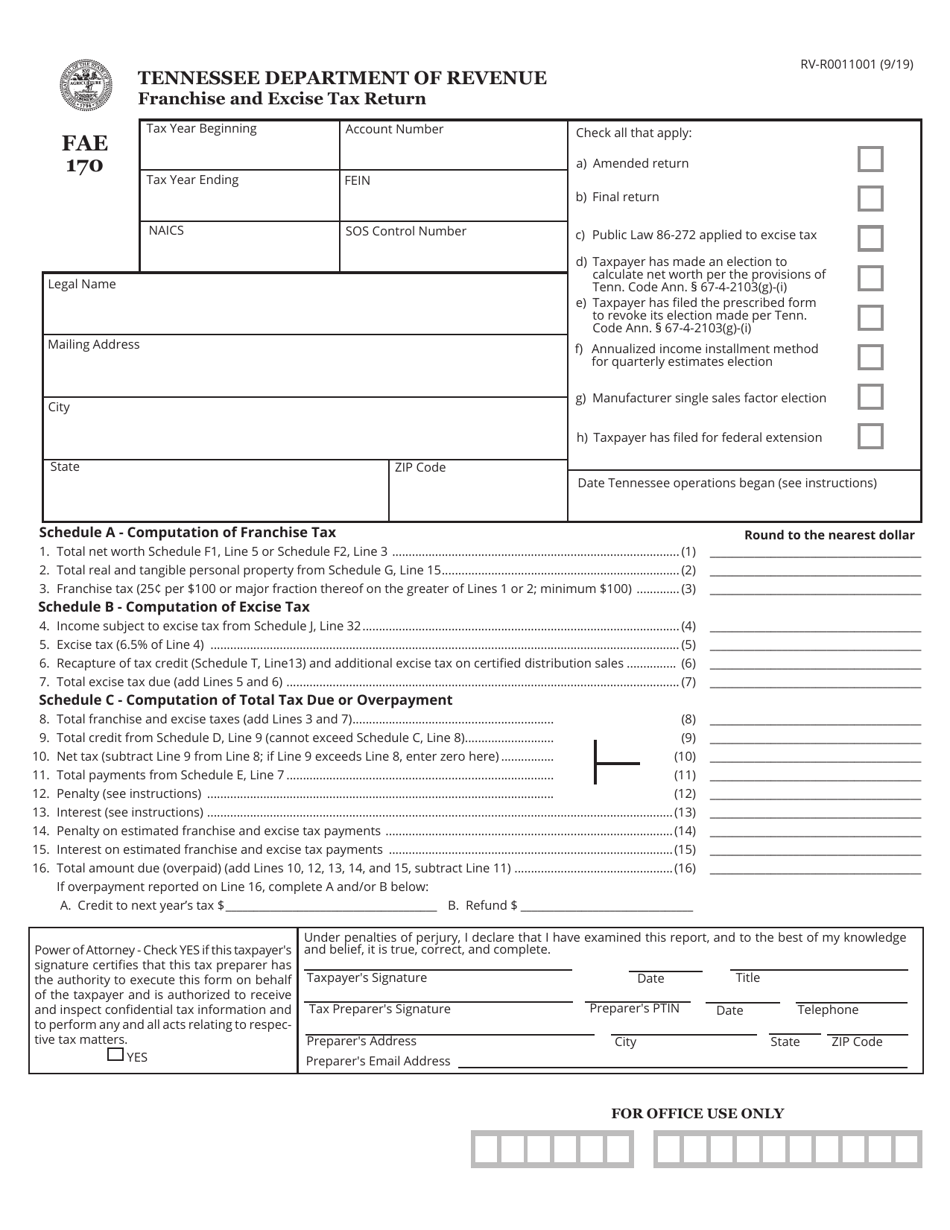

Tennessee Form 170

Tennessee Form 170 - This form includes 8 pages of schedules for the annual franchise and excise tax reports. For tax years beginning on or after 1/1/21, and ending on or before 12/31/21. Web date tennessee operations began should be completed if this is the initial return. You can print other tennessee tax forms here. Tennessee franchise & excise tax form fae 170 franchise and excise tax return. Web thinking of filing tennessee form fae 170? Web form fae 170, consolidated net worth election registration application tennessee franchise, excise fae 170 tax return if the partnership is inactive in tennessee, enter an x on the tennessee > general > basic data > taxpayer is inactive in tn field. On filler, you can find forms for the 2008, 2010 and 2014 taxable years. Web up to $40 cash back this form in particular is designed for entrepreneurs in the state of tennessee. Get ready for tax season deadlines by completing any required tax forms today.

