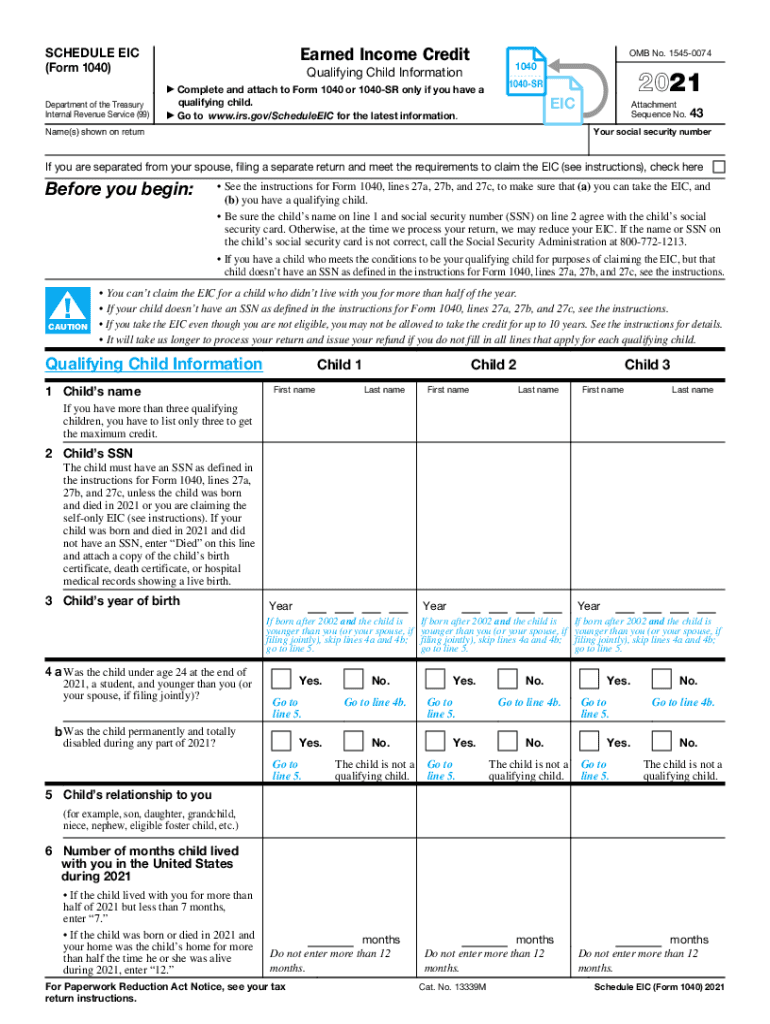

Schedule Eic Form

Schedule Eic Form - Get ready for this year's tax season quickly and safely with pdffiller! Web schedule eic, which is used to claim the earned income credit with a qualifying child, must be completed prior to filling out form 8862. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes. Web form 1040 instructions, step 5, earned income worksheet a or worksheet b: Ad with the right expertise, federal tax credits and incentives could benefit your business. If you don’t have a. The purpose of the eic is to reduce the tax burden and to. You cannot claim the credit if you are married and filing a. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

Web for 2022, you may be able to take the eic using the rules in chapter 3 for taxpayers who don't have a qualifying child. Web schedule eic, which is used to claim the earned income credit with a qualifying child, must be completed prior to filling out form 8862. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes. Get ready for tax season deadlines by completing any required tax forms today. Web form 1040 instructions, step 5, earned income worksheet a or worksheet b: If you don’t have a. You cannot claim the credit if you are married and filing a. What is form 1040 (schedule eic)? Ad with the right expertise, federal tax credits and incentives could benefit your business. Web you need to complete an irs form schedule eic, earned income credit and file it with your return, if you’re claiming a qualifying child.

Get ready for tax season deadlines by completing any required tax forms today. Web you need to complete an irs form schedule eic, earned income credit and file it with your return, if you’re claiming a qualifying child. You cannot claim the credit if you are married and filing a. Get ready for this year's tax season quickly and safely with pdffiller! Web schedule eic (form 1040) department of the treasury internal revenue service (99) earned income credit qualifying child information a complete and attach to form 1040. Web we last updated the earned income tax credit in december 2022, so this is the latest version of 1040 (schedule eic), fully updated for tax year 2022. The purpose of the eic is to reduce the tax burden and to. Get ready for tax season deadlines by completing any required tax forms today. Web schedule eic, which is used to claim the earned income credit with a qualifying child, must be completed prior to filling out form 8862. Ad complete irs tax forms online or print government tax documents.

Your Federal Tax

Optimize your tax planning with a better understanding of federal credits and incentives. Get ready for tax season deadlines by completing any required tax forms today. Ad complete irs tax forms online or print government tax documents. Web for 2022, you may be able to take the eic using the rules in chapter 3 for taxpayers who don't have a.

Fill Free fillable Form 2018 Earned Credit EIC SCHEDULE EIC

If you don’t have a. Ad with the right expertise, federal tax credits and incentives could benefit your business. You cannot claim the credit if you are married and filing a. Optimize your tax planning with a better understanding of federal credits and incentives. Web form 1040 instructions, step 5, earned income worksheet a or worksheet b:

Schedule eic form 1010 Fill out & sign online DocHub

Complete, edit or print tax forms instantly. The purpose of the eic is to reduce the tax burden and to. Optimize your tax planning with a better understanding of federal credits and incentives. Web schedule eic (form 1040) department of the treasury internal revenue service (99) earned income credit qualifying child information a complete and attach to form 1040. Ad.

Schedule Eic Form Fill Out and Sign Printable PDF Template signNow

Get ready for this year's tax season quickly and safely with pdffiller! If you don’t have a. Optimize your tax planning with a better understanding of federal credits and incentives. Ad complete irs tax forms online or print government tax documents. Web schedule eic, which is used to claim the earned income credit with a qualifying child, must be completed.

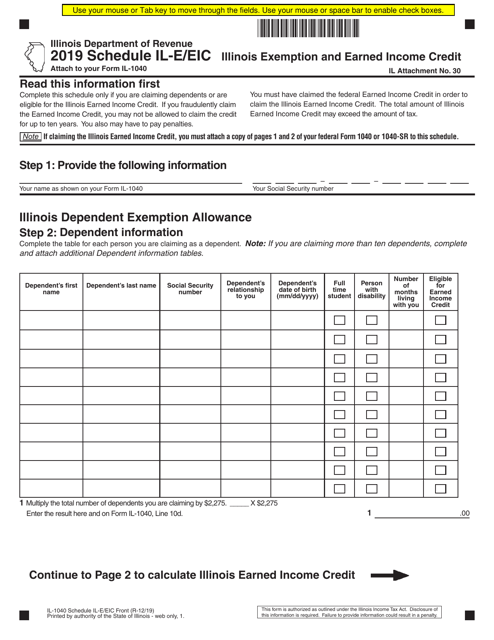

Form IL1040 Schedule ILE/EIC Download Fillable PDF or Fill Online

Get ready for this year's tax season quickly and safely with pdffiller! Get ready for tax season deadlines by completing any required tax forms today. Optimize your tax planning with a better understanding of federal credits and incentives. Web for 2022, you may be able to take the eic using the rules in chapter 3 for taxpayers who don't have.

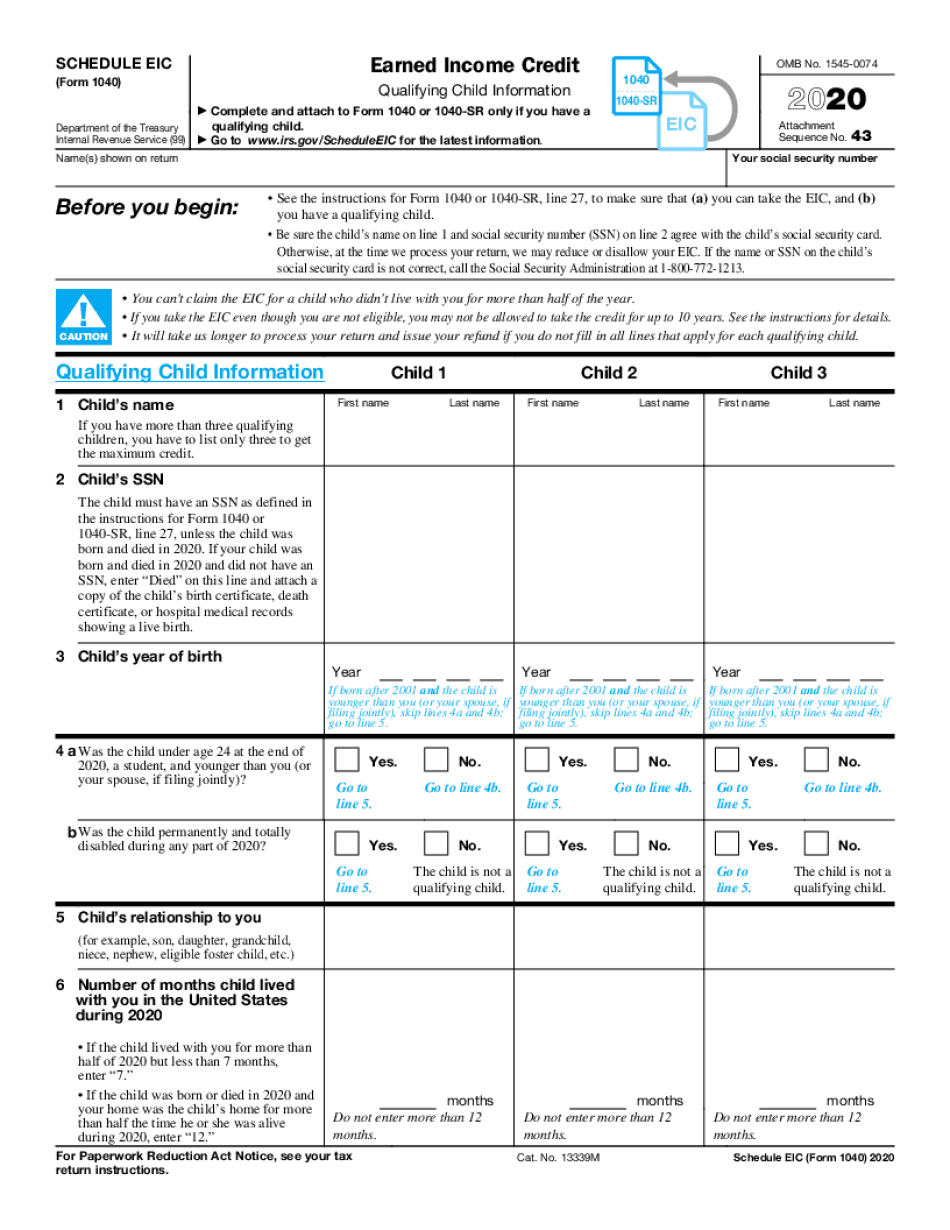

IRS Form 1040 Schedule EIC (2020)

Get ready for tax season deadlines by completing any required tax forms today. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes. Complete, edit or print tax forms instantly. Web for 2022, you may be able to take the eic using the rules in chapter 3 for.

Form 1040 Schedule EIC Earned Credit 1040 Form Printable

Web for 2022, you may be able to take the eic using the rules in chapter 3 for taxpayers who don't have a qualifying child. What is form 1040 (schedule eic)? Get ready for this year's tax season quickly and safely with pdffiller! Web we last updated the earned income tax credit in december 2022, so this is the latest.

Fill Free fillable F1040sei 2019 Schedule EIC (Form 1040 or 1040SR

Get ready for tax season deadlines by completing any required tax forms today. Ad with the right expertise, federal tax credits and incentives could benefit your business. Ad complete irs tax forms online or print government tax documents. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes..

schedule eic 2020 Fill Online, Printable, Fillable Blank form1040

Get ready for this year's tax season quickly and safely with pdffiller! Web schedule eic, which is used to claim the earned income credit with a qualifying child, must be completed prior to filling out form 8862. Get ready for tax season deadlines by completing any required tax forms today. Optimize your tax planning with a better understanding of federal.

1999 Form 1040 (Schedule EIC). Earned Credit Fill and Sign

Web we last updated the earned income tax credit in december 2022, so this is the latest version of 1040 (schedule eic), fully updated for tax year 2022. What is form 1040 (schedule eic)? Complete, edit or print tax forms instantly. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not.

