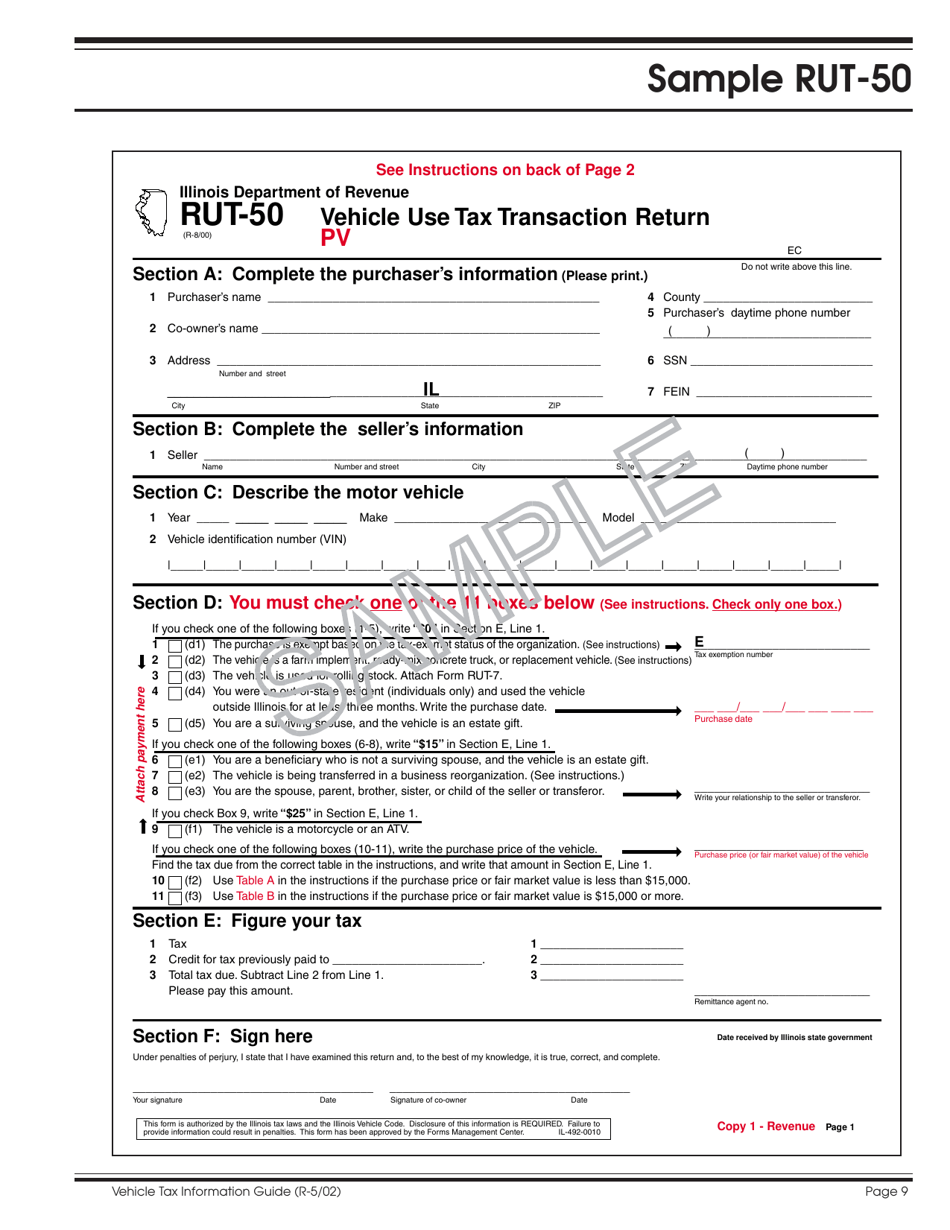

Rut-50 Tax Form

Rut-50 Tax Form - Web how to fill out and sign tax form rut 50 online? Transaction, if you purchased or acquired by gift or transfer a motor. Web what are the sales and use tax rates in illinois? Web withhold federal income tax at ____% (20% or greater) i direct you to make the distribution in accordance with my election. Enjoy smart fillable fields and interactivity. The eligibility for filing the form is based on the kind of transaction in illinois. I have read the “your rollover options” document. Identify yourself amount you are paying: The software allows you to modify information, esign,. The missouri department of revenue online withholding calculator is provided as a service for employees, employers, and tax professionals.

