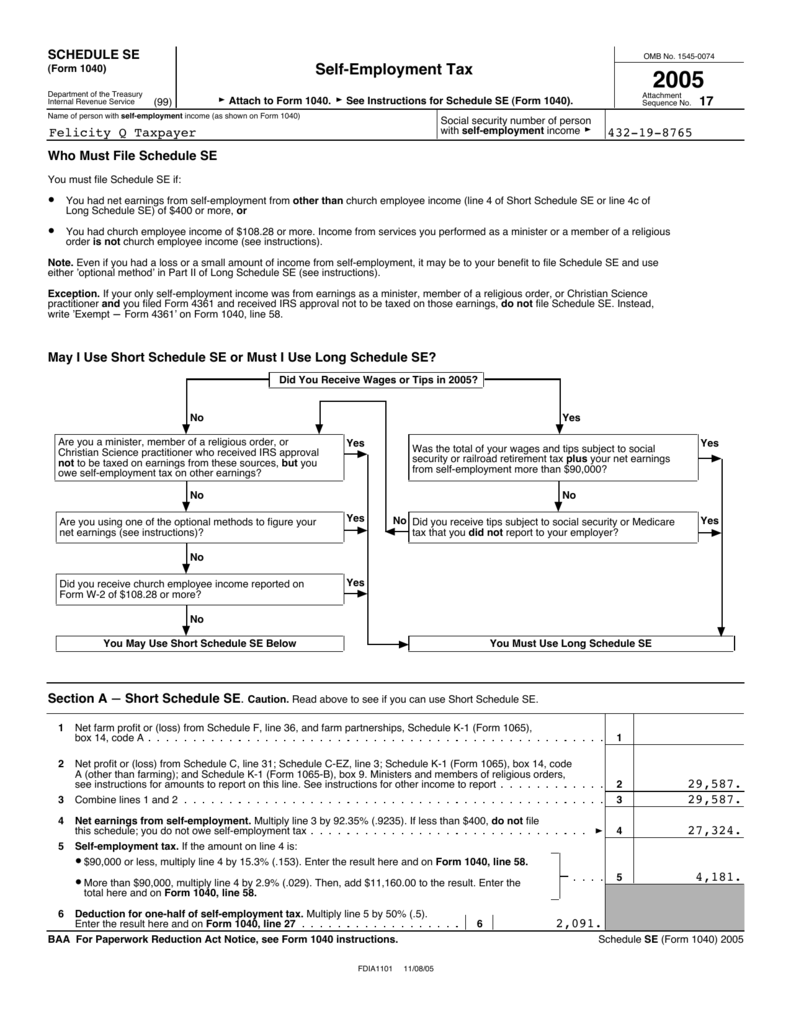

Schedule Se Tax Form

Schedule Se Tax Form - Web you can also visit the schedule se section in turbotax by: If line 4c is zero, skip lines 18 through 20,. Web schedule se (form 1040) 2020. This section of the program contains information for part iii of the schedule k. Web it is filed with form 1040. Add lines 10 and 11. Web what is schedule se? Specifically, schedule se is used to calculate the amount of social security and medicare taxes due. Use this address if you are not enclosing a payment use this. If you need to adjust.

*permanent residents of guam or the virgin islands cannot use form 9465. Web it is filed with form 1040. Web schedule se has been changed for the 2020 tax year, with the elimination of the short form option and the addition of a new part iii to calculate an optional deferral of. Web we last updated federal 1040 (schedule se) in december 2022 from the federal internal revenue service. Add lines 10 and 11. If line 4c is zero, skip lines 18 through 20,. Sch se and then select the jump to on the screen, select make adjustments. Web you can also visit the schedule se section in turbotax by: Web schedule se (form 1040) 2020. Web internal revenue service.

Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Web you can also visit the schedule se section in turbotax by: Sch se and then select the jump to on the screen, select make adjustments. Multiply line 12 by 50%. This form is for income earned in tax year 2022, with tax returns due. This section of the program contains information for part iii of the schedule k. Add lines 10 and 11. Your net earnings from self. If you need to adjust. *permanent residents of guam or the virgin islands cannot use form 9465.

