Rental Expense Form

Rental Expense Form - Most commonly for the use of cash payment by the tenant to their landlord. Web per diem rates. Include it in your income when you receive it. You can also download the sheet as an excel file to use on your home machine offline. On schedule e, you can reduce the gross rent by your rental property expenses. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts. Web in general, you can deduct expenses of renting property from your rental income. Gross wages per pay period $_____. 12th st., kansas city, missouri 64106. The receipt should only be filled in after the funds are transferred to the landlord.

You generally must include in your gross income all amounts you receive as rent. Do not list personal expenditures. November 2018) department of the treasury internal revenue service name rental real estate income and expenses of a partnership or an s corporation attach to form 1065 or form 1120s. Web income and expense statement of_____ i. Some of your personal expenses may be deductible on schedule a (form 1040) if you itemize your deductions. If you are reporting partnership. Current revision form 8825 pdf recent developments none at this time. The receipt should only be filled in after the funds are transferred to the landlord. Web foreign source taxable income is foreign source gross income less allocable expenses. The first is by calculating the actual value of the space, based on the actual costs of the space.

Current revision form 8825 pdf recent developments none at this time. Your investment, including expenses, must be at risk. Rental property tax law special tax laws have been created within the tax code to. Web do you receive rental income? Web to download the free rental income and expense worksheet template, click below to view the google sheet. Report real property on schedule e that’s rented: Or you can click here to make a google sheets copy. List your total income, expenses, and depreciation for each rental property on schedule e. Web only your rental expenses may be deducted on schedule e (form 1040). Web taxpayers can claim the deduction in two ways.

