Simple Ira Form 5305

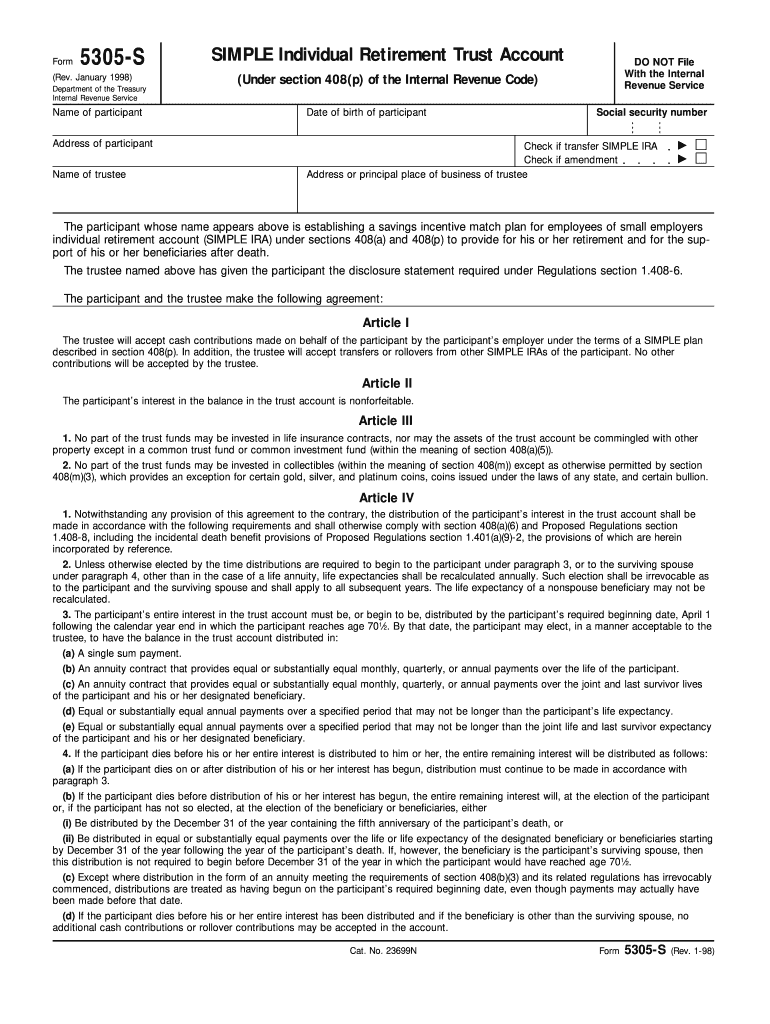

Simple Ira Form 5305 - A simple individual retirement account (simple ira) is established after the form is fully executed by both the individual (participant) and the custodian. You adopt the simple ira plan when you have completed all appropriate boxes and blanks on the form and you (and the designated financial institution, if any) have signed it. However, only articles i through vii have been reviewed by the irs. Open your plan print, read, and retain copies of the following documents: Plan adoption agreement (pdf) company profile form (pdf) Eligible employees can fund their own simple ira accounts through regular salary deferrals and employers make additional contributions. Fidelity simple ira plan agreement (pdf) fidelity funding account agreement (pdf) in order to set up your plan, you will need to print, complete and sign the following documents: Keep it for your records.* 2. More flexibility and more options. Contact a retirement plan professional or a representative of a financial institution that offers retirement plans.

Contact a retirement plan professional or a representative of a financial institution that offers retirement plans. Set up your new plan. Eligible employees can fund their own simple ira accounts through regular salary deferrals and employers make additional contributions. A simple individual retirement account (simple ira) is established after the form is fully executed by both the individual (participant) and the custodian. More flexibility and more options. However, only articles i through vii have been reviewed by the irs. Plan adoption agreement (pdf) company profile form (pdf) Open your plan print, read, and retain copies of the following documents: March 2002) do not file with the internal department of the treasury revenue service internal revenue service establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form. Keep it for your records.* 2.

Fidelity simple ira plan agreement (pdf) fidelity funding account agreement (pdf) in order to set up your plan, you will need to print, complete and sign the following documents: March 2002) do not file with the internal department of the treasury revenue service internal revenue service establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form. A simple individual retirement account (simple ira) is established after the form is fully executed by both the individual (participant) and the custodian. Plan adoption agreement (pdf) company profile form (pdf) Contact a retirement plan professional or a representative of a financial institution that offers retirement plans. Set up individual accounts within the plan. More flexibility and more options. However, only articles i through vii have been reviewed by the irs. Each form is a simple ira plan document. Open your plan print, read, and retain copies of the following documents:

What Is A Simple IRA, And Is Right For Your Retirement? Vertical

March 2002) do not file with the internal department of the treasury revenue service internal revenue service establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form. Set up individual accounts within the plan. Contact a retirement plan professional or a representative of a financial institution that.

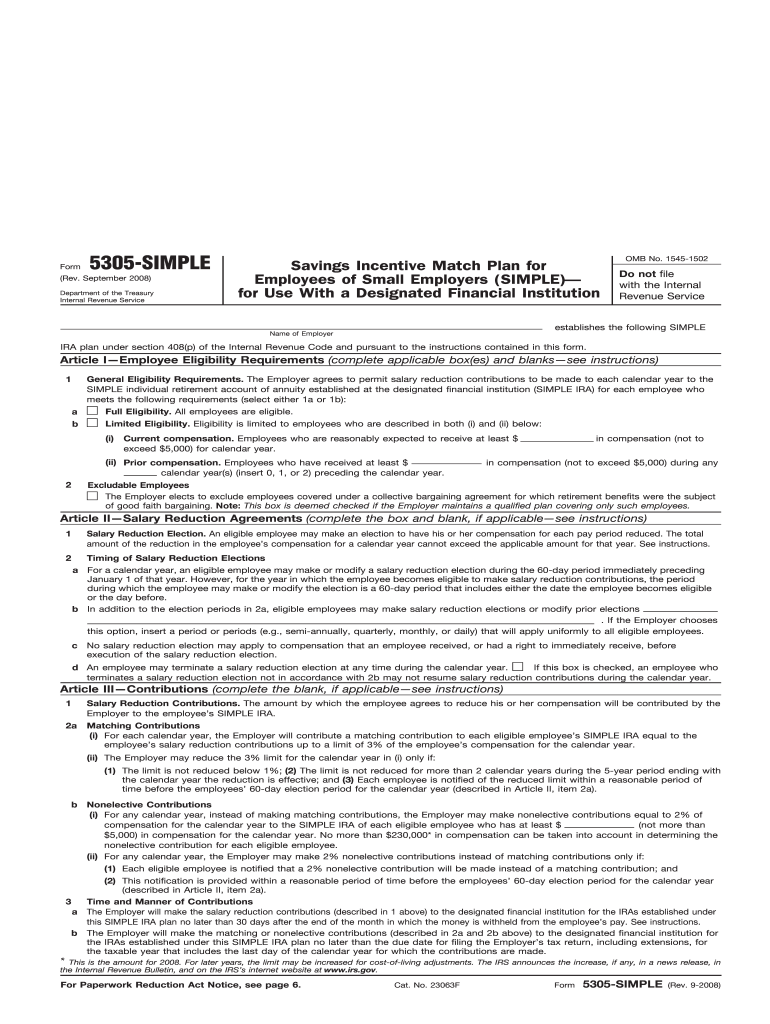

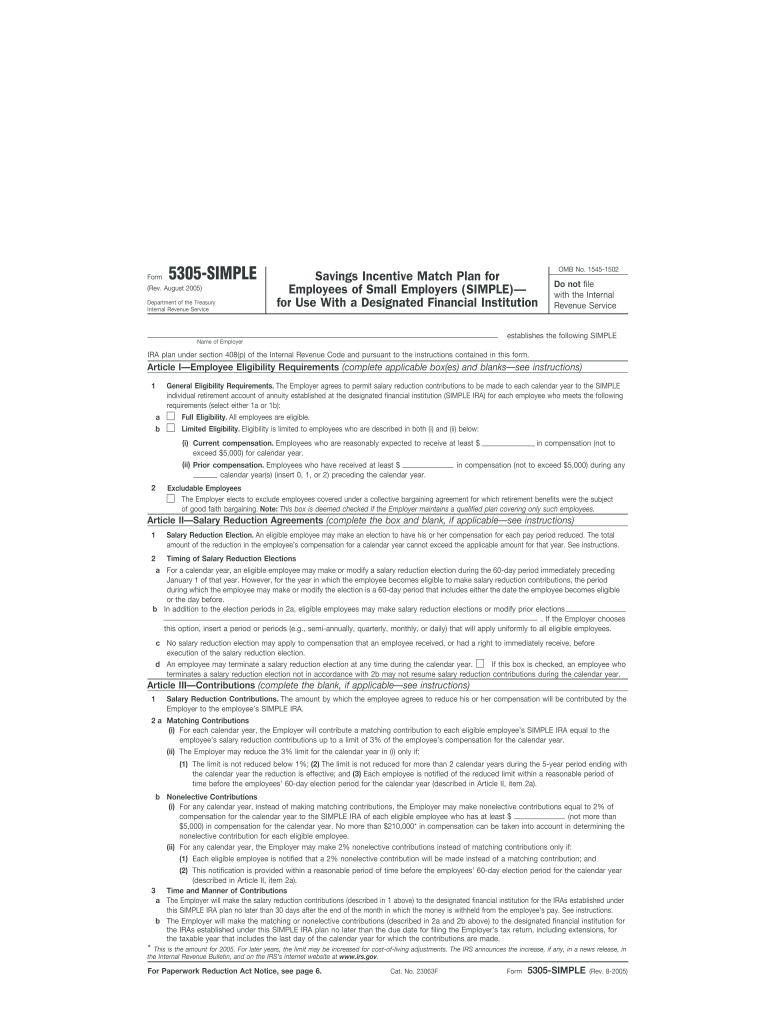

Fill Free fillable Form 5305SIMPLE Savings Incentive Match Plan PDF form

Fidelity simple ira plan agreement (pdf) fidelity funding account agreement (pdf) in order to set up your plan, you will need to print, complete and sign the following documents: Open your plan print, read, and retain copies of the following documents: Contact a retirement plan professional or a representative of a financial institution that offers retirement plans. A simple individual.

Sample 5305 Simple Fill Online, Printable, Fillable, Blank PDFfiller

However, only articles i through vii have been reviewed by the irs. Open your plan print, read, and retain copies of the following documents: A simple individual retirement account (simple ira) is established after the form is fully executed by both the individual (participant) and the custodian. Key things to know 2. Set up your new plan.

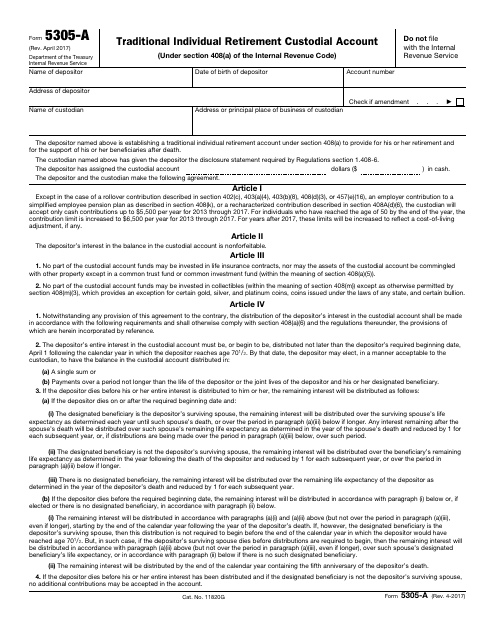

Form 5305SA Simple Individual Retirement Custodial Account (2012

Open your plan print, read, and retain copies of the following documents: Set up your new plan. Set up individual accounts within the plan. Contact a retirement plan professional or a representative of a financial institution that offers retirement plans. However, only articles i through vii have been reviewed by the irs.

Form 5305SA Simple Individual Retirement Custodial Account (2012

Keep it for your records.* 2. Each form is a simple ira plan document. Set up individual accounts within the plan. March 2002) do not file with the internal department of the treasury revenue service internal revenue service establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this.

How a SEP IRA Works Contributions, Benefits, Obligations and IRS Form

Key things to know 2. However, only articles i through vii have been reviewed by the irs. March 2002) do not file with the internal department of the treasury revenue service internal revenue service establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form. Plan adoption agreement.

Simple Ira August 5305 Form Fill Out and Sign Printable PDF Template

More flexibility and more options. Keep it for your records.* 2. Plan adoption agreement (pdf) company profile form (pdf) Eligible employees can fund their own simple ira accounts through regular salary deferrals and employers make additional contributions. Each form is a simple ira plan document.

IRS Form 5305A Download Fillable PDF or Fill Online Traditional

However, only articles i through vii have been reviewed by the irs. Eligible employees can fund their own simple ira accounts through regular salary deferrals and employers make additional contributions. Contact a retirement plan professional or a representative of a financial institution that offers retirement plans. Each form is a simple ira plan document. Keep it for your records.* 2.

Foresters Financial 5305 Simple Fill Out and Sign Printable PDF

March 2002) do not file with the internal department of the treasury revenue service internal revenue service establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form. Plan adoption agreement (pdf) company profile form (pdf) More flexibility and more options. You adopt the simple ira plan when.

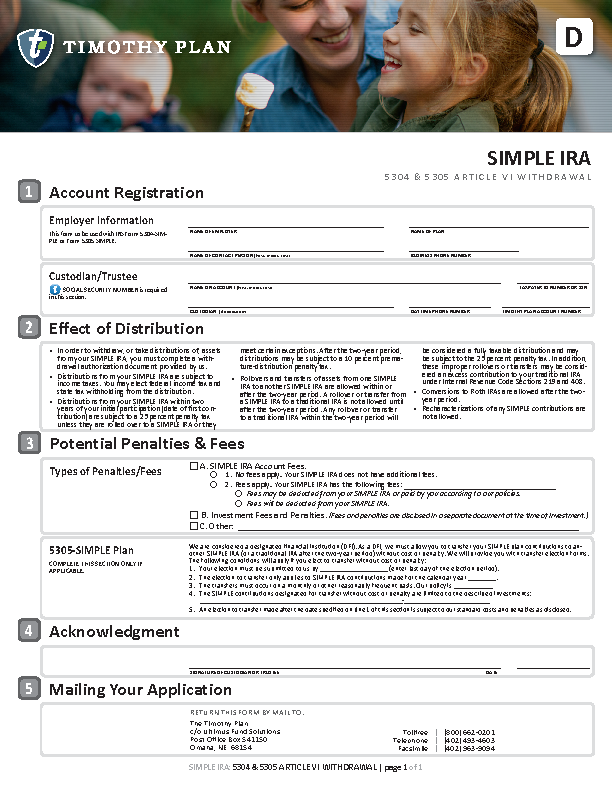

Timothy Plan® Applications for investing

You adopt the simple ira plan when you have completed all appropriate boxes and blanks on the form and you (and the designated financial institution, if any) have signed it. Contact a retirement plan professional or a representative of a financial institution that offers retirement plans. However, only articles i through vii have been reviewed by the irs. Keep it.

More Flexibility And More Options.

March 2002) do not file with the internal department of the treasury revenue service internal revenue service establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form. Open your plan print, read, and retain copies of the following documents: However, only articles i through vii have been reviewed by the irs. Each form is a simple ira plan document.

Fidelity Simple Ira Plan Agreement (Pdf) Fidelity Funding Account Agreement (Pdf) In Order To Set Up Your Plan, You Will Need To Print, Complete And Sign The Following Documents:

Keep it for your records.* 2. Contact a retirement plan professional or a representative of a financial institution that offers retirement plans. Eligible employees can fund their own simple ira accounts through regular salary deferrals and employers make additional contributions. A simple individual retirement account (simple ira) is established after the form is fully executed by both the individual (participant) and the custodian.

Set Up Your New Plan.

Key things to know 2. Set up individual accounts within the plan. You adopt the simple ira plan when you have completed all appropriate boxes and blanks on the form and you (and the designated financial institution, if any) have signed it. Plan adoption agreement (pdf) company profile form (pdf)