Do not sign this form unless all applicable lines have. $ _________________________ make your check payable to “illinois department of revenue.” pv number from original return. Transaction, if you purchased or acquired by gift or transfer a motor. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. If you need to obtain the forms prior to. The missouri department of revenue online withholding calculator is provided as a service for employees, employers, and tax professionals. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Web complete tax form rut 50 online with us legal forms. When do i have to pay my.

Transaction, if you purchased or acquired by gift or transfer a motor. Web complete tax form rut 50 online with us legal forms. Vehicle from a private party. In other words, if a vehicle is sold out of illinois, they are not. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Web withhold federal income tax at ____% (20% or greater) i direct you to make the distribution in accordance with my election. If you need to obtain the forms prior to. When do i have to pay my. Do not sign this form unless all applicable lines have. Enjoy smart fillable fields and interactivity.

Illinois Archives PDFSimpli

I have read the “your rollover options” document. The eligibility for filing the form is based on the kind of transaction in illinois. In other words, if a vehicle is sold out of illinois, they are not. If you need to obtain the forms prior to. When do i have to pay my.

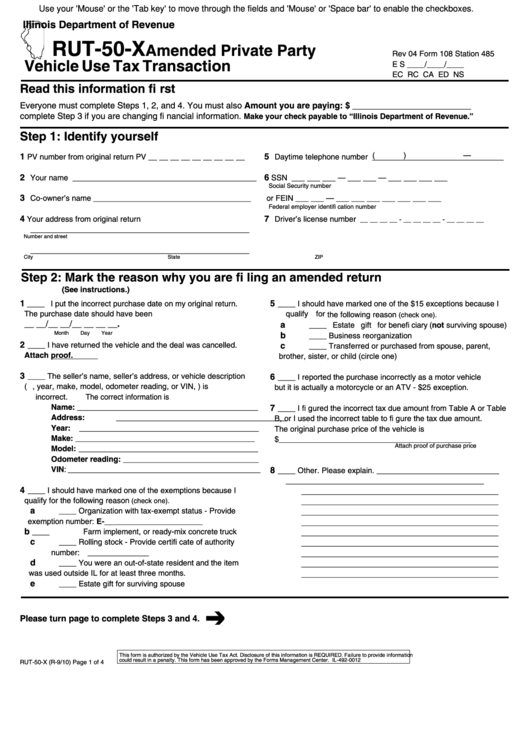

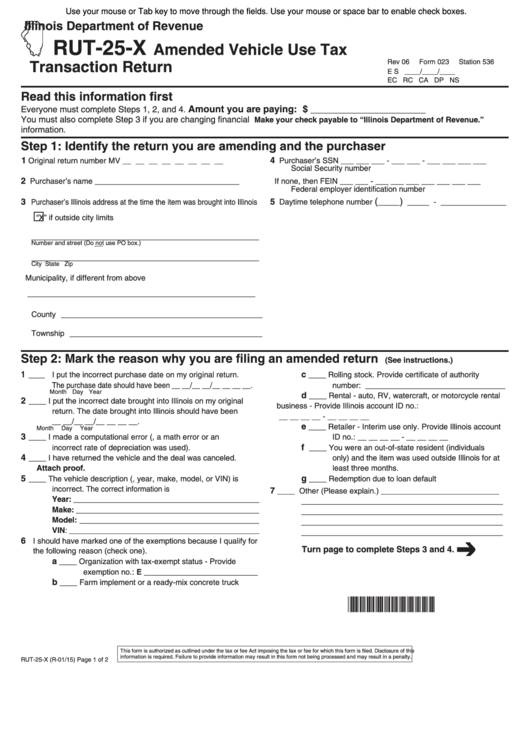

Fillable Form Rut50X Amended Private Party Vehicle Use Tax

Web what are the sales and use tax rates in illinois? Can i print a copy of my certificate of registration or license from mytax illinois? I have read the “your rollover options” document. The software allows you to modify information, esign,. When do i have to pay my.

