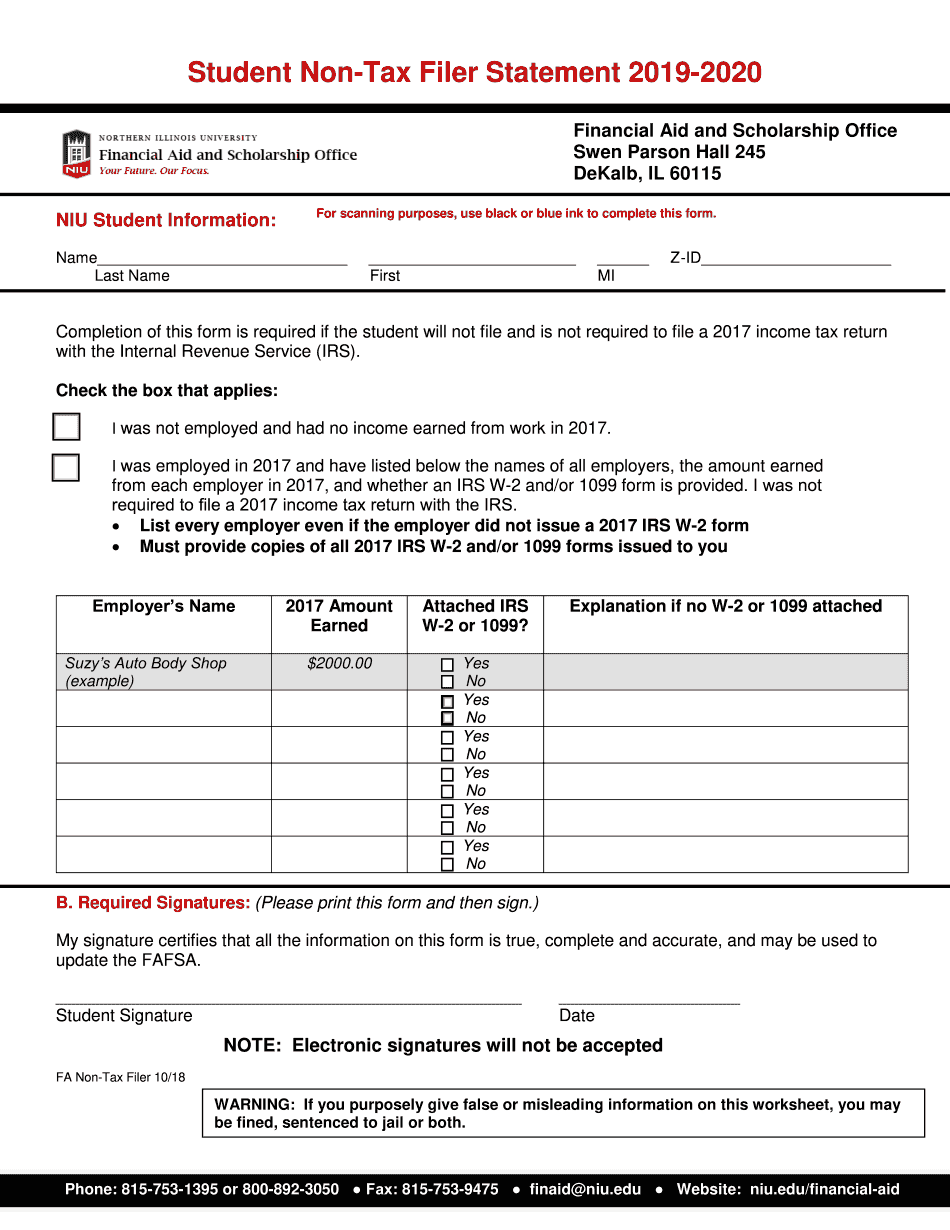

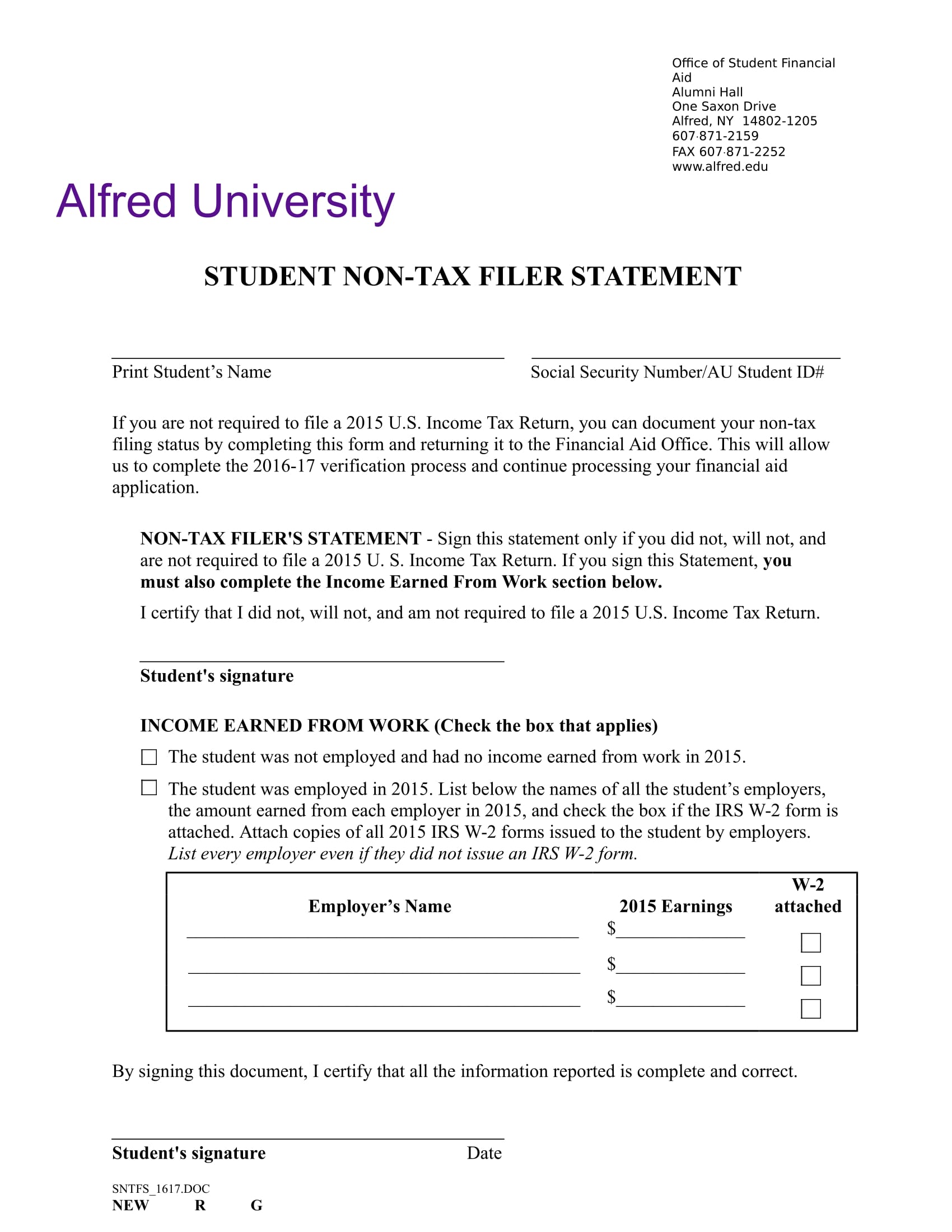

Student Non Tax Filer Form

Student Non Tax Filer Form - These forms require ink signatures. Online or by paper form. Web by signing this form, i certify that all of the information reported is complete and accurate. It may also provide us with confirmation of any. Complete this section if the. If this is correct please complete the form on this page based on. Web this non tax filing statement is required if the student and/or their spouse will not file and are not required to file a 2019 income tax return with the irs. Electronic signatures will not be accepted. Resident and will not file and are not. Digital signatures are not accepted.

It may also provide us with confirmation of any. Web by signing this form, i certify that all of the information reported is complete and accurate. Complete this section if the. Digital signatures are not accepted. Resident and will not file and are not. Electronic signatures will not be accepted. These forms require ink signatures. Your fafsa indicates that you did not file a 2020 federal tax return. Web this non tax filing statement is required if the student and/or their spouse will not file and are not required to file a 2018 income tax return with the irs. Web this non tax filing statement is required if the student and/or their spouse will not file and are not required to file a 2019 income tax return with the irs.

Your fafsa indicates that you did not file a 2020 federal tax return. It may also provide us with confirmation of any. Signature of student (required) date. Digital signatures are not accepted. These forms require ink signatures. Web if you* have not filed, will not file, and are not required to file a 2021 tax return, you must submit: Complete this section if the. Electronic signatures will not be accepted. Online, by telephone, or by paper. Web this non tax filing statement is required if the student and/or their spouse will not file and are not required to file a 2019 income tax return with the irs.

