Tax Form 8960

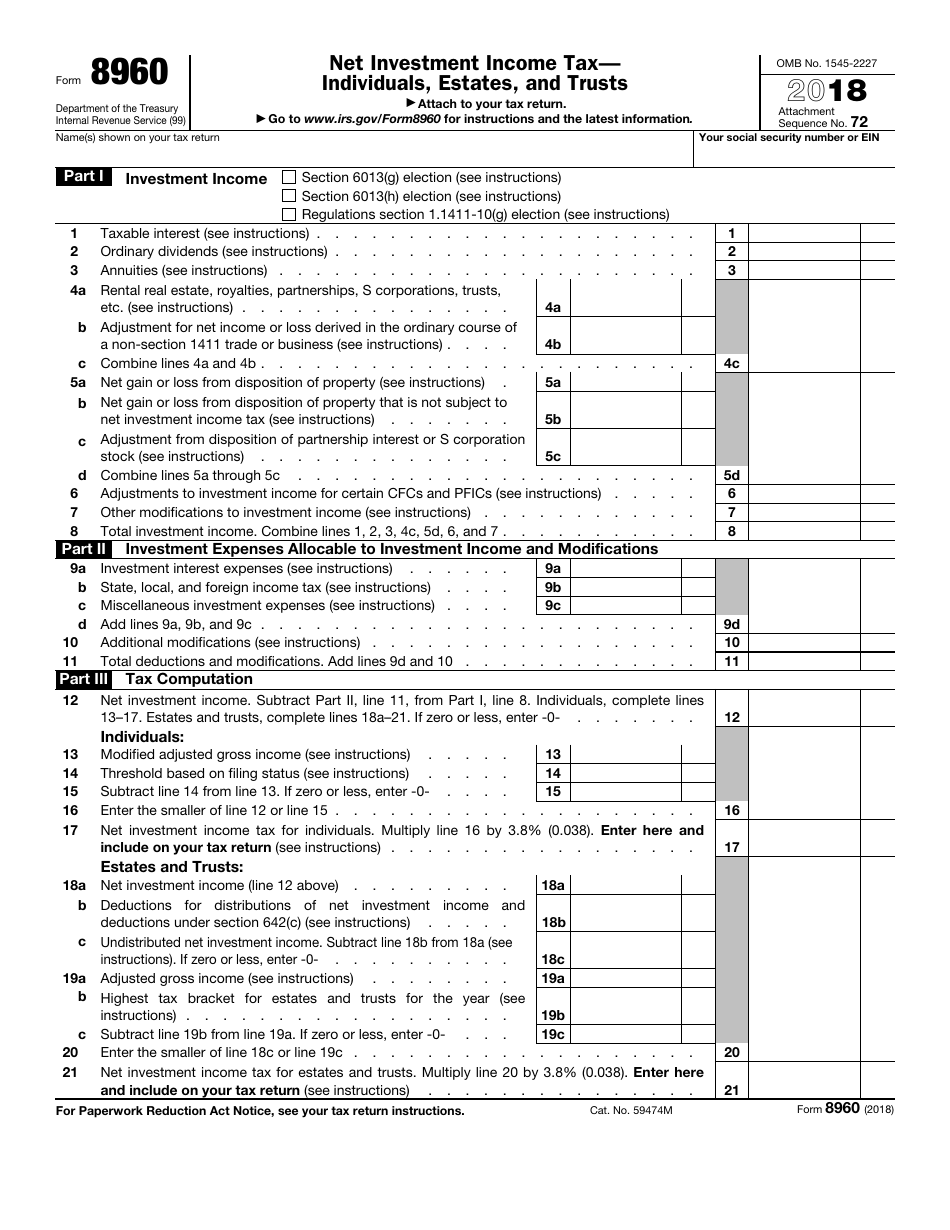

Tax Form 8960 - Go to www.irs.gov/form8960 for instructions and the latest information omb no. Attach form 8960 to your return if your modified adjusted gross. All forms are printable and downloadable. Download past year versions of this tax form as pdfs here: The net investment income tax is imposed by section 1411 of the internal revenue code. Generally, a cfc is any foreign corporation if more than 50% of its voting power or stock value is owned or. On average this form takes 9 minutes to complete. Ago to www.irs.gov/form8960 for instructions and the latest information. Web department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts attach to your tax return. It applies to individuals, families, estates, and trusts, but certain income thresholds must be met before the tax takes effect.