The link below will provide everything you need for filing the form. Taxable year fein or ssn beginning: Multiply amounts on lines 11(a) through 14(a) by the multiples on lines 11(b) through 14(b), and enter each total on lines 11(c) through 14(c). To indicate that the return is amended, from the main menu of the tennessee return select heading information > amended return. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web annual rental paid for property located in tennessee. Ad register and subscribe now to work on your tn dor form fae 170 & more fillable forms. File the annual exemption renewal (form fae183). Tennessee form fae 170, page 1, is then prepared and a minimum franchise tax of.

Web for individual (1040) returns, form 170 would be potentially filed by smllcs that file schedule c profit or loss from business (sole proprietorship) with their federal 1040 return. Fae in the form index stands for franchise and excise. The link below will provide everything you need for filing the form. Web form fae170 returns, schedules and instructions for prior years. For tax years beginning on or after 1/1/21, and ending on or before 12/31/21. Web up to $40 cash back this form in particular is designed for entrepreneurs in the state of tennessee. Get ready for tax season deadlines by completing any required tax forms today. Web annual rental paid for property located in tennessee. Tennessee franchise & excise tax form fae 170 franchise and excise tax return. Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date tennessee operations began, whichever occurred first.

Form FAE170 (RVR0011001) Download Printable PDF or Fill Online

Ad register and subscribe now to work on your tn dor form fae 170 & more fillable forms. Taxable year fein or ssn beginning: Get ready for tax season deadlines by completing any required tax forms today. Web fae 170if this is an amended return, please} check the box at right. For tax years beginning on or after 1/1/20, and.

