Schedule 8812 Form 2021

Schedule 8812 Form 2021 - Example ed’s son, jeff, turned 18 on december 30, and has a valid social security number (ssn). Go to www.irs.gov/schedule8812 for instructions and the latest information. What’s new child tax credit enhancements have expired. For 2021 only, the schedule is used to claim the dependent credits and determine if you have to pay back any excess advanced child tax credits you received in. See the temporary provisions lesson earlier for the updates. Schedule 8812 (form 1040) is now used to calculate child tax credits and to report advance child tax credit payments received in 2021, and to figure any additional tax owed if excess advance child tax credit payments were received during 2021. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Web 2021 only for qualifying taxpayers. Web new schedule 8812, credits for qualifying children and other dependents in past years, schedule 8812 was used only to calculate the refundable portion of the child credit, known as the additional child tax credit (actc). The ctc and odc are nonrefundable credits.

Web for the latest information about developments related to schedule 8812 and its instructions, such as legislation enacted after they were published, go to irs.gov/schedule8812. For 2021 only, the schedule is used to claim the dependent credits and determine if you have to pay back any excess advanced child tax credits you received in. Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. The actc is a refundable credit. Web taxpayers should refer to schedule 8812 (form 1040). The credit is figured on schedule 8812. Web 2021 only for qualifying taxpayers. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. Web in 2022, if the total credit amount for all of your qualifying children exceeds the amount of tax you owe for the year, the irs requires you to prepare schedule 8812 to claim this amount.

Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. Web for the latest information about developments related to schedule 8812 and its instructions, such as legislation enacted after they were published, go to irs.gov/schedule8812. Web taxpayers should refer to schedule 8812 (form 1040). Web 2021 only for qualifying taxpayers. See the temporary provisions lesson earlier for the updates. What’s new child tax credit enhancements have expired. Web new schedule 8812, credits for qualifying children and other dependents in past years, schedule 8812 was used only to calculate the refundable portion of the child credit, known as the additional child tax credit (actc). Example ed’s son, jeff, turned 18 on december 30, and has a valid social security number (ssn). Go to www.irs.gov/schedule8812 for instructions and the latest information.

Irs Child Tax Credit IRS Form 1040 Schedule 8812 Download Fillable

See the temporary provisions lesson earlier for the updates. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). The actc is a refundable credit. Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. Schedule 8812 (form.

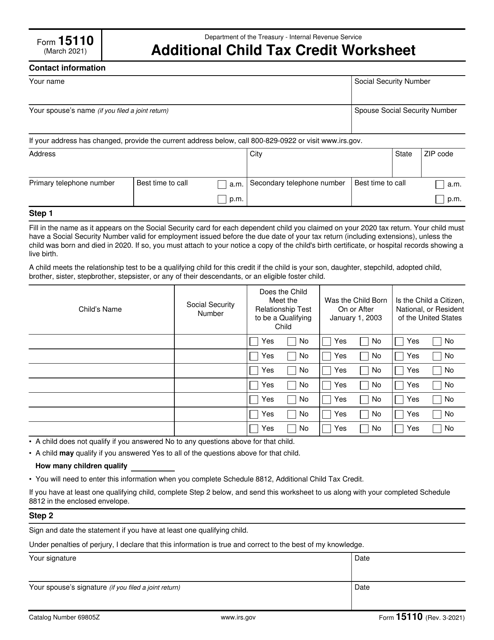

IRS Form 15110 Download Fillable PDF or Fill Online Additional Child

Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. See the temporary provisions lesson earlier for the updates. The tax software makes all these calculations based on your. For 2021 only, the schedule is used to claim the dependent credits and determine if you have to pay back any excess advanced.

Form 8812 Credit Limit Worksheet A

Web for the latest information about developments related to schedule 8812 and its instructions, such as legislation enacted after they were published, go to irs.gov/schedule8812. The ctc and odc are nonrefundable credits. Go to www.irs.gov/schedule8812 for instructions and the latest information. Web in 2022, if the total credit amount for all of your qualifying children exceeds the amount of tax.

