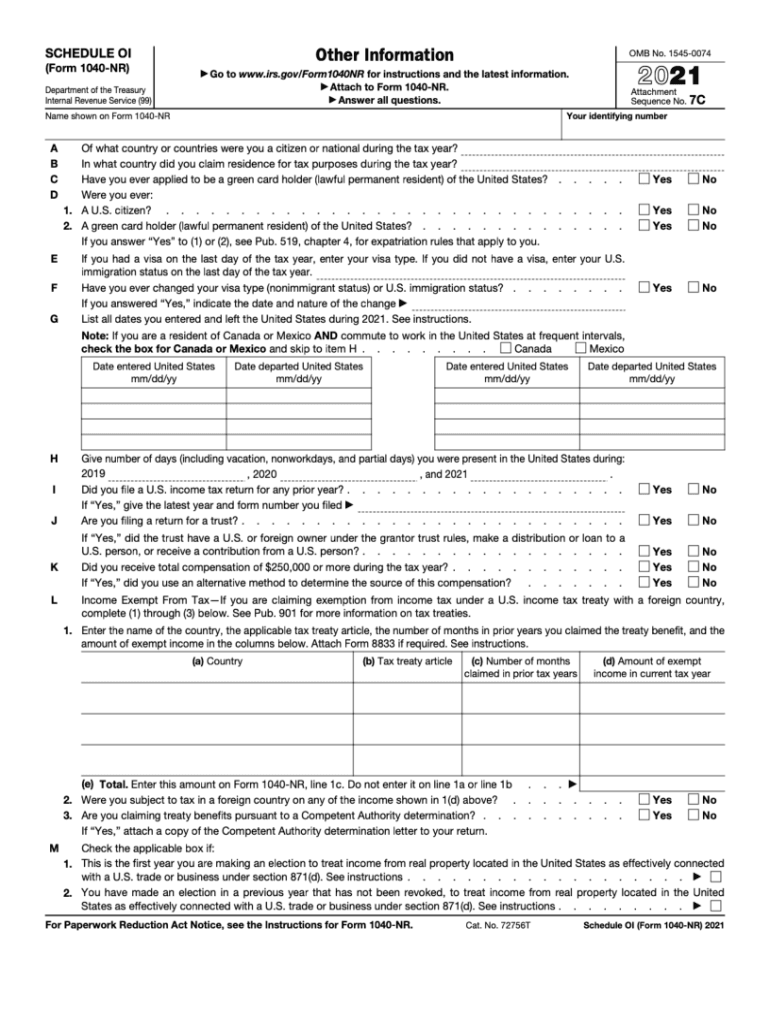

Schedule Oi Form 1040Nr

Schedule Oi Form 1040Nr - Web enter the name of the country, the applicable tax treaty article, the number of months in prior years you claimed the treaty benefit, and the amount of exempt income in the columns. The reason is the following. Web 1040 nr schedule oi form. Get everything done in minutes. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save schedule oi 1040nr instructions rating ★ ★ ★ ★ ★ ★ ★. Pick the template you want in the library of legal forms. Web i tried to efile 1040nr with tax treaty 20 (c), but the return was rejected by taxing authority. This form is an important. Nonresident alien income tax return. Complete, edit or print tax forms instantly.

Filing status check only one box. Sign it in a few clicks draw your signature, type it,. Choose the get form button to. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. For instructions and the latest information. The reason is the following. This form is an important. Web enter the name of the country, the applicable tax treaty article, the number of months in prior years you claimed the treaty benefit, and the amount of exempt income in the columns. Edit your irs 1040 nr online type text, add images, blackout confidential details, add comments, highlights and more. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other.

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Nonresident alien income tax return (99)2021 omb no. Web i tried to efile 1040nr with tax treaty 20 (c), but the return was rejected by taxing authority. Web 1040 nr schedule oi form. We have a simple example for a taxpayer with u.s. For instructions and the latest information. This return could not be processed for e. Web enter the name of the country, the applicable tax treaty article, the number of months in prior years you claimed the treaty benefit, and the amount of exempt income in the columns. Nonresident alien income tax return. Edit your irs 1040 nr online type text, add images, blackout confidential details, add comments, highlights and more.

