Short Put Calendar Spread

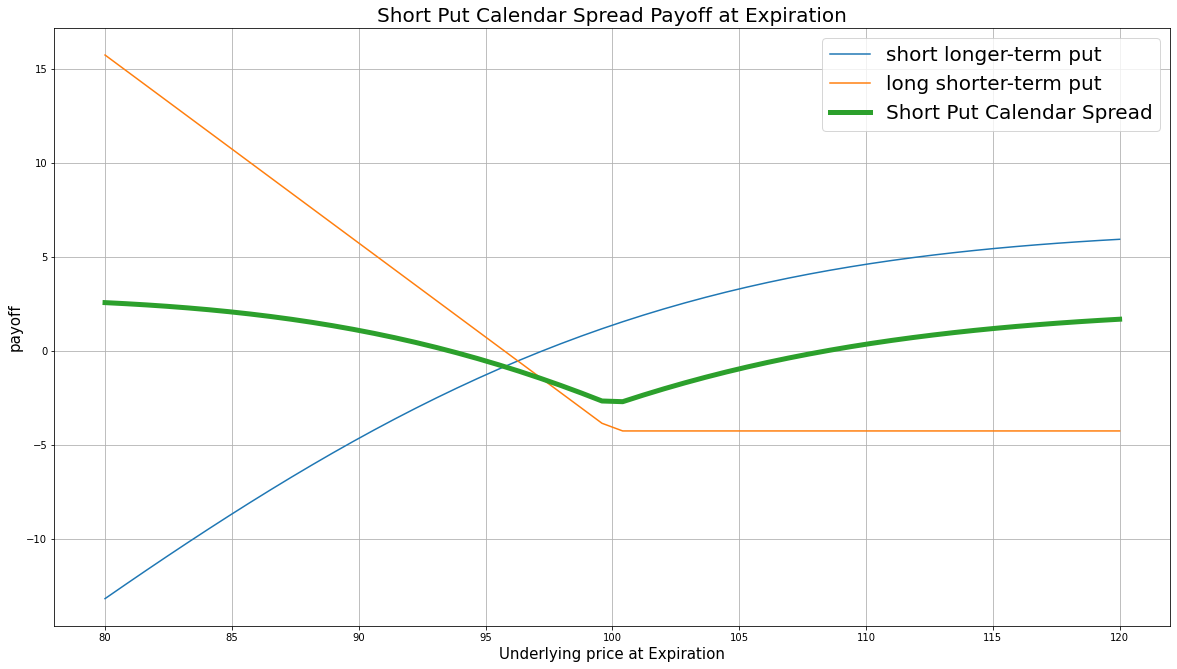

Short Put Calendar Spread - Web short calendar spread with puts potential goals. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a short put calendar spread is another type of spread that uses two different put options. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. In a short calendar spread, there are two positions with the same strike price:. To profit from a large stock price move away from the strike price of the. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web short calendar spread with calls and puts.

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. In a short calendar spread, there are two positions with the same strike price:. To profit from a large stock price move away from the strike price of the. Web short calendar spread with calls and puts. Web short calendar spread with puts potential goals. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web a short put calendar spread is another type of spread that uses two different put options. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying.

Web short calendar spread with calls and puts. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. In a short calendar spread, there are two positions with the same strike price:. Web a short put calendar spread is another type of spread that uses two different put options. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. To profit from a large stock price move away from the strike price of the. Web short calendar spread with puts potential goals. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying.

Bearish Put Calendar Spread Option Strategy Guide

To profit from a large stock price move away from the strike price of the. In a short calendar spread, there are two positions with the same strike price:. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a short put calendar spread is another type.

Put Calendar Spread Option Alpha

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying..

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

To profit from a large stock price move away from the strike price of the. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. In a short calendar spread, there are.

Calendar Put Spread Options Edge

Web short calendar spread with calls and puts. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. To profit from a large stock price move away from.

Short Put Calendar Short put calendar Spread Reverse Calendar

Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web short calendar spread with calls and puts. To profit from a large stock price move away from the strike price of the. Web short calendar spread with puts potential goals. In a short calendar spread, there are two positions.

Put Calendar Spread

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web short calendar spread with calls and puts. To profit from a large stock price move away from the strike price of the. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and.

Bearish Put Calendar Spread Option Strategy Guide

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying..

Calendar Spread Explained InvestingFuse

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. In a short calendar spread, there are two positions with the same strike price:. Web short calendar spread with calls.

Short Put Spread

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. To profit from a large stock price move away from the strike price of the. Web short calendar spread with calls and puts. Web a calendar spread is an options or futures strategy established by simultaneously entering a.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

To profit from a large stock price move away from the strike price of the. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web short calendar spread with puts potential.

To Profit From A Large Stock Price Move Away From The Strike Price Of The.

Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web short calendar spread with puts potential goals. In a short calendar spread, there are two positions with the same strike price:. Web a short put calendar spread is another type of spread that uses two different put options.

Web A Long Calendar Spread—Often Referred To As A Time Spread—Is The Buying And Selling Of A Call Option Or The Buying.

Web short calendar spread with calls and puts. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/607da29411b814023198cd31_Put-Calendar-Spread-Options-Strategies-Option-Alpha-Handbook.png)