State Of Michigan Tax Exemption Form

State Of Michigan Tax Exemption Form - Download or email mi form 5076 & more fillable forms, register and subscribe now You must file a revised form within 10. Web michigan sales and use tax certificate of exemption: Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Web michigan department of treasury form 3372 (rev. Web we have three michigan sales tax exemption forms available for you to print or save as a pdf file. Do not send to the department of treasury. Sales and use tax exempt status. Download a pdf form 3372 sales. Web request to rescind principal residence exemption.

Certificate must be retained in the seller’s records. Web additional resources need a different form? Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Web we have three michigan sales tax exemption forms available for you to print or save as a pdf file. Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan sales and use tax certificate of exemption. Complete, edit or print tax forms instantly. Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. Web for other michigan sales tax exemption certificates, go here. Notice of denial of principal residence exemption (local (city/township)) 2753. Batch cover sheet for principal.

Michigan sales and use tax contractor eligibility statement: Web for other michigan sales tax exemption certificates, go here. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Web we have three michigan sales tax exemption forms available for you to print or save as a pdf file. Download or email mi form 5076 & more fillable forms, register and subscribe now Certificate must be retained in the seller’s records. Web in order to claim this exemption, this form must be filed with the local unit (city or township) where the personal property is located no later than february 20, 2019. Web request to rescind principal residence exemption. You must file a revised form within 10. Web the charitable nonprofit housing property exemption, public act 612 of 2006, mcl 211.7kk, as amended, was created to exempt certain residential property owned by a.

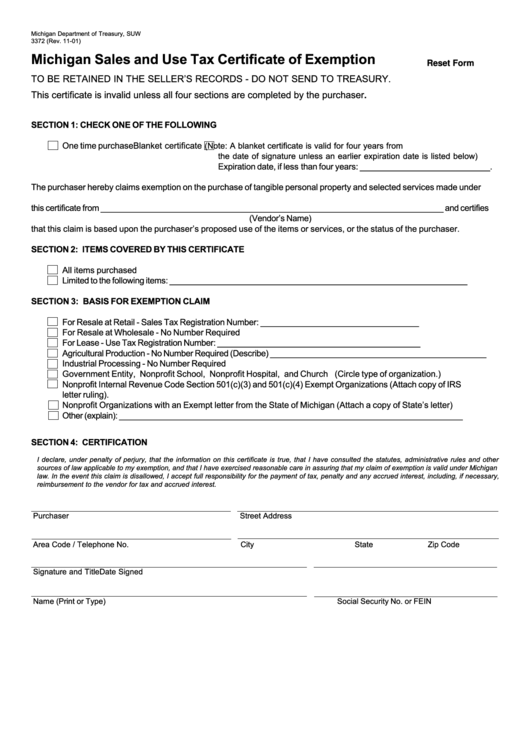

MICHIGAN SALES AND USE TAX CERTIFICATE OF EXEMPTION

Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently. You must file a revised form within 10. Web michigan sales and use tax certificate of exemption instructions: Web michigan sales and use tax certificate of exemption: Download or email mi form 5076.

Michigan certificate of tax exemption from 3372 Fill out & sign online

Web michigan department of treasury form 3372 (rev. Web we have three michigan sales tax exemption forms available for you to print or save as a pdf file. Look for forms using our forms search or view a list of income tax forms by year. You must file a revised form within 10. Web the certificate that qualifying agricultural producers,.

Michigan State Tax Reform Plan 2018 PDF Tax Exemption Taxpayer

Web request to rescind principal residence exemption. Sales and use tax exempt status. You must file a revised form within 10. Web for other michigan sales tax exemption certificates, go here. Web in order to claim this exemption, this form must be filed with the local unit (city or township) where the personal property is located no later than february.

How to get a Certificate of Exemption in Michigan

You must file a revised form within 10. Sales tax return for special events: Michigan sales and use tax contractor eligibility statement: Web in order to claim this exemption, this form must be filed with the local unit (city or township) where the personal property is located no later than february 20, 2019. Any altering of a form to change.

by Carrollton Public

Web michigan sales and use tax certificate of exemption instructions: You must file a revised form within 10. Any altering of a form to change a tax year or any reported tax period outside. Download a copy of the michigan general sales tax. Web michigan sales and use tax certificate of exemption:

Form Mi 1041 Fill Out and Sign Printable PDF Template signNow

If any of these links are broken, or you can't find the form you need, please let. Web for other michigan sales tax exemption certificates, go here. Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently. Michigan sales and use tax contractor.

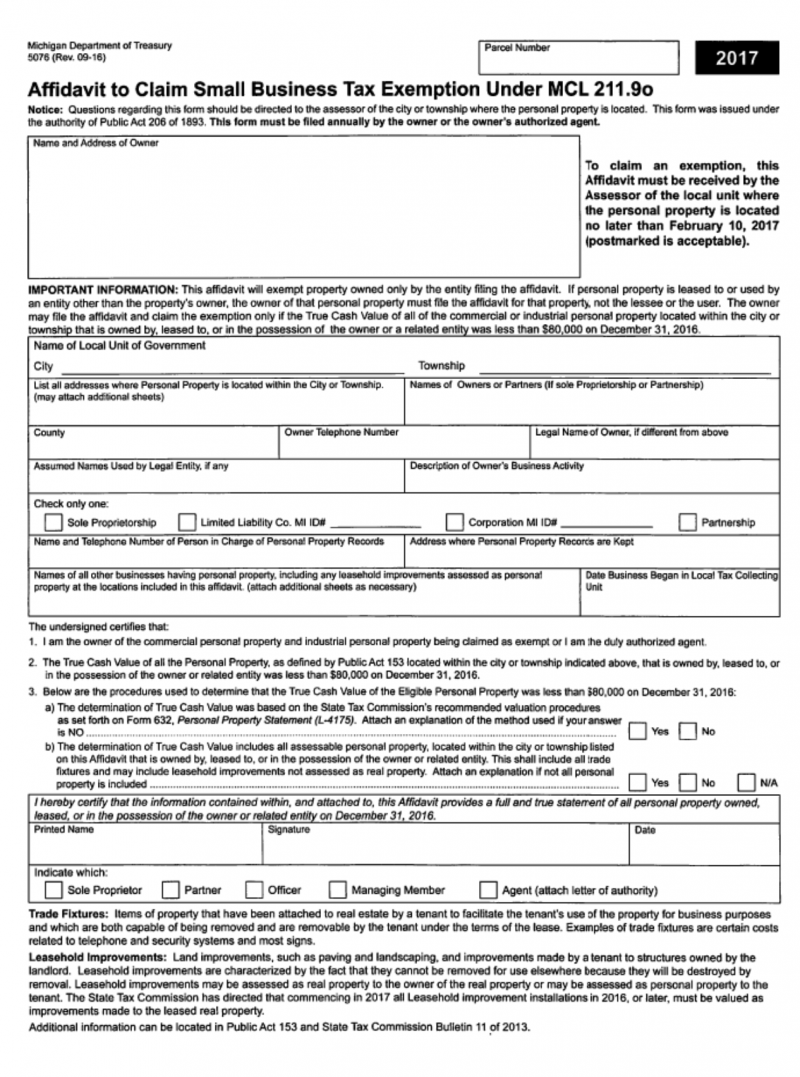

Form 5076 Right Michigan

Web michigan sales and use tax certificate of exemption instructions: Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan sales and use tax certificate of exemption. Web the charitable nonprofit housing property exemption, public act 612 of 2006, mcl 211.7kk, as amended, was created to exempt certain residential property owned by a..

