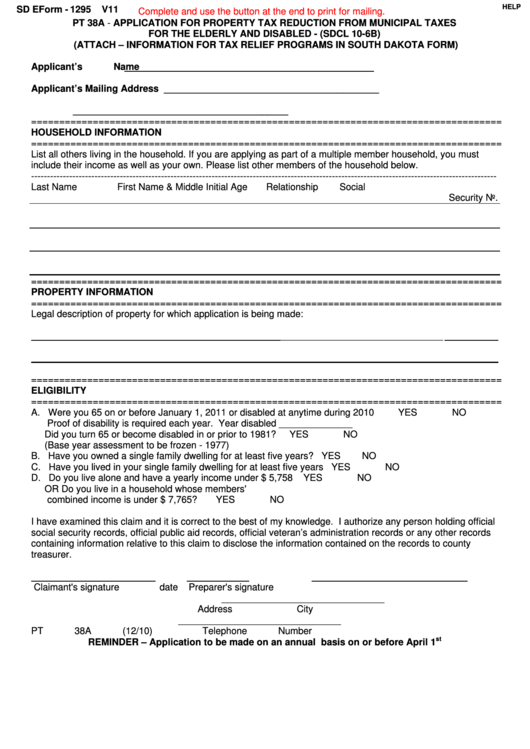

South Dakota Tax Exempt Form

South Dakota Tax Exempt Form - Plates are not removed from vehicle. Not all states allow all exemptions listed on this. Web what can we do for you today? Web official qualifies for the exemption, they are to write the individual tax exemption number from the card in section 3, line f. Sales tax applies to the gross sales or transactions including selling, renting, or leasing products or services (including products delivered. Web south dakota streamlined sales and use tax agreement certificate of exemption instructions use this form to claim exemption from sales tax on purchases of otherwise. Indian tribes united states government agencies state of south. Charitable organizations in south dakota are. Web tax clearance certificate. Fill out the empty fields;

Businesses who would like to apply for reinstatement with the secretary of state’s office must first receive a tax clearance. Not all states allow all exemptions listed on this. Charitable organizations in south dakota are. Looking for information regarding the 2023 law changes? The purchaser must complete all fields on the exemption certificate and provide the fully. Automate certificate management and rate calculation to reduce the risk of noncompliance. Plates are not removed from vehicle. Web several examples of items that exempt from south dakota sales tax are prescription medications, farm machinery, advertising services, replacement parts, and livestock. Click here to find out more! Web south dakota streamlined sales and use tax agreement certificate of exemption instructions use this form to claim exemption from sales tax on purchases of otherwise.

Not all states allow all exemptions listed on this. You will find all state's forms here. Web what can we do for you today? Streamlined sales and use tax agreement. Online services use south dakota department of revenue. Web tax clearance certificate. One can find information, download forms for printing, and fill out. Sales tax applies to the gross sales or transactions including selling, renting, or leasing products or services (including products delivered. Fill out the empty fields; Web get the south dakota tax exempt form you want.

Louisiana Hotel Tax Exempt Form 2020 Fill and Sign Printable Template

Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the south dakota sales tax. Sales tax applies to the gross sales or transactions including selling, renting, or leasing products or services (including products delivered. You will find all state's forms here. Plates are not removed.

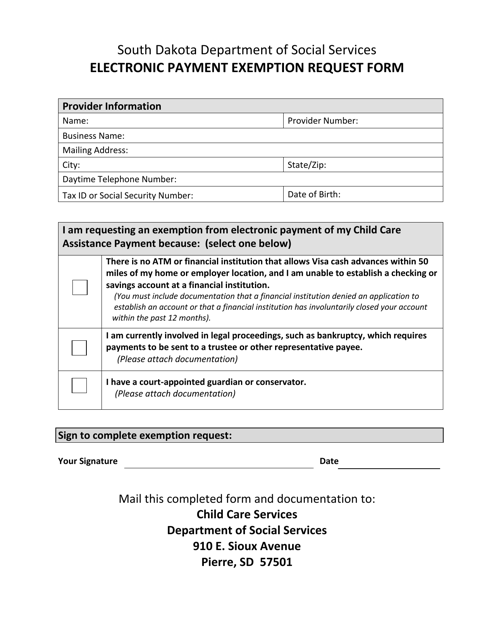

South Dakota Electronic Payment Exemption Request Form Download

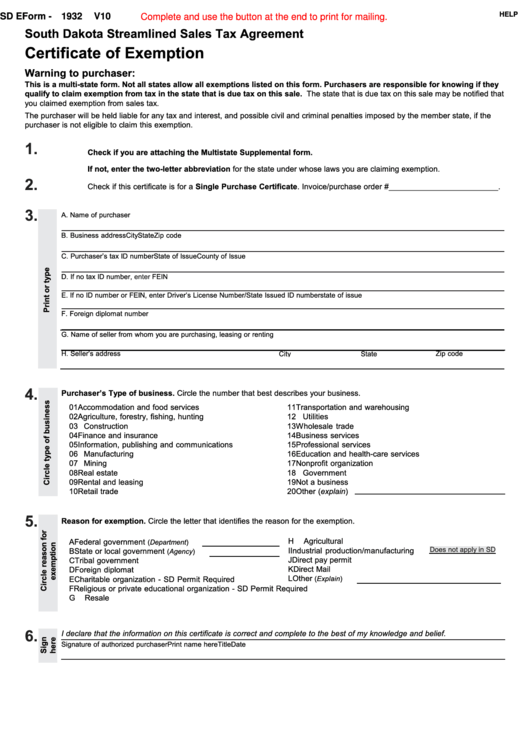

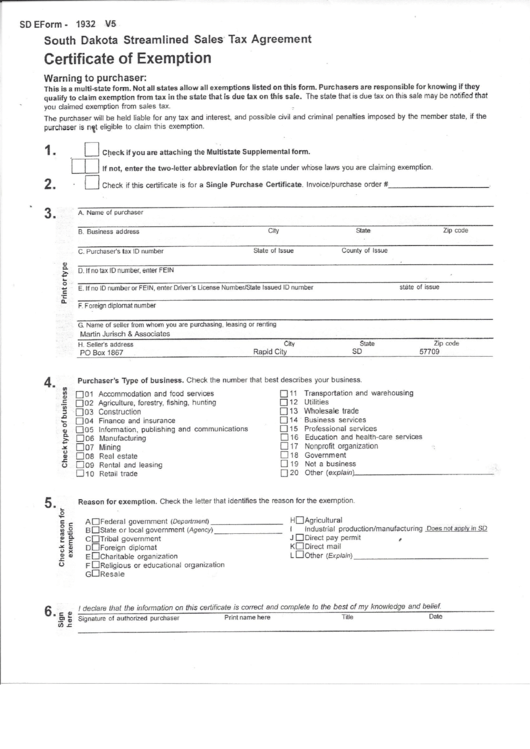

Web south dakota streamlined sales and use tax agreement certificate of exemption instructions use this form to claim exemption from sales tax on purchases of otherwise. Click here to find out more! Streamlined sales and use tax agreement. Web get the south dakota tax exempt form you want. Looking for information regarding the 2023 law changes?

1974 South Dakota Tax Exempt License Plate CY*5454

Click here to find out more! Automate certificate management and rate calculation to reduce the risk of noncompliance. You will find all state's forms here. Welcome to south dakota state government's online forms. Web official qualifies for the exemption, they are to write the individual tax exemption number from the card in section 3, line f.

Sd Eform 1932 V10 South Dakota Streamlined Sales Tax Agreement

Streamlined sales and use tax agreement. Fill out the empty fields; You will find all state's forms here. Looking for information regarding the 2023 law changes? Web south dakota department of revenue.

Certificate Of Exemption South Dakota Streamlined Sales Tax Agreement

Not all states allow all exemptions listed on this. Sales tax applies to the gross sales or transactions including selling, renting, or leasing products or services (including products delivered. Charitable organizations in south dakota are. Web use this form to claim exemption from sales tax on purchases of otherwise taxable items. Web south dakota streamlined sales tax agreement certificate of.

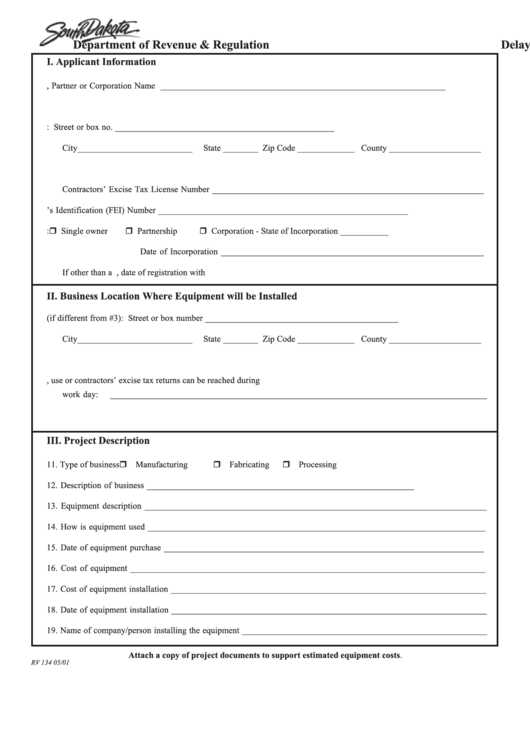

South Dakota Delay In Sales/use Tax Form printable pdf download

Ad avalara has a tax compliance solution for manufacturers and distributors. Web tax clearance certificate. Click here to find out more! Web south dakota streamlined sales tax agreement certificate of exemption warning to purchaser: Web south dakota department of revenue.

Top 22 South Dakota Tax Exempt Form Templates free to download in PDF

Web south dakota streamlined sales and use tax agreement certificate of exemption instructions use this form to claim exemption from sales tax on purchases of otherwise. Indian tribes united states government agencies state of south. Ad avalara has a tax compliance solution for manufacturers and distributors. Automate certificate management and rate calculation to reduce the risk of noncompliance. Plates are.

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

Not all states allow all exemptions listed on this. Indian tribes united states government agencies state of south. Charitable organizations in south dakota are. Web tax clearance certificate. Fill out the empty fields;

South Dakota Tax Exempt Form Pdf Fill Online, Printable, Fillable

Online services use south dakota department of revenue. Ad avalara has a tax compliance solution for manufacturers and distributors. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the south dakota sales tax. Fill out the empty fields; The purchaser must complete all fields on.

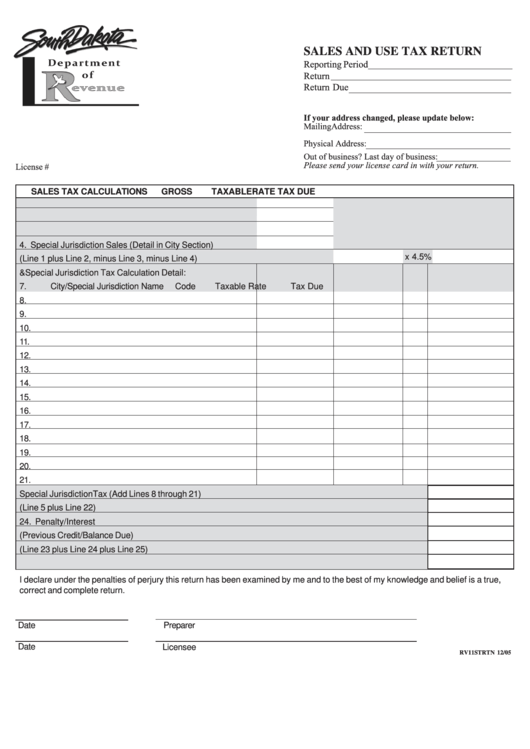

Sales And Use Tax Return Form South Dakota printable pdf download

Concerned parties names, addresses and. Streamlined sales and use tax agreement. One can find information, download forms for printing, and fill out. Web tax clearance certificate. Sales tax applies to the gross sales or transactions including selling, renting, or leasing products or services (including products delivered.

Welcome To South Dakota State Government's Online Forms.

Charitable organizations in south dakota are. Web south dakota streamlined sales and use tax agreement certificate of exemption instructions use this form to claim exemption from sales tax on purchases of otherwise. Web south dakota streamlined sales tax agreement certificate of exemption warning to purchaser: Online services use south dakota department of revenue.

Fill Out The Empty Fields;

Sales tax applies to the gross sales or transactions including selling, renting, or leasing products or services (including products delivered. Looking for information regarding the 2023 law changes? Web what can we do for you today? Web south dakota department of revenue.

Web Use This Form To Claim Exemption From Sales Tax On Purchases Of Otherwise Taxable Items.

One can find information, download forms for printing, and fill out. The purchaser must complete all fields on the exemption certificate and provide the fully. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the south dakota sales tax. Automate certificate management and rate calculation to reduce the risk of noncompliance.

Click Here To Find Out More!

Businesses who would like to apply for reinstatement with the secretary of state’s office must first receive a tax clearance. Exemptions 5 through 11 must have been titled previously in south. Web several examples of items that exempt from south dakota sales tax are prescription medications, farm machinery, advertising services, replacement parts, and livestock. Streamlined sales and use tax agreement.