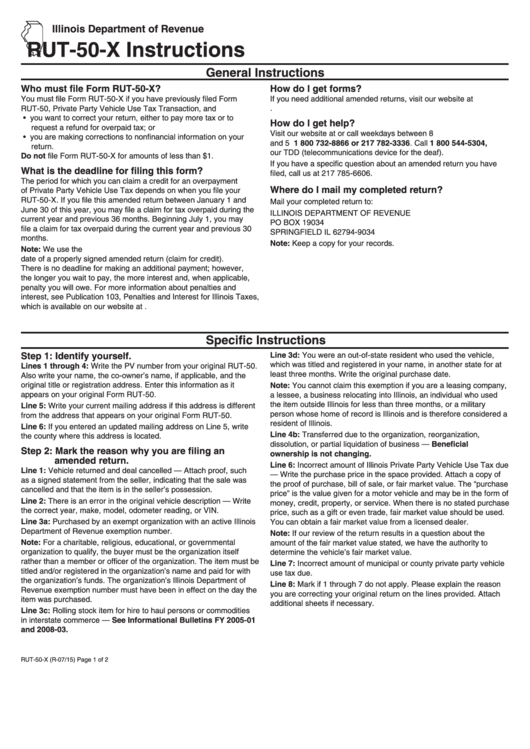

Form Rut50X Instructions printable pdf download

Web how to fill out and sign tax form rut 50 online? Web what are the sales and use tax rates in illinois? When do i have to pay my. Can i print a copy of my certificate of registration or license from mytax illinois? Web complete tax form rut 50 online with us legal forms.

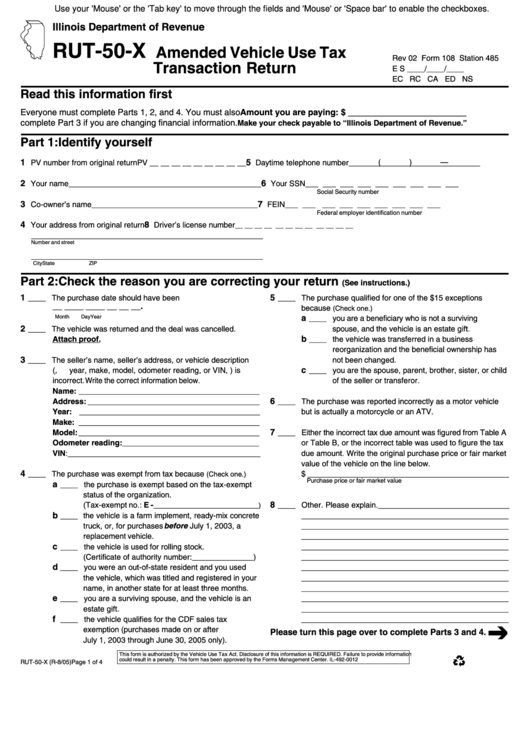

Fillable Form Rut50X Amended Vehicle Use Tax Transaction Return

Do not sign this form unless all applicable lines have. Get your online template and fill it in using progressive features. The software allows you to modify information, esign,. Identify yourself amount you are paying: Enjoy smart fillable fields and interactivity.

