Qoz Tax Form

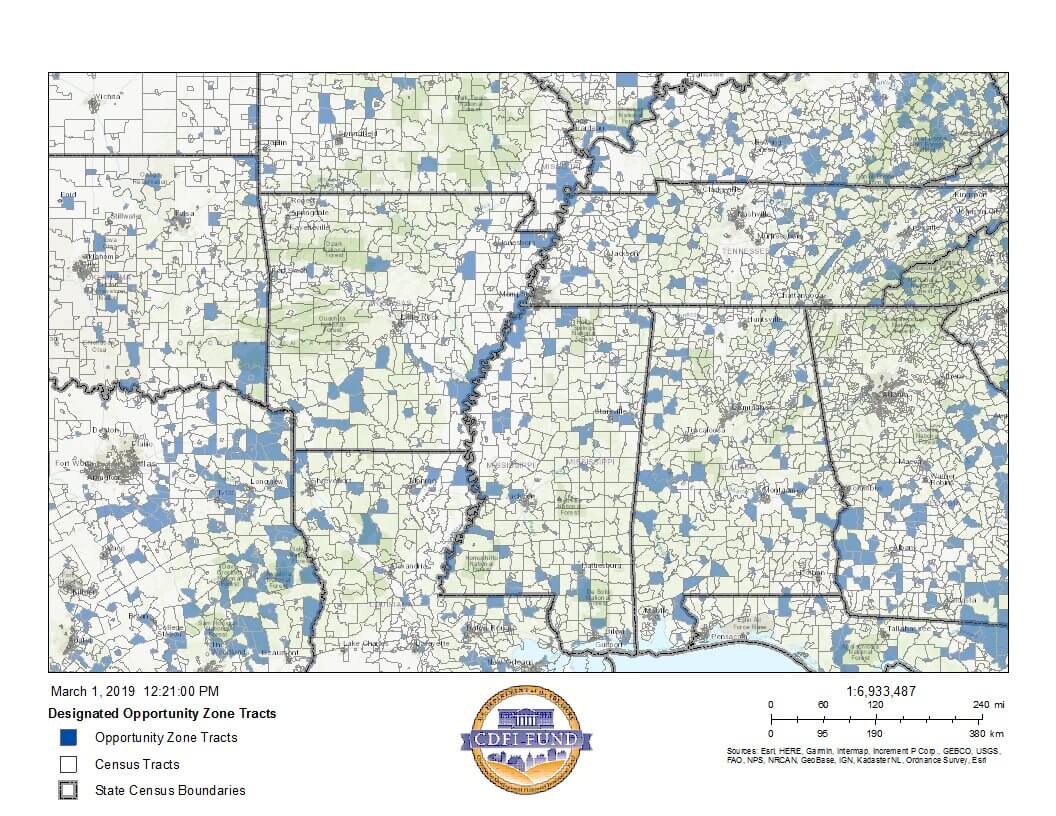

Qoz Tax Form - Get irs approved instant schedule 1 copy. Web a qof is an investment vehicle in the form of a domestic corporation or domestic partnership that invests in property within a qoz. File your form 2290 online & efile with the irs. Web taxpayers will file the form 8949 with their federal income tax return to elect the capital gains deferral on the qualifying investment into a qof. Web a qoz is an economically distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment. Web qualified opportunity zones (qozs) enable taxpayers to defer and reduce capital gains to unlock substantial tax incentives. This program was built to incentivize taxpayers to. Web the corporation or partnership must be a certified qof. Use form 8997 to inform the irs of the qof investments and. Web the qualified opportunity zone (qoz) incentive program was created in late 2017 as part of the tax cuts and jobs act (tcja).

1100 missouri tax forms and templates are collected for any. 4 a qof can invest directly. Web about form 8997, initial and annual statement of qualified opportunity fund (qof) investments. Use form 8997 to inform the irs of the qof investments and. Estate investment company focused on bespoke investment. The qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains. Web a qof is an investment vehicle in the form of a domestic corporation or domestic partnership that invests in property within a qoz. Web the qualified opportunity zone (qoz) incentive program was created in late 2017 as part of the tax cuts and jobs act (tcja). Ad don't leave it to the last minute. Web qualified opportunity zones (qozs) enable taxpayers to defer and reduce capital gains to unlock substantial tax incentives.

Web jul 9, 2020. Use form 8997 to inform the irs of the qof investments and. Web a qof is an investment vehicle in the form of a domestic corporation or domestic partnership that invests in property within a qoz. Get irs approved instant schedule 1 copy. Web the corporation or partnership must be a certified qof. Estate investment company focused on bespoke investment. 4 a qof can invest directly. As has become its practice with legislation and regulations of significance, the irs has recently issued a set of. The qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains. 1100 missouri tax forms and templates are collected for any.

