Printable W9 2023

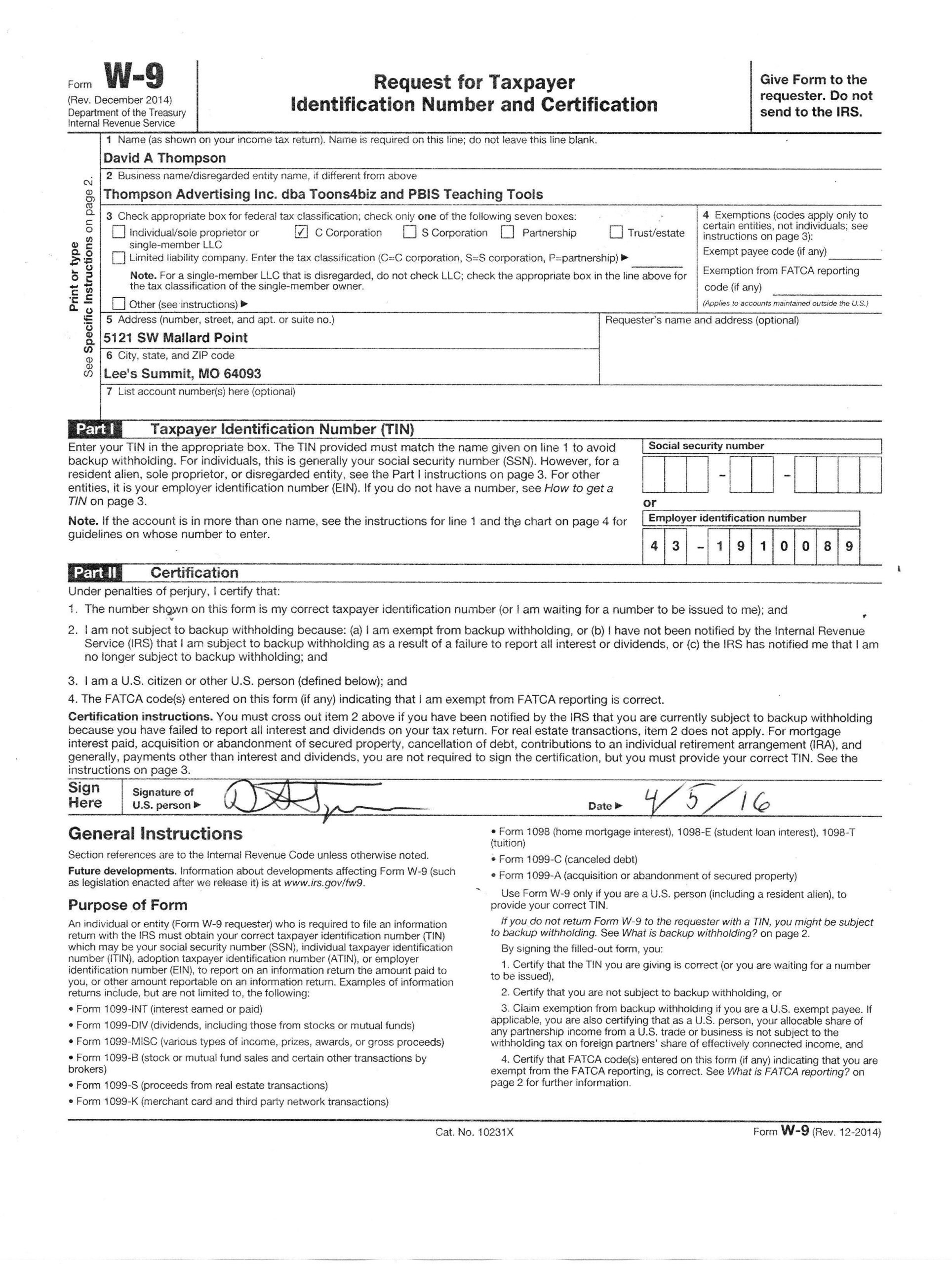

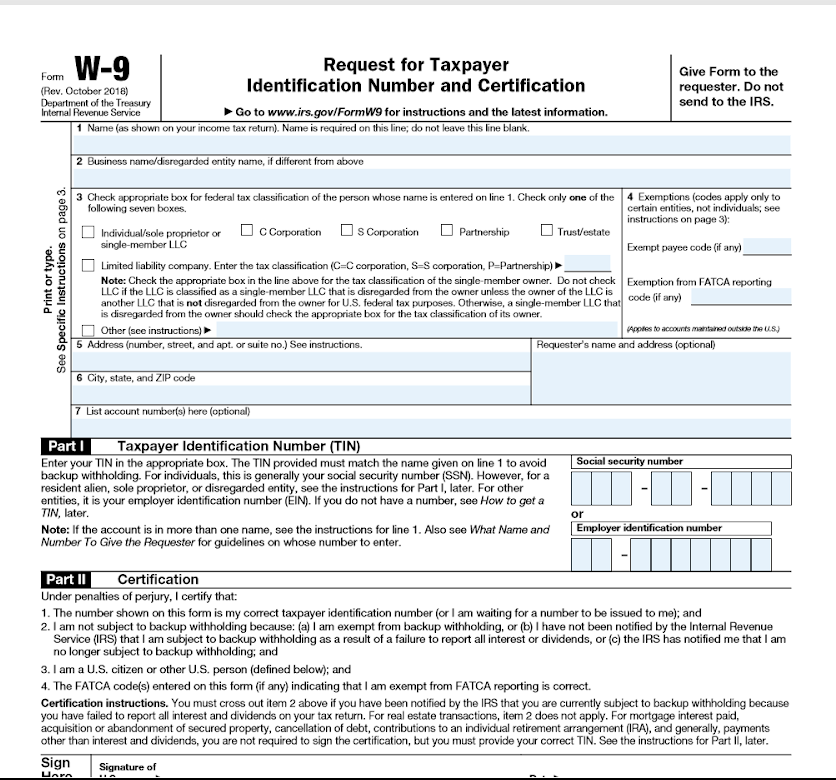

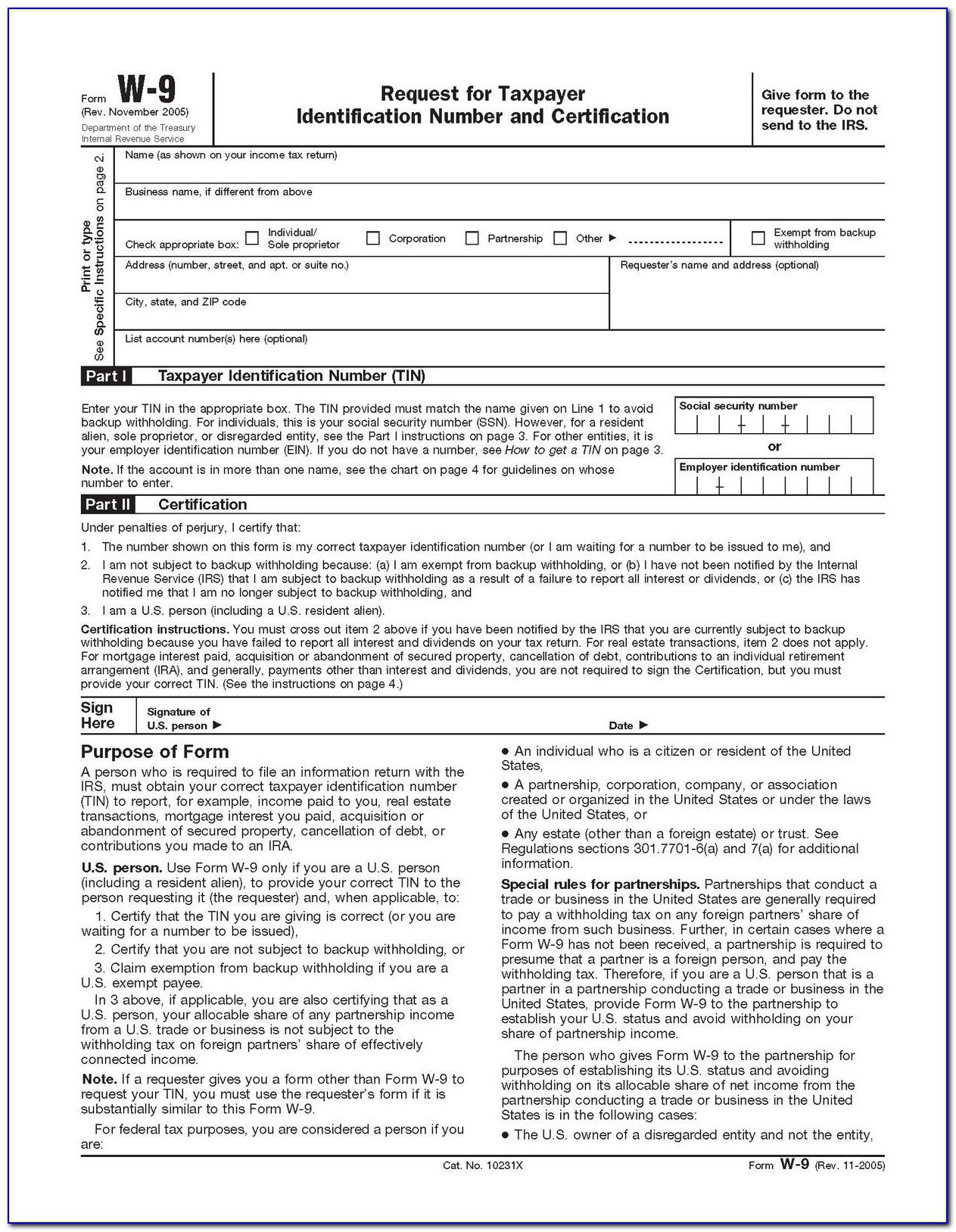

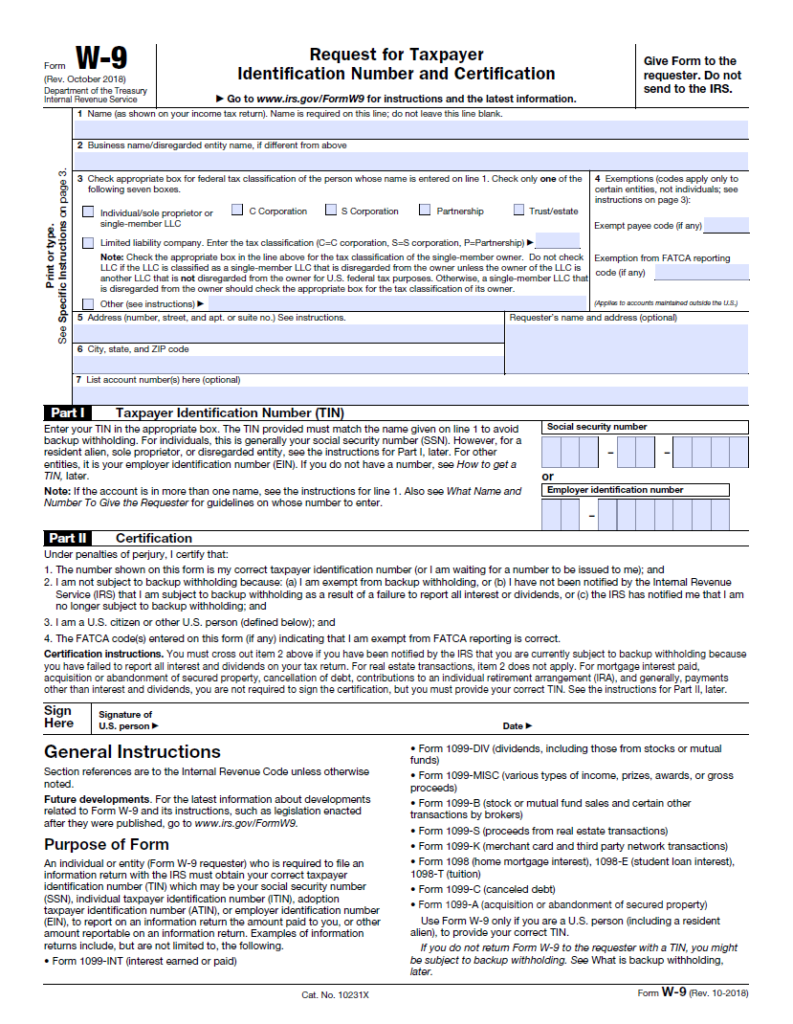

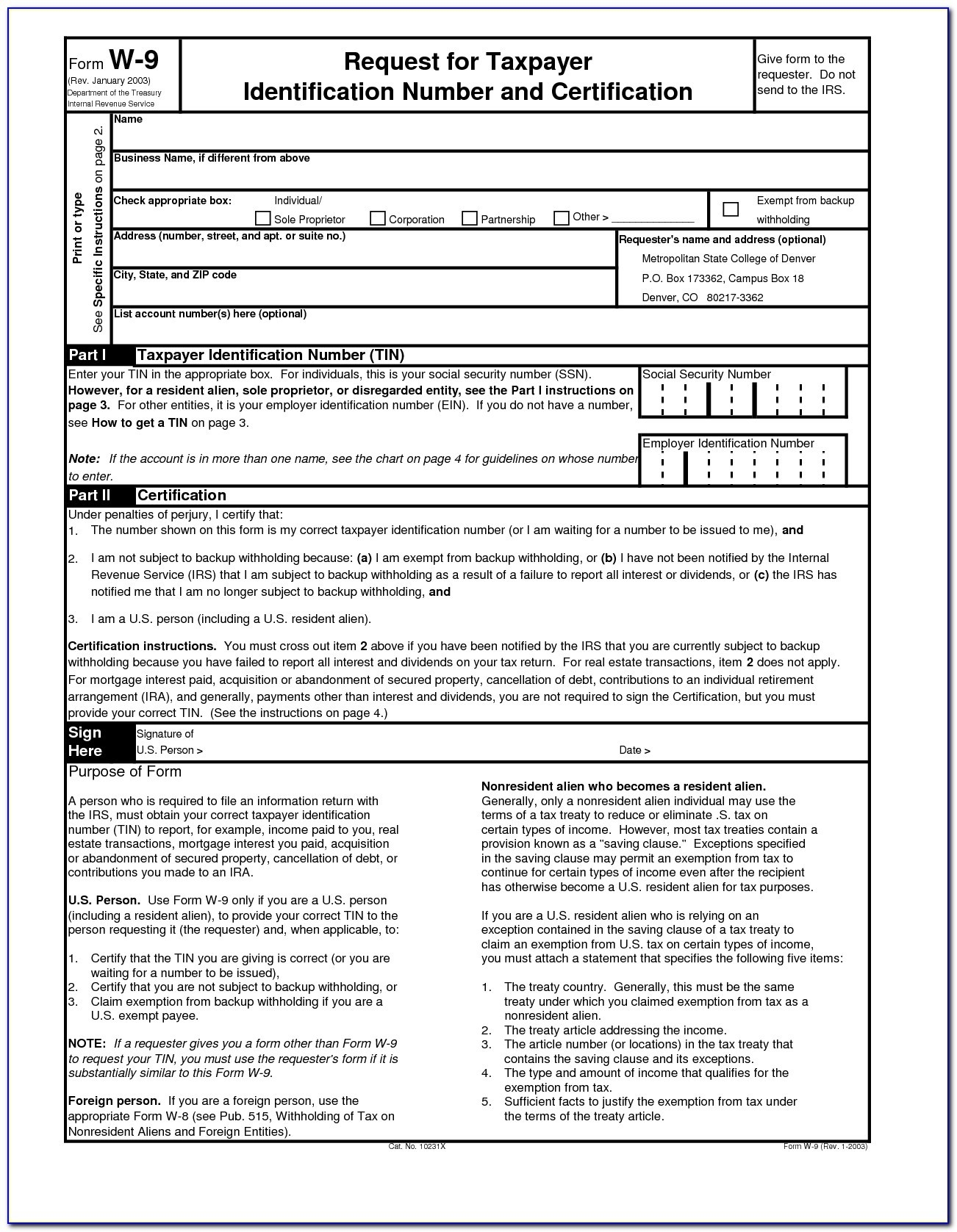

Printable W9 2023 - Web updated june 12, 2023. Name is required on this line; Do not leave this line blank. Who has to fill it out? 2 business name/disregarded entity name, if different from above 3 check appropriate box for federal tax classification of the person whose name is entered on line 1. Click on a column heading to sort the list by the contents of that column. Do not leave this line blank. W9 form 2023 are for freelancers, independent contractors, and consultants. You need to fill out this form if you. Business name/disregarded entity name, if different from above.

Click on a column heading to sort the list by the contents of that column. Check only one of the Acquisition or abandonment of secured property. Do not leave this line blank. Web print or type. Name is required on this line; W9 form 2023 are for freelancers, independent contractors, and consultants. This important tax document is vital for accurate reporting of income and taxes. See specific instructions on page 3. Name (as shown on your income tax return).

1 name (as shown on your income tax return). Name is required on this line; This form summarizes all the payments that you have received. View more information about using irs forms, instructions, publications and other item files. We've got answers to all your questions! Web print or type. Name (as shown on your income tax return). W9 form 2023 are for freelancers, independent contractors, and consultants. See specific instructions on page 3. Do not leave this line blank.

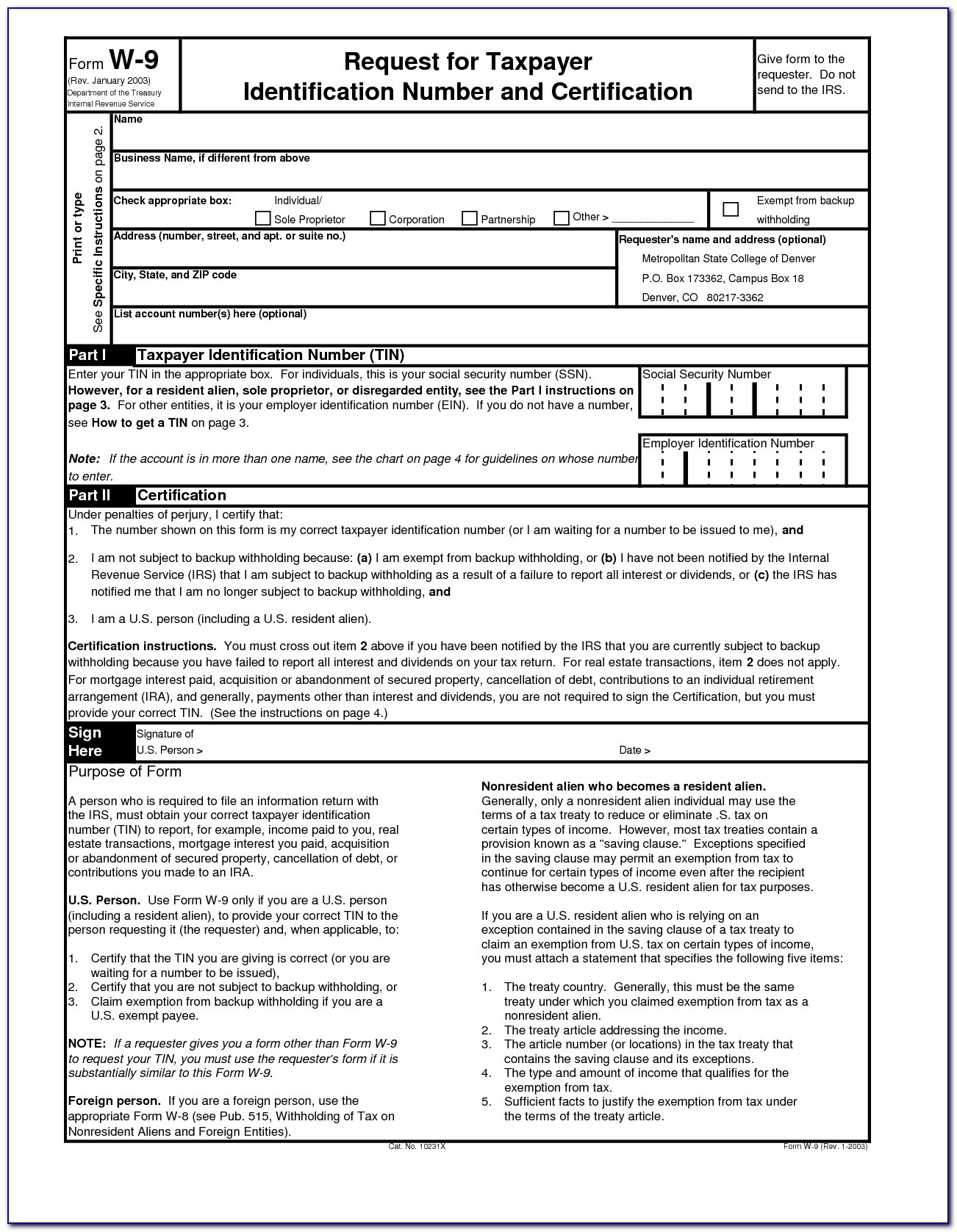

Blank W9 2018 2019 Free W9Form To Print Free Printable W9 Free

Web the latest versions of irs forms, instructions, and publications. Who has to fill it out? Web w9 form 2023. Name is required on this line; Do not leave this line blank.

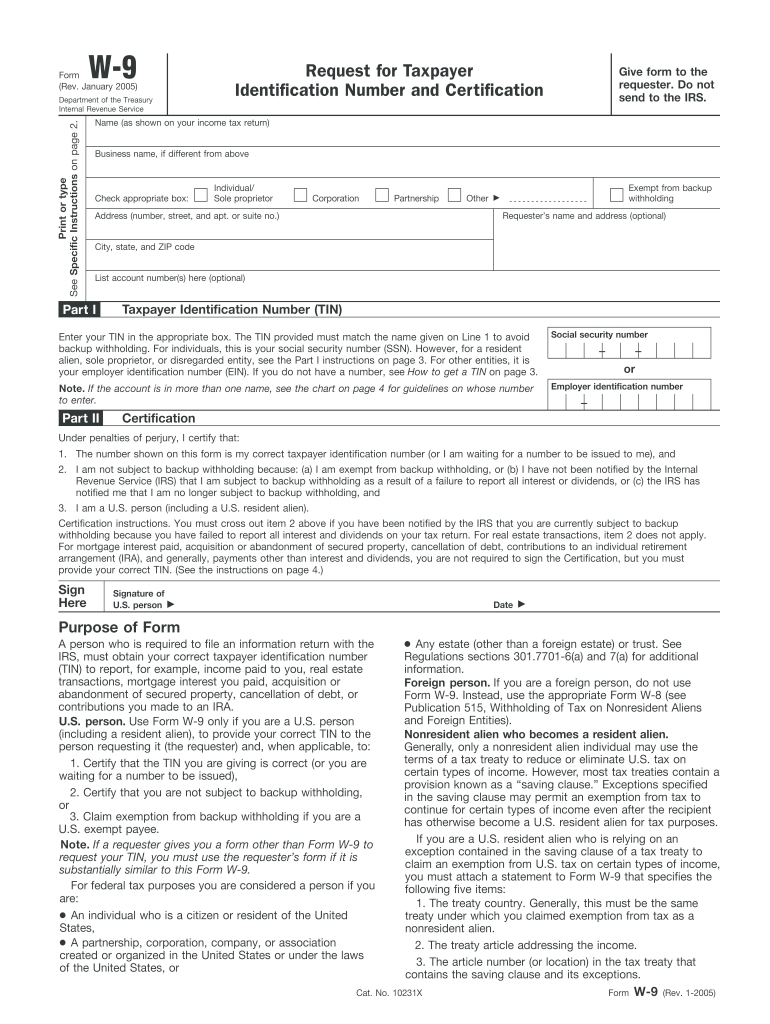

Blank W 9 Form 2021 Fillable Printable Calendar Template Printable

W9s are most commonly used for independent contractors but are also in real estate transactions, by banks, and even in legal settlements. Web w9 form 2023. Click on a column heading to sort the list by the contents of that column. Name (as shown on your income tax return). Do not leave this line blank.

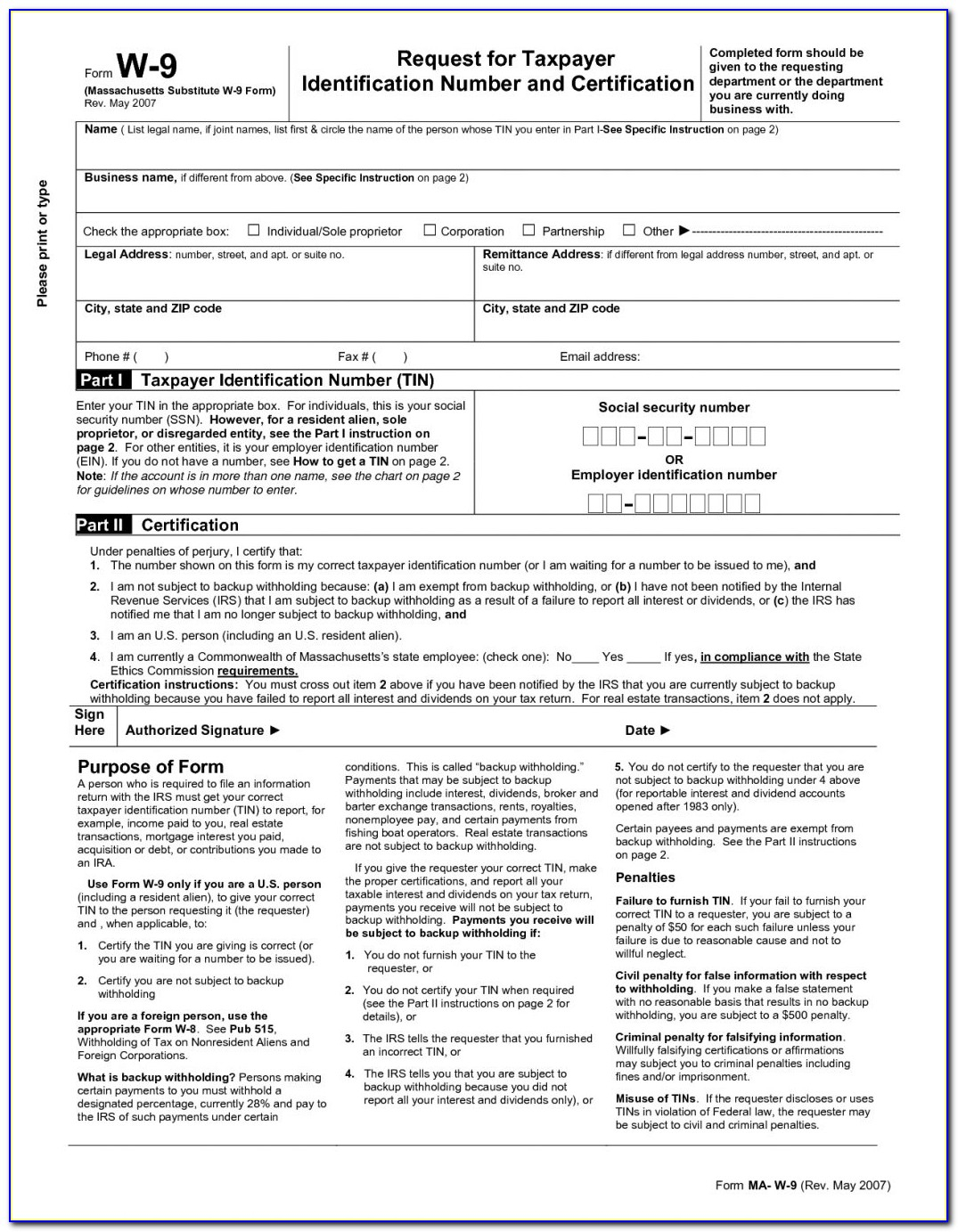

Printable Blank W9 Form Example Calendar Printable

W9 form 2023 are for freelancers, independent contractors, and consultants. Check out the relevant requirements for contractors & employers. Do not leave this line blank. We've got answers to all your questions! This important tax document is vital for accurate reporting of income and taxes.

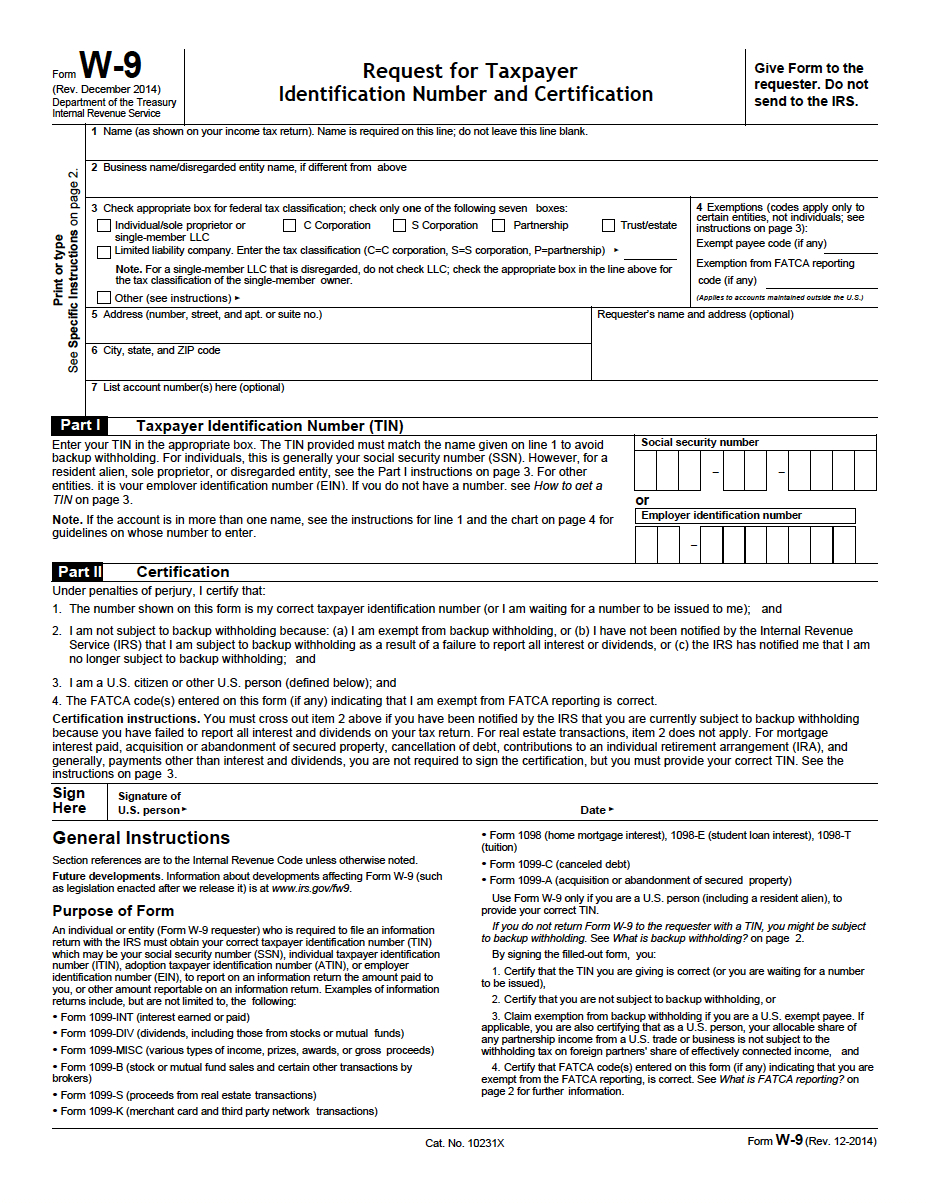

Blank W9 2018 2019 Free W9Form To Print W9 Form Printable 2017

Do not leave this line blank. Name is required on this line; You need to fill out this form if you. W9s are most commonly used for independent contractors but are also in real estate transactions, by banks, and even in legal settlements. Contributions you made to an ira.

W 9 Form Pdf Printable Example Calendar Printable

Name is required on this line; Check out the relevant requirements for contractors & employers. We've got answers to all your questions! Web w9 form 2023. Acquisition or abandonment of secured property.

Free Printable W9 Form From Irs

W9s are most commonly used for independent contractors but are also in real estate transactions, by banks, and even in legal settlements. This important tax document is vital for accurate reporting of income and taxes. Check out the relevant requirements for contractors & employers. Acquisition or abandonment of secured property. See specific instructions on page 3.

2020 W9 Forms To Print Example Calendar Printable in W9 Form

Name is required on this line; We've got answers to all your questions! Check appropriate box for federal tax classification of the person whose name is entered on line 1. Name (as shown on your income tax return). Click on a column heading to sort the list by the contents of that column.

Printable W9 Form W9Form With Regard To Printable W9 Form Free

Acquisition or abandonment of secured property. This important tax document is vital for accurate reporting of income and taxes. Do not leave this line blank. Click on a column heading to sort the list by the contents of that column. Name is required on this line;

W 9 Forms Printable

Check out the relevant requirements for contractors & employers. Name is required on this line; Acquisition or abandonment of secured property. 2 business name/disregarded entity name, if different from above 3 check appropriate box for federal tax classification of the person whose name is entered on line 1. See specific instructions on page 3.

Blank Tn 2020 W9 Calendar Template Printable

Check appropriate box for federal tax classification of the person whose name is entered on line 1. Acquisition or abandonment of secured property. This important tax document is vital for accurate reporting of income and taxes. 2 business name/disregarded entity name, if different from above 3 check appropriate box for federal tax classification of the person whose name is entered.

We've Got Answers To All Your Questions!

Name is required on this line; Do not leave this line blank. See specific instructions on page 3. Check out the relevant requirements for contractors & employers.

Name (As Shown On Your Income Tax Return).

Acquisition or abandonment of secured property. Contributions you made to an ira. This important tax document is vital for accurate reporting of income and taxes. Click on a column heading to sort the list by the contents of that column.

Check Appropriate Box For Federal Tax Classification Of The Person Whose Name Is Entered On Line 1.

2 business name/disregarded entity name, if different from above 3 check appropriate box for federal tax classification of the person whose name is entered on line 1. W9s are most commonly used for independent contractors but are also in real estate transactions, by banks, and even in legal settlements. View more information about using irs forms, instructions, publications and other item files. Business name/disregarded entity name, if different from above.

Web Print Or Type.

W9 form 2023 are for freelancers, independent contractors, and consultants. Who has to fill it out? Web the latest versions of irs forms, instructions, and publications. This form summarizes all the payments that you have received.