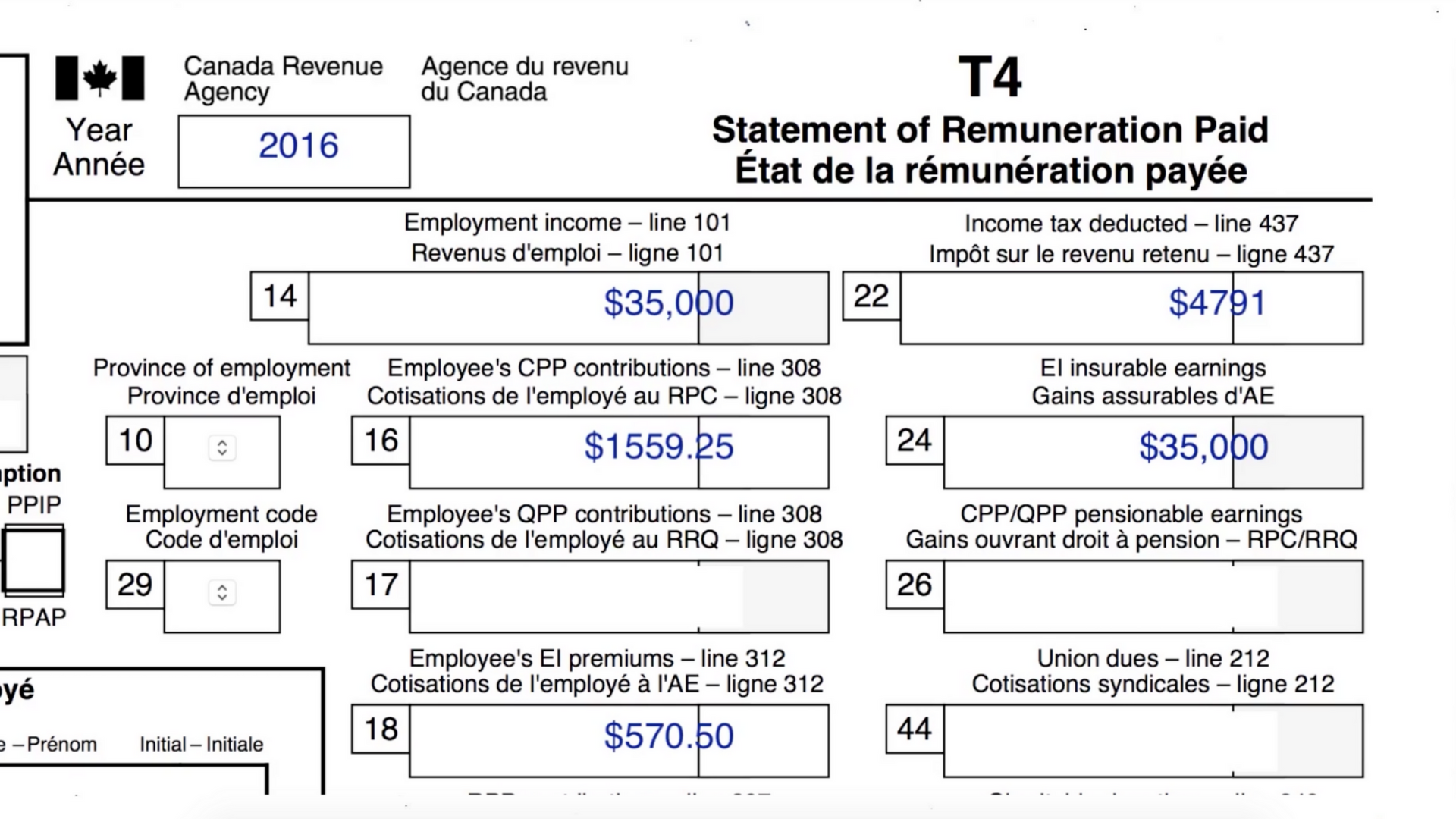

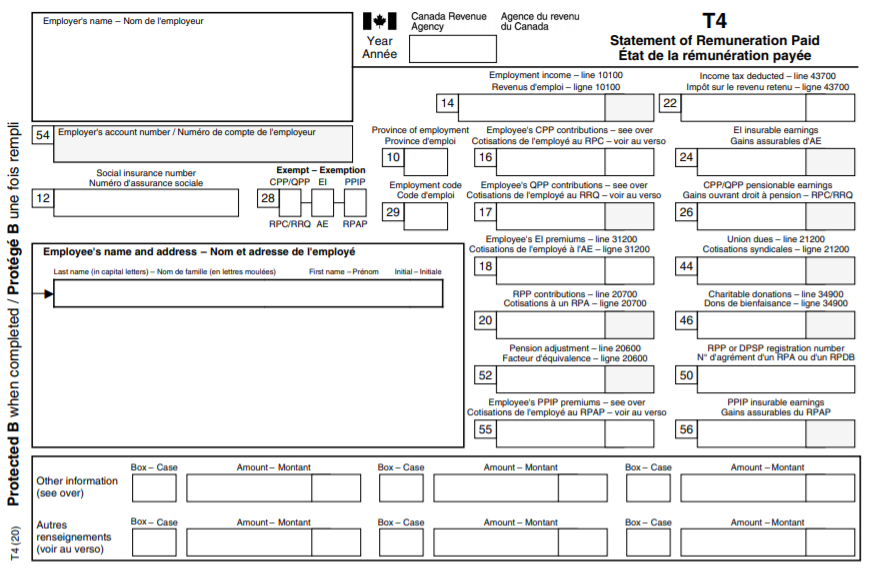

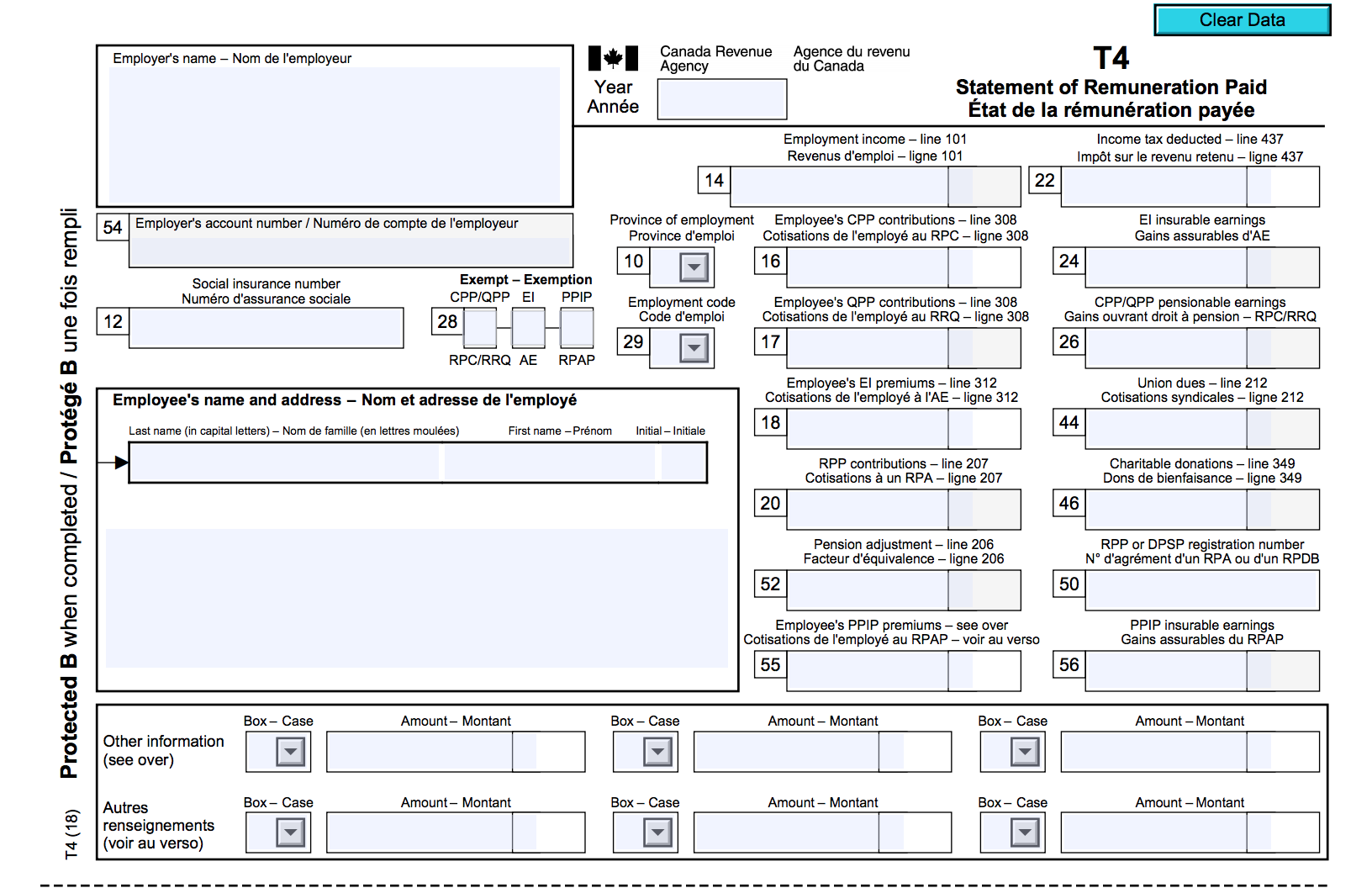

T4 Canada Tax Form

T4 Canada Tax Form - Web what's the difference? These include income tax, employment insurance,. Employers have until the end of february each year to issue their employees’ t4. Statement of remuneration paid for detailed information on the amounts shown in the boxes of your t4 slip, see the corresponding box number below. Web get your t4, t5, t3, t2202, rc62, rc210 or rrsp slips slips are prepared by your employer, payer, administrator or financial institution. Web also called a statement of remuneration paid, a t4 slip is a document you receive from your employer that summarizes all the money they’ve paid you over the previous year. Ad download or email canada t4 form & more fillable forms, register and subscribe now! Web every employee in canada who earns $500 or more in employment income within a calendar year (january 1 to december 31) must receive a t4 from every. We have decades of experience with holistic international tax strategies and planning. Web boxes 16 and 26 are completed with the appropriate amounts and boxes 18 and 24 are left blank.