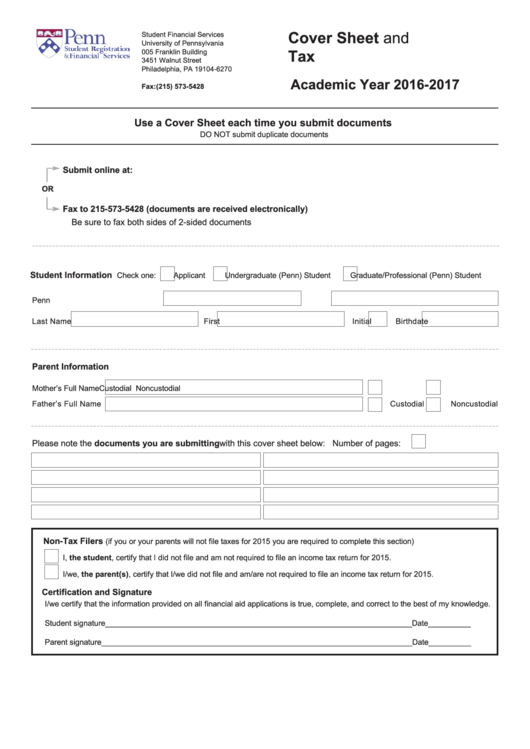

How To Fill Out The Non Filers Form Filer Form Fill Online Printable

Online, by telephone, or by paper. Digital signatures are not accepted. Web if you* have not filed, will not file, and are not required to file a 2021 tax return, you must submit: Signature of student (required) date. Electronic signatures will not be accepted.

What is an IRS Verification of Nonfiling Letter? Niner Central UNC

Electronic signatures will not be accepted. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. If this is correct please complete the form on this page based on. Complete this section if the. Web by signing this form, i certify that all of the information reported is complete and accurate.

How to Fill out the IRS NonFiler Form Get It Back Tax Credits for

Online, by telephone, or by paper. Web if you* have not filed, will not file, and are not required to file a 2021 tax return, you must submit: Electronic signatures will not be accepted. These forms require ink signatures. Complete this section if the.

Non Tax Filer Form Fill Out and Sign Printable PDF Template signNow

If this is correct please complete the form on this page based on. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Resident and will not file and are not. Online, by telephone, or by paper. Web this non tax filing statement is required if the student and/or their spouse will.

Fillable Cover Sheet And Tax I.d. / NonTax Filer Form printable pdf

Electronic signatures will not be accepted. These forms require ink signatures. Complete this section if the. Your fafsa indicates that you did not file a 2020 federal tax return. Web this non tax filing statement is required if the student and/or their spouse will not file and are not required to file a 2019 income tax return with the irs.

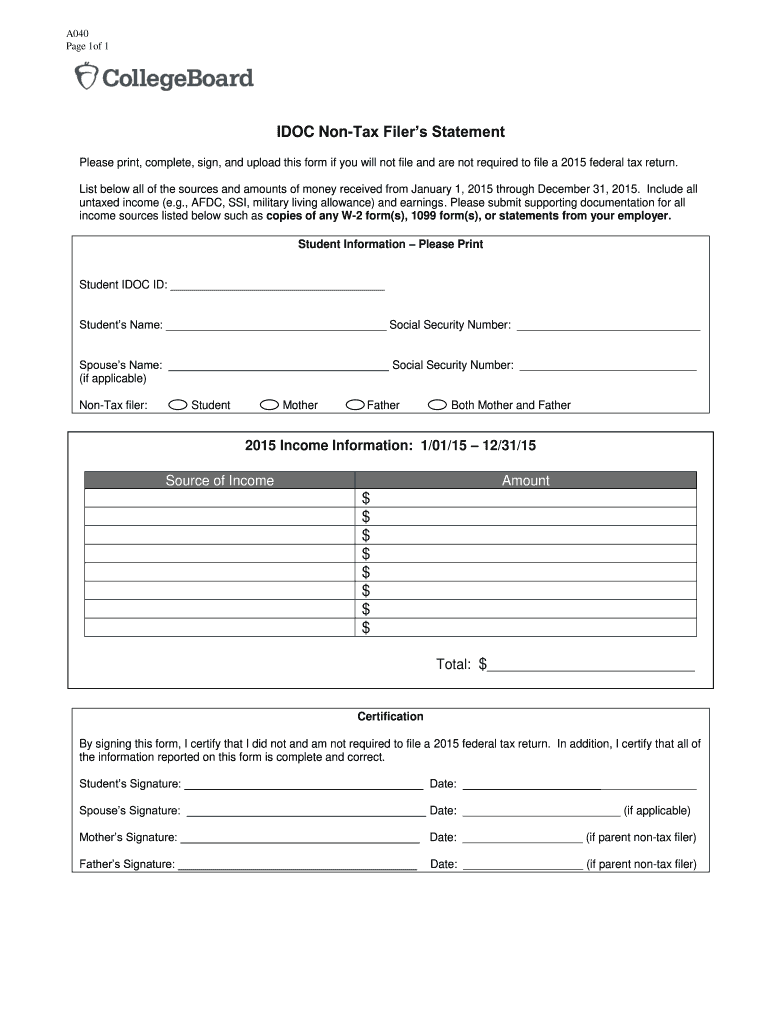

Idoc Non Tax Filer Statement Fill Out and Sign Printable PDF Template

If this is correct please complete the form on this page based on. It may also provide us with confirmation of any. Web this non tax filing statement is required if the student and/or their spouse will not file and are not required to file a 2019 income tax return with the irs. Resident and will not file and are.

20212022 NonTax Filing StatementStudent by SUNY Erie Issuu

It may also provide us with confirmation of any. Your fafsa indicates that you did not file a 2020 federal tax return. If this is correct please complete the form on this page based on. Digital signatures are not accepted. Signature of student (required) date.

Northern Illinois University NonTax Filer Statement 2019 Fill and

Resident and will not file and are not. List below your and/or your parent(s)’/spouse's employers and/or sources of income and the amount of income. Your fafsa indicates that you did not file a 2020 federal tax return. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. If this is correct please.

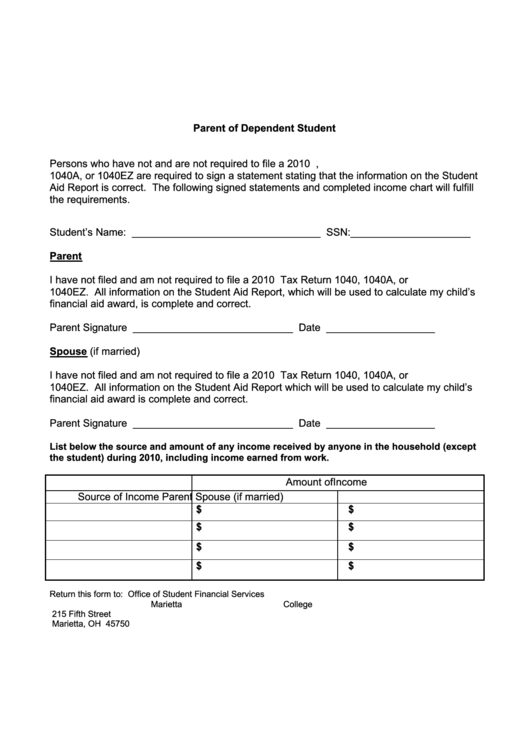

Fillable U.s. Tax NonFiler Statement Parent Of Dependent

Resident and will not file and are not. Electronic signatures will not be accepted. Digital signatures are not accepted. If this is correct please complete the form on this page based on. Online, by telephone, or by paper.

31+ Statement Forms in MS Word PDF Excel

Web this non tax filing statement is required if the student and/or their spouse will not file and are not required to file a 2019 income tax return with the irs. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web if you* have not filed, will not file, and are.

Web Watch Newsmax Live For The Latest News And Analysis On Today's Top Stories, Right Here On Facebook.

Electronic signatures will not be accepted. Signature of student (required) date. Web this non tax filing statement is required if the student and/or their spouse will not file and are not required to file a 2019 income tax return with the irs. It may also provide us with confirmation of any.

If This Is Correct Please Complete The Form On This Page Based On.

Digital signatures are not accepted. Web by signing this form, i certify that all of the information reported is complete and accurate. List below your and/or your parent(s)’/spouse's employers and/or sources of income and the amount of income. Your fafsa indicates that you did not file a 2020 federal tax return.

Complete This Section If The.

Web this non tax filing statement is required if the student and/or their spouse will not file and are not required to file a 2018 income tax return with the irs. Online, by telephone, or by paper. These forms require ink signatures. Web if you* have not filed, will not file, and are not required to file a 2021 tax return, you must submit:

Online Or By Paper Form.

Resident and will not file and are not.