Web The Earned Income Credit (Eic) Is A Refundable Tax Credit For Most People Who Work But Do Not Earn High Incomes.

Complete, edit or print tax forms instantly. Ad complete irs tax forms online or print government tax documents. What is form 1040 (schedule eic)? The purpose of the eic is to reduce the tax burden and to.

Get Ready For This Year's Tax Season Quickly And Safely With Pdffiller!

If you don’t have a. Ad with the right expertise, federal tax credits and incentives could benefit your business. Web schedule eic (form 1040) department of the treasury internal revenue service (99) earned income credit qualifying child information a complete and attach to form 1040. Get ready for tax season deadlines by completing any required tax forms today.

Web Form 1040 Instructions, Step 5, Earned Income Worksheet A Or Worksheet B:

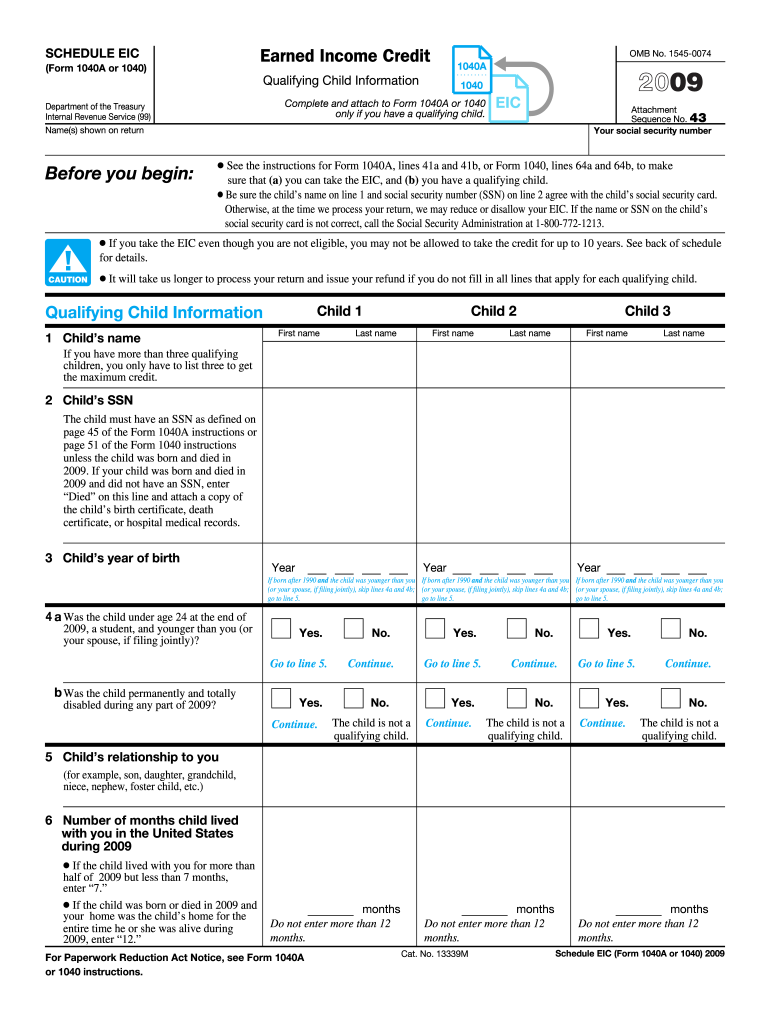

Web we last updated the earned income tax credit in december 2022, so this is the latest version of 1040 (schedule eic), fully updated for tax year 2022. You cannot claim the credit if you are married and filing a. Web schedule eic (form 1040a or 1040) 2016 purpose of schedule page 2 after you have figured your earned income credit (eic), use schedule eic to give the irs information. Get ready for tax season deadlines by completing any required tax forms today.

Web Schedule Eic, Which Is Used To Claim The Earned Income Credit With A Qualifying Child, Must Be Completed Prior To Filling Out Form 8862.

Optimize your tax planning with a better understanding of federal credits and incentives. Web for 2022, you may be able to take the eic using the rules in chapter 3 for taxpayers who don't have a qualifying child. Web you need to complete an irs form schedule eic, earned income credit and file it with your return, if you’re claiming a qualifying child.