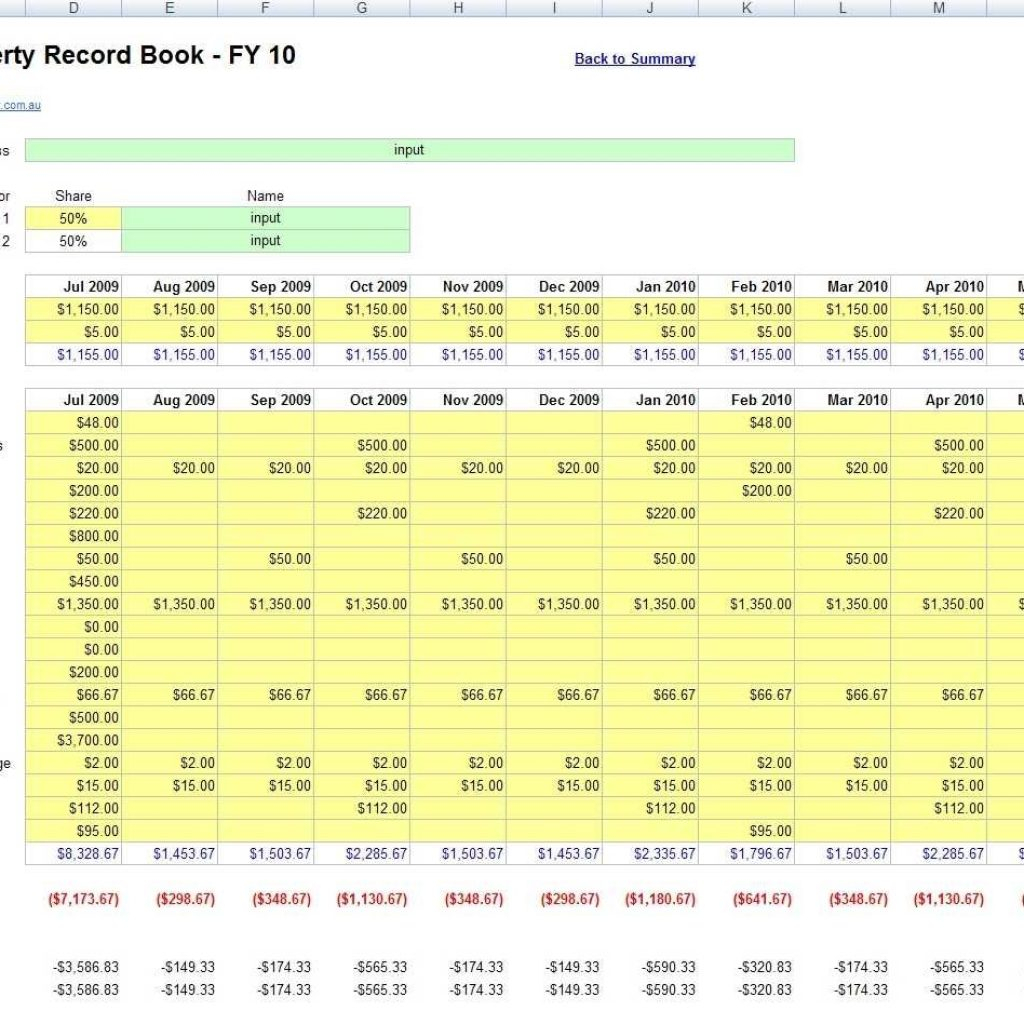

Free Rental Expense Spreadsheet within Property Management Expenses

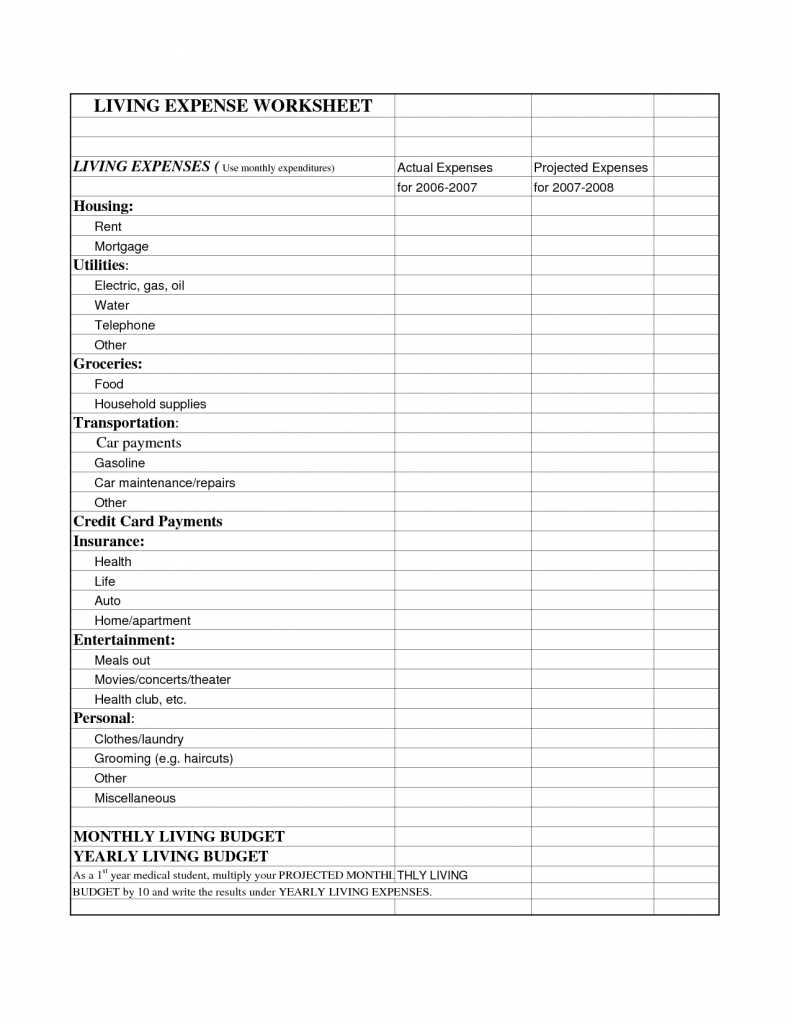

Web appropriate sections are broken down by month and by property. Do not list personal expenditures. (12b) expenses for the period (12c) expenses for the period (if no dates are shown, report expenses for current calendar year) $ $ $ 2. Find irs forms and publications about supplemental income (rental). Security deposits used as a final payment of rent are.