QOZ Fund I Origin Investments

Web about form 8997, initial and annual statement of qualified opportunity fund (qof) investments. This program was built to incentivize taxpayers to. The qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains. 1100 missouri tax forms and templates are collected for any. Estate investment company focused on bespoke investment.

QOZ Fund I Origin Investments

This program was built to incentivize taxpayers to. Web taxpayers use form 8997 to inform the irs of. File your form 2290 today avoid the rush. Web the corporation or partnership must be a certified qof. Web taxpayers will file the form 8949 with their federal income tax return to elect the capital gains deferral on the qualifying investment into.

QOZ Updates & New York’s Move to Decouple from QOZ Tax Benefits PHT

Web taxpayers use form 8997 to inform the irs of. Web irs form 8997 unlike the above form 8949, form 8997, “initial and annual statement of qualified opportunity fund (qof) investments,” must be filed each year. Web the corporation or partnership must be a certified qof. Use form 8997 to inform the irs of the qof investments and. File your.

QOZ Fund I Origin Investments

Web about form 8997, initial and annual statement of qualified opportunity fund (qof) investments. Web qualified opportunity zones (qozs) enable taxpayers to defer and reduce capital gains to unlock substantial tax incentives. Use form 8997 to inform the irs of the qof investments and. Estate investment company focused on bespoke investment. 4 a qof can invest directly.

Investing in QOZs Blackstar Real Estate Partners

As has become its practice with legislation and regulations of significance, the irs has recently issued a set of. The qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains. Web about form 8997, initial and annual statement of qualified opportunity fund (qof) investments. Ad don't leave it to the.

Window for 10 Basis StepUp Closing Quickly for QOZ Investors

Web taxpayers will file the form 8949 with their federal income tax return to elect the capital gains deferral on the qualifying investment into a qof. Get irs approved instant schedule 1 copy. Web qualified opportunity zones (qozs) enable taxpayers to defer and reduce capital gains to unlock substantial tax incentives. Web jul 9, 2020. This program was built to.

Defer Capital Gains Tax & Reinvest Tax Free Proforma Partners

Ad don't leave it to the last minute. Web a qof is an investment vehicle in the form of a domestic corporation or domestic partnership that invests in property within a qoz. Get irs approved instant schedule 1 copy. Web qualified opportunity zones (qozs) enable taxpayers to defer and reduce capital gains to unlock substantial tax incentives. File your form.

Qualified Opportunity Zones Tax Incentives CoMingled with Private

Estate investment company focused on bespoke investment. File your form 2290 today avoid the rush. Web taxpayers use form 8997 to inform the irs of. 4 a qof can invest directly. Web a qof is an investment vehicle in the form of a domestic corporation or domestic partnership that invests in property within a qoz.

New Tax Code Creates Real Estate Incentives Glaub Farm Management

Web qualified opportunity zones (qozs) enable taxpayers to defer and reduce capital gains to unlock substantial tax incentives. File your form 2290 today avoid the rush. Get irs approved instant schedule 1 copy. Estate investment company focused on bespoke investment. Web a qoz is an economically distressed community where new investments, under certain conditions, may be eligible for preferential tax.

1031 Exchange vs. QOZ Real Estate Which Tax Break Is Better? Origin

Ad don't leave it to the last minute. Use form 8997 to inform the irs of the qof investments and. 1100 missouri tax forms and templates are collected for any. This program was built to incentivize taxpayers to. Web about form 8997, initial and annual statement of qualified opportunity fund (qof) investments.

File Your Form 2290 Online & Efile With The Irs.

Web the corporation or partnership must be a certified qof. Web irs form 8997 unlike the above form 8949, form 8997, “initial and annual statement of qualified opportunity fund (qof) investments,” must be filed each year. As has become its practice with legislation and regulations of significance, the irs has recently issued a set of. File your form 2290 today avoid the rush.

Web Jul 9, 2020.

Web a qof is an investment vehicle in the form of a domestic corporation or domestic partnership that invests in property within a qoz. Web taxpayers will file the form 8949 with their federal income tax return to elect the capital gains deferral on the qualifying investment into a qof. Web about form 8997, initial and annual statement of qualified opportunity fund (qof) investments. The qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains.

Web A Qoz Is An Economically Distressed Community Where New Investments, Under Certain Conditions, May Be Eligible For Preferential Tax Treatment.

Estate investment company focused on bespoke investment. Web qualified opportunity zones (qozs) enable taxpayers to defer and reduce capital gains to unlock substantial tax incentives. Web the qualified opportunity zone (qoz) incentive program was created in late 2017 as part of the tax cuts and jobs act (tcja). 1100 missouri tax forms and templates are collected for any.

Web Taxpayers Use Form 8997 To Inform The Irs Of.

Ad don't leave it to the last minute. This program was built to incentivize taxpayers to. Use form 8997 to inform the irs of the qof investments and. 4 a qof can invest directly.