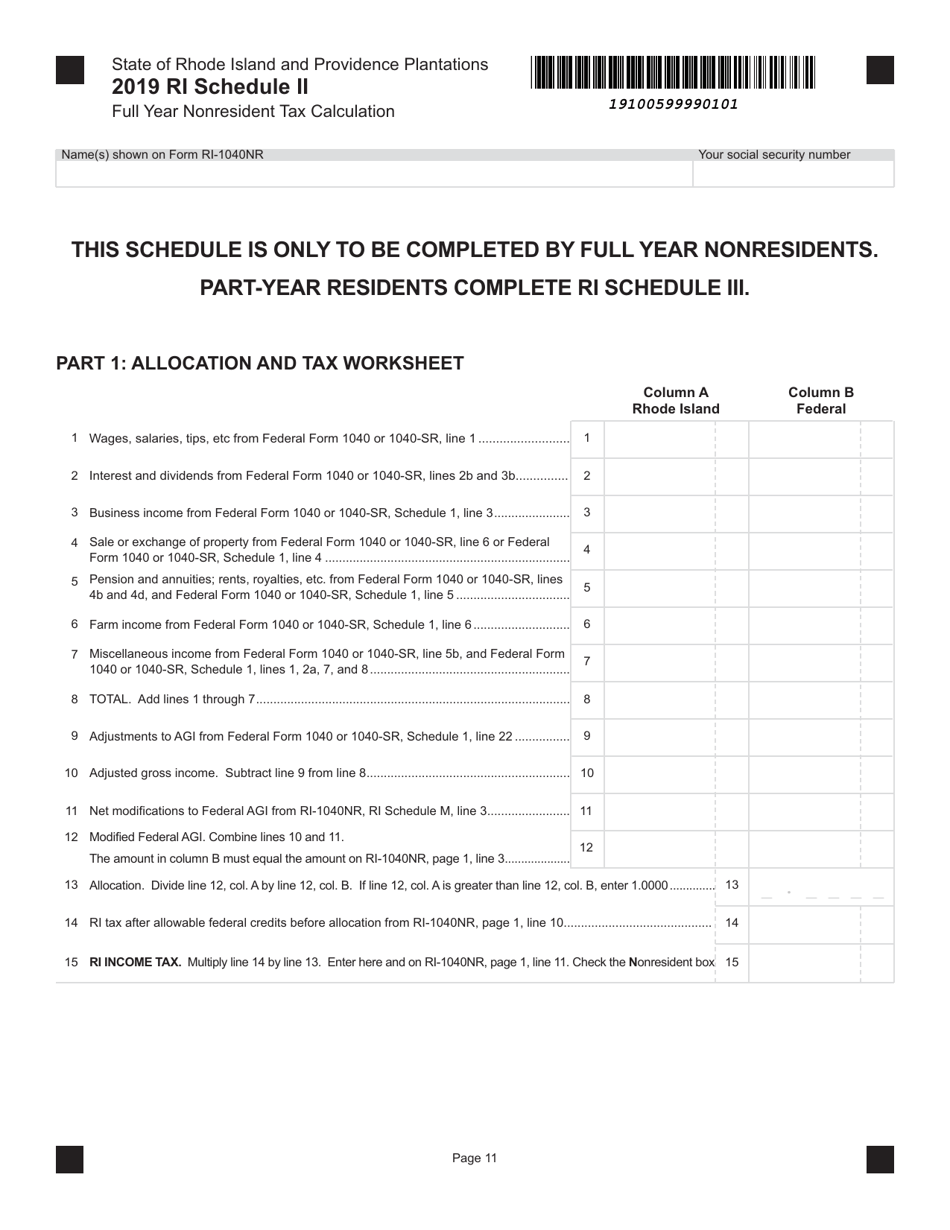

Form 1040NR Schedule II Download Fillable PDF or Fill Online Full Year

Nonresident alien income tax return (99)2021 omb no. This return could not be processed for e. Web 1040 nr schedule oi form. The reason is the following. Pick the template you want in the library of legal forms.