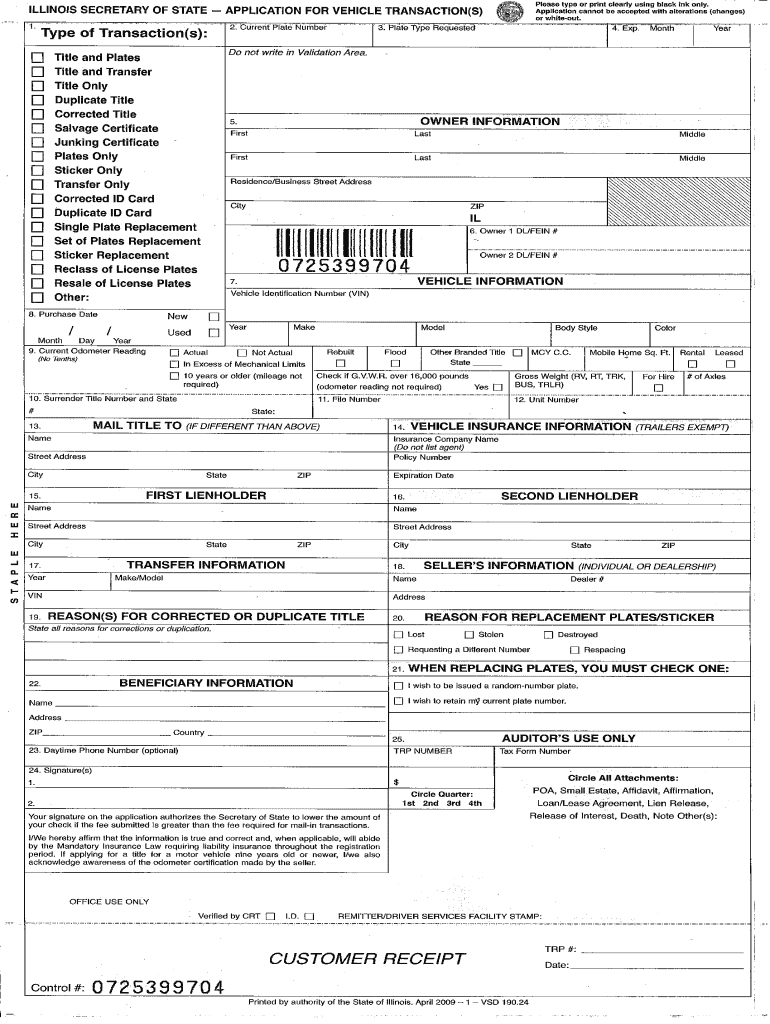

Secretary Cyberdriveillinois Bank Get Fill Online, Printable

Save or instantly send your ready documents. The eligibility for filing the form is based on the kind of transaction in illinois. Transaction, if you purchased or acquired by gift or transfer a motor. Vehicle from a private party. One of these forms must be presented with a separate tax payment made out to the illinois department of.