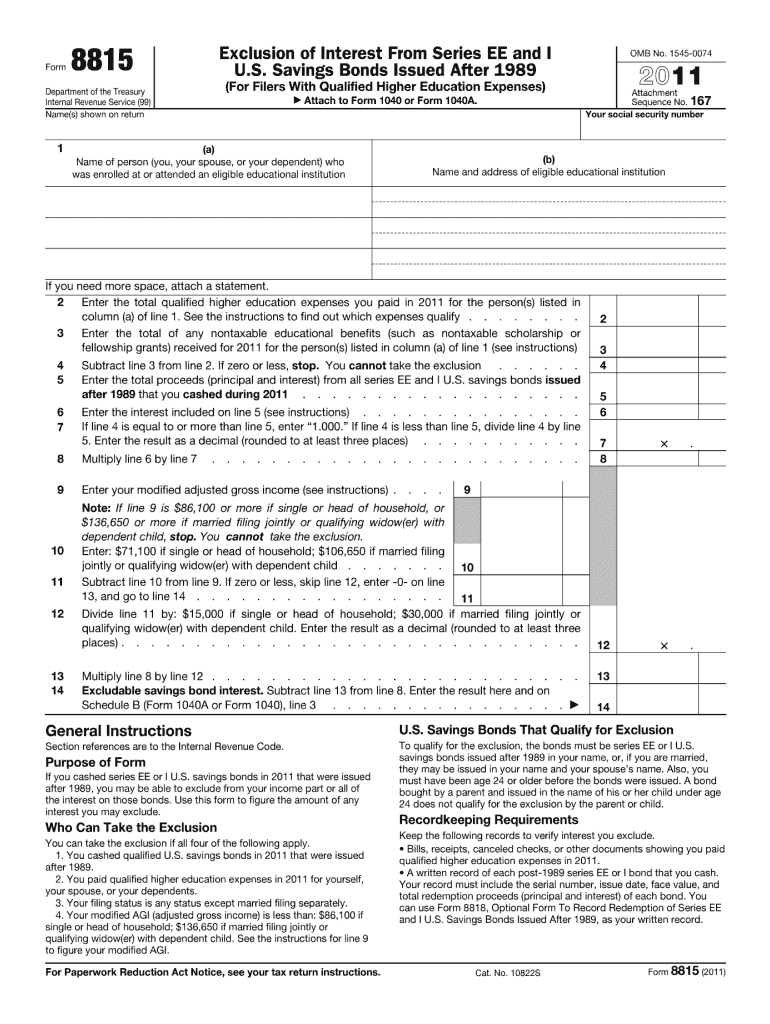

Form 8815 Instructions Fill Out and Sign Printable PDF Template signNow

See the temporary provisions lesson earlier for the updates. Web in 2022, if the total credit amount for all of your qualifying children exceeds the amount of tax you owe for the year, the irs requires you to prepare schedule 8812 to claim this amount. What’s new child tax credit enhancements have expired. For 2021 only, the schedule is used.