22+ Sample Audit Plan Template SampleTemplatess SampleTemplatess

For instructions and the latest information. Web 1040 nr schedule oi form. Ad access irs tax forms. Get everything done in minutes. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save schedule oi 1040nr instructions rating ★ ★ ★ ★ ★ ★ ★.

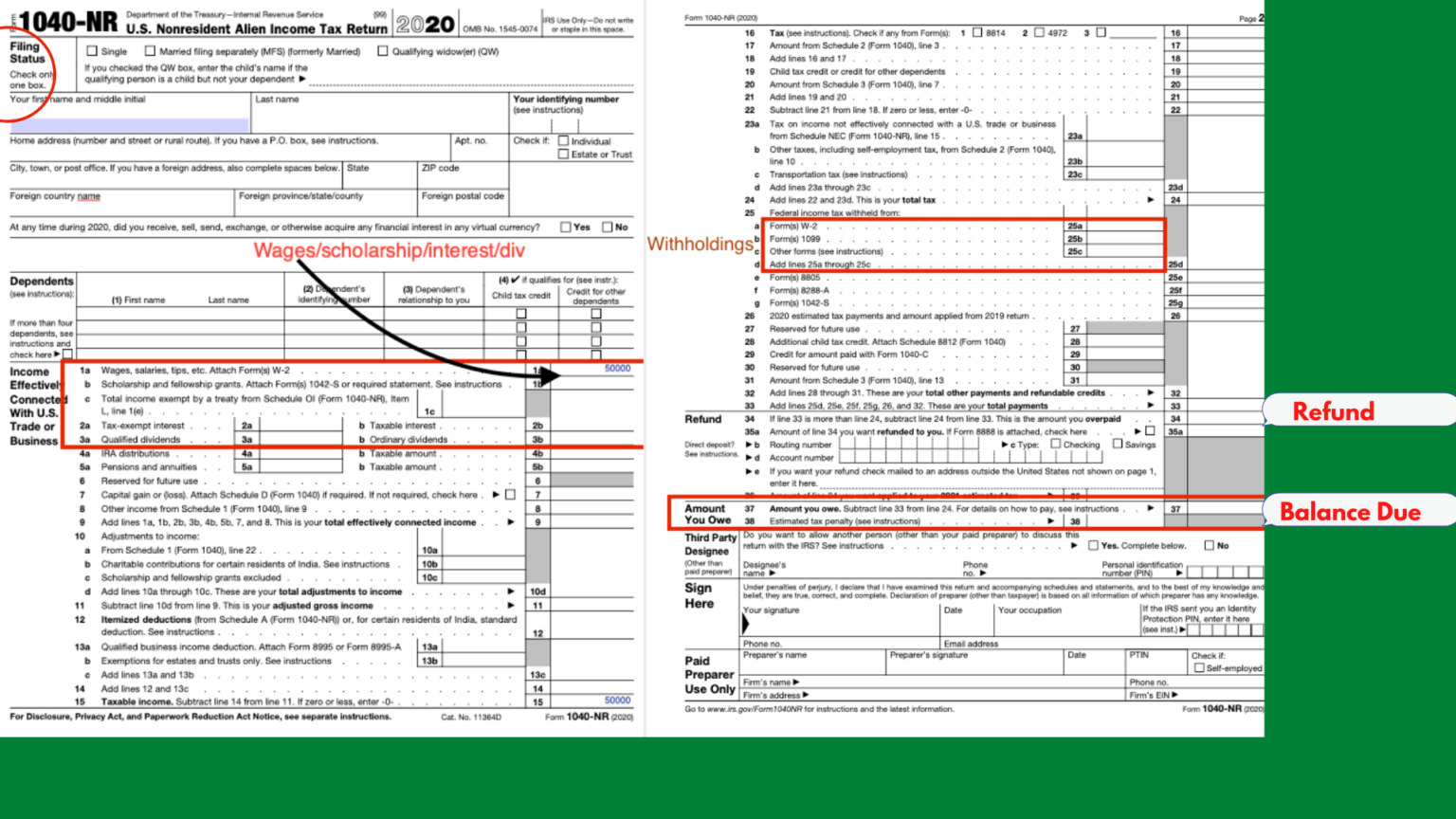

NonResident US Tax Return Form 1040NR Things you must know

Sign it in a few clicks draw your signature, type it,. Complete, edit or print tax forms instantly. Edit your irs 1040 nr online type text, add images, blackout confidential details, add comments, highlights and more. Trade or business even if no income from that trade or business or no u.s. This form is an important.

