Schedule 1 Form 2290

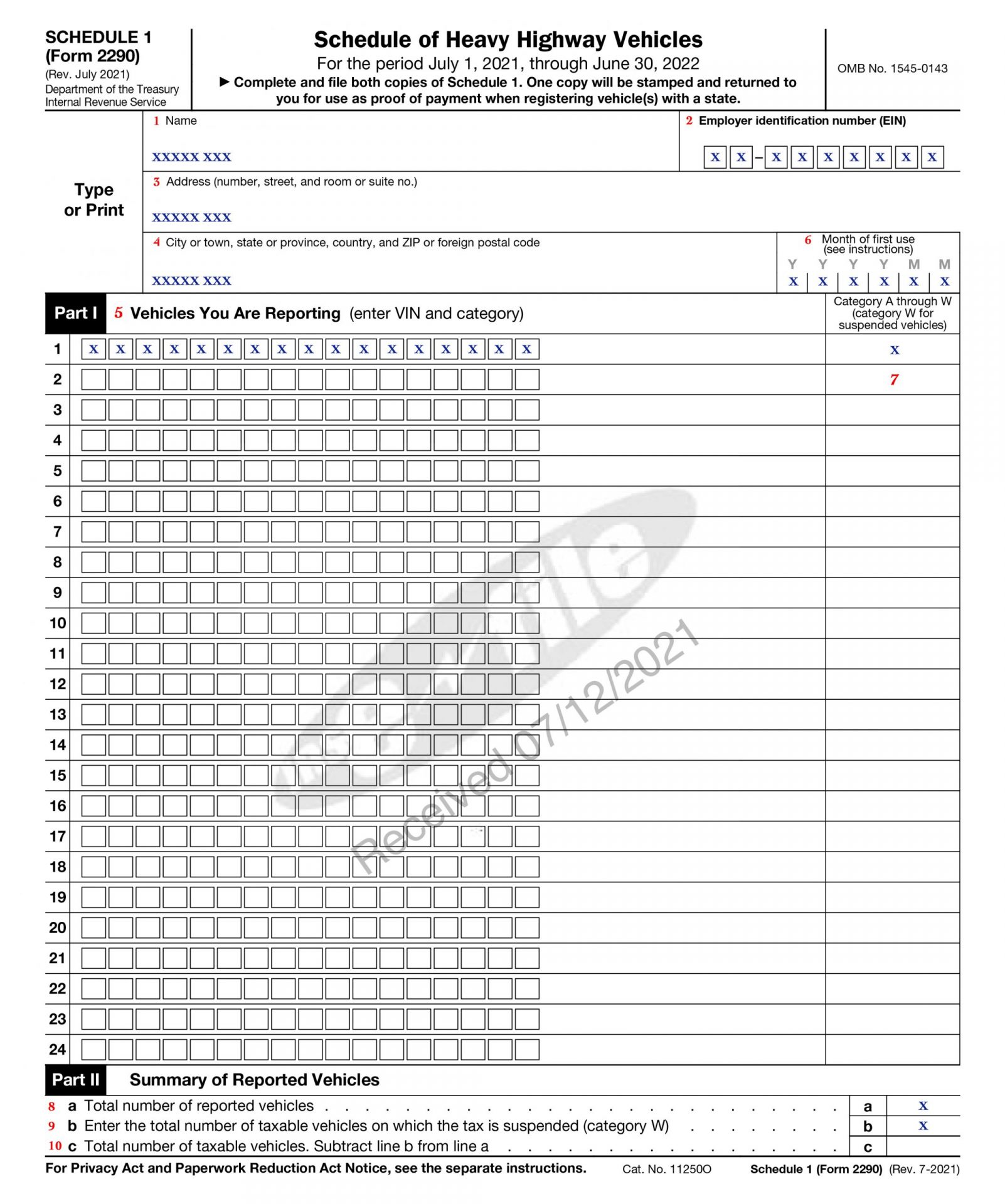

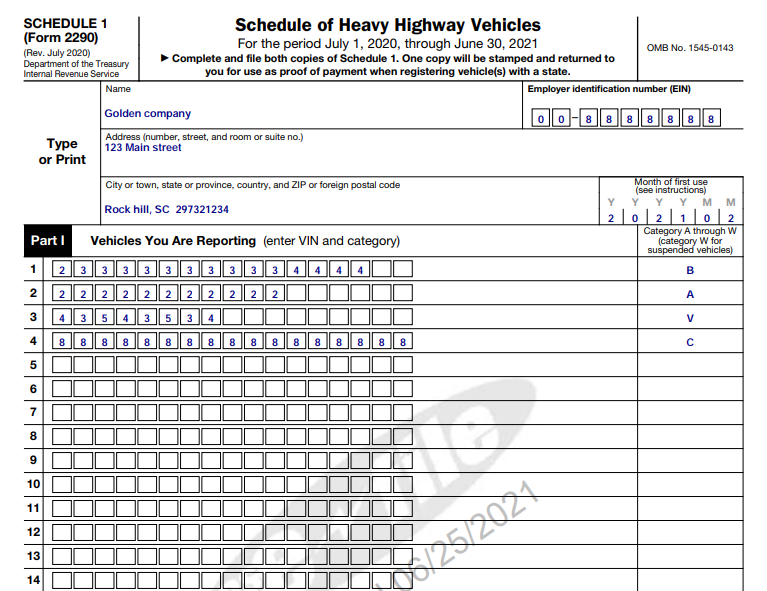

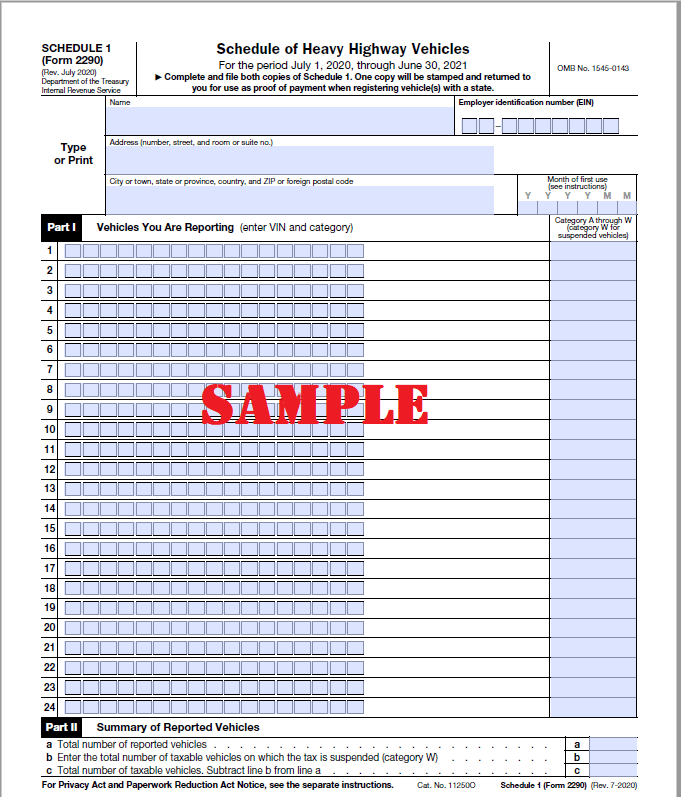

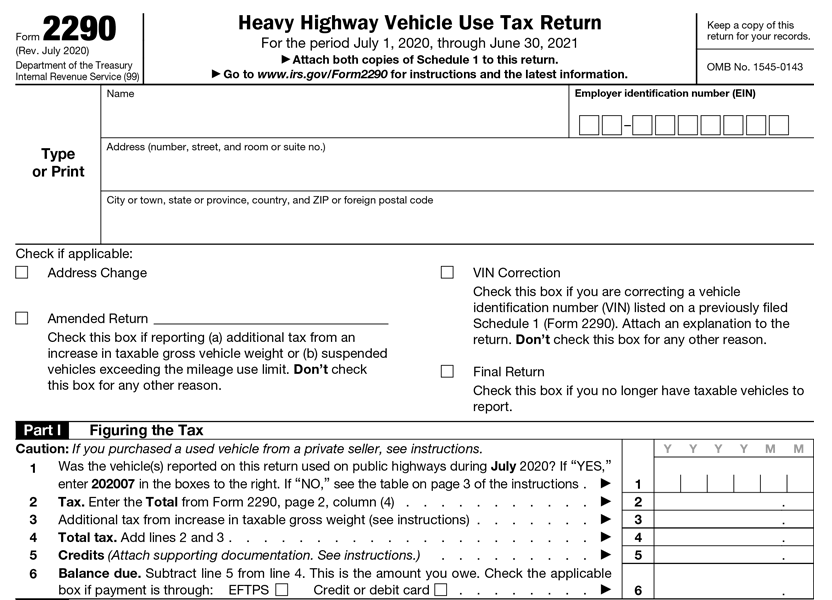

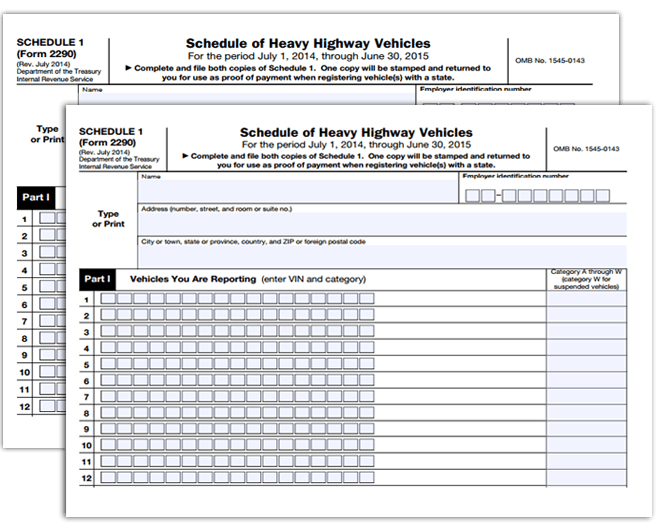

Schedule 1 Form 2290 - Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Web schedule 1 form 2290 proof helps you drive your vehicle on public roads. 5,000 miles or less 7,500 miles or less for agricultural vehicles. Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. During the period july 1, 2022, through june 30, 2023, and are suspended from the tax. Web schedule 1 form 2290 is a proof of payment provided to you by the irs (internal revenue service) upon payment of your heavy highway vehicle use tax. Quick and secured way to prepare your truck tax return. Form schedule 1 proof helps to report and renew heavy vehicles with the irs, such as taxable and suspended vehicles. You must include a copy of the form 2290 and schedule 1 previously filed. No fee for vin correction.

Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. Go to www.irs.gov/form2290 for instructions and the latest information. During the period july 1, 2022, through june 30, 2023, and are suspended from the tax. Web schedule 1 form 2290 proof helps you drive your vehicle on public roads. No fee for vin correction. Get schedule 1 in minutes. You must include a copy of the form 2290 and schedule 1 previously filed. To receive a copy of a current schedule 1, be sure you have already filed form 2290 and fully paid the tax (if any tax was due). It contains vehicle information and business details and also helps with vehicle registration. Once your hvut return is processed by the irs, they will create two stamped copies of your schedule of heavy highway vehicles.