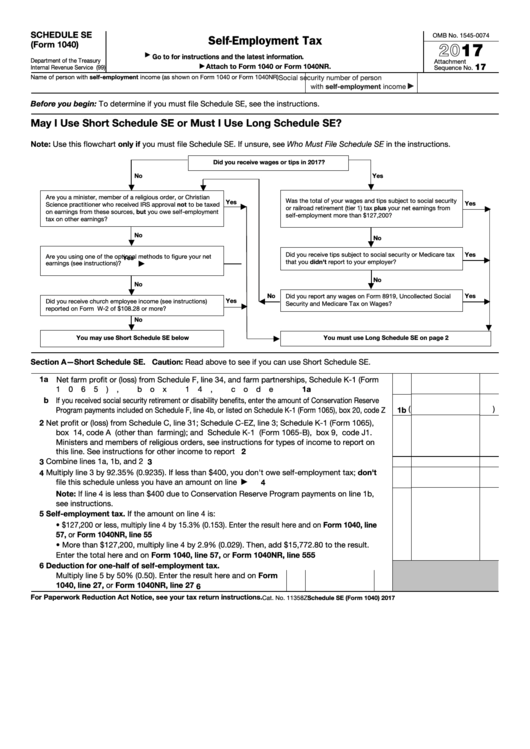

Fillable Schedule Se (Form 1040) SelfEmployment Tax 2017 printable

This form is for income earned in tax year 2022, with tax returns due. Web we last updated federal 1040 (schedule se) in december 2022 from the federal internal revenue service. Use this address if you are not enclosing a payment use this. If line 4c is zero, skip lines 18 through 20,. Multiply line 12 by 50%.