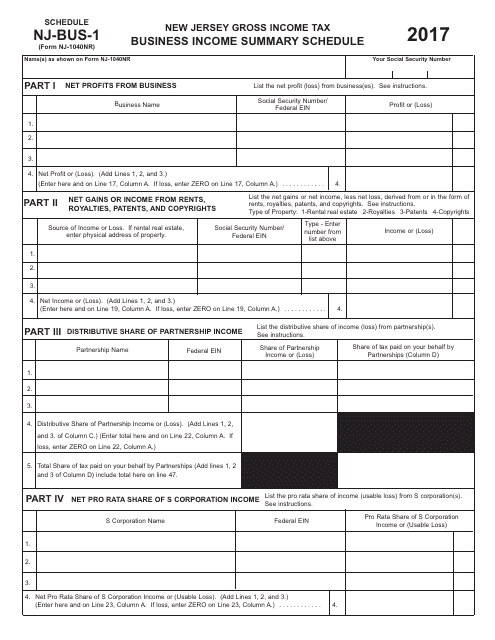

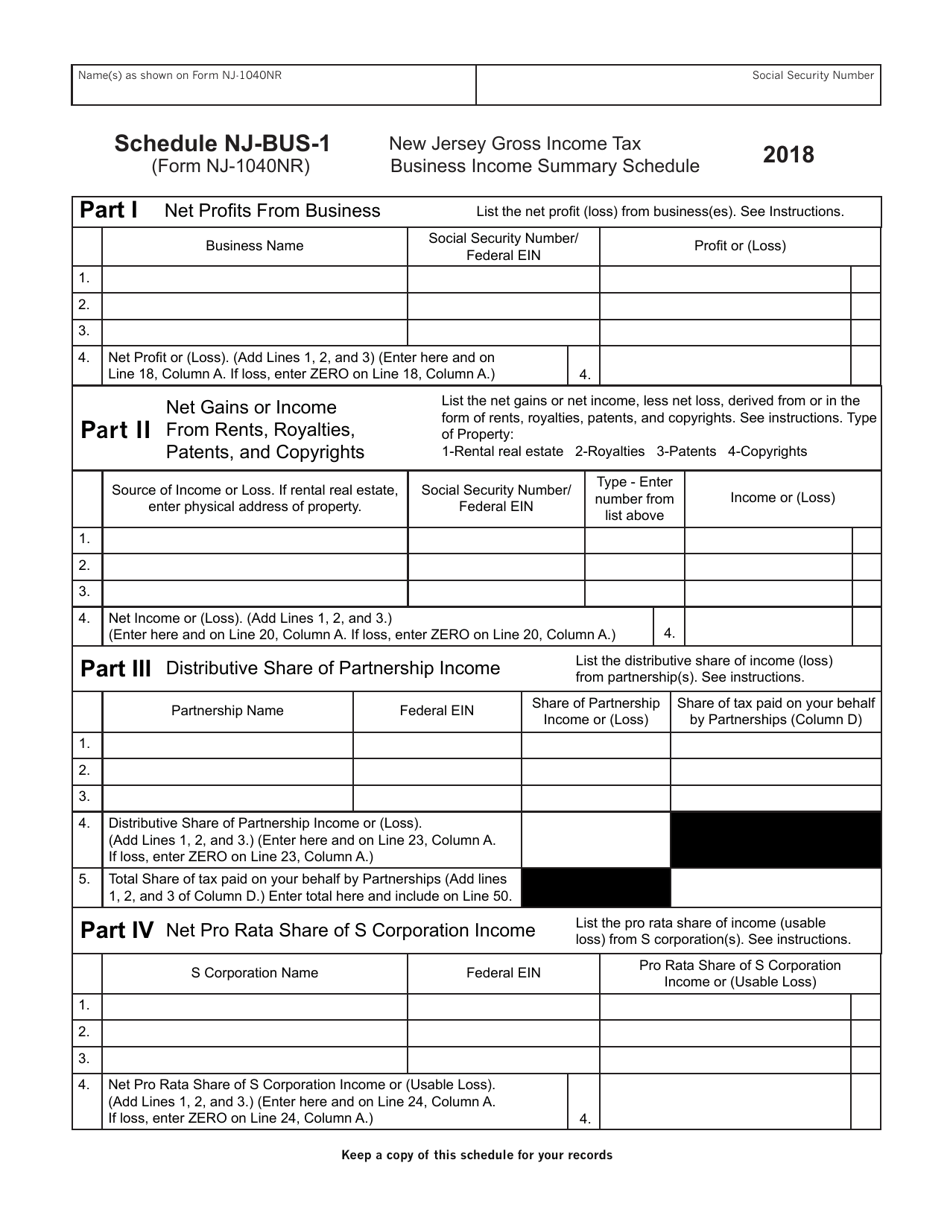

Form NJ1040NR Schedule NJBUS1 Download Fillable PDF or Fill Online

Web 1040 nr schedule oi form. Sign it in a few clicks draw your signature, type it,. This return could not be processed for e. Nonresident alien income tax return (99)2021 omb no. Pick the template you want in the library of legal forms.

Fill Free fillable form 1040nr 2018 u.s. nonresident alien tax

Complete, edit or print tax forms instantly. Nonresident alien income tax return. Nonresident alien income tax return (99)2021 omb no. For instructions and the latest information. Get everything done in minutes.

What is Form 1040NR? All you wanted to know about NonResident Alien

Trade or business even if no income from that trade or business or no u.s. For instructions and the latest information. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Choose the document template you need from our collection of legal forms. Filing status check only one box.

留学生报税如何利用 Tax Treaty 轻松省下1000刀? Tax Panda

Trade or business even if no income from that trade or business or no u.s. Pick the template you want in the library of legal forms. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. This form.

2021 Form IRS 1040NR Schedule OI Fill Online, Printable, Fillable

The reason is the following. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. For instructions and the latest information. Edit your irs 1040 nr online type text, add images, blackout confidential details, add comments, highlights and more. Get everything done in minutes.

Form NJ1040NR Schedule NJBUS1 Download Fillable PDF or Fill Online