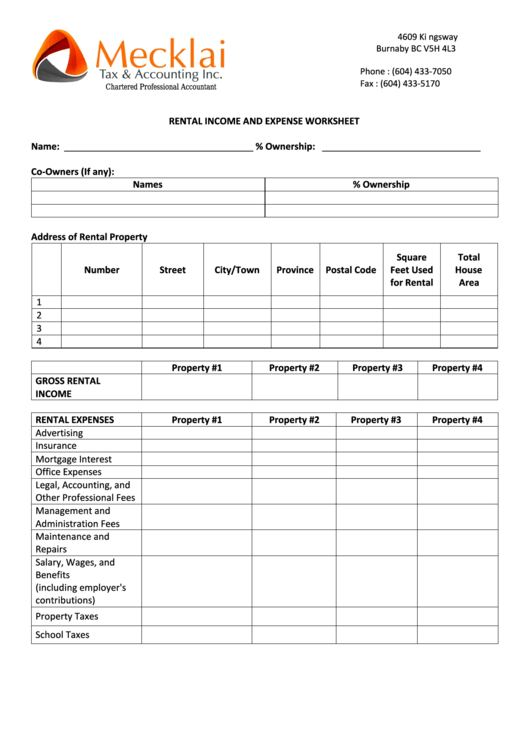

Rental And Expense Worksheet printable pdf download

Web in general, you can deduct expenses of renting property from your rental income. Web to download the free rental income and expense worksheet template, click below to view the google sheet. To download the free rental income and expense worksheet template, click the green button at the top of the page. November 2018) department of the treasury internal revenue.

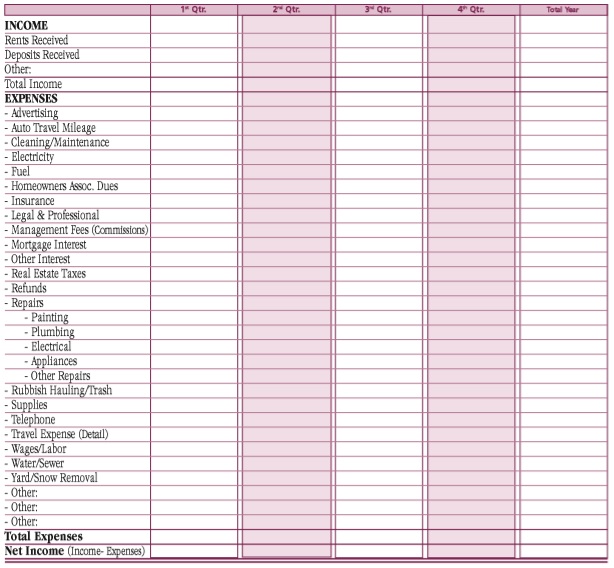

5+ Free Rental Property Expenses Spreadsheets Excel TMP

Find irs forms and publications about supplemental income (rental). If you’re the tenant, it’s better to pay by check, money order or electronically than by cash so you have an additional record of payment. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Security deposits used as a final payment of rent are considered.

Rental And Expense Worksheet Pdf Fill Online, Printable

Web only your rental expenses may be deducted on schedule e (form 1040). You can also download the sheet as an excel file to use on your home machine offline. Expenses of renting property can be deducted from your gross rental income. Find irs forms and publications about supplemental income (rental). (12b) expenses for the period (12c) expenses for the.

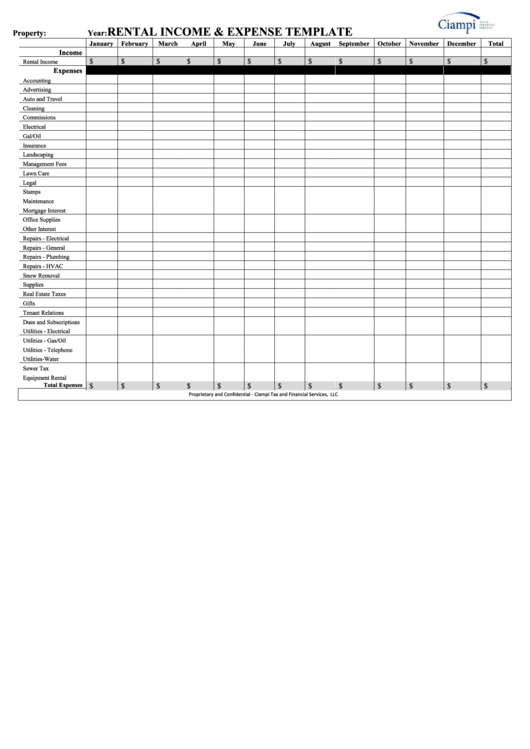

Rental Expense Spreadsheet —

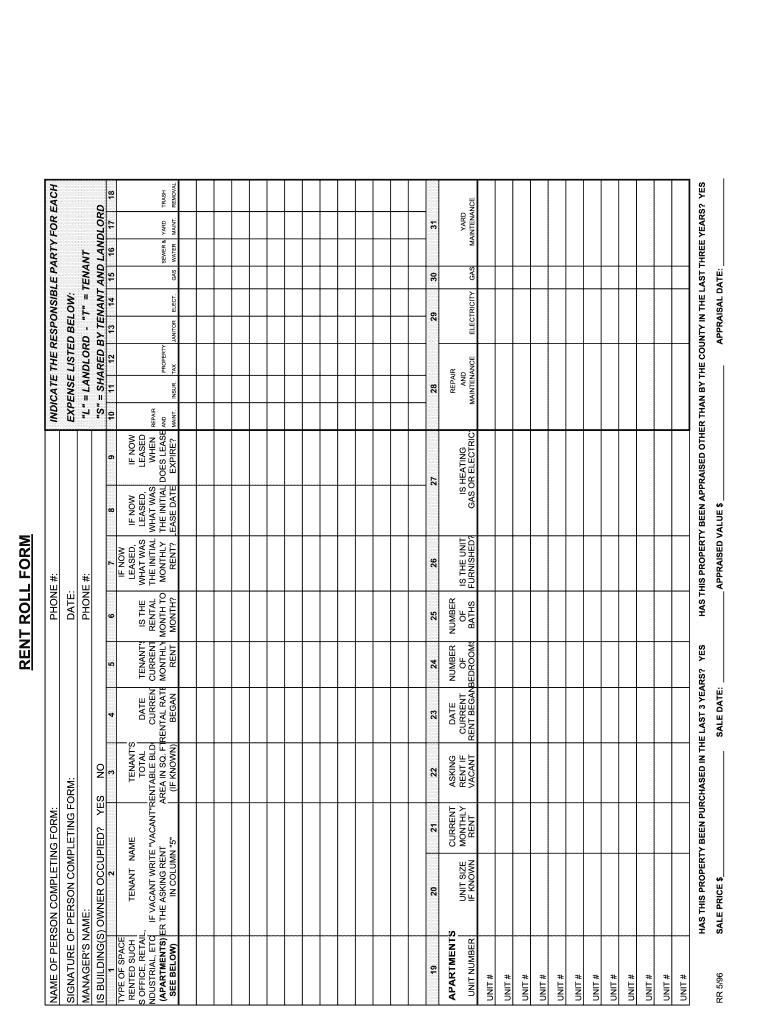

If you are reporting partnership. Current revision form 8825 pdf recent developments none at this time. A rent ledger (also called a lease ledger) is a document used to keep track of income, expenses, repairs, and other important information for a rental property or group of rental properties. Web do you receive rental income? Web this rental income brochure summarizes.

Rental Property and Expense Spreadsheet

The second is through a standard formula provided by the irs. Include it in your income when you receive it. Web do you receive rental income? In that case, you will need to include the income and expenses of each property on the form. Expenses of renting property can be deducted from your gross rental income.

Top Rental Property Expenses Spreadsheet Templates free to download in

Web only your rental expenses may be deducted on schedule e (form 1040). Expenses of renting property can be deducted from your gross rental income. Web form 8825 reports the rental income of partnerships or s corporations in the united states. You generally must include in your gross income all amounts you receive as rent. Web updated april 14, 2023.