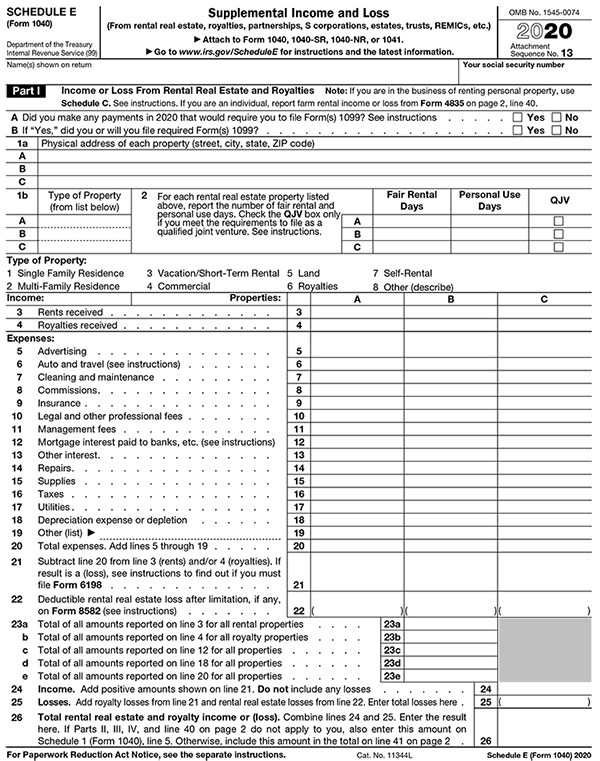

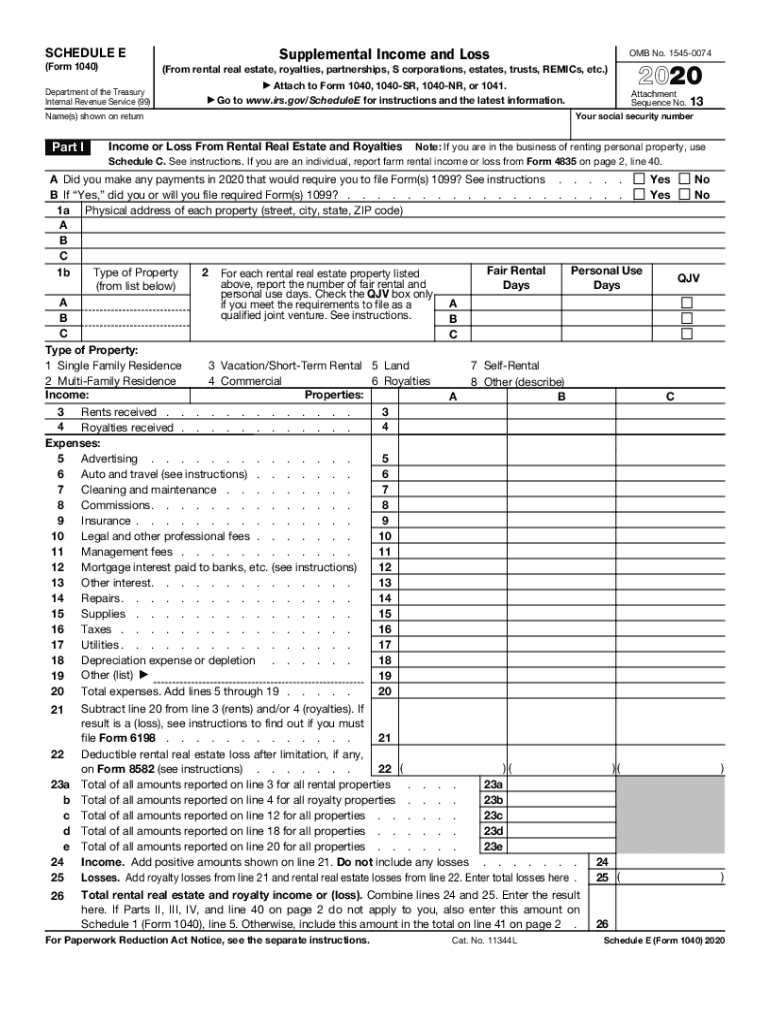

2020 Tax Form Schedule E U.S. Government Bookstore

Add lines 10 and 11. Specifically, schedule se is used to calculate the amount of social security and medicare taxes due. Web you can also visit the schedule se section in turbotax by: Web we last updated federal 1040 (schedule se) in december 2022 from the federal internal revenue service. Your net earnings from self.

