Qualified Business Income Deduction Form 8995

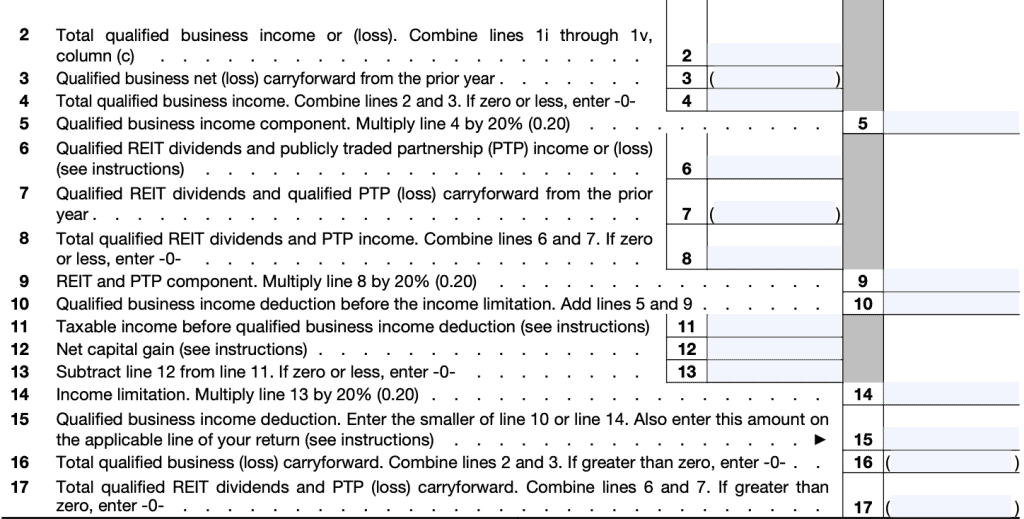

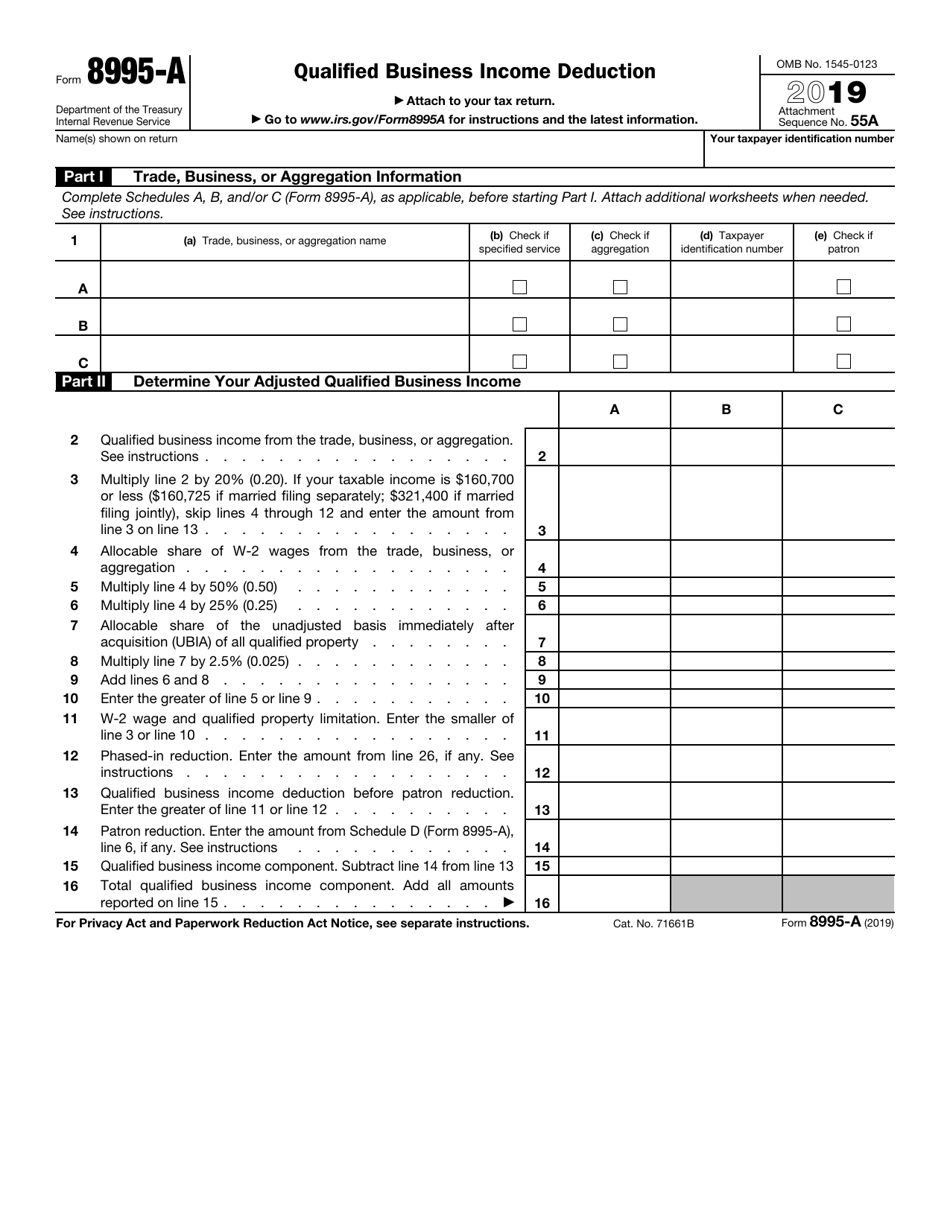

Qualified Business Income Deduction Form 8995 - You have qualified business income, qualified reit dividends, or qualified ptp income (loss), your 2020 taxable income before the qualified business. Web use form 8995 if: Web use this form if your taxable income, before your qualified business income deduction, is at or below $163,300 ($326,600 if married filing jointly), and you aren’t a patron of an. If you are unfamiliar with the qualified business income deduction (qbid), click here for more information. Web further confusing matters, the qbi deduction also applies to additional qualified items of income, such as real estate investment trust dividends, qualified. Web this fillable form 8995 simplifies the process of determining the qbi deduction, which can potentially lower taxable income and result in significant tax savings. You have qualified business income, qualified reit dividends, or qualified ptp income (loss), your 2021 taxable income before the qualified business. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: Web download or print the 2022 federal 8995 (qualified business income deduction simplified computation) for free from the federal internal revenue service.

Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: You have qualified business income, qualified reit dividends, or qualified ptp income (loss), your 2020 taxable income before the qualified business. Web download or print the 2022 federal 8995 (qualified business income deduction simplified computation) for free from the federal internal revenue service. Web what is form 8995? Web this fillable form 8995 simplifies the process of determining the qbi deduction, which can potentially lower taxable income and result in significant tax savings. The qbi deduction will flow to line 10 of form. You have qbi, qualified reit dividends, or qualified ptp income or loss. Web further confusing matters, the qbi deduction also applies to additional qualified items of income, such as real estate investment trust dividends, qualified. Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if:

Department of the treasury internal revenue service. If you are unfamiliar with the qualified business income deduction (qbid), click here for more information. Qualified business income deduction simplified computation. Web use this form if your taxable income, before your qualified business income deduction, is at or below $163,300 ($326,600 if married filing jointly), and you aren’t a patron of an. To take advantage of this, taxpayers. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). You have qbi, qualified reit dividends, or qualified ptp income or loss. Web what is form 8995? You have qualified business income, qualified reit dividends, or qualified ptp income (loss), your 2020 taxable income before the qualified business. Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if:

Form 8995a Qualified Business Deduction Phrase on the Sheet

Web what is form 8995? To take advantage of this, taxpayers. Qualified business income deduction simplified computation. You have qbi, qualified reit dividends, or qualified ptp income or loss. Web use this form if your taxable income, before your qualified business income deduction, is at or below $163,300 ($326,600 if married filing jointly), and you aren’t a patron of an.