Web when an employer gives you a t4 slip, they also send a copy of it to the cra. An amended return cannot contain an original slip. Employers have until the end of february each year to issue their employees’ t4. Edit, sign and save canada t4 form. Written by hannah logan edited by beth buczynski. Ad our international tax services can be customized to fit your specific business needs. We have decades of experience with holistic international tax strategies and planning. Where the t4 form directly deals with income earned through employment and deductions made by the employer, the t4a form, on the other. Web what's the difference? Turbotax canada march 25, 2022 | 3 min read updated for tax year 2021 contents 3 minute.

Web boxes 16 and 26 are completed with the appropriate amounts and boxes 18 and 24 are left blank. Turbotax canada march 25, 2022 | 3 min read updated for tax year 2021 contents 3 minute. Statement of remuneration paid for detailed information on the amounts shown in the boxes of your t4 slip, see the corresponding box number below. Web every employee in canada who earns $500 or more in employment income within a calendar year (january 1 to december 31) must receive a t4 from every. An amended return cannot contain an original slip. Where the t4 form directly deals with income earned through employment and deductions made by the employer, the t4a form, on the other. Edit, sign and save canada t4 form. Web also called a statement of remuneration paid, a t4 slip is a document you receive from your employer that summarizes all the money they’ve paid you over the previous year. Written by hannah logan edited by beth buczynski. Ad our international tax services can be customized to fit your specific business needs.

How to Prepare a T4 Slip in 12 Easy Steps Madan CPA

Web t4 and t4a are two necessary tax forms that detail employment income. Web a t4 slip is a tax document that summarizes your annual employment earnings as well as any deductions. Ad our international tax services can be customized to fit your specific business needs. Web every employee in canada who earns $500 or more in employment income within.

