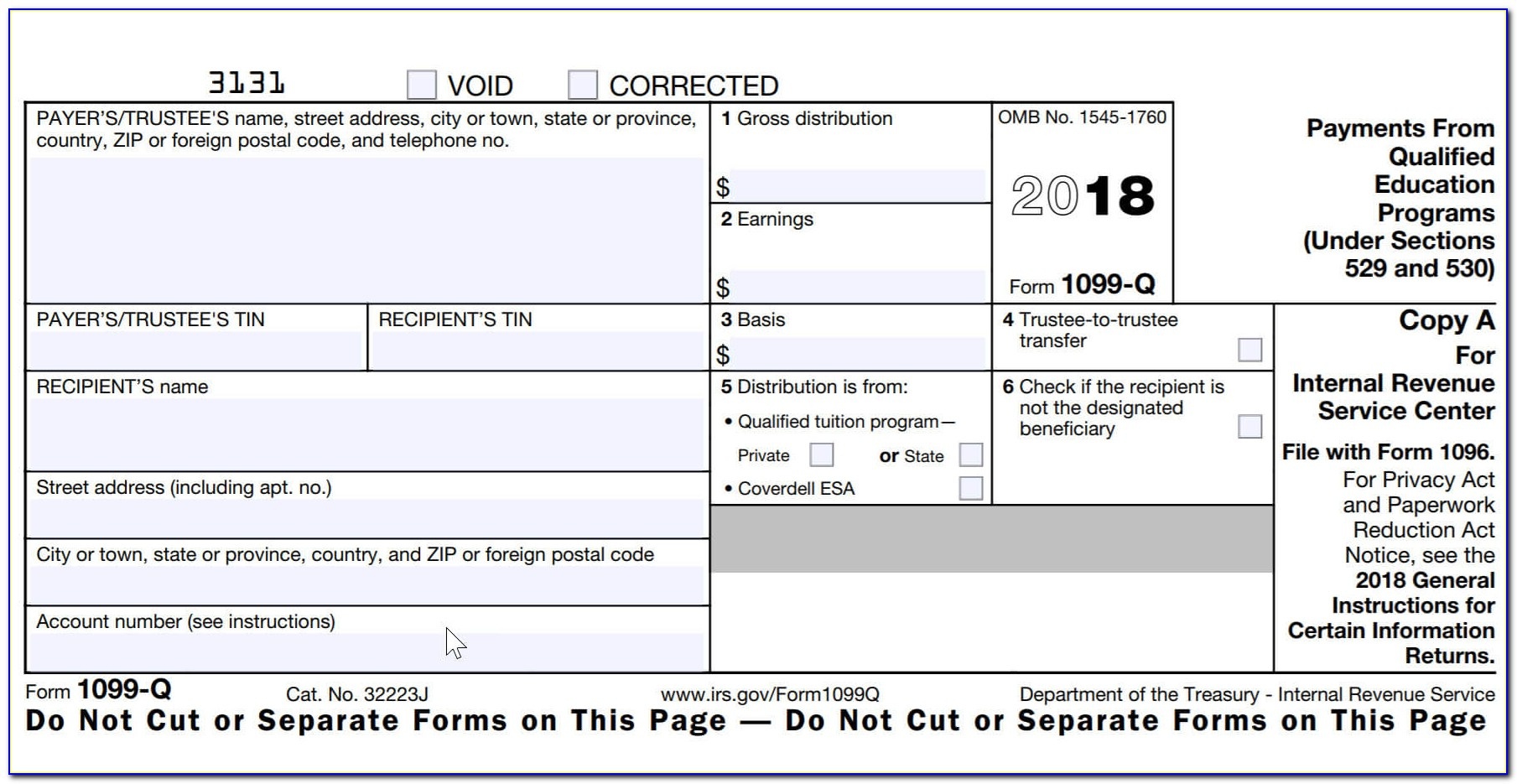

EFile 1099 File Form 1099 Online Form 1099 for 2020

Penalties may apply if the form is postmarked after that date. Web the first is that the recipient must receive the statement by january 31; The second deadline is for filing 1099s with the irs. Medical and health care payments. An amount shown in box 2a may be taxable earnings on an excess contribution.

11 Common Misconceptions About Irs Form 11 Form Information Free

Penalties may apply if the form is postmarked after that date. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Web copy 1 for state tax department www.irs.gov/form1099misc (if checked) copy b for recipient this.

Free Printable 1099 Misc Forms Free Printable

If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Penalties may apply if the form is postmarked after that date. The second deadline is for filing 1099s with the irs. Cash paid from a notional.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Medical and health care payments. For distributions from a roth ira, generally the payer isn’t required to compute the taxable amount. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. You must compute any taxable.

Where To Get Official 1099 Misc Forms Universal Network

Web the first is that the recipient must receive the statement by january 31; The second deadline is for filing 1099s with the irs. Web copy 1 for state tax department www.irs.gov/form1099misc (if checked) copy b for recipient this is important tax information and is being furnished to the irs. For your protection, this form may show only the last.

Both The Forms And Instructions Will Be Updated As Needed.

Medical and health care payments. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Web copy 1 for state tax department www.irs.gov/form1099misc (if checked) copy b for recipient this is important tax information and is being furnished to the irs. Web the first is that the recipient must receive the statement by january 31;

You Must Compute Any Taxable Amount On Form 8606.

Cash paid from a notional principal contract made to an individual, partnership, or. An amount shown in box 2a may be taxable earnings on an excess contribution. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. For distributions from a roth ira, generally the payer isn’t required to compute the taxable amount.

Penalties May Apply If The Form Is Postmarked After That Date.

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. The second deadline is for filing 1099s with the irs. Web instructions for recipient recipient’s taxpayer identification number (tin).