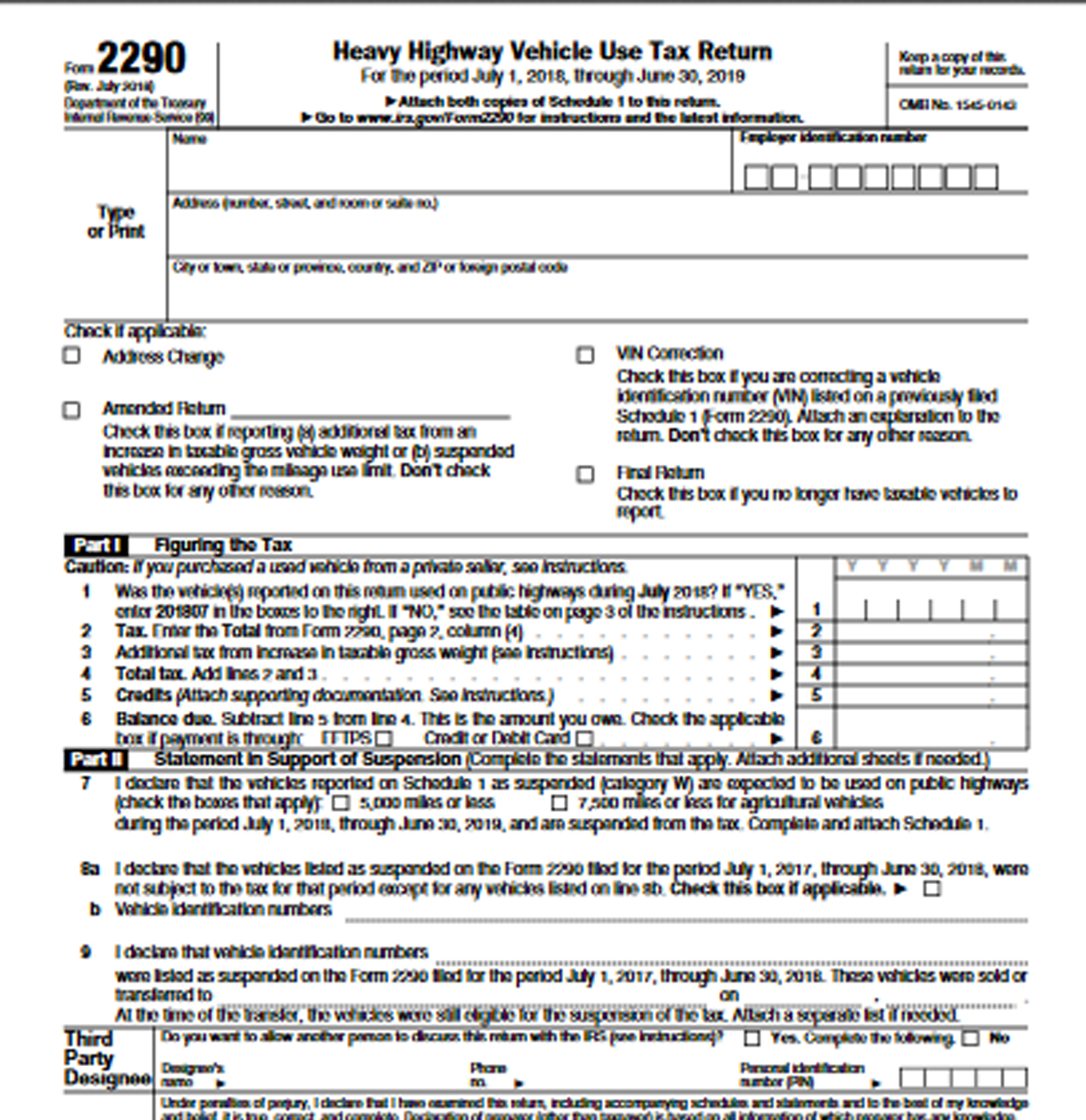

To receive a copy of a current schedule 1, be sure you have already filed form 2290 and fully paid the tax (if any tax was due). Web the schedule 1 designated for vehicles for which tax has been suspended. During the period july 1, 2022, through june 30, 2023, and are suspended from the tax. Web schedule 1 copies for filed forms 2290. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021 attach both copies of schedule 1 to this return. See month of first use under schedule 1 (form 2290) ,. 5,000 miles or less 7,500 miles or less for agricultural vehicles. Get schedule 1 in minutes. Go to www.irs.gov/form2290 for instructions and the latest information. Web schedule 1 form 2290 is a proof of payment provided to you by the irs (internal revenue service) upon payment of your heavy highway vehicle use tax.

How to Efile Form 2290 for 202223 Tax Period

It contains vehicle information and business details and also helps with vehicle registration. Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions.