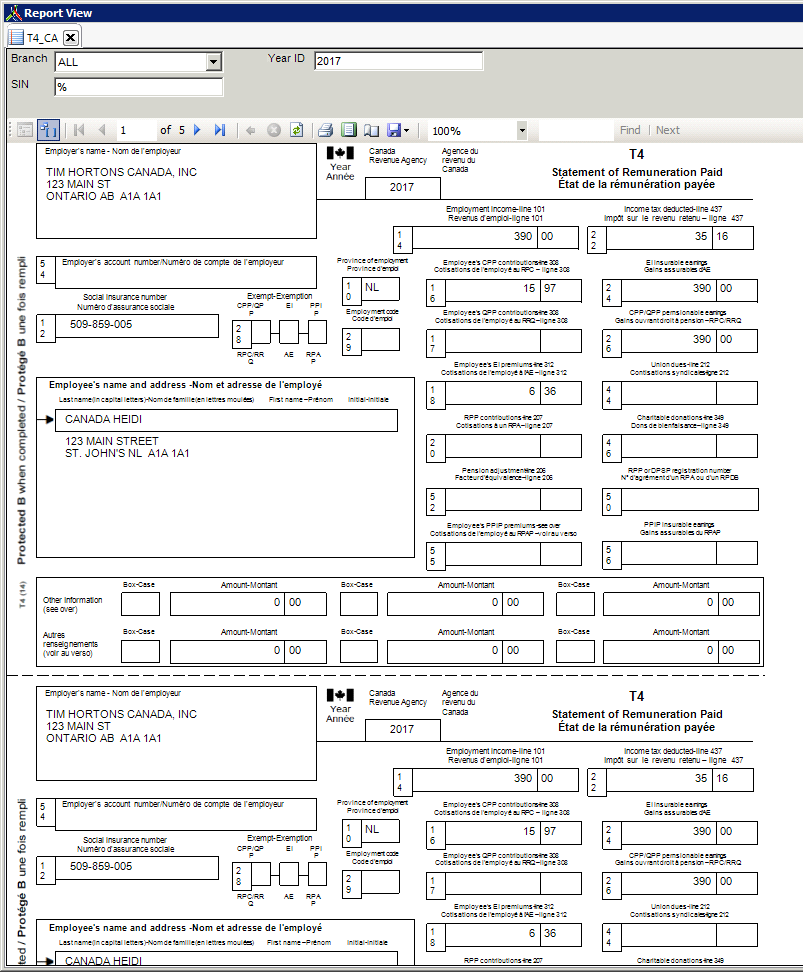

Standard Canadian Report T4_CA Avionte Classic

Employers have until the end of february each year to issue their employees’ t4. Written by hannah logan edited by beth buczynski. Ad our international tax services can be customized to fit your specific business needs. We have decades of experience with holistic international tax strategies and planning. Ad download or email canada t4 form & more fillable forms, register.

What is a T4 slip? Canada.ca

Employers have until the end of february each year to issue their employees’ t4. You should receive most of. Web get your t4, t5, t3, t2202, rc62, rc210 or rrsp slips slips are prepared by your employer, payer, administrator or financial institution. Edit, sign and save canada t4 form. Web boxes 16 and 26 are completed with the appropriate amounts.

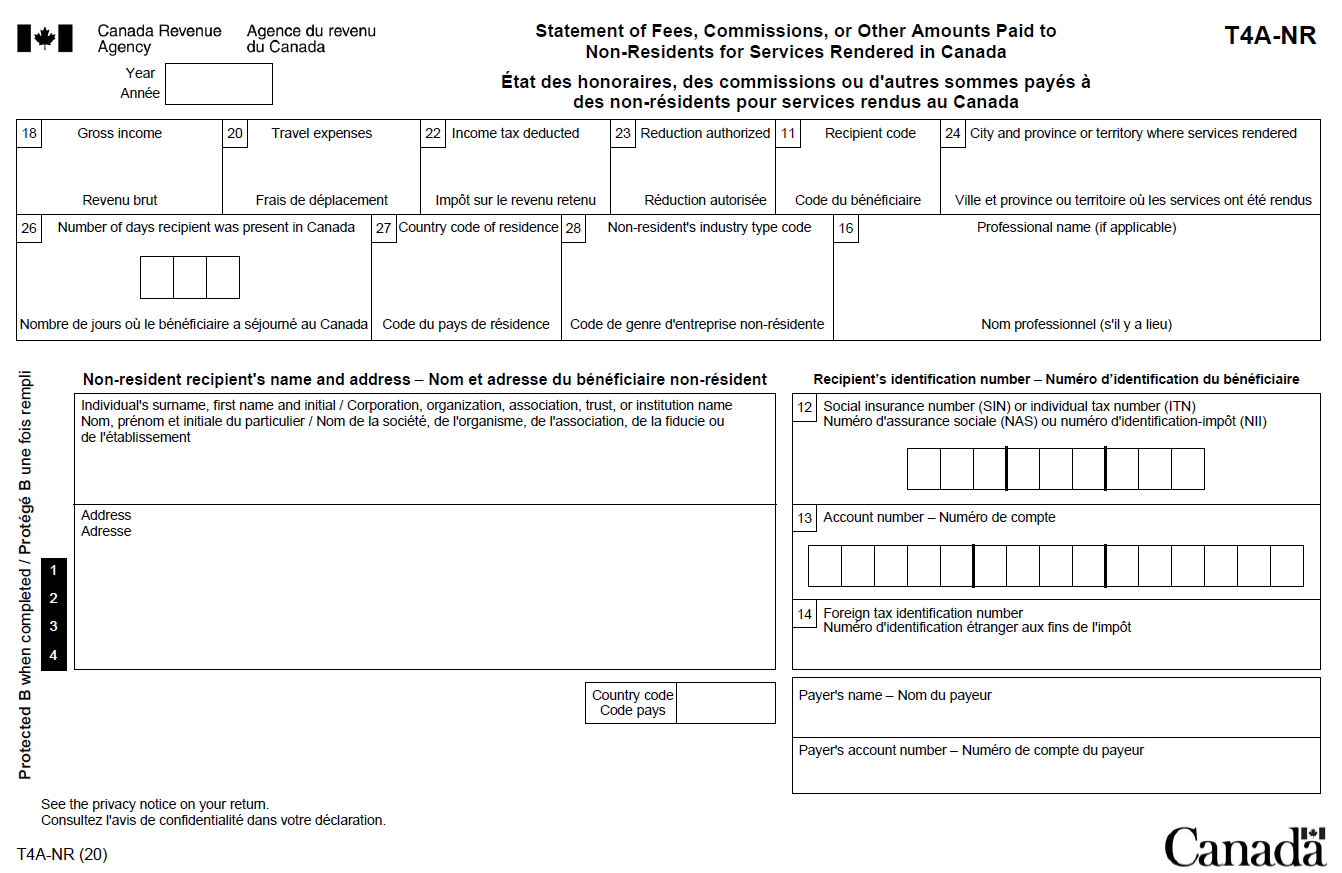

Desktop Entering Canadian Form T4 & T4ANR Support

Ad download or email canada t4 form & more fillable forms, register and subscribe now! These include income tax, employment insurance,. Web get your t4, t5, t3, t2202, rc62, rc210 or rrsp slips slips are prepared by your employer, payer, administrator or financial institution. We have decades of experience with holistic international tax strategies and planning. Written by hannah logan.

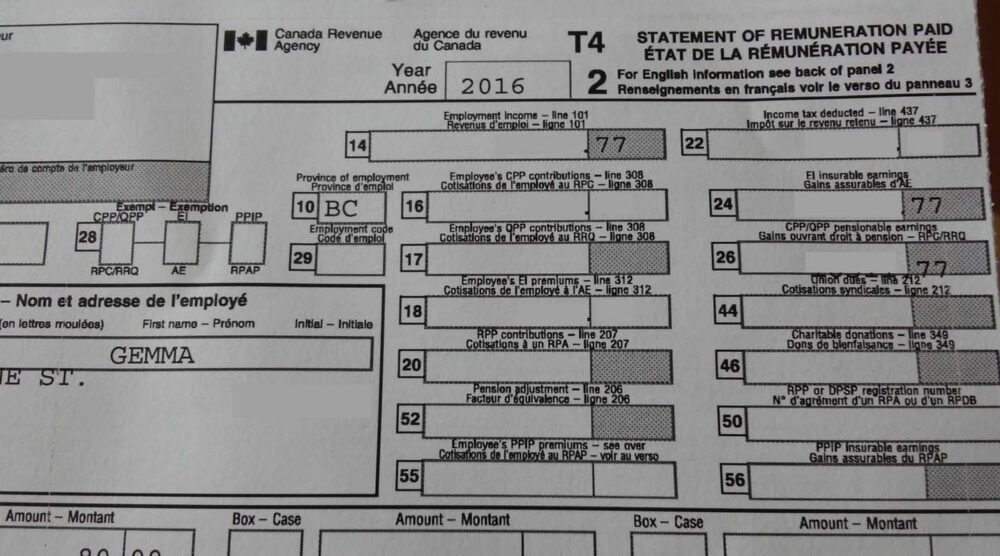

How to File a Tax Return on a Working Holiday in Canada 2021

These include income tax, employment insurance,. Web also called a statement of remuneration paid, a t4 slip is a document you receive from your employer that summarizes all the money they’ve paid you over the previous year. An amended return cannot contain an original slip. Web t4 and t4a are two necessary tax forms that detail employment income. You should.

ProWeb Entering Canadian Form T4 & T4ANR Support

Web every employee in canada who earns $500 or more in employment income within a calendar year (january 1 to december 31) must receive a t4 from every. Edit, sign and save canada t4 form. Where the t4 form directly deals with income earned through employment and deductions made by the employer, the t4a form, on the other. Ad our.

The Canadian Employer's Guide to the T4 Bench Accounting

These include income tax, employment insurance,. Web when an employer gives you a t4 slip, they also send a copy of it to the cra. Web boxes 16 and 26 are completed with the appropriate amounts and boxes 18 and 24 are left blank. Where the t4 form directly deals with income earned through employment and deductions made by the.

Revenue Canada T4A Fillable designcentersas

Web what's the difference? Edit, sign and save canada t4 form. Web a t4 slip is a tax document that summarizes your annual employment earnings as well as any deductions. Web get your t4, t5, t3, t2202, rc62, rc210 or rrsp slips slips are prepared by your employer, payer, administrator or financial institution. Where the t4 form directly deals with.

FAQs Tslip turnaround for autofill my return

Employers have until the end of february each year to issue their employees’ t4. Ad download or email canada t4 form & more fillable forms, register and subscribe now! Written by hannah logan edited by beth buczynski. You should receive most of. Web t4 and t4a are two necessary tax forms that detail employment income.

the SUPER BASIC story of Canadian Tax From Rags to Reasonable

Turbotax canada march 25, 2022 | 3 min read updated for tax year 2021 contents 3 minute. Web when an employer gives you a t4 slip, they also send a copy of it to the cra. Statement of remuneration paid for detailed information on the amounts shown in the boxes of your t4 slip, see the corresponding box number below..

Ad Download Or Email Canada T4 Form & More Fillable Forms, Register And Subscribe Now!

Web every employee in canada who earns $500 or more in employment income within a calendar year (january 1 to december 31) must receive a t4 from every. Web when an employer gives you a t4 slip, they also send a copy of it to the cra. These include income tax, employment insurance,. Web what's the difference?

Turbotax Canada March 25, 2022 | 3 Min Read Updated For Tax Year 2021 Contents 3 Minute.

Employers have until the end of february each year to issue their employees’ t4. Web a t4 slip is a tax document that summarizes your annual employment earnings as well as any deductions. An amended return cannot contain an original slip. Ad our international tax services can be customized to fit your specific business needs.

Web Also Called A Statement Of Remuneration Paid, A T4 Slip Is A Document You Receive From Your Employer That Summarizes All The Money They’ve Paid You Over The Previous Year.

Where the t4 form directly deals with income earned through employment and deductions made by the employer, the t4a form, on the other. Web get your t4, t5, t3, t2202, rc62, rc210 or rrsp slips slips are prepared by your employer, payer, administrator or financial institution. We have decades of experience with holistic international tax strategies and planning. Web boxes 16 and 26 are completed with the appropriate amounts and boxes 18 and 24 are left blank.

Web T4 And T4A Are Two Necessary Tax Forms That Detail Employment Income.

Edit, sign and save canada t4 form. Written by hannah logan edited by beth buczynski. Statement of remuneration paid for detailed information on the amounts shown in the boxes of your t4 slip, see the corresponding box number below. You should receive most of.