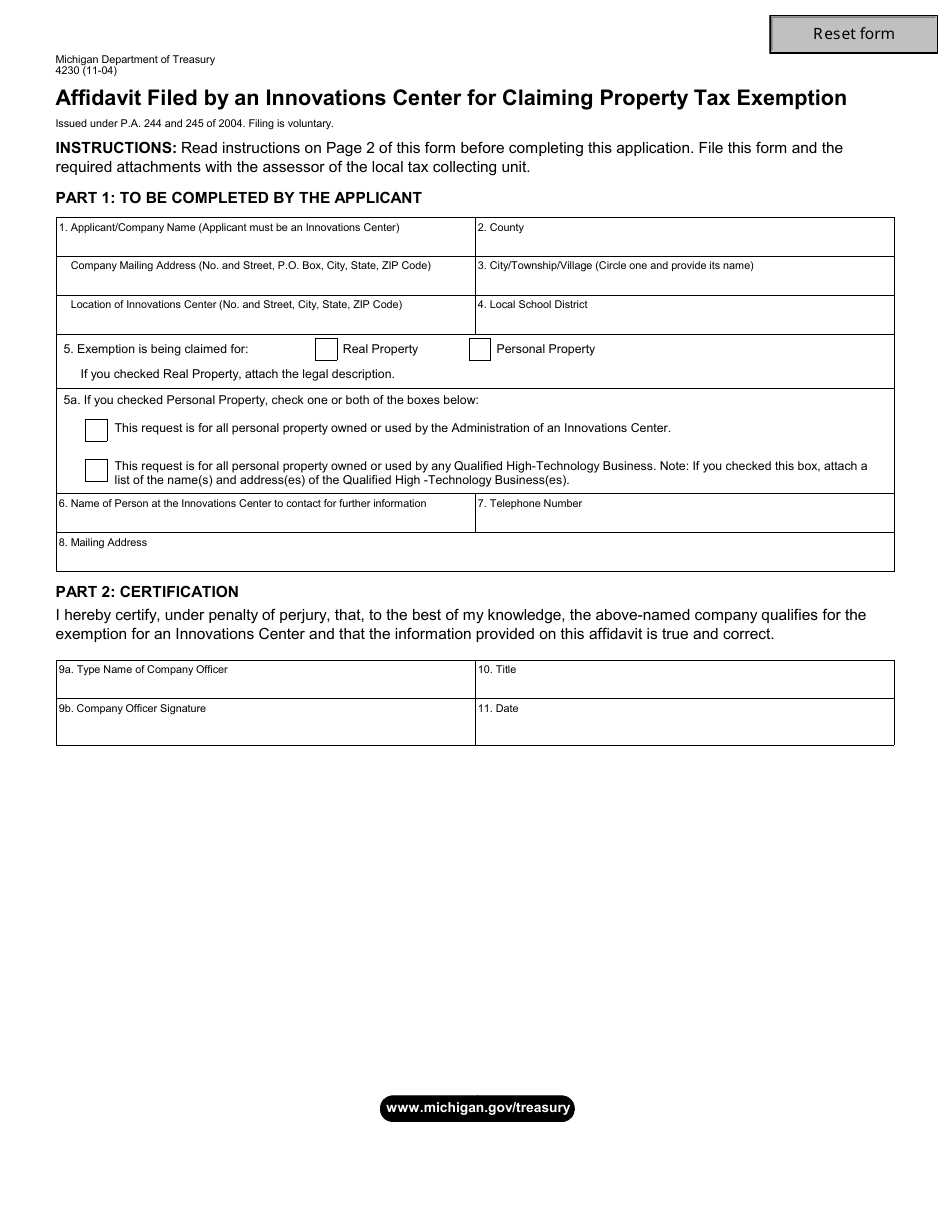

Form 4230 Download Fillable PDF or Fill Online Affidavit Filed by an

You must file a revised form within 10. Any altering of a form to change a tax year or any reported tax period outside. Look for forms using our forms search or view a list of income tax forms by year. Web request to rescind principal residence exemption. Michigan sales and use tax contractor eligibility statement:

Top 19 Michigan Tax Exempt Form Templates free to download in PDF format

Web request to rescind principal residence exemption. Web michigan sales and use tax certificate of exemption: Web michigan department of treasury form 3372 (rev. Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan sales and use.

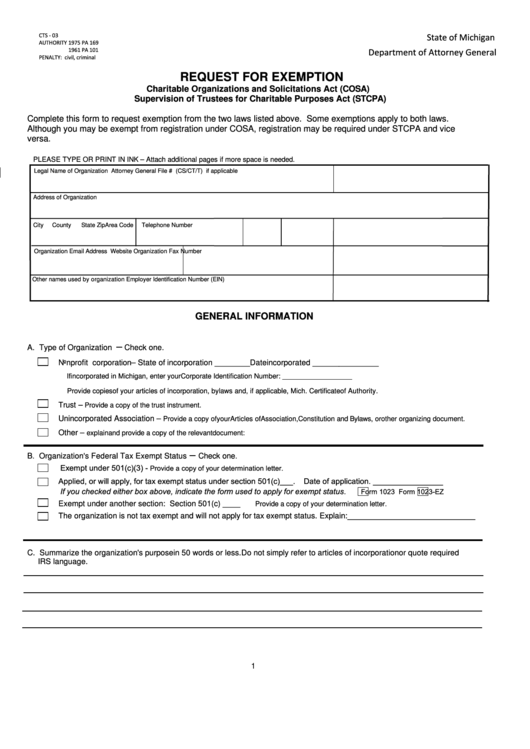

Fillable Request For Exemption State Of Michigan printable pdf download

If any of these links are broken, or you can't find the form you need, please let. Web michigan department of treasury form 3372 (rev. Notice of denial of principal residence exemption (local (city/township)) 2753. Complete, edit or print tax forms instantly. Any altering of a form to change a tax year or any reported tax period outside.

Web The State Also Provides A $2,900 Special Exemption For Each Tax Filer Or Dependent In The Household Who Is Deaf, Paraplegic, Quadriplegic, Hemiplegic, Totally And Permanently.

Web additional resources need a different form? Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan sales and use tax certificate of exemption. You must file a revised form within 10. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following:

Do Not Send To The Department Of Treasury.

Web the charitable nonprofit housing property exemption, public act 612 of 2006, mcl 211.7kk, as amended, was created to exempt certain residential property owned by a. If any of these links are broken, or you can't find the form you need, please let. Web in order to claim this exemption, this form must be filed with the local unit (city or township) where the personal property is located no later than february 20, 2019. Download a pdf form 3372 sales.

Any Altering Of A Form To Change A Tax Year Or Any Reported Tax Period Outside.

Notice of denial of principal residence exemption (local (city/township)) 2753. Download a copy of the michigan general sales tax. Web if you would like more information about tax exemptions, visit the state of michigan department of treasury website. This letter serves as notice to a seller that michigan state university qualifies to buy goods and services without paying the.

Michigan Sales And Use Tax Contractor Eligibility Statement:

Web we have three michigan sales tax exemption forms available for you to print or save as a pdf file. Web michigan sales and use tax certificate of exemption instructions: Web michigan department of treasury form 3372 (rev. Batch cover sheet for principal.