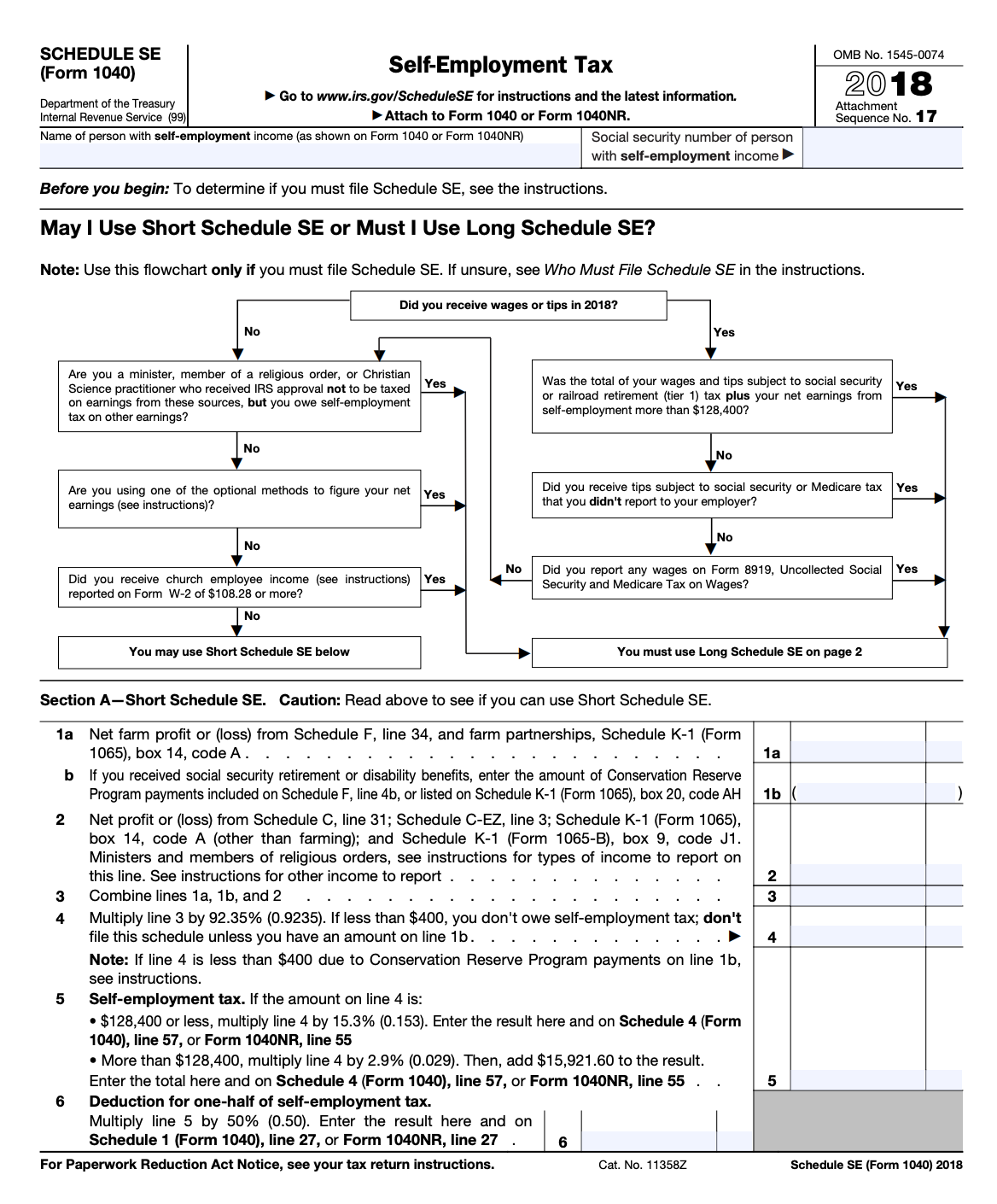

Schedule SE A Simple Guide to Filing the SelfEmployment Tax Form

Web internal revenue service. If line 4c is zero, skip lines 18 through 20,. Specifically, schedule se is used to calculate the amount of social security and medicare taxes due. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Sba.gov's business.

Paying selfemployment taxes on the revised Schedule SE Don't Mess

Web what is schedule se? For clarity, a schedule is just an. This section of the program contains information for part iii of the schedule k. Web what is schedule se? Your net earnings from self.

IRS Form 1040 Schedule SE Self Employment Tax Stock video footage

Sba.gov's business licenses and permits search tool. *permanent residents of guam or the virgin islands cannot use form 9465. Web schedule se has been changed for the 2020 tax year, with the elimination of the short form option and the addition of a new part iii to calculate an optional deferral of. Web internal revenue service. Web it is filed.

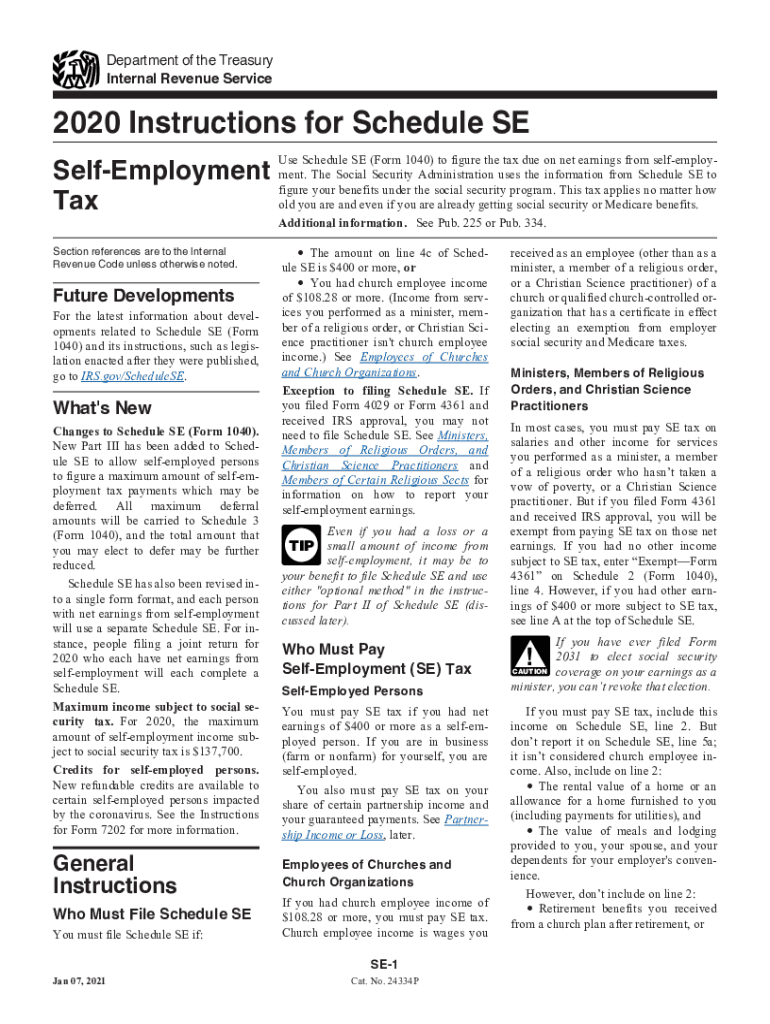

2020 Form IRS Instruction 1040 Schedule SE Fill Online, Printable

Specifically, schedule se is used to calculate the amount of social security and medicare taxes due. Multiply line 12 by 50%. Web you can also visit the schedule se section in turbotax by: If line 4c is zero, skip lines 18 through 20,. Web internal revenue service.

