Should Liabilities Be Negative On Balance Sheet

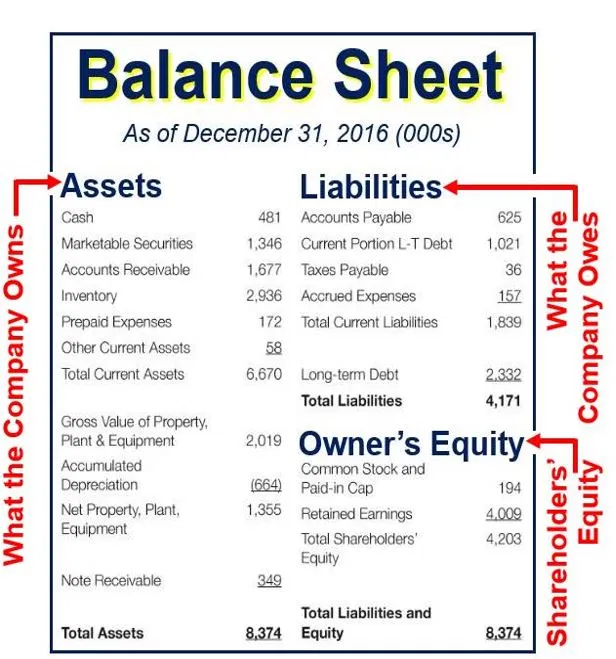

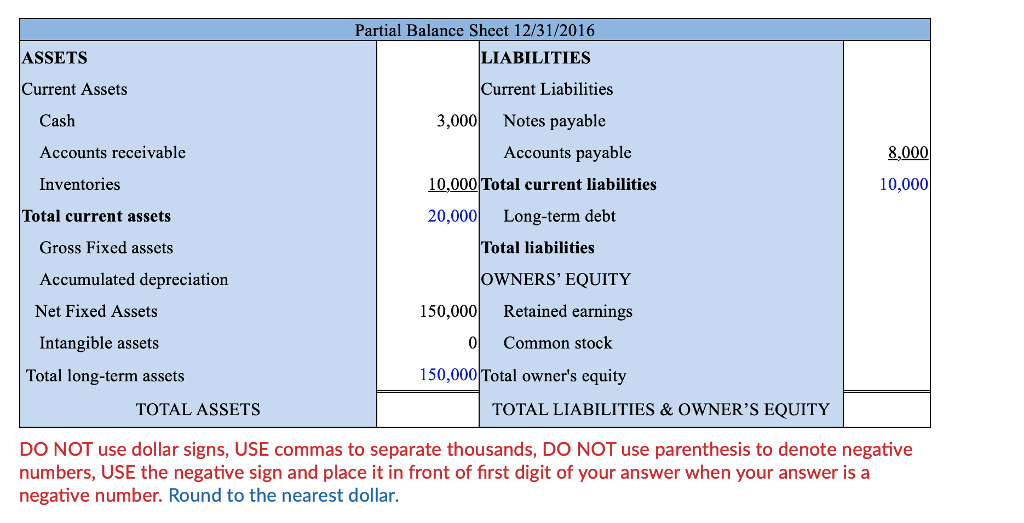

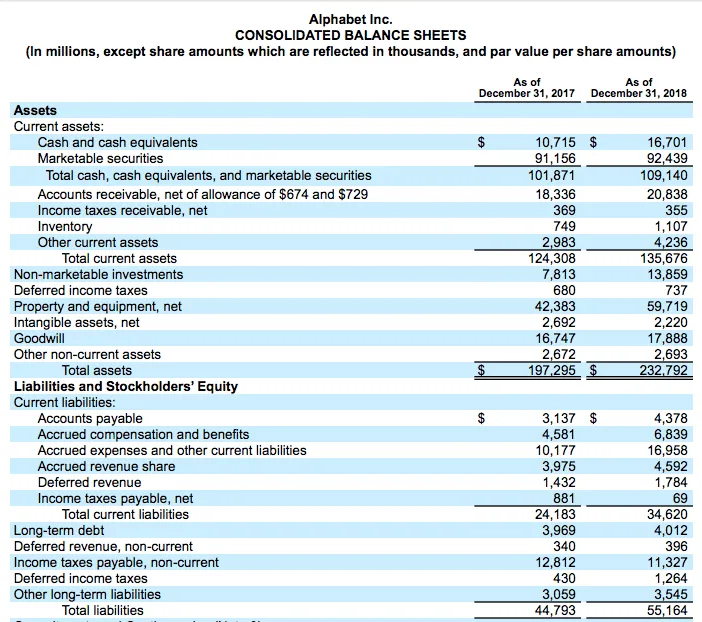

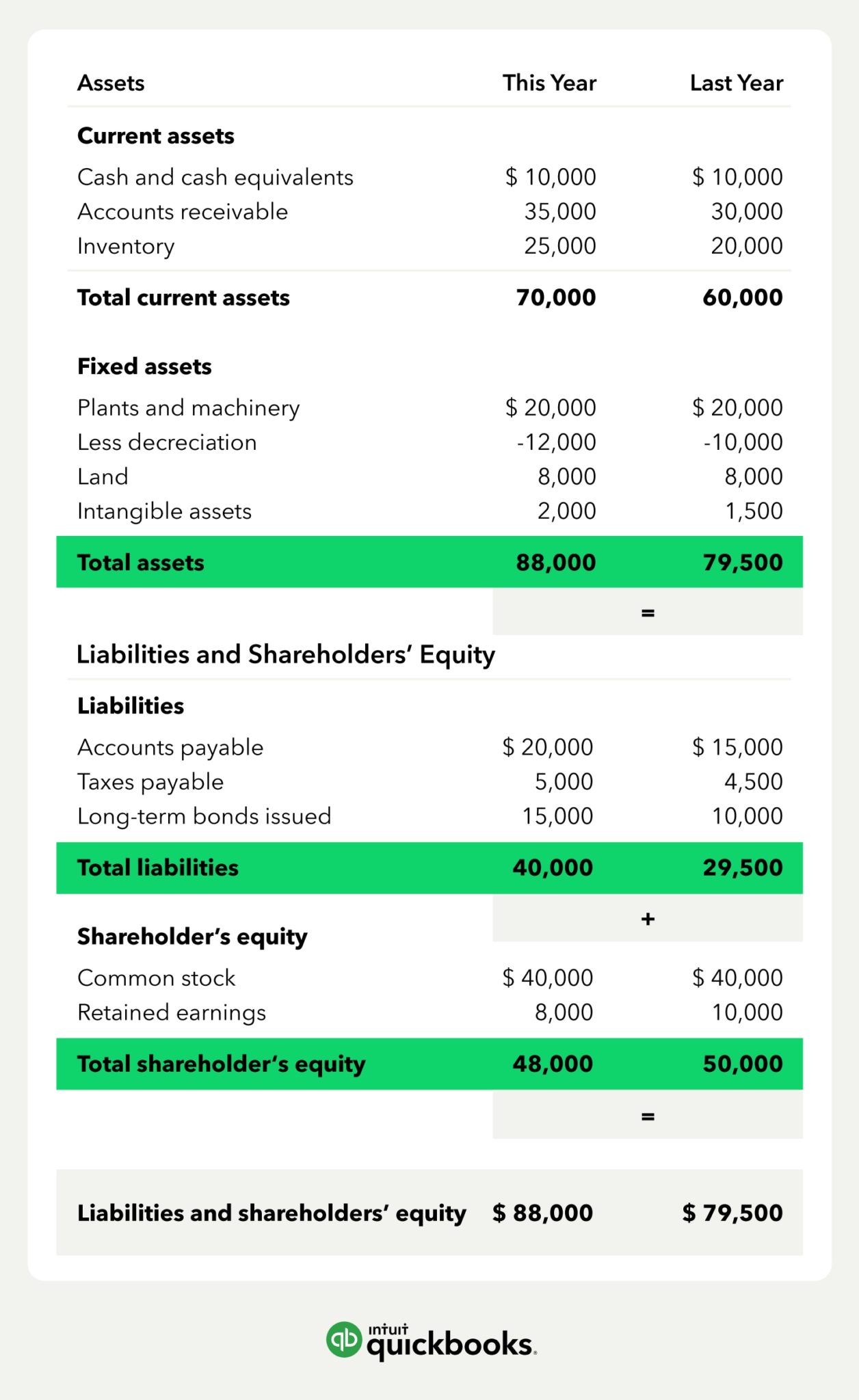

Should Liabilities Be Negative On Balance Sheet - Web negative liability on balance sheet updated: Web why would a balance sheet list current liabilities as negative amounts? Reasons for negative current liabilities on a balance sheet. For example, if you were to accidentally pay a supplier's. Web when a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability account and setting up the entry to. Jun 20, 2023 a balance sheet gives you a financial snapshot of the company as of the specific date. It calculates how much the company worth. Web a negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Some older accounting software used minus signs or parentheses to indicate.

Web negative liability on balance sheet updated: Jun 20, 2023 a balance sheet gives you a financial snapshot of the company as of the specific date. Web when a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability account and setting up the entry to. Some older accounting software used minus signs or parentheses to indicate. Reasons for negative current liabilities on a balance sheet. It calculates how much the company worth. For example, if you were to accidentally pay a supplier's. Web a negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Web why would a balance sheet list current liabilities as negative amounts?

Web negative liability on balance sheet updated: Reasons for negative current liabilities on a balance sheet. Web when a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability account and setting up the entry to. Some older accounting software used minus signs or parentheses to indicate. Jun 20, 2023 a balance sheet gives you a financial snapshot of the company as of the specific date. It calculates how much the company worth. Web a negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. For example, if you were to accidentally pay a supplier's. Web why would a balance sheet list current liabilities as negative amounts?

Negative Shareholders Equity Examples Buyback Losses

Web when a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability account and setting up the entry to. Some older accounting software used minus signs or parentheses to indicate. Web negative liability on balance sheet updated: Reasons for negative current liabilities.

Stockholders' Equity What It Is, How To Calculate It, Examples

Web why would a balance sheet list current liabilities as negative amounts? For example, if you were to accidentally pay a supplier's. Web when a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability account and setting up the entry to. It.

Liabilities How to classify, Track and calculate liabilities?

Jun 20, 2023 a balance sheet gives you a financial snapshot of the company as of the specific date. Reasons for negative current liabilities on a balance sheet. Web a negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Some older accounting software used minus signs or parentheses.

Under Which method ledger accounts are totaled and their closing

Web a negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Web negative liability on balance sheet updated: Web when a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability.

Main Functions of Accounting

It calculates how much the company worth. Jun 20, 2023 a balance sheet gives you a financial snapshot of the company as of the specific date. Web when a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability account and setting up.

Solved Balance sheet. Use the data from the financial

Reasons for negative current liabilities on a balance sheet. Some older accounting software used minus signs or parentheses to indicate. Web why would a balance sheet list current liabilities as negative amounts? Web negative liability on balance sheet updated: It calculates how much the company worth.

Ultimate Guide To Your Balance Sheet Profit And Loss Statement

Jun 20, 2023 a balance sheet gives you a financial snapshot of the company as of the specific date. For example, if you were to accidentally pay a supplier's. Web why would a balance sheet list current liabilities as negative amounts? Web negative liability on balance sheet updated: Web when a negative cash balance is present, it is customary to.

A Beginner's Guide to the Types of Liabilities on a Balance Sheet

Reasons for negative current liabilities on a balance sheet. For example, if you were to accidentally pay a supplier's. Web why would a balance sheet list current liabilities as negative amounts? Some older accounting software used minus signs or parentheses to indicate. Web when a negative cash balance is present, it is customary to avoid showing it on the balance.

Understanding Negative Balances in Your Financial Statements Fortiviti

Web a negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Web negative liability on balance sheet updated: Some older accounting software used minus signs or parentheses to indicate. Reasons for negative current liabilities on a balance sheet. Web when a negative cash balance is present, it is.

Negative Working Capital Formula + Calculator

Web negative liability on balance sheet updated: Web a negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Web when a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability.

Jun 20, 2023 A Balance Sheet Gives You A Financial Snapshot Of The Company As Of The Specific Date.

It calculates how much the company worth. Web when a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability account and setting up the entry to. Web why would a balance sheet list current liabilities as negative amounts? Reasons for negative current liabilities on a balance sheet.

Web A Negative Liability Typically Appears On The Balance Sheet When A Company Pays Out More Than The Amount Required By A Liability.

Web negative liability on balance sheet updated: For example, if you were to accidentally pay a supplier's. Some older accounting software used minus signs or parentheses to indicate.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)