Schedule 1 2290 IRS Form 2290 Schedule 1 eForm 2290

Get schedule 1 in minutes. During the period july 1, 2022, through june 30, 2023, and are suspended from the tax. To receive a copy of a current schedule 1, be sure you have already filed form 2290 and fully paid the tax (if any tax was due). Form 2290 filers must enter the month of first use in schedule.

Fillable Form 2290 20232024 Create, Fill & Download 2290

Web schedule 1 (form 2290)—month of first use. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Go to www.irs.gov/form2290 for instructions and the latest information. It contains vehicle information and business details and also helps with vehicle registration. Quick and secured way to prepare your truck.

Schedule 1 IRS Form 2290 Proof of Payment

Web i declare that the vehicles reported on schedule 1 as suspended (category w) are expected to be used on public highways (check the boxes that apply): July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021 attach both copies of schedule.

2290 Schedule 1 EFile IRS Form 2290 Stamped Schedule 1

Get schedule 1 in minutes. Web schedule 1 copies for filed forms 2290. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. The vehicle identification number of the vehicle being registered must appear on the schedule 1 (or an attached page) in order for the schedule 1 to be a valid proof.

Efiling IRS Form 2290 EFile 2290 for lowest price 6.90

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. You must include a copy of the form 2290 and schedule 1 previously filed. Web schedule 1 copies for filed forms 2290. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july.

Federal Form 2290 Schedule 1 Universal Network

July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021 attach both copies of schedule 1 to this return. Web i declare that the vehicles reported on schedule 1 as suspended (category w) are expected to be used on public highways (check.

Instructions For Form 2290 Schedule 1 Form Resume Examples QJ9eP5g2my

Web schedule 1 form 2290 proof helps you drive your vehicle on public roads. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. During the period july 1, 2022, through june 30, 2023, and are suspended from the tax. To receive a copy of a current schedule.

File Tax 2290 File 2290 Online 2290 Tax Form

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web schedule 1 copies for filed forms 2290. Web i declare that the vehicles reported on schedule 1 as suspended (category w) are expected to be used on public highways (check the boxes that apply): 5,000 miles or.

Get Form 2290 Schedule 1 in Minutes HVUT Proof of Payment

Web schedule 1 form 2290 is a proof of payment provided to you by the irs (internal revenue service) upon payment of your heavy highway vehicle use tax. During the period july 1, 2022, through june 30, 2023, and are suspended from the tax. Web the schedule 1 designated for vehicles for which tax has been suspended. Form 2290 is.

Web Information About Form 2290, Heavy Highway Vehicle Use Tax Return, Including Recent Updates, Related Forms, And Instructions On How To File.

No fee for vin correction. Web schedule 1 form 2290 proof helps you drive your vehicle on public roads. The vehicle identification number of the vehicle being registered must appear on the schedule 1 (or an attached page) in order for the schedule 1 to be a valid proof of payment for such vehicle. To receive a copy of a current schedule 1, be sure you have already filed form 2290 and fully paid the tax (if any tax was due).

Web I Declare That The Vehicles Reported On Schedule 1 As Suspended (Category W) Are Expected To Be Used On Public Highways (Check The Boxes That Apply):

July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021 attach both copies of schedule 1 to this return. Web schedule 1 form 2290 is a proof of payment provided to you by the irs (internal revenue service) upon payment of your heavy highway vehicle use tax. Web schedule 1 (form 2290)—month of first use. Form schedule 1 proof helps to report and renew heavy vehicles with the irs, such as taxable and suspended vehicles.

Form 2290 Filers Must Enter The Month Of First Use In Schedule 1 To Indicate When The Vehicles Included In Schedule 1 Were First Used During The Tax Period.

Web schedule 1 copies for filed forms 2290. You must include a copy of the form 2290 and schedule 1 previously filed. It contains vehicle information and business details and also helps with vehicle registration. Get schedule 1 in minutes.

See Month Of First Use Under Schedule 1 (Form 2290) ,.

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Go to www.irs.gov/form2290 for instructions and the latest information. Web the schedule 1 designated for vehicles for which tax has been suspended. During the period july 1, 2022, through june 30, 2023, and are suspended from the tax.