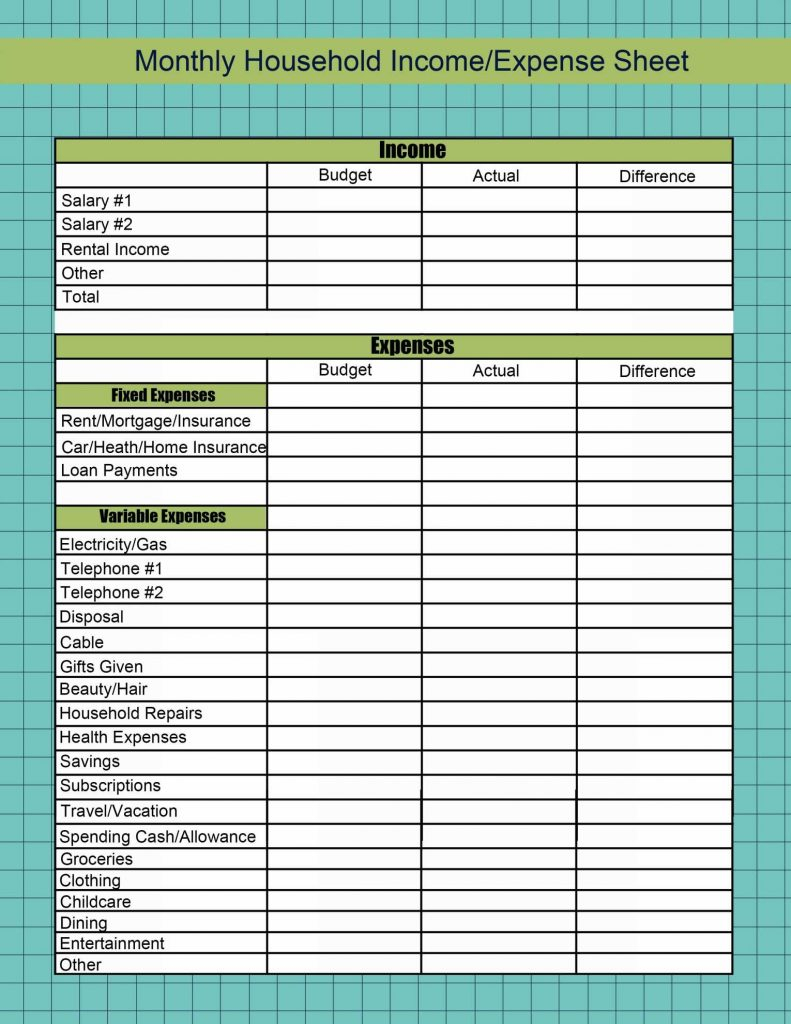

Monthly Living Expenses Spreadsheet In Spreadsheet For Household

Current revision form 8825 pdf recent developments none at this time. November 2018) department of the treasury internal revenue service name rental real estate income and expenses of a partnership or an s corporation attach to form 1065 or form 1120s. Rent or mortgage payments (include home association dues) $_____. You must include $10,000 in your income in the first.

Rental And Expense Spreadsheet Template 1 Printable Spreadshee

Web here’s our easy to use rent receipt template. A rent ledger (also called a lease ledger) is a document used to keep track of income, expenses, repairs, and other important information for a rental property or group of rental properties. Go to www.irs.gov/form8825 for the latest information. If you’re the tenant, it’s better to pay by check, money order.

Rental And Expense Worksheet Pdf Fill Online, Printable

The receipt should only be filled in after the funds are transferred to the landlord. A rent ledger (also called a lease ledger) is a document used to keep track of income, expenses, repairs, and other important information for a rental property or group of rental properties. Web income and expense statement of_____ i. Web total expenses relating to rental.

Web Per Diem Rates.

Web real estate investors use a rental income and expense worksheet to accurately track cash flow each and every month, calculate return on investment or “roi,” identify opportunities to increase revenues, and make sure they. Web total expenses relating to rental property or operation of business. Go to www.irs.gov/form8825 for the latest information. Expenses of renting property can be deducted from your gross rental income.

On Schedule E, You Can Reduce The Gross Rent By Your Rental Property Expenses.

Web updated april 14, 2023. Include it in your income when you receive it. Web this rental income brochure summarizes the most common forms of rental income, allowable expenses and their tax treatment. 12th st., kansas city, missouri 64106.

The Form May Be Issued ‘On The Spot’ With The Landlord Completing.

Gross wages per pay period $_____. Web in the first year, you receive $5,000 for the first year's rent and $5,000 as rent for the last year of the lease. Web rental businesses must be registered and licensed to do business in kansas city, missouri. Web taxpayers can claim the deduction in two ways.

The Worksheet On The Reverse Side Should Help You Document Your Rental Income And Identify Deductible Expenses From Rental Activities.

Web you must always report gross rental income. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts. Find irs forms and publications about supplemental income (rental). Marcelo • jan 01 2021.