Property Lien Form Texas

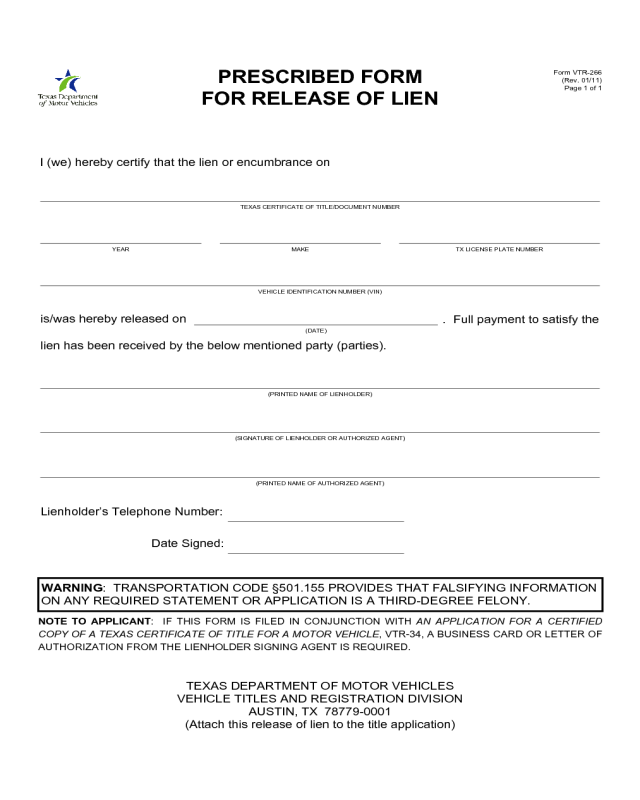

Property Lien Form Texas - We offer thousands of liens. Web about texas release of lien form. Web (p) lien means the mechanic's and materialman's lien on the property that results from the contract and the work performed. Composed by texaslawhelp.org • last updated on january 23, 2023. The lien holder must sign the lien release on the title (see section n for alternate release of lien). Fill out your lien form with complete, accurate details. Promptly recording this document in the same county as the original deed of trust and promissory note serves to unencumber (free up) the title to the related real property. Mechanic's, contractor's, or materialman's lien § 53.284. The property owner has not requested a deferral of taxes authorized by section 33.06, tax code. Some of the forms offered are listed by area below.

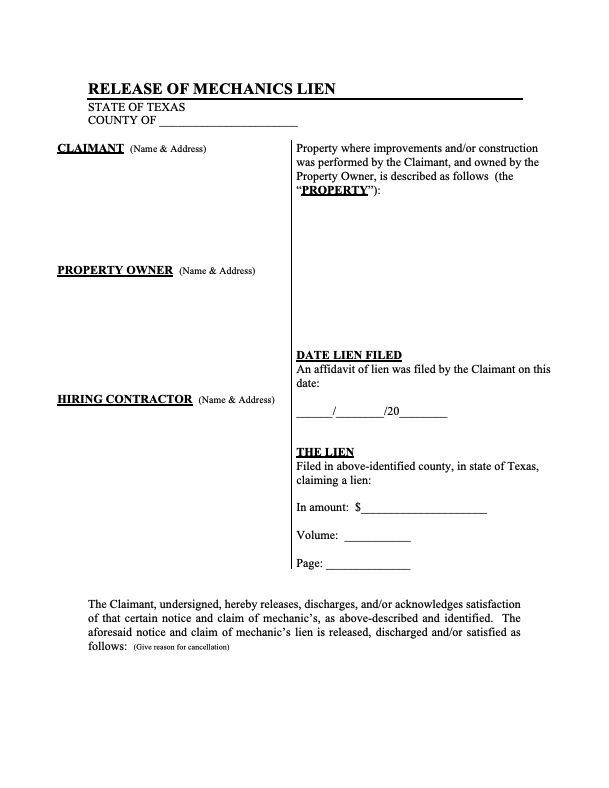

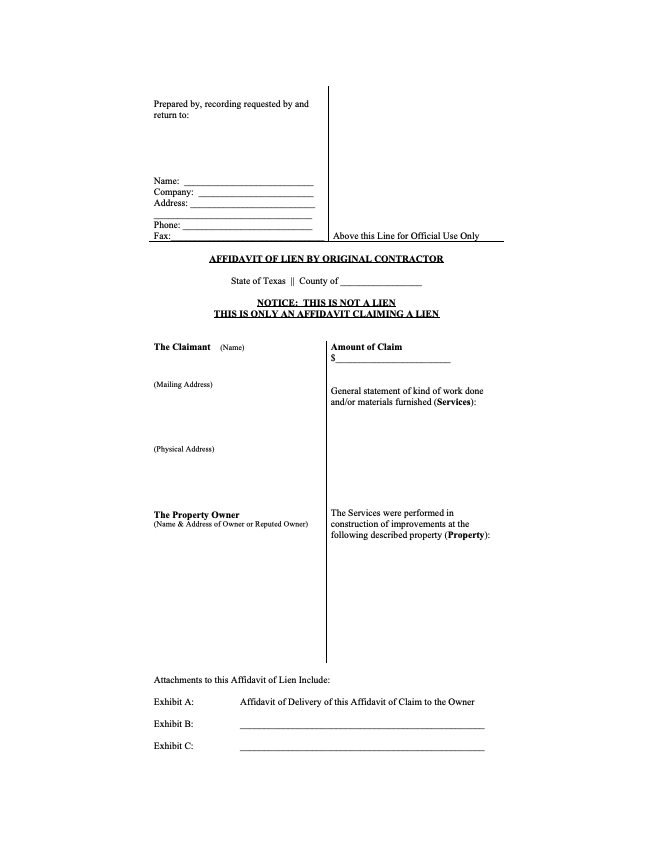

When do the changes to the texas lien laws take effect? Fill out the texas “affidavit of lien” form. Web texas lien form categories how to file a lien in texas. Fill out the fields to download a free release of lien form to cancel or discharge a mechanics lien on property in texas. Fill out your lien form with complete, accurate details. At texas easy lien, we provide easy access to professional construction lien services for contractors, subcontractors, and materials suppliers across texas. Filing a lien release removes the claim from the property title. Waivers for claims under a prime contract signed after january 1, 2021, do not need to be notarized. The lien includes all existing and future improvements, easements, and rights in the property. Web updated july 28, 2022.

You can also use our levelset document builder to send this document electronically for free. The texas property code defines three major categories of people and companies who may file a lien on a property: Composed by texaslawhelp.org • last updated on january 23, 2023. Web this article explains what a residential landlord's lien is. The title will be mailed to the owner of record. Web 3 steps to file a mechanics lien in texas. There are several different kinds of property liens in which foreclosure can be used to collect the debt that is owed. With jotform’s property lien form, you can create a custom form in seconds and share it via email to be filled out and. Texas is very specific about the form required to file a mechanics lien. Web this form is a new requirement as of january 1, 2022 notice of claim for unpaid labor or materials warning:

Lien Release Form Texas Contractor Form Resume Examples emVKelL9rX

Web property liens are notices that are attached to a piece of real property by a creditor when money is owed to them by the homeowner. We offer thousands of liens. Web release of lien for real estate located in texas. Web example of lien documents. The updated texas lien law took effect on january 1, 2022.

Release Of Lien Texas 20202021 Fill and Sign Printable Template

Web release of lien for real estate located in texas. The title will be mailed to the owner of record. Web who can place a lien on property in texas? This notice is provided to preserve lien rights. At texas easy lien, we provide easy access to professional construction lien services for contractors, subcontractors, and materials suppliers across texas.

Notice Of Intent To Lien Texas Pdf Fill Online, Printable, Fillable

The property owner has not requested a deferral of taxes authorized by section 33.06, tax code. At texas easy lien, we provide easy access to professional construction lien services for contractors, subcontractors, and materials suppliers across texas. Web updated july 28, 2022. Texas is very specific about the form required to file a mechanics lien. Mechanic's, contractor's, or materialman's lien.

Texas Release of Lien Form Free Template Download

Texas is very specific about the form required to file a mechanics lien. A property lien form is a document used by a contractor, owner, or claimant that shows that the property has unpaid debts. This article explains the types of property at risk of being seized under a landlord’s lien, and what to do if you are subject to.

Texas Mechanics Lien Form for General Contractors Levelset

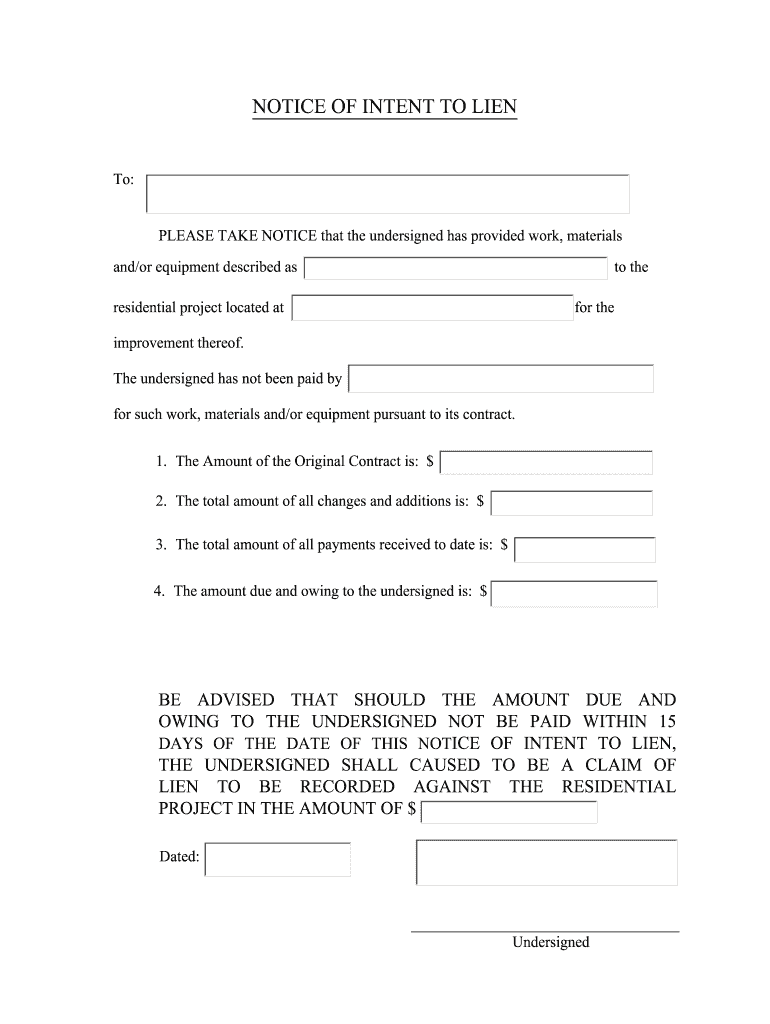

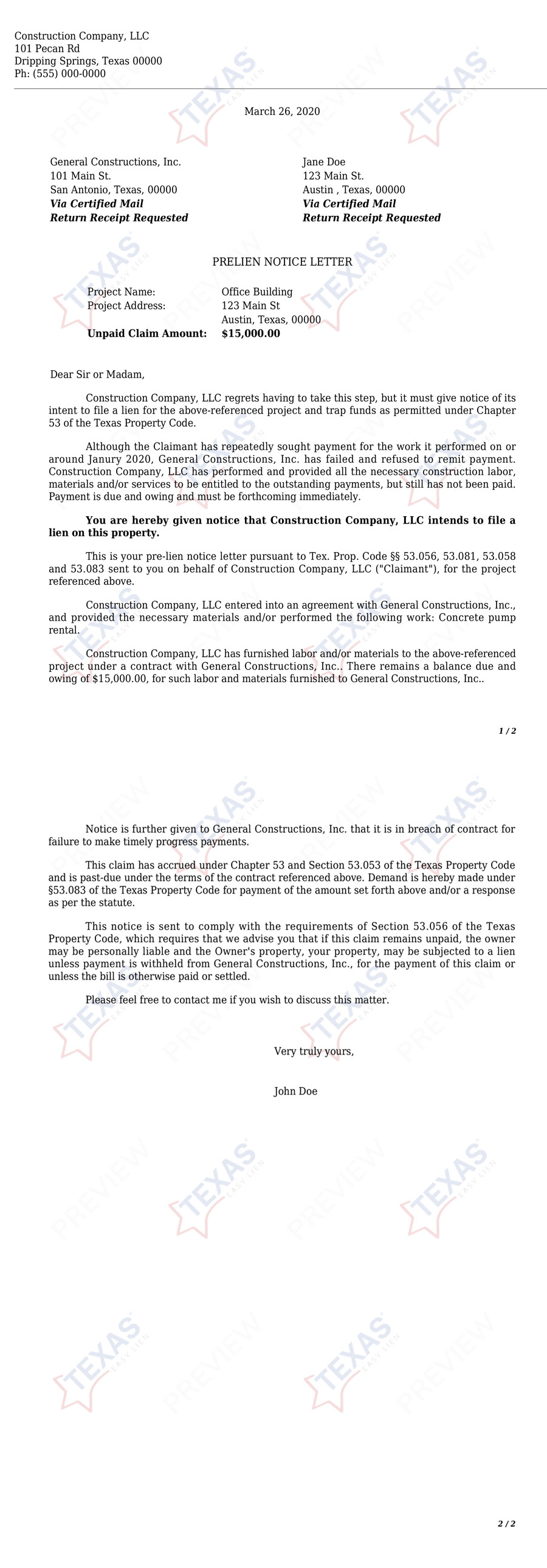

Web by completing the form on the right you can download a free texas notice of intent to lien form template that can be filled out with a pdf editor or by hand after printing. Fill out the texas “affidavit of lien” form. With jotform’s property lien form, you can create a custom form in seconds and share it via.

Partial Release Of Lien Form Texas Form Resume Examples mL52Z4K5Xo

Web by completing the form on the right you can download a free texas notice of intent to lien form template that can be filled out with a pdf editor or by hand after printing. The lien includes all existing and future improvements, easements, and rights in the property. Texas is very specific about the form required to file a.

Texas Unconditional Lien Release Form Form Resume Examples ojYqbnB6Vz

Composed by texaslawhelp.org • last updated on january 23, 2023. We offer thousands of liens. Fill out the fields to download a free release of lien form to cancel or discharge a mechanics lien on property in texas. Web this article explains what a residential landlord's lien is. Legal action is not being sought against the occupant of the property.

Vehicle Lien Release Form PDF the Form in Seconds Fill Out and Sign

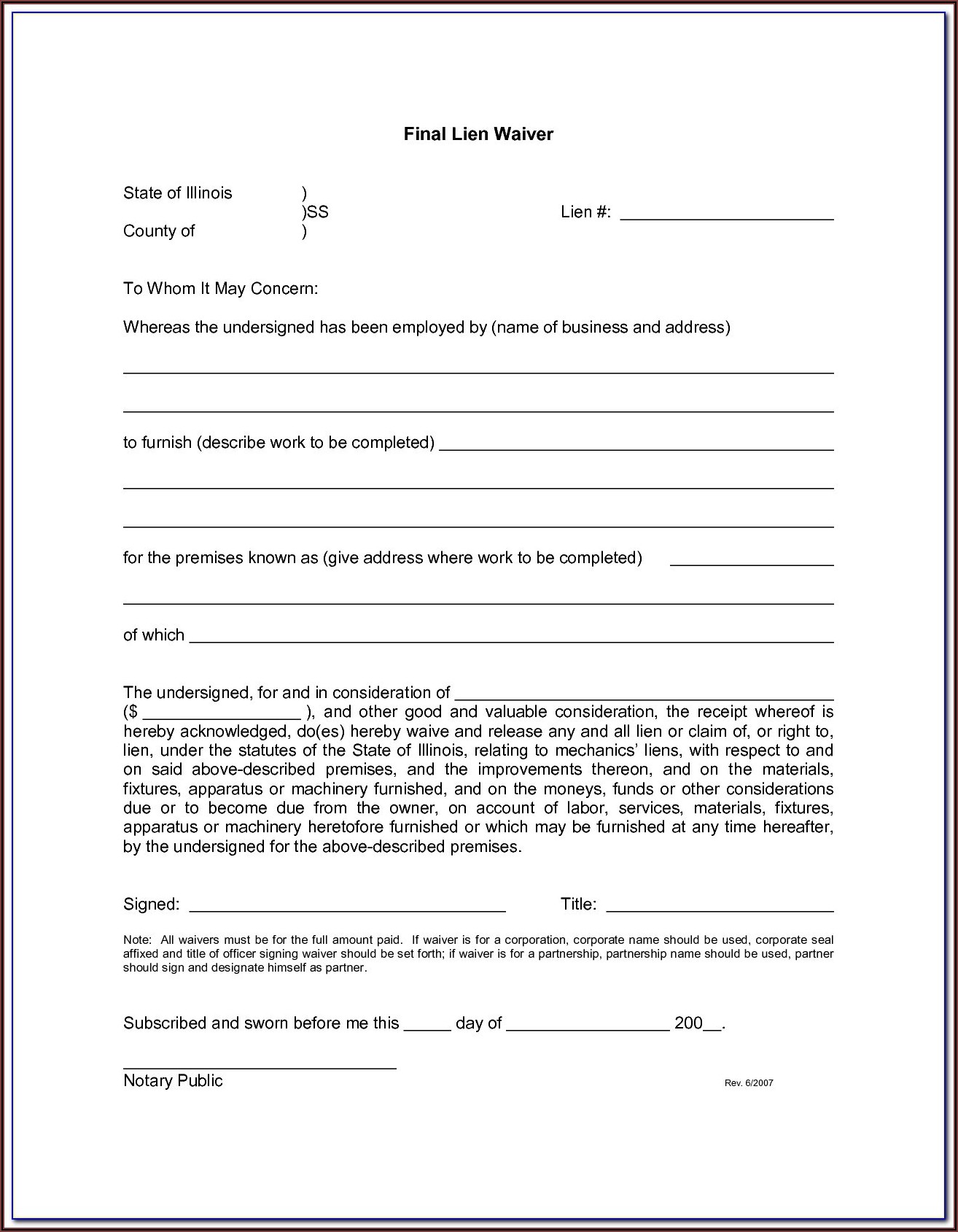

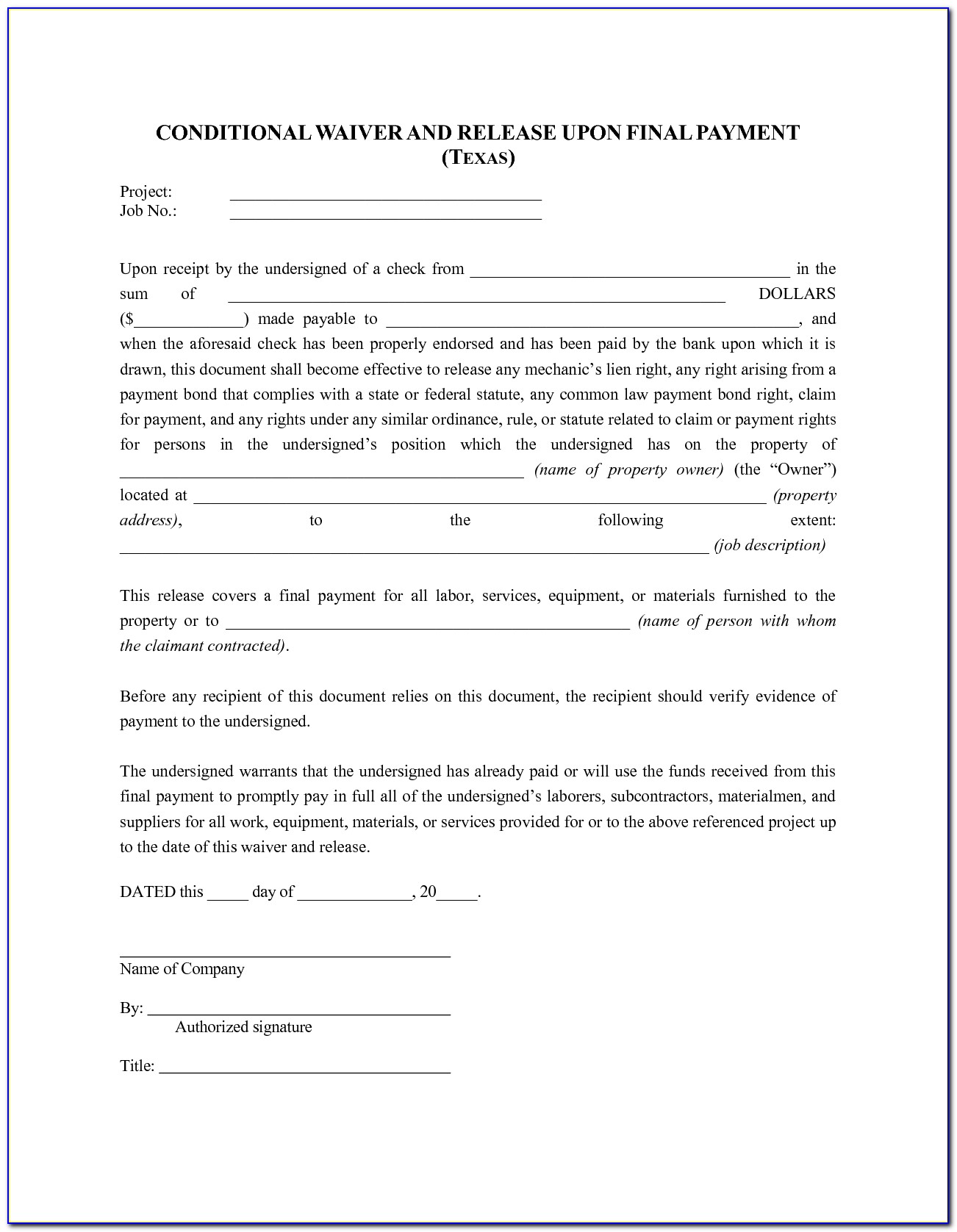

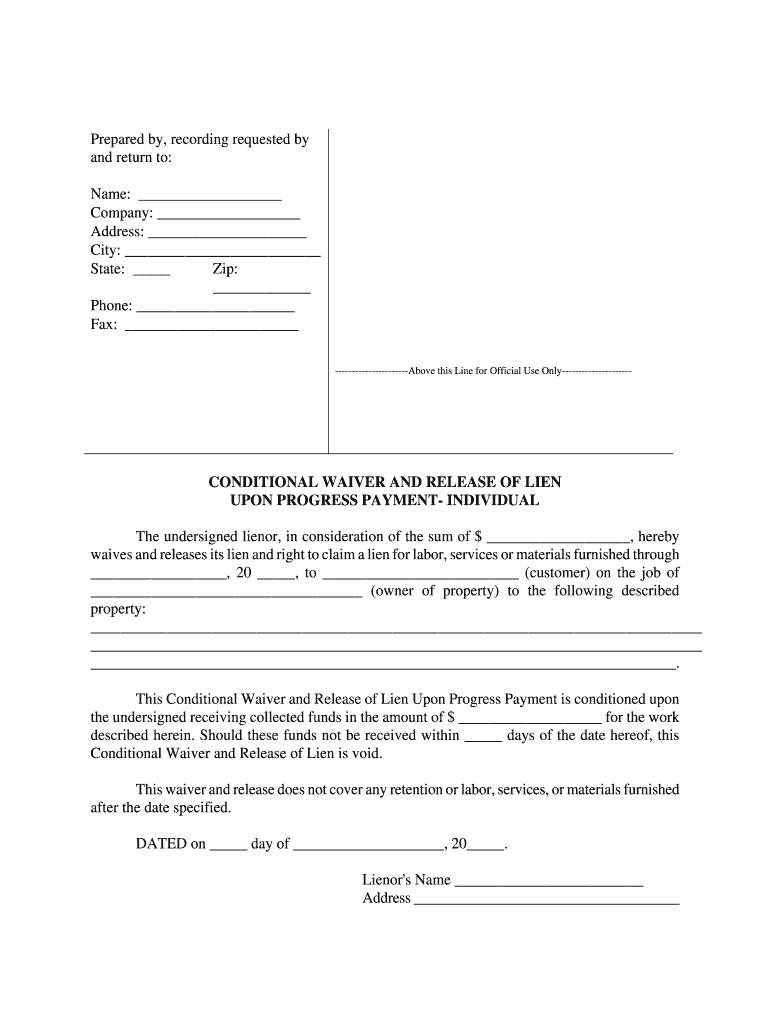

We offer thousands of liens. Web (p) lien means the mechanic's and materialman's lien on the property that results from the contract and the work performed. Fill out the texas “affidavit of lien” form. Web lien waiver forms texas property code, section 53.284, prescribes statutory language for waiver and release of lien or payment bond claims. Filing a lien release.

2022 Lien Release Form Fillable, Printable PDF & Forms Handypdf

Fill out the texas “affidavit of lien” form. Web lien waiver forms texas property code, section 53.284, prescribes statutory language for waiver and release of lien or payment bond claims. Mechanic's, contractor's, or materialman's lien § 53.284. Web this article explains what a residential landlord's lien is. The texas property code defines three major categories of people and companies who.

How to File a Lien On Property In Texas Texas Easy Lien

Web lien waiver forms texas property code, section 53.284, prescribes statutory language for waiver and release of lien or payment bond claims. The texas property code defines three major categories of people and companies who may file a lien on a property: Web about texas release of lien form. The updated texas lien law took effect on january 1, 2022..

The Updated Texas Lien Law Took Effect On January 1, 2022.

The title will be mailed to the owner of record. A property lien form is a document used by a contractor, owner, or claimant that shows that the property has unpaid debts. Fill out your lien form with complete, accurate details. Texas is very specific about the form required to file a mechanics lien.

It Is Important To Note That The Changes Only Apply To.

With jotform’s property lien form, you can create a custom form in seconds and share it via email to be filled out and. After completing payments on the promissory note connected to a deed of trust, the lender completes this release of lien form. Filing a lien release removes the claim from the property title. If the claimant purchases the property, they will be responsible for the liens.

Legal Action Is Not Being Sought Against The Occupant Of The Property Unless The Occupant Is Named As A Respondent In This.

Forms for waiver & release of lien or payment bond claim mechanic's, contractor's, or. Web this form is a new requirement as of january 1, 2022 notice of claim for unpaid labor or materials warning: Mechanic's, contractor's, or materialman's lien § 53.284. When do the changes to the texas lien laws take effect?

A Lien Release Allows An Entity Or Individual That Owns Property To Waive Any Debt That Was Owed On Their Behalf And Was Attached To Their Property.

Web updated july 28, 2022. Web 3 steps to file a mechanics lien in texas. Web who can place a lien on property in texas? The property owner has not requested a deferral of taxes authorized by section 33.06, tax code.