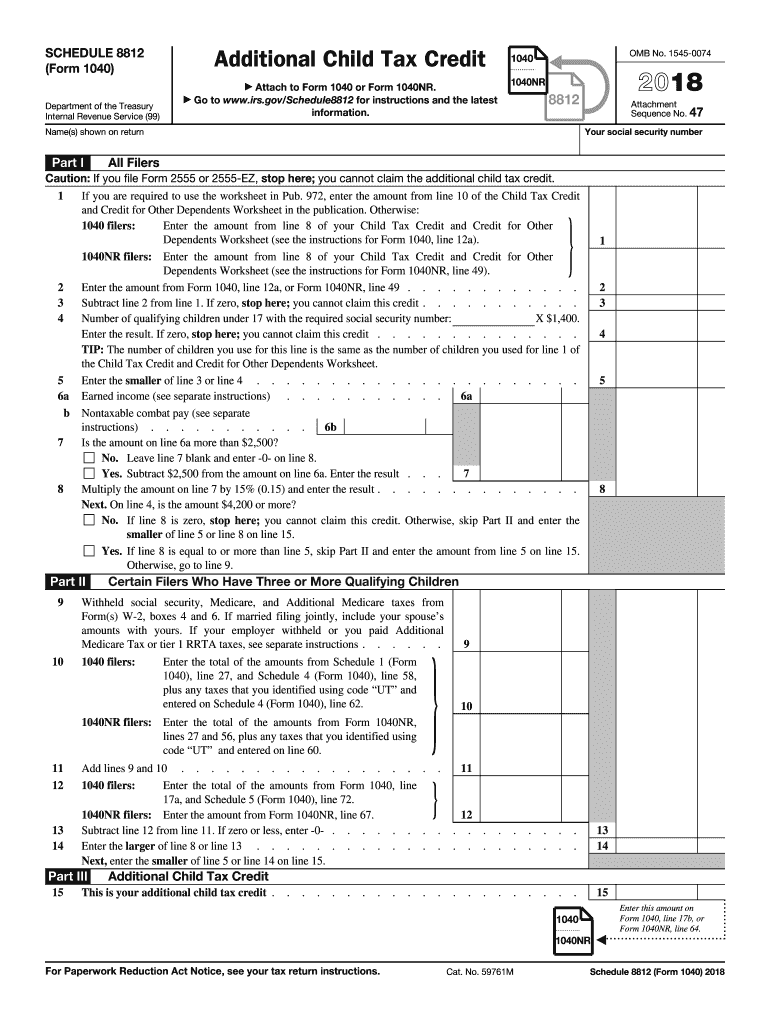

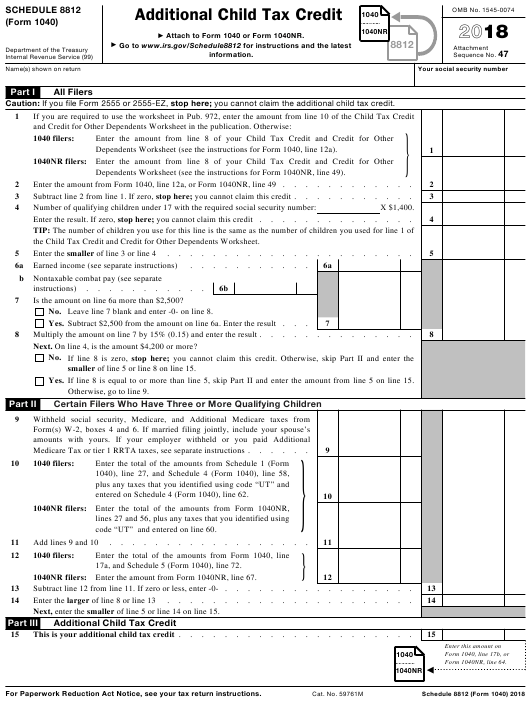

2018 Form IRS 1040 Schedule 8812 Fill Online, Printable, Fillable

Web 2021 only for qualifying taxpayers. The credit is figured on schedule 8812. Web taxpayers should refer to schedule 8812 (form 1040). For 2021 only, the schedule is used to claim the dependent credits and determine if you have to pay back any excess advanced child tax credits you received in. Go to www.irs.gov/schedule8812 for instructions and the latest information.

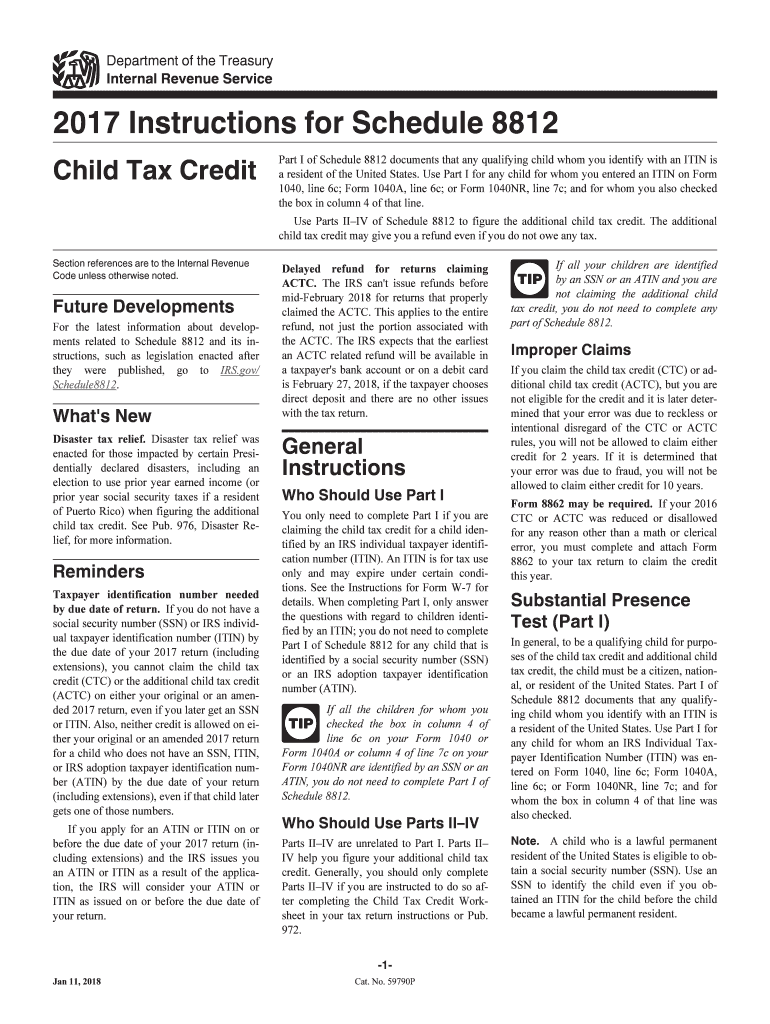

Irs Instructions Form 8812 Fill Out and Sign Printable PDF Template

Go to www.irs.gov/schedule8812 for instructions and the latest information. Go to www.irs.gov/schedule8812 for instructions and the latest information. Web in 2022, if the total credit amount for all of your qualifying children exceeds the amount of tax you owe for the year, the irs requires you to prepare schedule 8812 to claim this amount. For 2021 only, the schedule is.

Schedule 8812 Credit Limit Worksheet A

The ctc and odc are nonrefundable credits. The actc is a refundable credit. Go to www.irs.gov/schedule8812 for instructions and the latest information. See the temporary provisions lesson earlier for the updates. Schedule 8812 (form 1040) is now used to calculate child tax credits and to report advance child tax credit payments received in 2021, and to figure any additional tax.

Schedule 8812 Credit Limit Worksheet A

Web in 2022, if the total credit amount for all of your qualifying children exceeds the amount of tax you owe for the year, the irs requires you to prepare schedule 8812 to claim this amount. Go to www.irs.gov/schedule8812 for instructions and the latest information. Many changes to the ctc for 2021 implemented by the american rescue plan act of.

8812 Worksheet

Web new schedule 8812, credits for qualifying children and other dependents in past years, schedule 8812 was used only to calculate the refundable portion of the child credit, known as the additional child tax credit (actc). For 2021 only, the schedule is used to claim the dependent credits and determine if you have to pay back any excess advanced child.

Many Changes To The Ctc For 2021 Implemented By The American Rescue Plan Act Of 2021, Have Expired.

The tax software makes all these calculations based on your. Go to www.irs.gov/schedule8812 for instructions and the latest information. Web 2021 only for qualifying taxpayers. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc).

The Credit Is Figured On Schedule 8812.

Web new schedule 8812, credits for qualifying children and other dependents in past years, schedule 8812 was used only to calculate the refundable portion of the child credit, known as the additional child tax credit (actc). See the temporary provisions lesson earlier for the updates. Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021.

Go To Www.irs.gov/Schedule8812 For Instructions And The Latest Information.

Example ed’s son, jeff, turned 18 on december 30, and has a valid social security number (ssn). For 2021 only, the schedule is used to claim the dependent credits and determine if you have to pay back any excess advanced child tax credits you received in. What’s new child tax credit enhancements have expired. Web taxpayers should refer to schedule 8812 (form 1040).

The Ctc And Odc Are Nonrefundable Credits.

Web in 2022, if the total credit amount for all of your qualifying children exceeds the amount of tax you owe for the year, the irs requires you to prepare schedule 8812 to claim this amount. 47 name(s) shown on return your social security. Web for the latest information about developments related to schedule 8812 and its instructions, such as legislation enacted after they were published, go to irs.gov/schedule8812. The actc is a refundable credit.