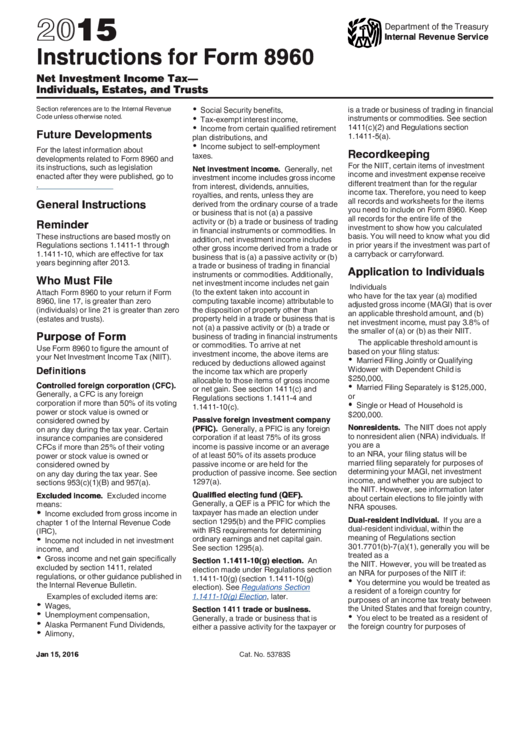

Employee's withholding certificate form 941; Web use form 8960 to figure the amount of your net investment income tax (niit). It first appeared in tax year 2013. The net investment income tax is imposed by section 1411 of the internal revenue code. Generally, a cfc is any foreign corporation if more than 50% of its voting power or stock value is owned or considered owned by us. Web purpose of form use form 8960 to figure the amount of your net investment income tax (niit). Definitions controlled foreign corporation (cfc). Web irs form 8960 is used to report your net investment income tax. A relatively new tax created as part of the obamacare legislation, the net investment income tax is a 3.8% tax on. On average this form takes 9 minutes to complete.

Generally, a cfc is any foreign corporation if more than 50% of its voting power or stock value is owned or. Employee's withholding certificate form 941; Get answers to your tax questions. Web use form 8960 net investment income tax—individuals, estates, and trusts to figure the amount of your net investment income tax (niit). Web use fill to complete blank online irs pdf forms for free. Definitions controlled foreign corporation (cfc). Web irs form 8960 is used to report your net investment income tax. Employers engaged in a trade or business who pay compensation form 9465; Ago to www.irs.gov/form8960 for instructions and the latest information. The niit applies at a rate of 3.8% to certain net investment income of individuals, estates and trusts that have income.

IRS Form Investment Tax

Employers engaged in a trade or business who pay compensation form 9465; All forms are printable and downloadable. The net investment income tax is imposed by section 1411 of the internal revenue code. Web irs form 8960 is used to report your net investment income tax. What is the net investment income tax (niit)?

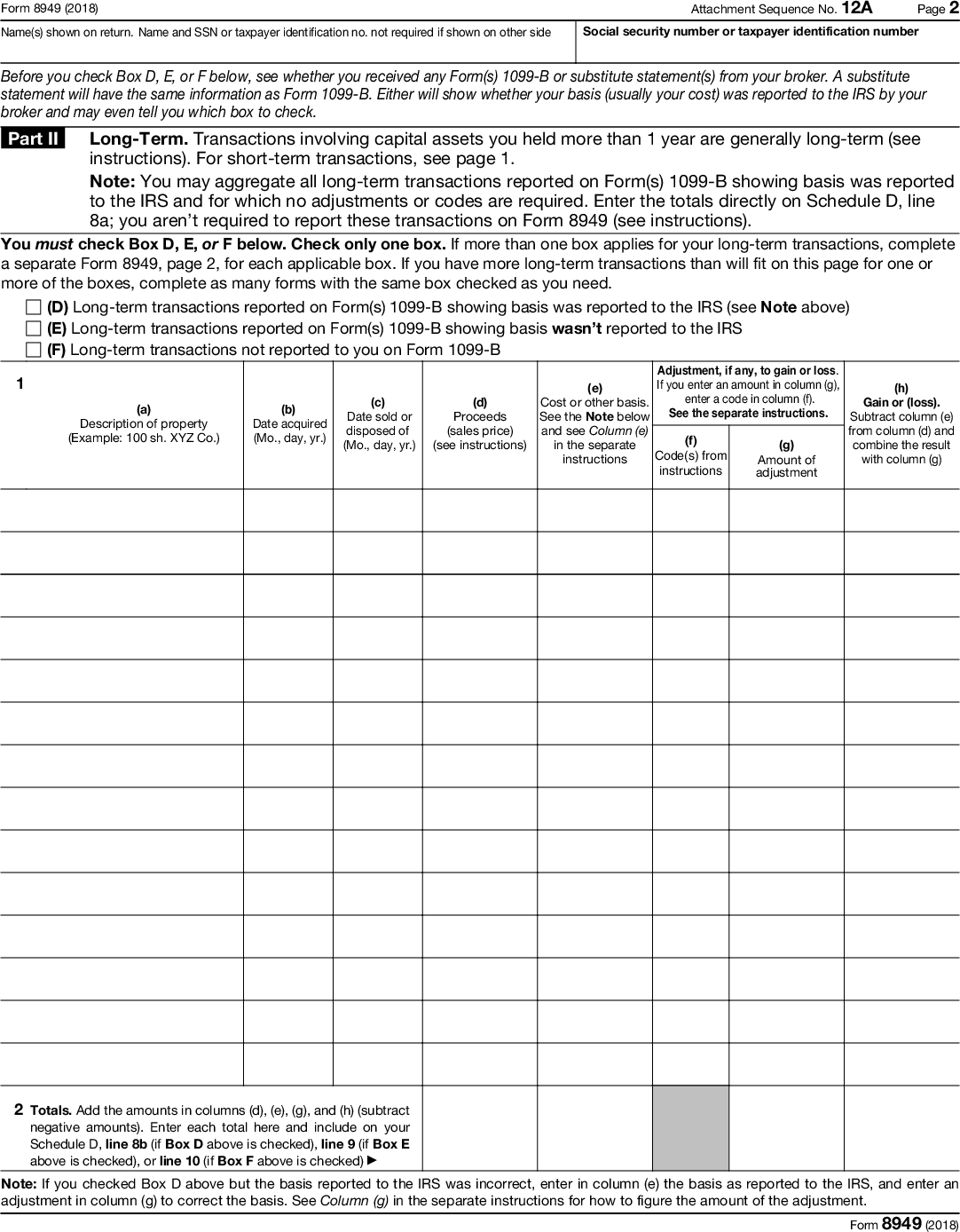

Online generation of Schedule D and Form 8949 for 10.00

Web irs form 8960 is used to report your net investment income tax. Go to www.irs.gov/form8960 for instructions and the latest information omb no. The niit applies at a rate of 3.8% to certain net investment income of individuals, estates and trusts that have income. Web department of the treasury internal revenue service (99) net investment income tax— individuals, estates,.

Instructions For Form 8960 (2015) printable pdf download

Individual tax return form 1040 instructions; Definitions controlled foreign corporation (cfc). Web irs form 8960 contains one page, with three parts. Employers engaged in a trade or business who pay compensation form 9465; Web file your taxes for free.

What Is Form 8960? H&R Block

Web file your taxes for free. Check your federal tax withholding. Apply for an employer id number (ein) Generally, a cfc is any foreign corporation if more than 50% of its voting power or stock value is owned or considered owned by us. Aattach to your tax return.

IRS Form 8960 Download Fillable PDF or Fill Online Net Investment

Definitions controlled foreign corporation (cfc). Request for transcript of tax. Web use fill to complete blank online irs pdf forms for free. What is the net investment income tax (niit)? Web department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts attach to your tax return.

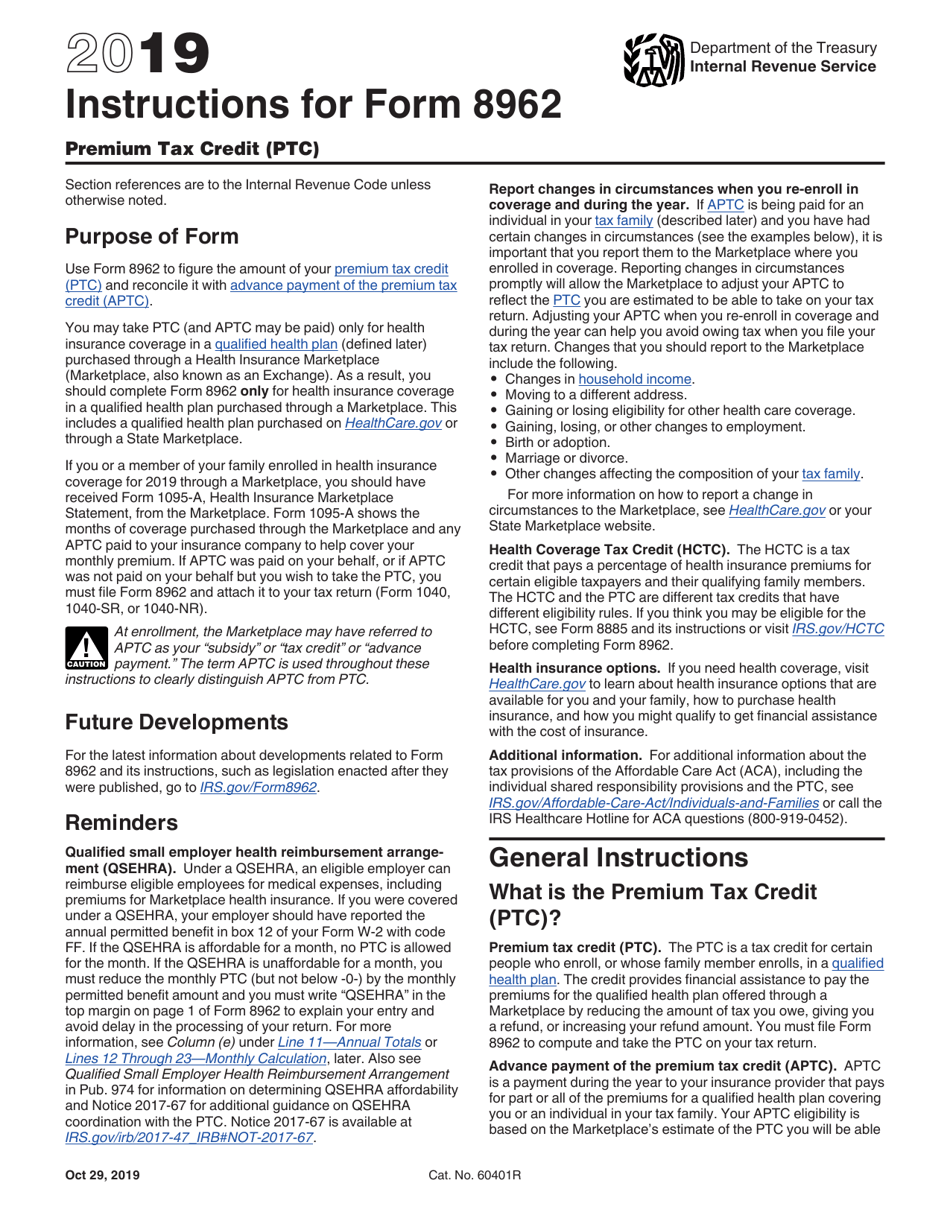

Download Instructions for IRS Form 8962 Premium Tax Credit (Ptc) PDF

( university of missouri libraries ) services. Web irs form 8960 contains one page, with three parts. Sign in to your account. What is the net investment income tax (niit)? Web file your taxes for free.

Is an Anomaly in Form 8960 Resulting in an Unintended Tax on TaxExempt

A relatively new tax created as part of the obamacare legislation, the net investment income tax is a 3.8% tax on. Aattach to your tax return. ( university of missouri libraries ) services. On average this form takes 9 minutes to complete. If you have income from investments and your modified adjusted gross.

Is an Anomaly in Form 8960 Resulting in an Unintended Tax on TaxExempt

Investment income in part i, we’ll go through lines 1 through 8 to determine total investment income. Aattach to your tax return. Get answers to your tax questions. All forms are printable and downloadable. Generally, a cfc is any foreign corporation if more than 50% of its voting power or stock value is owned or considered owned by us.

Instructions for IRS Form 8960 Net Investment Tax

Web irs form 8960 is used to report your net investment income tax. What is the net investment income tax (niit)? Go to www.irs.gov/form8960 for instructions and the latest information omb no. Apply for an employer id number (ein) Once completed you can sign your fillable form or send for signing.

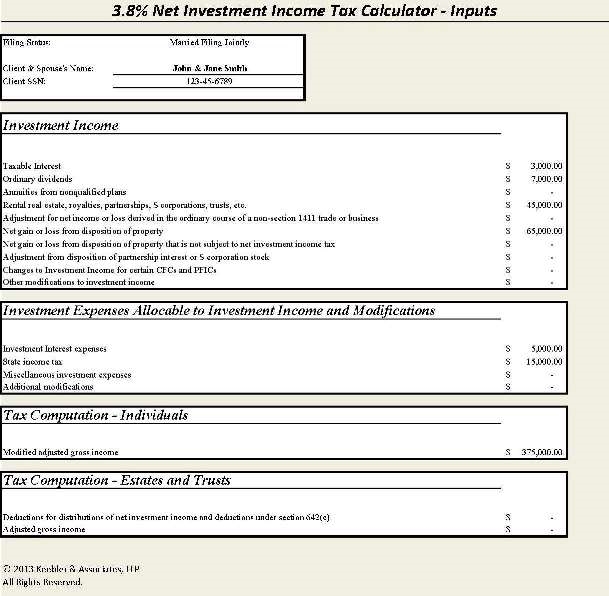

Net Investment Tax ("NIIT") Calculator Ultimate Estate Planner

Per irs instructions for form 8960, on page 1: Sign in to your account. Investment income in part i, we’ll go through lines 1 through 8 to determine total investment income. Employers engaged in a trade or business who pay compensation form 9465; If you have income from investments and your modified adjusted gross.

Download Past Year Versions Of This Tax Form As Pdfs Here:

Sign in to your account. Web popular forms & instructions; Web irs form 8960 contains one page, with three parts. It first appeared in tax year 2013.

Web Use Fill To Complete Blank Online Irs Pdf Forms For Free.

Part i helps the taxpayer arrive at total investment income elections at the top of the. Generally, a cfc is any foreign corporation if more than 50% of its voting power or stock value is owned or. Attach form 8960 to your return if your modified adjusted gross. Employers engaged in a trade or business who pay compensation form 9465;

Department Of The Treasury Internal Revenue Service (99) Net Investment Income Tax— Individuals, Estates, And Trusts.

Web department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts attach to your tax return. The niit applies at a rate of 3.8% to certain net investment income of individuals, estates and trusts that have income. Per irs instructions for form 8960, on page 1: Go to www.irs.gov/form8960 for instructions and the latest information omb no.

Employee's Withholding Certificate Form 941;

The net investment income tax is imposed by section 1411 of the internal revenue code. Request for transcript of tax. Web irs form 8960 is used to report your net investment income tax. Web use form 8960 net investment income tax—individuals, estates, and trusts to figure the amount of your net investment income tax (niit).