Edit your irs 1040 nr online type text, add images, blackout confidential details, add comments, highlights and more. Complete, edit or print tax forms instantly. Pick the template you want in the library of legal forms. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Filing status check only one.

1040NR 第5頁 填寫說明與範例 Schedule OI—Other Information Rib的投資學習筆記

Web i tried to efile 1040nr with tax treaty 20 (c), but the return was rejected by taxing authority. Question l1 (e) is calculated and carried to form 1040nr, line 22. Nonresident alien income tax return. Complete, edit or print tax forms instantly. Choose the document template you need from our collection of legal forms.

There Are A Schedule A.

For instructions and the latest information. Ad access irs tax forms. Web 1040 nr schedule oi form. Choose the document template you need from our collection of legal forms.

Edit Your Irs 1040 Nr Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Web department of the treasury internal revenue service. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Get everything done in minutes. Sign it in a few clicks draw your signature, type it,.

Choose The Get Form Button To.

And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. 31, 2022, or other tax year beginning, 2022, ending , 20 see separate. Pick the template you want in the library of legal forms. The reason is the following.

This Form Is An Important.

Question l1 (e) is calculated and carried to form 1040nr, line 22. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save schedule oi 1040nr instructions rating ★ ★ ★ ★ ★ ★ ★. Web i tried to efile 1040nr with tax treaty 20 (c), but the return was rejected by taxing authority. We have a simple example for a taxpayer with u.s.