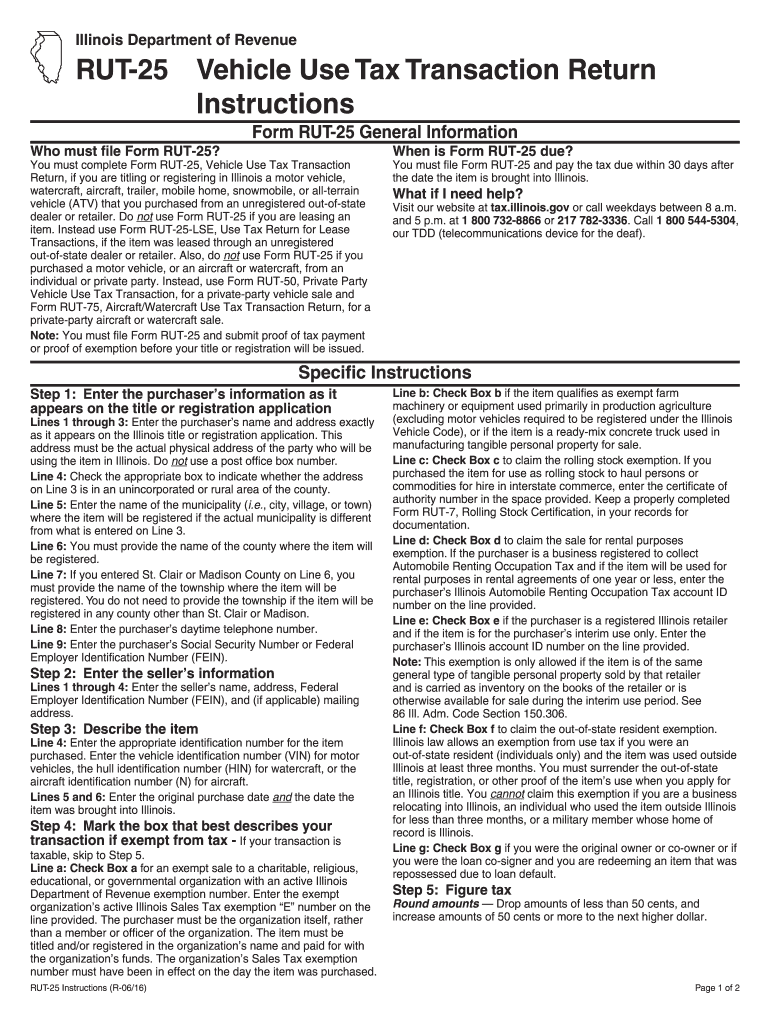

Rut 25 20202022 Fill and Sign Printable Template Online US Legal Forms

Can i print a copy of my certificate of registration or license from mytax illinois? Enjoy smart fillable fields and interactivity. The software allows you to modify information, esign,. Web up to $40 cash back complete rut 75 tax form printable and other documents on your android device with the pdffiller app. Easily fill out pdf blank, edit, and sign.

Rut 25 Lse Form Pdf Fill Out and Sign Printable PDF Template signNow

Do not sign this form unless all applicable lines have. One of these forms must be presented with a separate tax payment made out to the illinois department of. Save or instantly send your ready documents. When do i have to pay my. In other words, if a vehicle is sold out of illinois, they are not.

Tax Form Rut50 Printable Printable Word Searches

The missouri department of revenue online withholding calculator is provided as a service for employees, employers, and tax professionals. Do not sign this form unless all applicable lines have. Vehicle from a private party. If a recently purchased vehicle has not been titled or registered in this. Web complete tax form rut 50 online with us legal forms.

Sample Form RUT50 Fill Out, Sign Online and Download Printable PDF

Get your online template and fill it in using progressive features. The missouri department of revenue online withholding calculator is provided as a service for employees, employers, and tax professionals. Request for copy of tax return. Web what are the sales and use tax rates in illinois? If you need to obtain the forms prior to.

Vsd 190 20202022 Fill and Sign Printable Template Online US Legal

Do not sign this form unless all applicable lines have. I have read the “your rollover options” document. Web what are the sales and use tax rates in illinois? Web up to $40 cash back complete rut 75 tax form printable and other documents on your android device with the pdffiller app. Web withhold federal income tax at ____% (20%.

If You Need To Obtain The Forms Prior To.

Web how to fill out and sign tax form rut 50 online? Web up to $40 cash back complete rut 75 tax form printable and other documents on your android device with the pdffiller app. Vehicle from a private party. The missouri department of revenue online withholding calculator is provided as a service for employees, employers, and tax professionals.

$ _________________________ Make Your Check Payable To “Illinois Department Of Revenue.” Pv Number From Original Return.

If a recently purchased vehicle has not been titled or registered in this. Web complete tax form rut 50 online with us legal forms. Enjoy smart fillable fields and interactivity. Web what are the sales and use tax rates in illinois?

One Of These Forms Must Be Presented With A Separate Tax Payment Made Out To The Illinois Department Of.

In other words, if a vehicle is sold out of illinois, they are not. When do i have to pay my. Do not sign this form unless all applicable lines have. Easily fill out pdf blank, edit, and sign them.

Web Withhold Federal Income Tax At ____% (20% Or Greater) I Direct You To Make The Distribution In Accordance With My Election.

Save or instantly send your ready documents. I have read the “your rollover options” document. The eligibility for filing the form is based on the kind of transaction in illinois. Identify yourself amount you are paying: