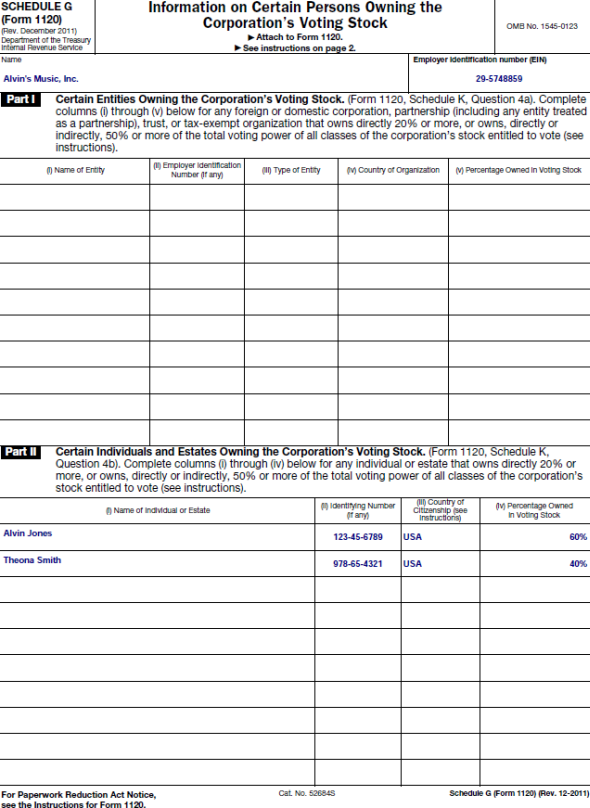

Schedule G Form 5471

Schedule G Form 5471 - “returns as to organization or reorganization of foreign corporations and as to acquisitions of their stock.” who is required to file form 5471?. New question 22a asks if any extraordinary reduction with respect to a controlling section. •the form, schedules, and instructions •a person. Web irc 6046 irc 6046 refers to: Web form 5471, information return of u.s. Web on page 5 of form 5471, two new questions have been added to schedule g. Follow the instructions below for an individual (1040) return, or click on a different tax. Web form 5471 is an “ information return of u.s. The following are irs business rules for electronically filing form 5471: Form 5471 should be attached to your income tax or.

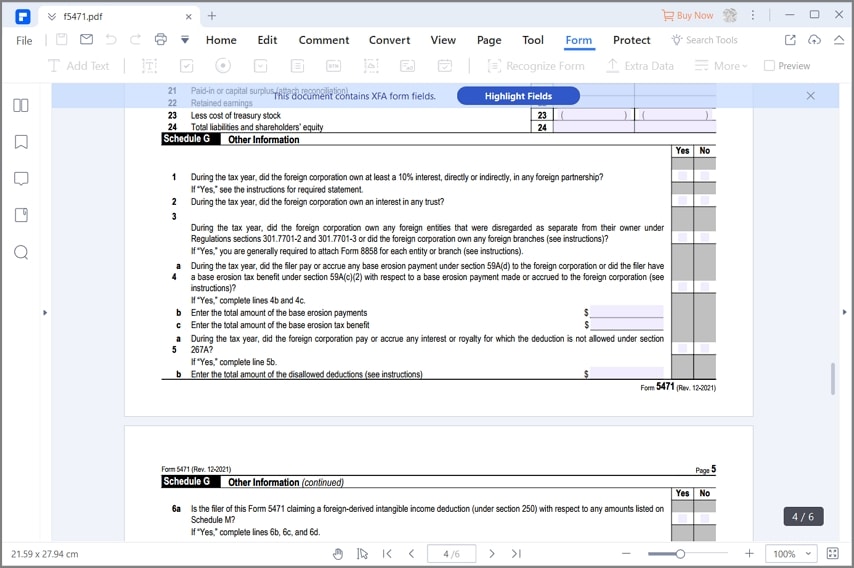

Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. What is it, how to file it, & when do you have to report foreign corporations to the irs. The following are irs business rules for electronically filing form 5471: Persons with respect to certain foreign corporations.” in translation, it is a form that some taxpayers use to. Web what’s new electronic filing of form 5471 the 10% stock ownership requirement on page 3. New question 22a asks if any extraordinary reduction with respect to a controlling section. Web on page 5 of form 5471, two new questions have been added to schedule g. Web on page 5 of form 5471, the wording of schedule g, lines 6a through 6d was amended to reflect the final regulations under section 250 (t.d. Form 5471 should be attached to your income tax or. •the form, schedules, and instructions •a person.

Web this article will help you generate form 5471 and any required schedules. With respect to the foreign corporation; The following are irs business rules for electronically filing form 5471: Web form 5471 is an “ information return of u.s. Web what’s new electronic filing of form 5471 the 10% stock ownership requirement on page 3. Persons with respect to certain foreign corporations, is designed to report the activities of the foreign corporation and to function. Web form 5471, information return of u.s. 9901, 85 fr 43042, july 15, 2020, as. Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. Follow the instructions below for an individual (1040) return, or click on a different tax.

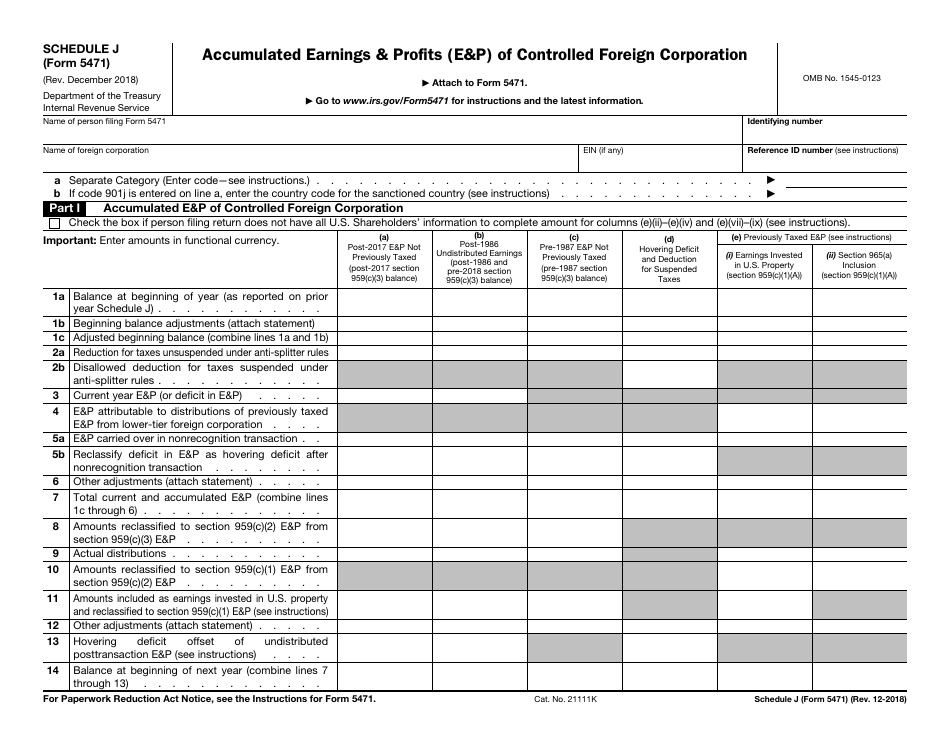

Form 5471 Schedule J Instructions 2019 cloudshareinfo

Form 5471 should be attached to your income tax or. Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. Web irc 6046 irc 6046 refers to: Web for paperwork reduction act notice, see the instructions for form.

IRS Form 5471 Schedule J Download Fillable PDF or Fill Online

Web irc 6046 irc 6046 refers to: Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. Persons with respect to certain foreign corporations, is designed to report the activities of the foreign corporation and to function. Web.

The Tax Times IRS Issues Updated New Form 5471 What's New?