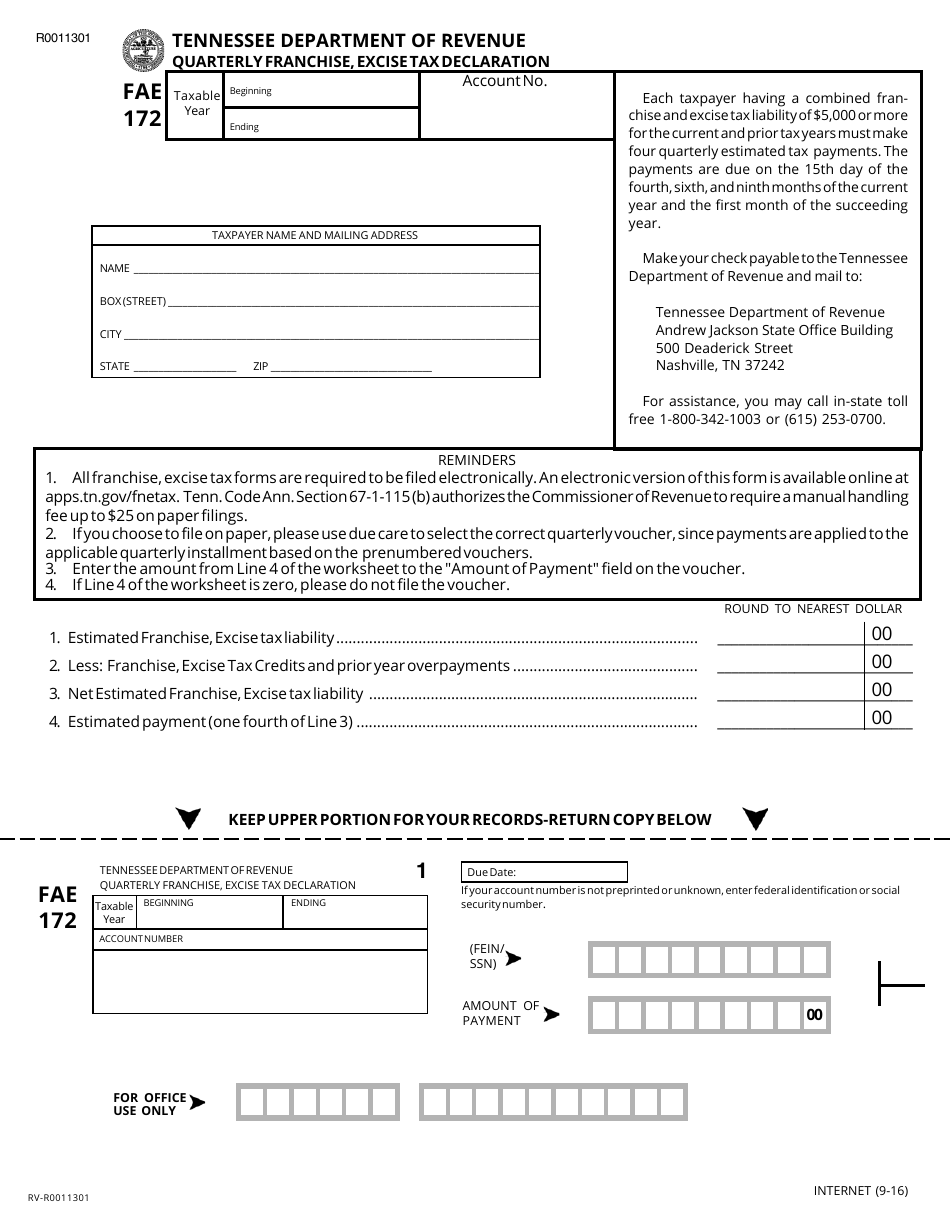

Form FAE172 Download Printable PDF or Fill Online Quarterly Franchise

Taxpayers incorporated or otherwise formed Tennessee franchise & excise tax form fae 170 franchise and excise tax return. This form is for income earned in tax year 2022, with tax returns due in april 2023. You can print other tennessee tax forms here. Multiply amounts on lines 11(a) through 14(a) by the multiples on lines 11(b) through 14(b), and enter.