Form 1040, Schedule SE SelfEmployment Tax

This form is for income earned in tax year 2022, with tax returns due. Sch se and then select the jump to on the screen, select make adjustments. Your net earnings from self. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even.

Schedule SE

Web what is schedule se? If line 4c is zero, skip lines 18 through 20,. Sba.gov's business licenses and permits search tool. Web we last updated federal 1040 (schedule se) in december 2022 from the federal internal revenue service. *permanent residents of guam or the virgin islands cannot use form 9465.

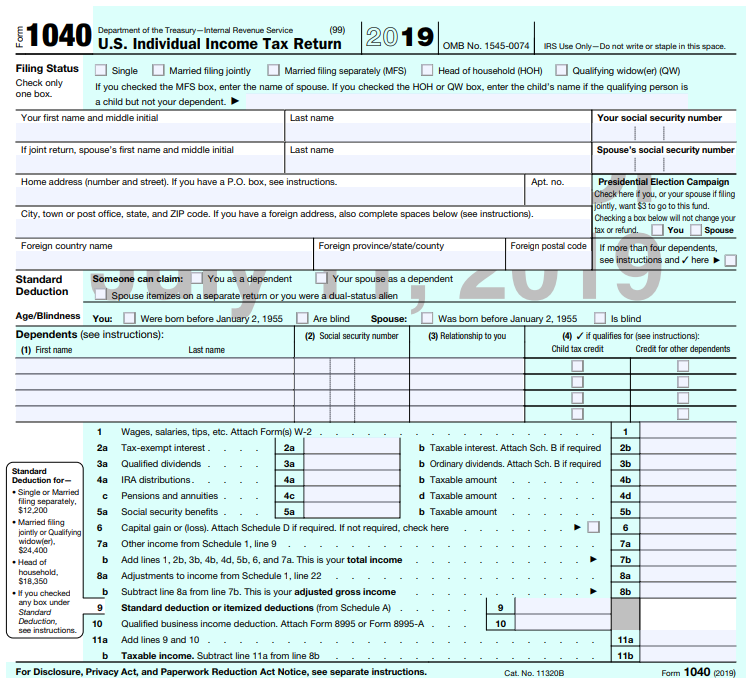

Draft Form 1040

Specifically, schedule se is used to calculate the amount of social security and medicare taxes due. Use this address if you are not enclosing a payment use this. This form is for income earned in tax year 2022, with tax returns due. Web schedule se (form 1040) 2020. Sba.gov's business licenses and permits search tool.

IRS 1040 Schedule E 2020 Fill out Tax Template Online US Legal Forms

If you need to adjust. Add lines 10 and 11. Web we last updated federal 1040 (schedule se) in december 2022 from the federal internal revenue service. Sba.gov's business licenses and permits search tool. Specifically, schedule se is used to calculate the amount of social security and medicare taxes due.

Use This Address If You Are Not Enclosing A Payment Use This.

Web what is schedule se? Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Add lines 10 and 11. Web you can also visit the schedule se section in turbotax by:

Web We Last Updated Federal 1040 (Schedule Se) In December 2022 From The Federal Internal Revenue Service.

*permanent residents of guam or the virgin islands cannot use form 9465. Sch se and then select the jump to on the screen, select make adjustments. Web it is filed with form 1040. For clarity, a schedule is just an.

If You Need To Adjust.

Web what is schedule se? If line 4c is zero, skip lines 18 through 20,. Your net earnings from self. Web schedule se has been changed for the 2020 tax year, with the elimination of the short form option and the addition of a new part iii to calculate an optional deferral of.

Web Internal Revenue Service.

Specifically, schedule se is used to calculate the amount of social security and medicare taxes due. Multiply line 12 by 50%. Web schedule se (form 1040) 2020. Sba.gov's business licenses and permits search tool.