Schedule A Form 990 Ez

Schedule A Form 990 Ez - Web if yes, complete schedule l, part i section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Web go to www.irs.gov/form990ez for instructions and the latest information. For other organizations that file. Go to www.irs.gov/form990 for the. Web create my document a schedule a form is used by the internal revenue service. Enter amount of tax imposed on organization managers or. Complete, edit or print tax forms instantly. Also known as a public charity status and public support form, it is attached to form 990 or. Get ready for tax season deadlines by completing any required tax forms today. Instructions for these schedules are.

At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. If you checked 12d of part i, complete sections a and d, and complete part v.). Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Web create my document a schedule a form is used by the internal revenue service. Web schedule a (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3). Also known as a public charity status and public support form, it is attached to form 990 or. Complete, edit or print tax forms instantly. Instructions for these schedules are. Ad access irs tax forms.

For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Web schedule a (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3). Get ready for tax season deadlines by completing any required tax forms today. Enter amount of tax imposed on organization managers or. Ad access irs tax forms. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Go to www.irs.gov/form990 for the. Web if yes, complete schedule l, part i section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Also known as a public charity status and public support form, it is attached to form 990 or.

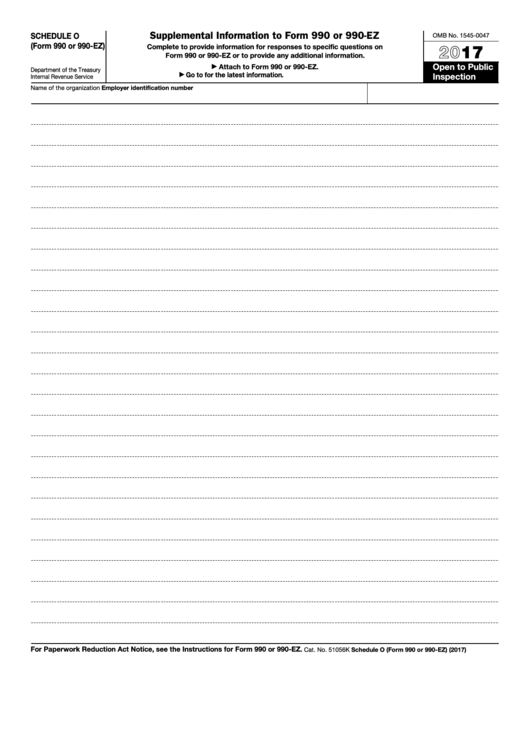

Fillable Schedule O (Form 990 Or 990Ez) Supplemental Information To

Also known as a public charity status and public support form, it is attached to form 990 or. Enter amount of tax imposed on organization managers or. Web if yes, complete schedule l, part i section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Get ready for tax season deadlines by completing any required tax forms today. Web schedule a (form 990) department.

990 T Printable Irs Forms 2019 Fill Out Digital PDF Sample

Go to www.irs.gov/form990 for the. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Complete, edit or print tax forms instantly. If you checked 12d of part i, complete sections a and d, and complete part v.). Web the following schedules to form 990, return of organization exempt from income tax,.

form 990 schedule o Fill Online, Printable, Fillable Blank form990

Enter amount of tax imposed on organization managers or. For other organizations that file. Web create my document a schedule a form is used by the internal revenue service. Go to www.irs.gov/form990 for the. Also known as a public charity status and public support form, it is attached to form 990 or.