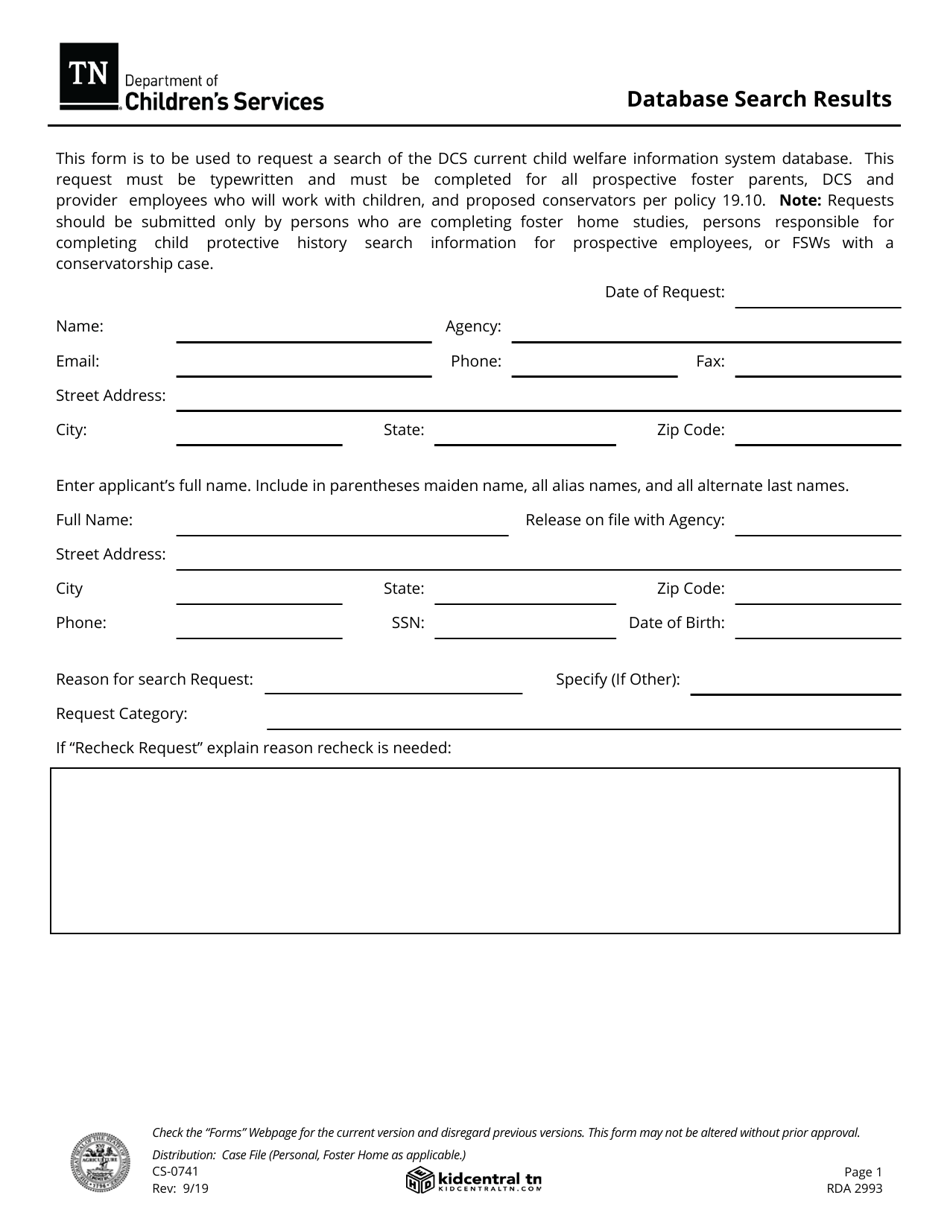

Form CS0741 Download Fillable PDF or Fill Online Database Search

It's not supported for electronic filing when prepared in conjunction with federal forms 1040 and 1041. Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date tennessee operations began, whichever occurred first. Tennessee form fae 170, page 1, is then prepared and a minimum franchise tax of..

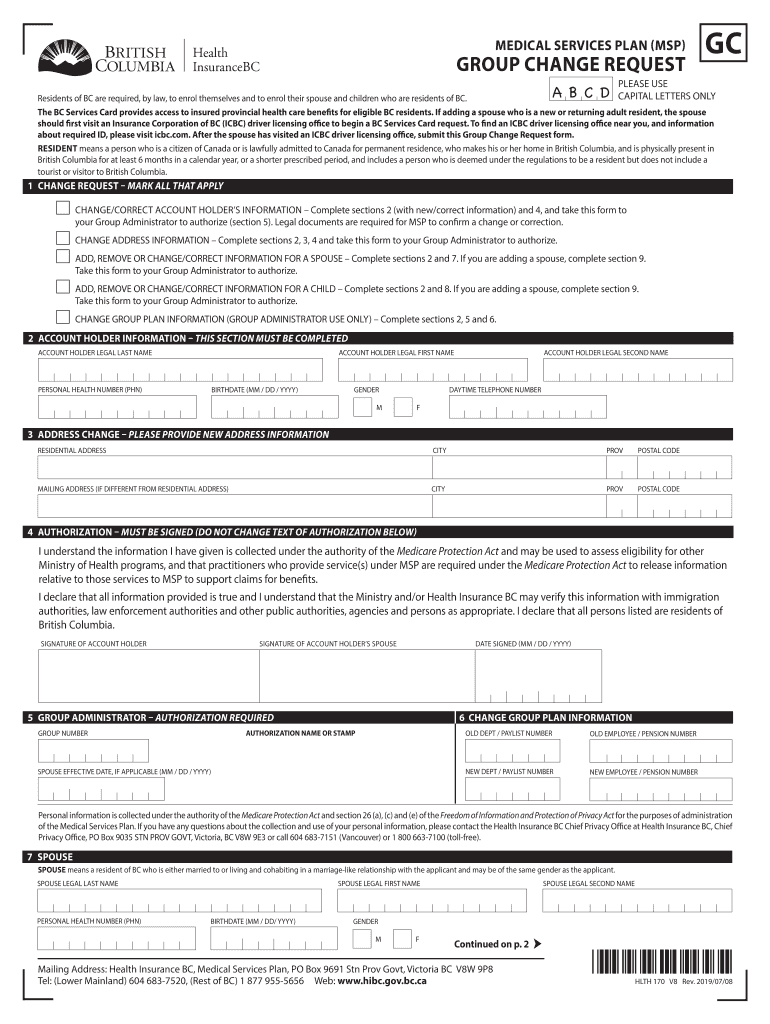

20192021 Form Canada HLTH 170 Fill Online, Printable, Fillable, Blank

Web file a franchise and excise tax return (form fae170). Web form fae 170, consolidated net worth election registration application tennessee franchise, excise fae 170 tax return if the partnership is inactive in tennessee, enter an x on the tennessee > general > basic data > taxpayer is inactive in tn field. For tax years beginning on or after 1/1/20,.

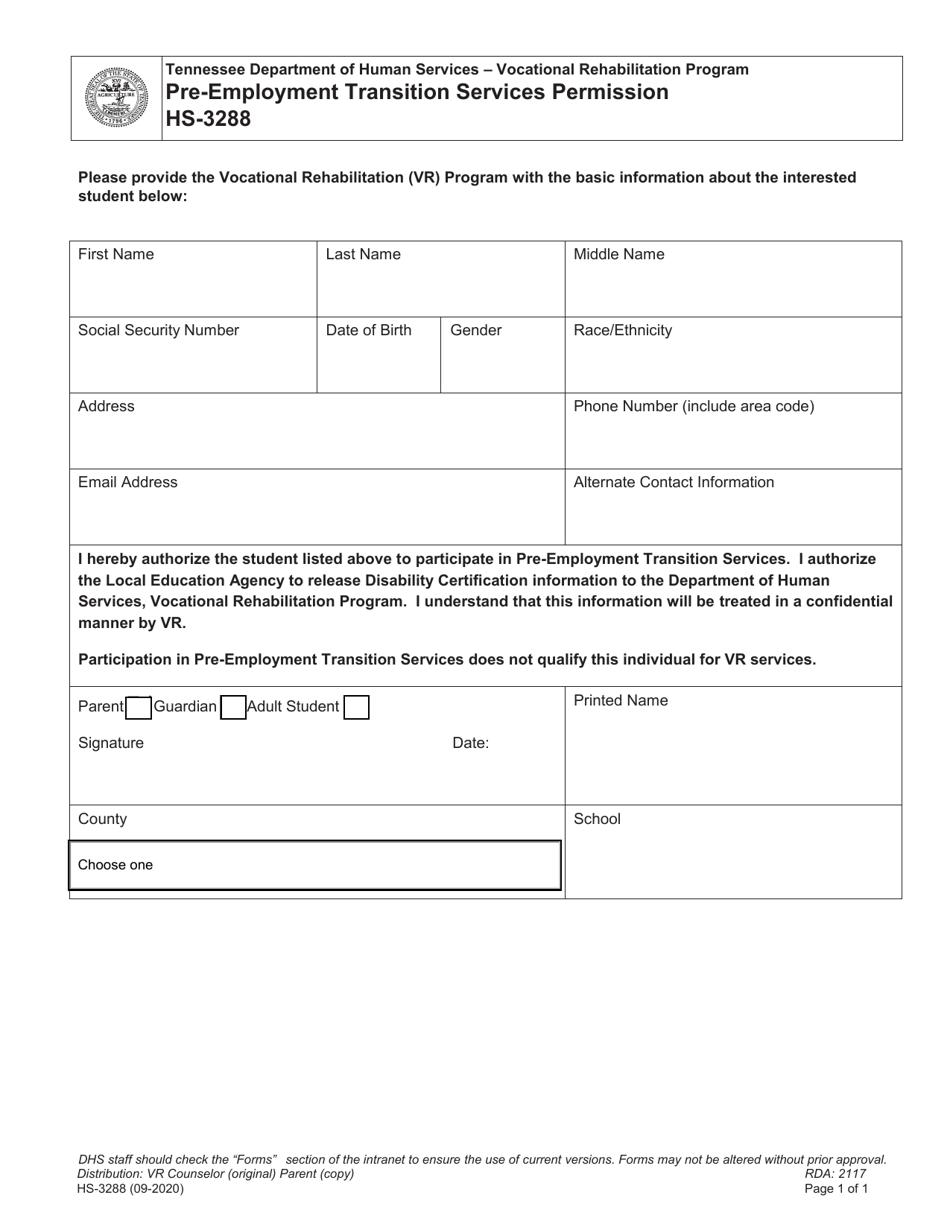

Form HS3288 Download Fillable PDF or Fill Online Preemployment

What is form fae 170 for? Get ready for tax season deadlines by completing any required tax forms today. Taxpayers incorporated or otherwise formed Web date tennessee operations began should be completed if this is the initial return. For tax years beginning on or after 1/1/20, and ending on or before 12/31/20.