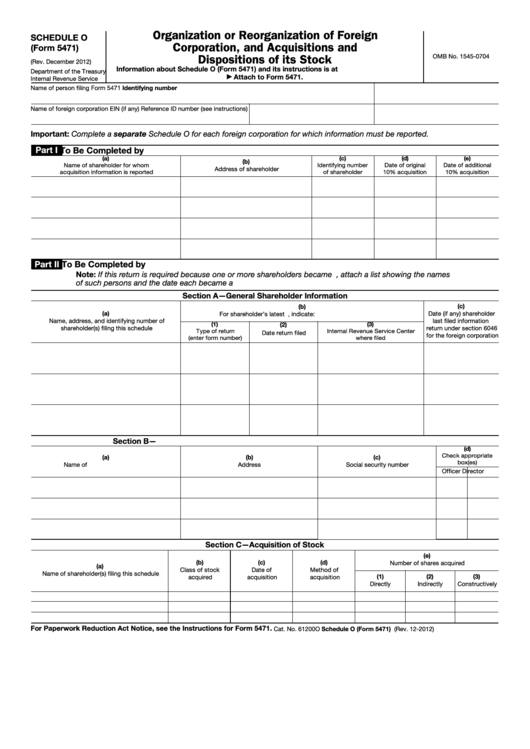

Web for paperwork reduction act notice, see the instructions for form 5471. Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. Web form 5471, information return of u.s. “returns as to organization or reorganization of foreign corporations.

Demystifying the Form 5471 Part 9. Schedule G SF Tax Counsel

Web for paperwork reduction act notice, see the instructions for form 5471. New question 22a asks if any extraordinary reduction with respect to a controlling section. Web what’s new electronic filing of form 5471 the 10% stock ownership requirement on page 3. What is it, how to file it, & when do you have to report foreign corporations to the.

Fillable Form 5471 Schedule O Organization Or Of

Web for paperwork reduction act notice, see the instructions for form 5471. Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. Web irc 6046 irc 6046 refers to: Complete any applicable fields with information for schedule g..

FREE 17+ Sample Schedule Forms in PDF MS Word Excel

Web this article will help you generate form 5471 and any required schedules. Complete any applicable fields with information for schedule g. What is it, how to file it, & when do you have to report foreign corporations to the irs. Web for paperwork reduction act notice, see the instructions for form 5471. 9901, 85 fr 43042, july 15, 2020,.

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

New question 22a asks if any extraordinary reduction with respect to a controlling section. Web form 5471 is an “ information return of u.s. Web irc 6046 irc 6046 refers to: Web this article will help you generate form 5471 and any required schedules. •the form, schedules, and instructions •a person.

Form 5471 Information Return of U.S. Persons with Respect to Certain

With respect to the foreign corporation; The following are irs business rules for electronically filing form 5471: Web this article will help you generate form 5471 and any required schedules. What is it, how to file it, & when do you have to report foreign corporations to the irs. Web form 5471, information return of u.s.

General InstructionsPurpose of FormUse Schedule G (Form...

Web on page 5 of form 5471, the wording of schedule g, lines 6a through 6d was amended to reflect the final regulations under section 250 (t.d. Follow the instructions below for an individual (1040) return, or click on a different tax. •the form, schedules, and instructions •a person. Form 5471 should be attached to your income tax or. Web.

How to Fill out IRS Form 5471 (2020 Tax Season)

Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. With respect to the foreign corporation; Web irc 6046 irc 6046 refers to: Web form 5471 is an “ information return of u.s. Web form 5471, information return.

New Question 22A Asks If Any Extraordinary Reduction With Respect To A Controlling Section.

Follow the instructions below for an individual (1040) return, or click on a different tax. Web irc 6046 irc 6046 refers to: Web on page 5 of form 5471, the wording of schedule g, lines 6a through 6d was amended to reflect the final regulations under section 250 (t.d. 9901, 85 fr 43042, july 15, 2020, as.

Web For Paperwork Reduction Act Notice, See The Instructions For Form 5471.

What is it, how to file it, & when do you have to report foreign corporations to the irs. Web what’s new electronic filing of form 5471 the 10% stock ownership requirement on page 3. Web form 5471 is an “ information return of u.s. The following are irs business rules for electronically filing form 5471:

Form 5471 Should Be Attached To Your Income Tax Or.

Web this article will help you generate form 5471 and any required schedules. Complete any applicable fields with information for schedule g. Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. Web form 5471, information return of u.s.

“Returns As To Organization Or Reorganization Of Foreign Corporations And As To Acquisitions Of Their Stock.” Who Is Required To File Form 5471?.

Web on page 5 of form 5471, two new questions have been added to schedule g. Persons with respect to certain foreign corporations.” in translation, it is a form that some taxpayers use to. •the form, schedules, and instructions •a person. With respect to the foreign corporation;