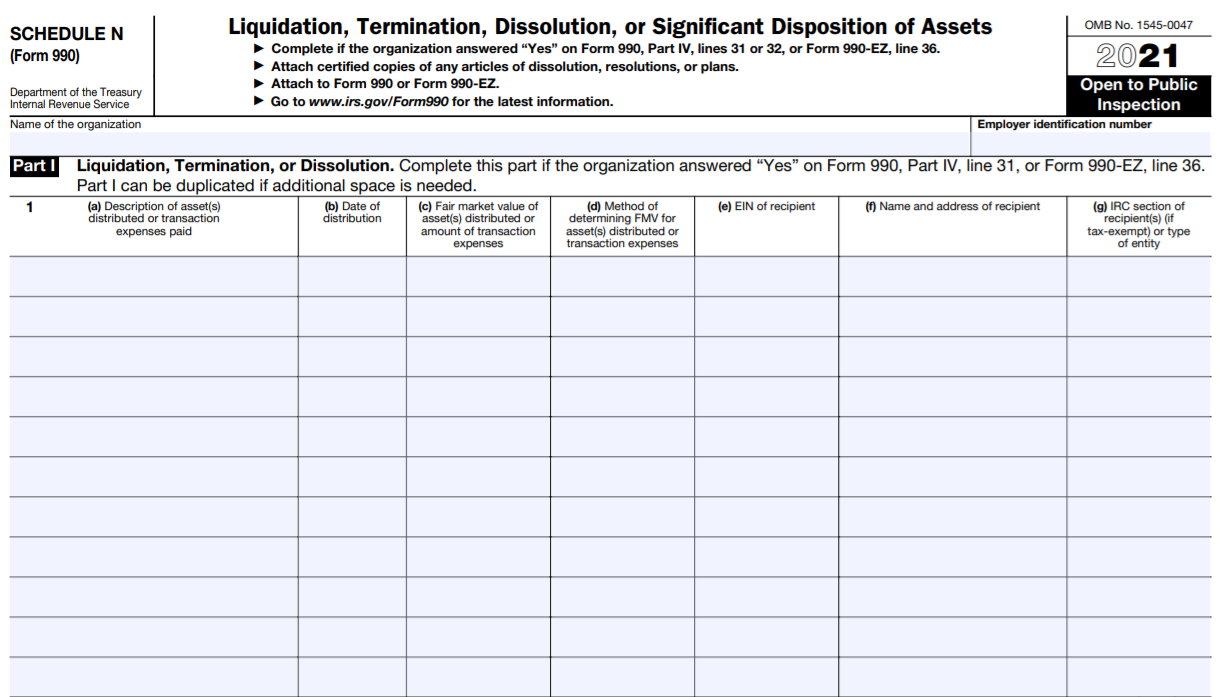

IRS Form 990/990EZ Schedule N Instructions Liquidation, Termination

Web create my document a schedule a form is used by the internal revenue service. If you checked 12d of part i, complete sections a and d, and complete part v.). Also known as a public charity status and public support form, it is attached to form 990 or. The information provided will enable you to file a more complete.

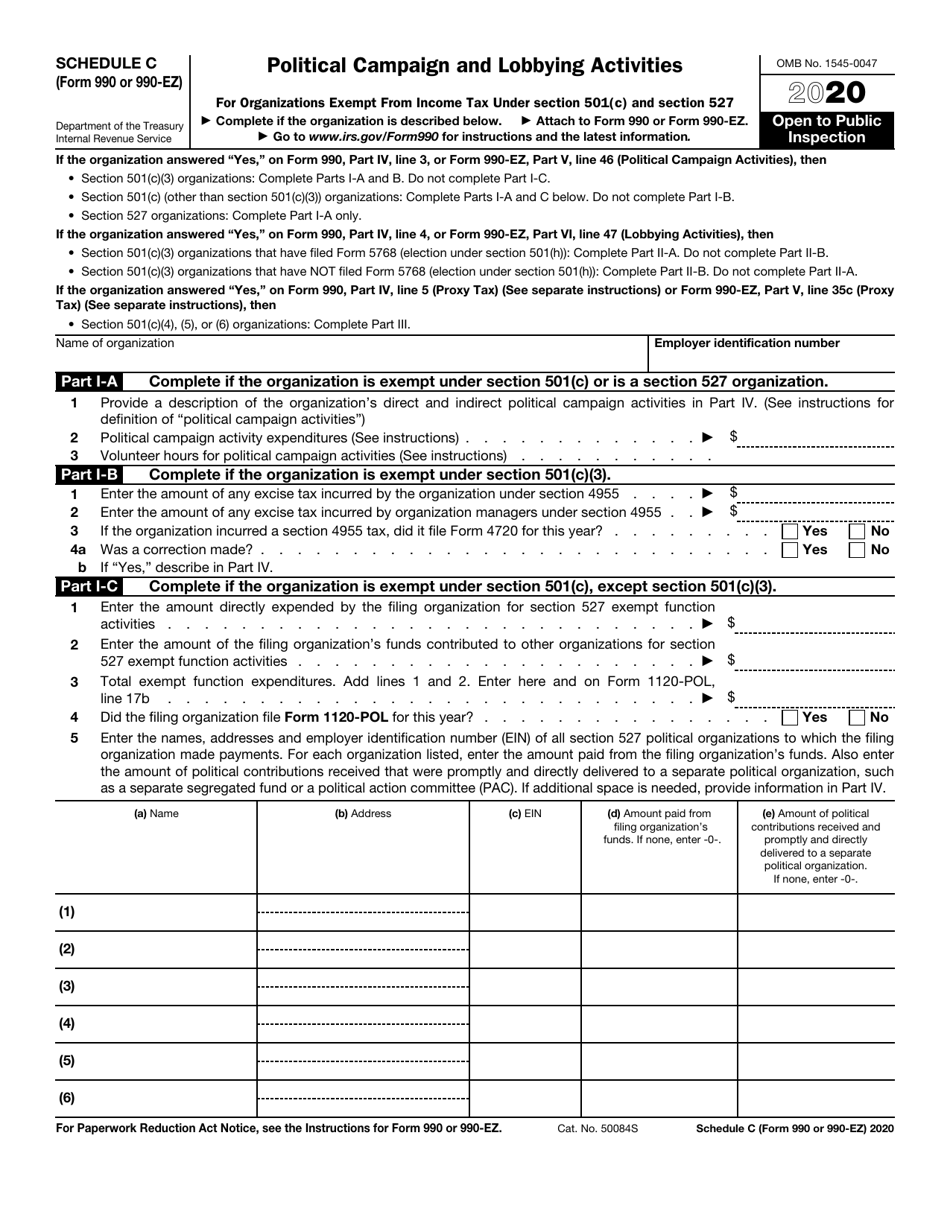

IRS Form 990 (990EZ) Schedule C Download Fillable PDF or Fill Online

Web if yes, complete schedule l, part i section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Instructions for these schedules are. Web schedule a (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3). Go to www.irs.gov/form990 for the. If you checked 12d of part i, complete sections a.

IRS Instructions Schedule A (990 Or 990EZ) 20202022 Fill out Tax

Web schedule a (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3). At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. If you checked 12d of part i, complete sections a and d, and complete part v.)..

199N E Postcard Fill Out and Sign Printable PDF Template signNow

Go to www.irs.gov/form990 for the. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Enter amount of tax imposed on organization managers or. If you checked 12d of part i, complete sections a and d, and complete part v.). Ad access irs tax forms.

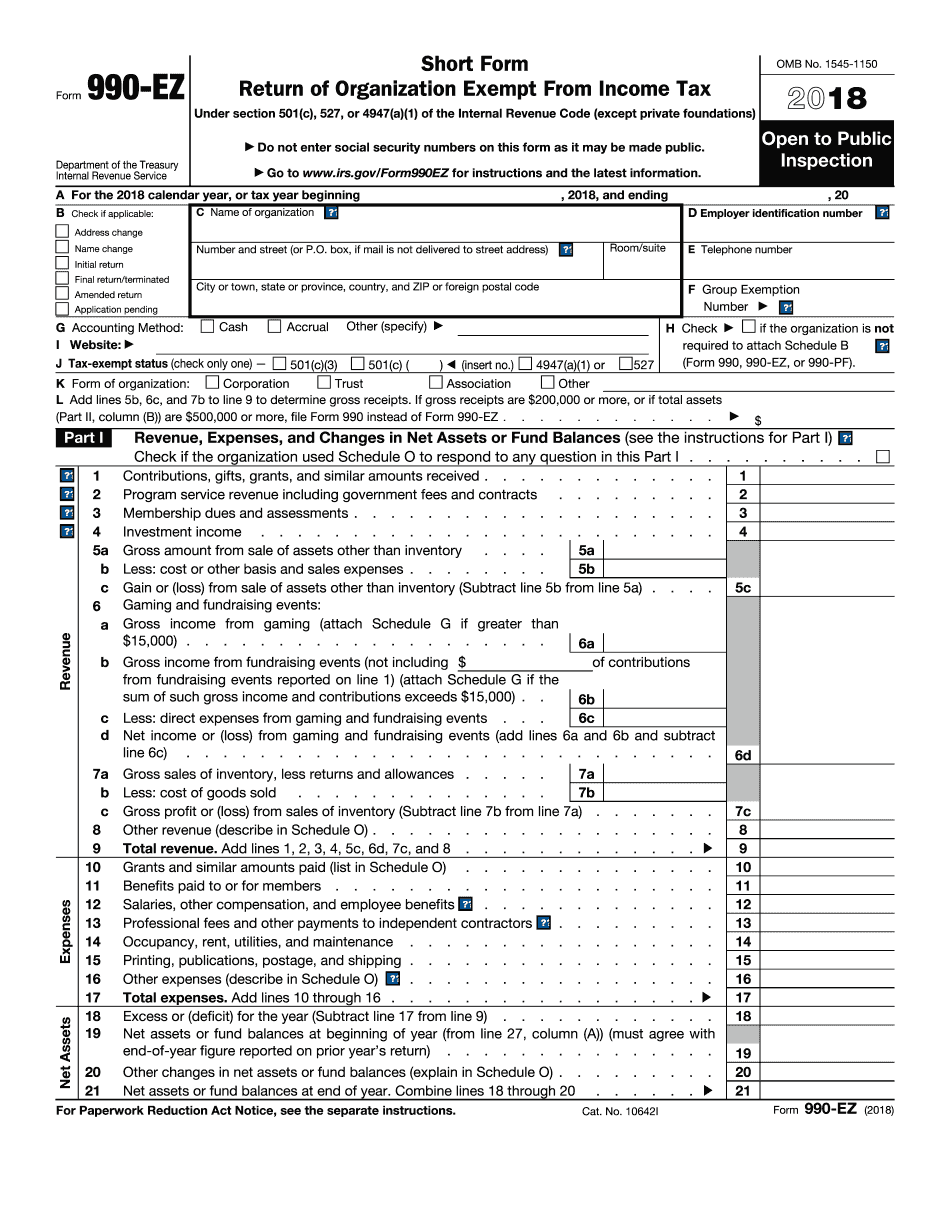

IRS Form 990EZ 2018 2019 Printable & Fillable Sample in PDF

The information provided will enable you to file a more complete return and reduce the. Go to www.irs.gov/form990 for the. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Complete, edit or print tax forms instantly. Web the following schedules to form 990, return of organization exempt from income tax, do.

How To Fill Out Form 990 Ez 2020 Blank Sample to Fill out Online in PDF

If you checked 12d of part i, complete sections a and d, and complete part v.). At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Get ready for tax season deadlines by completing any required tax forms today. For other organizations that file. Web if yes, complete schedule l, part i.

Form 990 (Schedule R) 2019 Blank Sample to Fill out Online in PDF

For other organizations that file. Web go to www.irs.gov/form990ez for instructions and the latest information. Web if yes, complete schedule l, part i section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Instructions for these schedules are. Also known as a public charity status and public support form, it is attached to form 990 or.

Ad Access Irs Tax Forms.

For other organizations that file. Web go to www.irs.gov/form990ez for instructions and the latest information. Complete, edit or print tax forms instantly. Enter amount of tax imposed on organization managers or.

If You Checked 12D Of Part I, Complete Sections A And D, And Complete Part V.).

The information provided will enable you to file a more complete return and reduce the. Get ready for tax season deadlines by completing any required tax forms today. Web if yes, complete schedule l, part i section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Web schedule a (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3).

Instructions For These Schedules Are.

Go to www.irs.gov/form990 for the. Ad access irs tax forms. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Get ready for tax season deadlines by completing any required tax forms today.

For Organizations With Gross Receipts Greater Than $100,000, We Have A Sliding Scale Fee Structure Starting At $41.

At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Web create my document a schedule a form is used by the internal revenue service. Also known as a public charity status and public support form, it is attached to form 990 or. Complete, edit or print tax forms instantly.