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

You have qbi, qualified reit dividends, or qualified ptp income or loss. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: The qbi deduction will flow to line 10 of form. Web.

IRS Form 8995 Instructions Your Simplified QBI Deduction

To take advantage of this, taxpayers. Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: Department of the treasury internal revenue service. Web the qualified business income deduction (qbi) is a recently established tax deduction allowing businesses to deduct as much as 20% of their earnings. Web further confusing matters,.

Using Form 8995 To Determine Your Qualified Business Deduction

Web use form 8995 if: Web use form 8995 if: Web further confusing matters, the qbi deduction also applies to additional qualified items of income, such as real estate investment trust dividends, qualified. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). The qbi deduction will flow to line 10 of.

Fill Free fillable Form 2019 8995A Qualified Business

Web qualified business income deduction if you own a business or are a partner or shareholder where your business income flows through to your personal tax. If you are unfamiliar with the qualified business income deduction (qbid), click here for more information. Web download or print the 2022 federal 8995 (qualified business income deduction simplified computation) for free from the.

IRS Form 8995 Simplified Qualified Business Deduction

Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: You have qualified business income, qualified reit dividends, or qualified ptp income (loss), your 2020 taxable income before the qualified business. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web qualified.

IRS Form 8995A Download Fillable PDF or Fill Online Qualified Business

Web qualified business income deduction if you own a business or are a partner or shareholder where your business income flows through to your personal tax. Web the qualified business income deduction (qbi) is a recently established tax deduction allowing businesses to deduct as much as 20% of their earnings. Web use form 8995 if: You have qbi, qualified reit.

What You Need to Know about Qualified Business Deduction for

Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web qualified business income deduction if you own a business or are a partner or shareholder where your business income flows through to your personal tax. The qbi deduction will flow to line 10 of form. Web what is form 8995? Web.

Form 8995 Qualified Business Deduction Simplified Computation

Web qualified business income deduction if you own a business or are a partner or shareholder where your business income flows through to your personal tax. Web use this form if your taxable income, before your qualified business income deduction, is at or below $163,300 ($326,600 if married filing jointly), and you aren’t a patron of an. Web individuals and.

Additional Guidance Needed Regarding the Qualified Business

You have qualified business income, qualified reit dividends, or qualified ptp income (loss), your 2021 taxable income before the qualified business. You have qbi, qualified reit dividends, or qualified ptp income or loss. Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: Department of the treasury internal revenue service. Web.

Attach To Your Tax Return.

You have qualified business income, qualified reit dividends, or qualified ptp income (loss), your 2020 taxable income before the qualified business. Web this fillable form 8995 simplifies the process of determining the qbi deduction, which can potentially lower taxable income and result in significant tax savings. You have qbi, qualified reit dividends, or qualified ptp income or loss. To take advantage of this, taxpayers.

Web Qualified Business Income Deduction If You Own A Business Or Are A Partner Or Shareholder Where Your Business Income Flows Through To Your Personal Tax.

Web use form 8995 if: Web the qualified business income deduction (qbi) is a recently established tax deduction allowing businesses to deduct as much as 20% of their earnings. Qualified business income deduction simplified computation. Department of the treasury internal revenue service.

Web Use This Form If Your Taxable Income, Before Your Qualified Business Income Deduction, Is At Or Below $163,300 ($326,600 If Married Filing Jointly), And You Aren’t A Patron Of An.

You have qbi, qualified reit dividends, or qualified ptp income or loss. You have qualified business income, qualified reit dividends, or qualified ptp income (loss), your 2021 taxable income before the qualified business. Web further confusing matters, the qbi deduction also applies to additional qualified items of income, such as real estate investment trust dividends, qualified. If you are unfamiliar with the qualified business income deduction (qbid), click here for more information.

Web What Is Form 8995?

Web use form 8995 if: The qbi deduction will flow to line 10 of form. Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid).