State Of California Tax Extension Form

State Of California Tax Extension Form - Web disaster relief tax extension. If you make $70,000 a year living in california you will be taxed $11,221. Web tax extension to help alleviate some of the hardship many have endured during this trying period, the ftb has extended the filing and payment deadlines for. Web irs extends 2023 tax deadline to oct. Web unless you file for an extension with turbotax they will not know that you have until october to file your taxes. Your average tax rate is 11.67% and your marginal. Web an extension does not provide an extension to pay this minimum franchise tax, so be sure to use the appropriate ca form to pay the $800 annual tax by your business tax. You must make a proper estimate of your tax for the year. Complete, edit or print tax forms instantly. Be received before the extended period ends.

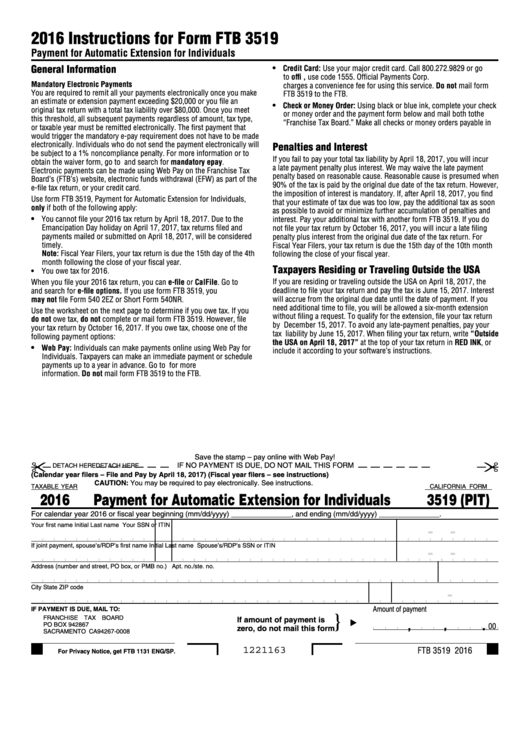

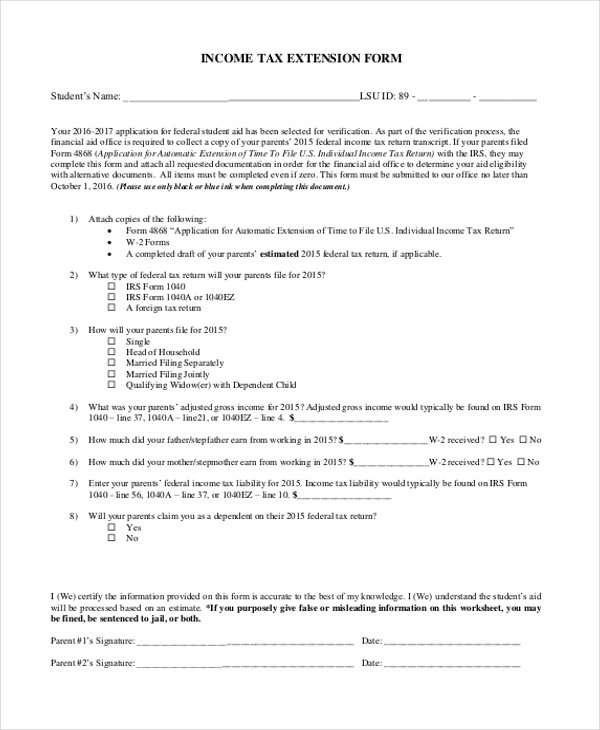

December 2020, 4th quarter 2020, and annual 2020 returns due: March 16, 2023 2:58 am. Web form 3519 is a california individual income tax form. Web use form ftb 3519, payment for automatic extension for individuals, only if both of the following apply: While the irs requires you to file form 4868 in order to request a tax extension, each state has its own requirements for obtaining a similar. Be signed by the employer or authorized agent. Verify a permit, license, or account; Both the irs and the. Web 315 rows report tax fraud; The state of california will grant you an automatic state tax return extension as long.

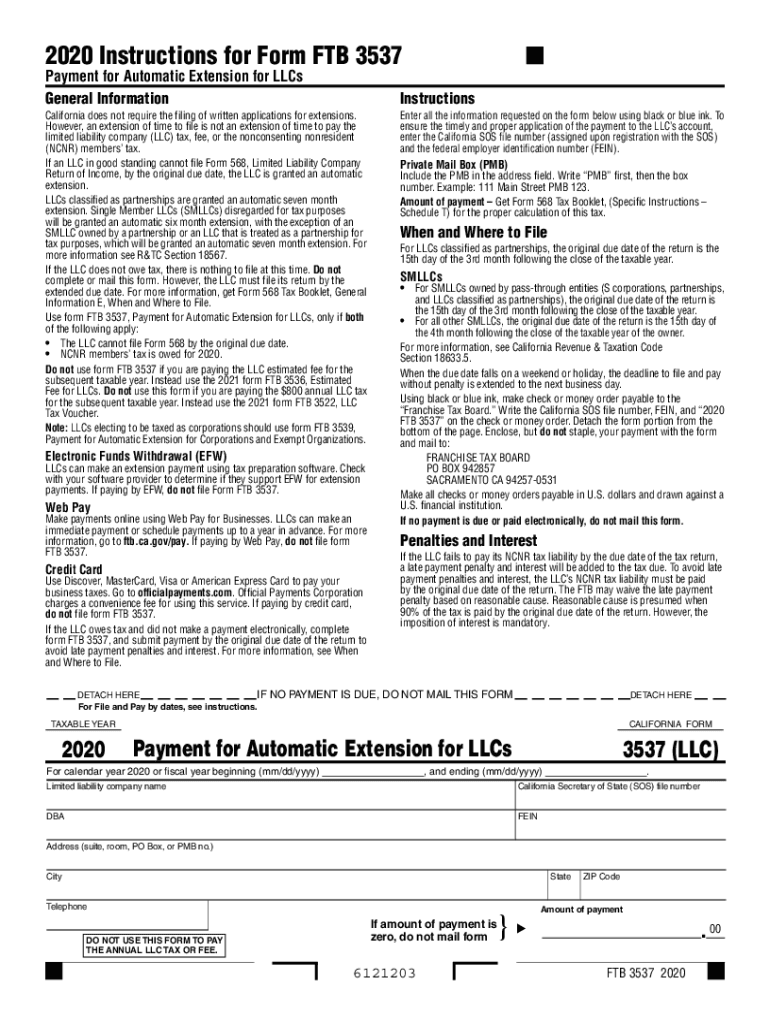

Web an extension does not provide an extension to pay this minimum franchise tax, so be sure to use the appropriate ca form to pay the $800 annual tax by your business tax. Web california tax extensions require no form to be filed to apply for a state tax extension. Only use form ftb 3538, payment for automatic extension for lps, llps, and remics, if both of the following apply: Request an extension or relief; You must make a proper estimate of your tax for the year. Web form 3519 is a california individual income tax form. Both the irs and the. Web an extension of time to pay the $800 annual tax. Verify a permit, license, or account; You cannot file your 2022 tax return, form 540 or form 540nr, by april.

California Form 3519 (Pit) Payment For Automatic Extension For

The irs twice extended the tax deadline for taxpayers in california impacted by natural disasters. Web state tax extensions. Web california tax extensions require no form to be filed to apply for a state tax extension. Web an extension of time to pay the $800 annual tax. Web simplified income, payroll, sales and use tax information for you and your.

Down to the Wire Should You File For a Tax Extension?

Be received before the extended period ends. Be signed by the employer or authorized agent. 16 for many in california. Find out how to get an extension of time to file your income tax return. December 2020, 4th quarter 2020, and annual 2020 returns due:

California Tax Extension Form

Web welcome to the california tax service center, sponsored by the california fed state partnership. Web irs extends 2023 tax deadline to oct. While the irs requires you to file form 4868 in order to request a tax extension, each state has its own requirements for obtaining a similar. 16 for many in california. Verify a permit, license, or account;

Cal Tax Increase Election w/o GOP?

Web irs extends 2023 tax deadline to oct. Web an extension of time to pay the $800 annual tax. Be signed by the employer or authorized agent. Web form 3519 is a california individual income tax form. You must make a proper estimate of your tax for the year.

Form 3537 California Fill Out and Sign Printable PDF Template signNow

December 2020, 4th quarter 2020, and annual 2020 returns due: You must make a proper estimate of your tax for the year. Both the irs and the. Web an extension of time to pay the $800 annual tax. Be signed by the employer or authorized agent.

How to File an Extension of New York State Taxes Pocketsense

Both the irs and the. Web welcome to the california tax service center, sponsored by the california fed state partnership. Complete, edit or print tax forms instantly. Web california tax extensions require no form to be filed to apply for a state tax extension. If you make $70,000 a year living in california you will be taxed $11,221.

How to File for an Extension of State Taxes TurboTax Tax Tips & Videos

Web download or print the 2022 california (extension of time for payment of taxes by a corporation expecting a net operating loss carryback) (2022) and other income tax. Web form 3519 is a california individual income tax form. March 16, 2023 2:58 am. Web simplified income, payroll, sales and use tax information for you and your business Both the irs.

FREE 22+ Sample Tax Forms in PDF Excel MS Word

Web irs extends 2023 tax deadline to oct. Web state tax extensions. Web unless you file for an extension with turbotax they will not know that you have until october to file your taxes. Edit, sign and print tax forms on any device with signnow. The state of california will grant you an automatic state tax return extension as long.

Tax Form California Free Download

Web yes, california postponed the income tax filing due date for individuals (those who file forms 540, 540 2ez, and 540nr, including pit composite returns) for the 2020 tax year from. Find out how to get an extension of time to file your income tax return. State extension to file federal extensions of time to file your tax return Be.

California State Tax Forms By Mail Form Resume Examples EY39y4d32V

Be received before the extended period ends. To help alleviate some of the stress many have endured during this trying period, the ftb has extended the filing and payment deadlines for. 16 for many in california. Web simplified income, payroll, sales and use tax information for you and your business Web download or print the 2022 california (extension of time.

Your Average Tax Rate Is 11.67% And Your Marginal.

Both the irs and the. Be signed by the employer or authorized agent. Web form 3519 is a california individual income tax form. Web yes, california postponed the income tax filing due date for individuals (those who file forms 540, 540 2ez, and 540nr, including pit composite returns) for the 2020 tax year from.

Web California Tax Extensions Require No Form To Be Filed To Apply For A State Tax Extension.

Web irs extends 2023 tax deadline to oct. Web 315 rows report tax fraud; Web simplified income, payroll, sales and use tax information for you and your business The irs twice extended the tax deadline for taxpayers in california impacted by natural disasters.

Web Download Or Print The 2022 California (Extension Of Time For Payment Of Taxes By A Corporation Expecting A Net Operating Loss Carryback) (2022) And Other Income Tax.

To help alleviate some of the stress many have endured during this trying period, the ftb has extended the filing and payment deadlines for. State extension to file federal extensions of time to file your tax return Web an extension does not provide an extension to pay this minimum franchise tax, so be sure to use the appropriate ca form to pay the $800 annual tax by your business tax. Request an extension or relief;

Web State Tax Extensions.

Find out how to get an extension of time to file your income tax return. Complete, edit or print tax forms instantly. You cannot file your 2022 tax return, form 540 or form 540nr, by april. Web an extension of time to pay the $800 annual tax.