Printable 2290 Form

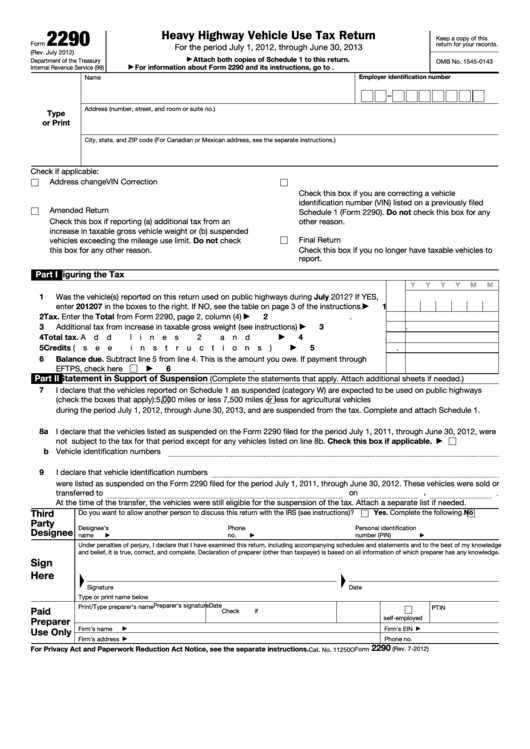

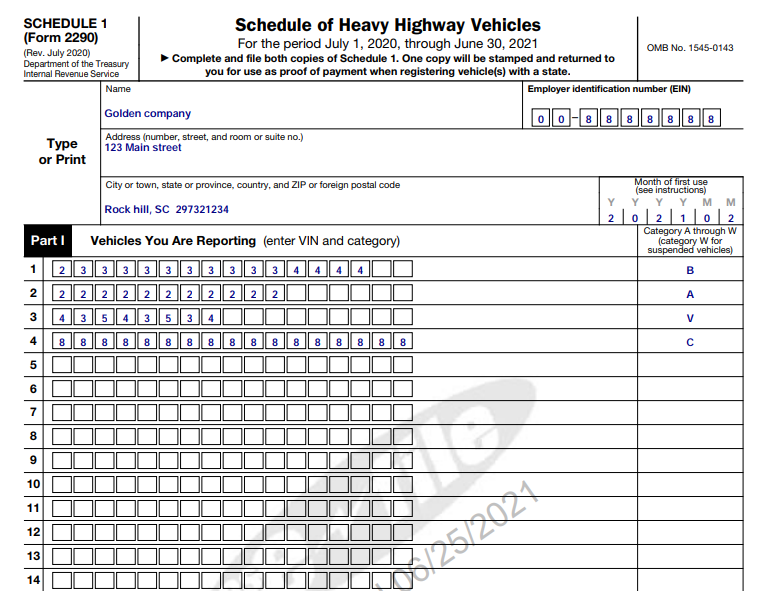

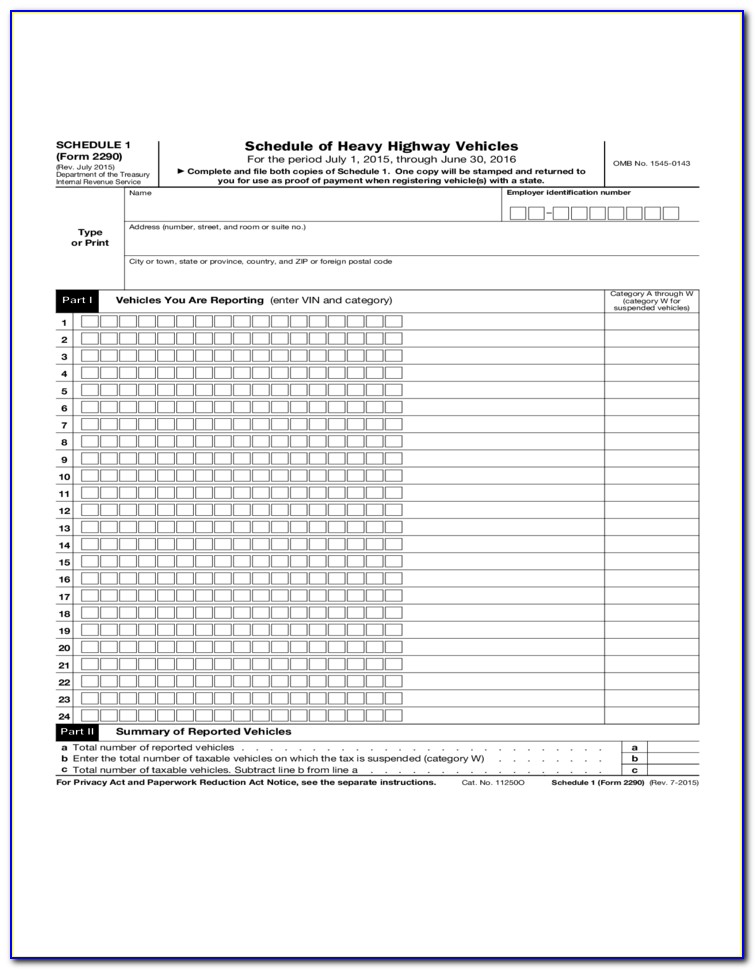

Printable 2290 Form - Web form 2290, heavy highway vehicle use tax return, is generally used by those who own or operate a highway motor vehicle with a taxable gross weight of 55,000 pounds or more. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. A highway motor vehicle for use tax purposes is defined inside the instructions booklet. Once your return is accepted by the irs, your stamped schedule 1 can be available within minutes. Review and transmit the form directly to the irs; It takes only a few minutes to file and download your form 2290 with expressefile. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. To obtain a prior revision of form 2290 and its separate instructions, visit. Web here’s how to download the printable form 2290: See when to file form 2290 for more details.

July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022. July 2017) for the tax period beginning on july 1, 2017, and ending on june 30, 2018. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Get irs stamped schedule 1 in minutes; Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. Web you must file this form 2290 (rev. Download or print 2290 for your records; Keep a copy of this return for your records. For instructions and the latest information. See when to file form 2290 for more details.

A highway motor vehicle for use tax purposes is defined inside the instructions booklet. Web you must file this form 2290 (rev. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web form 2290, heavy highway vehicle use tax return, is generally used by those who own or operate a highway motor vehicle with a taxable gross weight of 55,000 pounds or more. See when to file form 2290 for more details. Download or print 2290 for your records; Web here’s how to download the printable form 2290: Once your return is accepted by the irs, your stamped schedule 1 can be available within minutes. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use.

Printable IRS Form 2290 for 2020 Download 2290 Form

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. Use this revision if you need to file a return for a tax period that began on or before june.

Ssurvivor 2290 Form 2020 Printable

July 2017) for the tax period beginning on july 1, 2017, and ending on june 30, 2018. Keep a copy of this return for your records. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Web information.

form 2290 20182022 Fill Online, Printable, Fillable Blank

Get irs stamped schedule 1 in minutes; Keep a copy of this return for your records. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. See when to file form 2290 for more details. Web you must file this form 2290 (rev.

Fillable Form 2290 Heavy Highway Vehicle Use Tax Return printable pdf

July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022. Web the 2290 tax form printable is essential for reporting the federal excise tax imposed on heavy highway vehicles, ensuring the appropriate taxes amount is paid and the vehicle is legally registered. Everyone must.

Download Form 2290 for Free Page 3 FormTemplate

Keep a copy of this return for your records. Download or print 2290 for your records; Web the 2290 tax form printable is essential for reporting the federal excise tax imposed on heavy highway vehicles, ensuring the appropriate taxes amount is paid and the vehicle is legally registered. Attach both copies of schedule 1 to this return. Everyone must complete.

Instructions For Form 2290 For 2018 Form Resume Examples djVaq1nVJk

Attach both copies of schedule 1 to this return. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Keep a copy of this return for your records. Get irs.

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Web the 2290 tax form printable is essential for reporting the federal excise tax imposed on heavy highway vehicles, ensuring the appropriate taxes amount is paid and the.

IRS Form 2290 Printable for 202122 Download 2290 for 6.90

Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. July 2017) for the tax period beginning on july 1, 2017, and ending on june 30, 2018. Review and transmit the form directly to the irs; Web form.

Printable Form 2290 For 2020 Master of Document Templates

Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. Use this revision if you need to file a return for a tax period that began on or before june 30, 2017. Review and transmit the form directly to the irs; See when to file form 2290 for more details. July 2017).

Printable 2290 Form 2017 Irs Form 4506 T Beautiful Irs Form 4506 Image

To obtain a prior revision of form 2290 and its separate instructions, visit. July 2017) for the tax period beginning on july 1, 2017, and ending on june 30, 2018. Once your return is accepted by the irs, your stamped schedule 1 can be available within minutes. Form 2290 is used to figure and pay the tax due on certain.

Web The 2290 Tax Form Printable Is Essential For Reporting The Federal Excise Tax Imposed On Heavy Highway Vehicles, Ensuring The Appropriate Taxes Amount Is Paid And The Vehicle Is Legally Registered.

Once your return is accepted by the irs, your stamped schedule 1 can be available within minutes. See when to file form 2290 for more details. Download or print 2290 for your records; Attach both copies of schedule 1 to this return.

To Obtain A Prior Revision Of Form 2290 And Its Separate Instructions, Visit.

Web you must file this form 2290 (rev. A highway motor vehicle for use tax purposes is defined inside the instructions booklet. Web form 2290, heavy highway vehicle use tax return, is generally used by those who own or operate a highway motor vehicle with a taxable gross weight of 55,000 pounds or more. Get irs stamped schedule 1 in minutes;

Form 2290 Is Used To Figure And Pay The Tax Due On Certain Heavy Highway Motor Vehicles.

For instructions and the latest information. Review and transmit the form directly to the irs; Keep a copy of this return for your records. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022.

It Takes Only A Few Minutes To File And Download Your Form 2290 With Expressefile.

Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Web here’s how to download the printable form 2290: The blank template can be downloaded in a pdf format, making it easily accessible and simple to complete. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1.