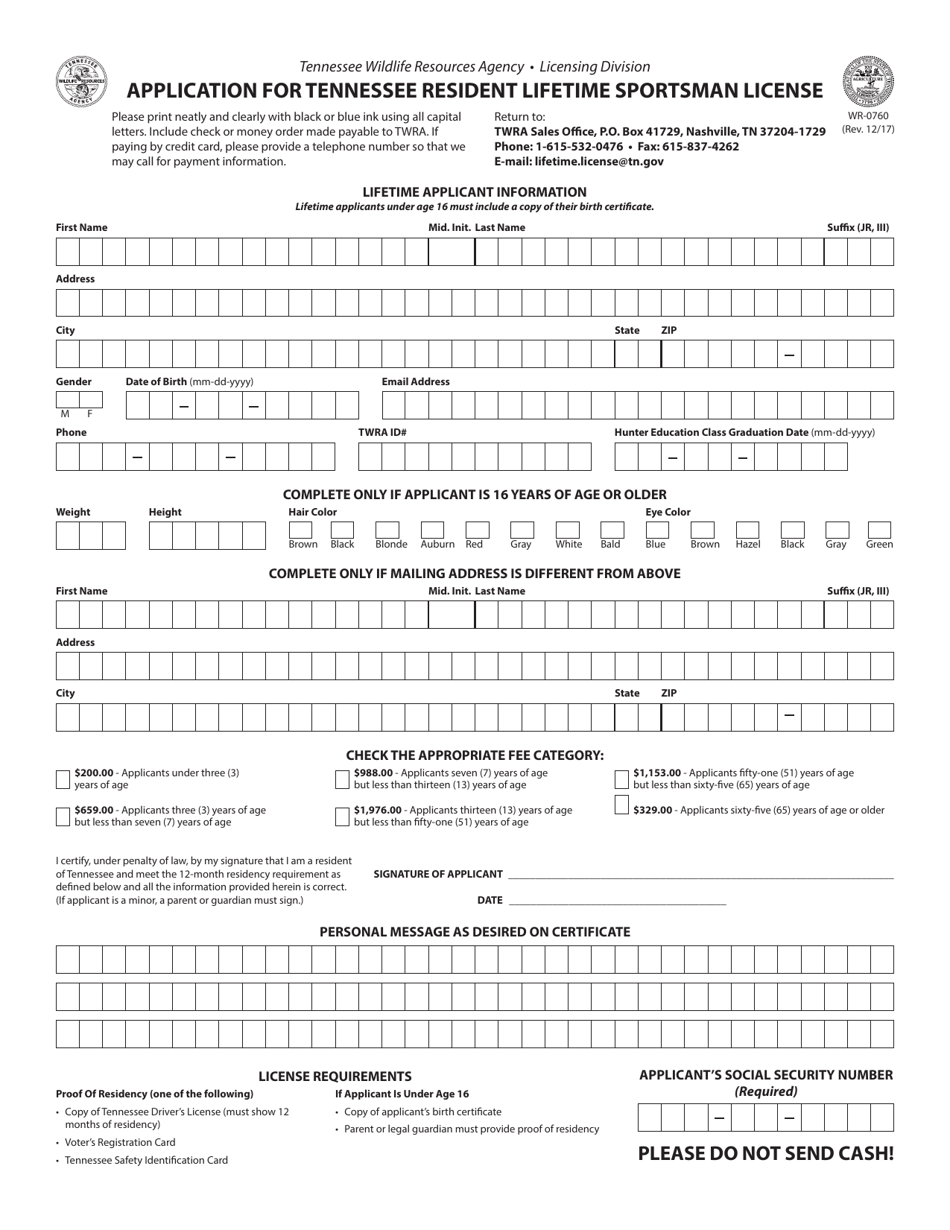

Form WR0760 Download Printable PDF or Fill Online Application for

To indicate that the return is amended, from the main menu of the tennessee return select heading information > amended return. Use the tips on how to fill out the tn dor fae 170: For tax years beginning on or after 1/1/19, and ending on or before 12/31/19. Fae in the form index stands for franchise and excise. Web fae.

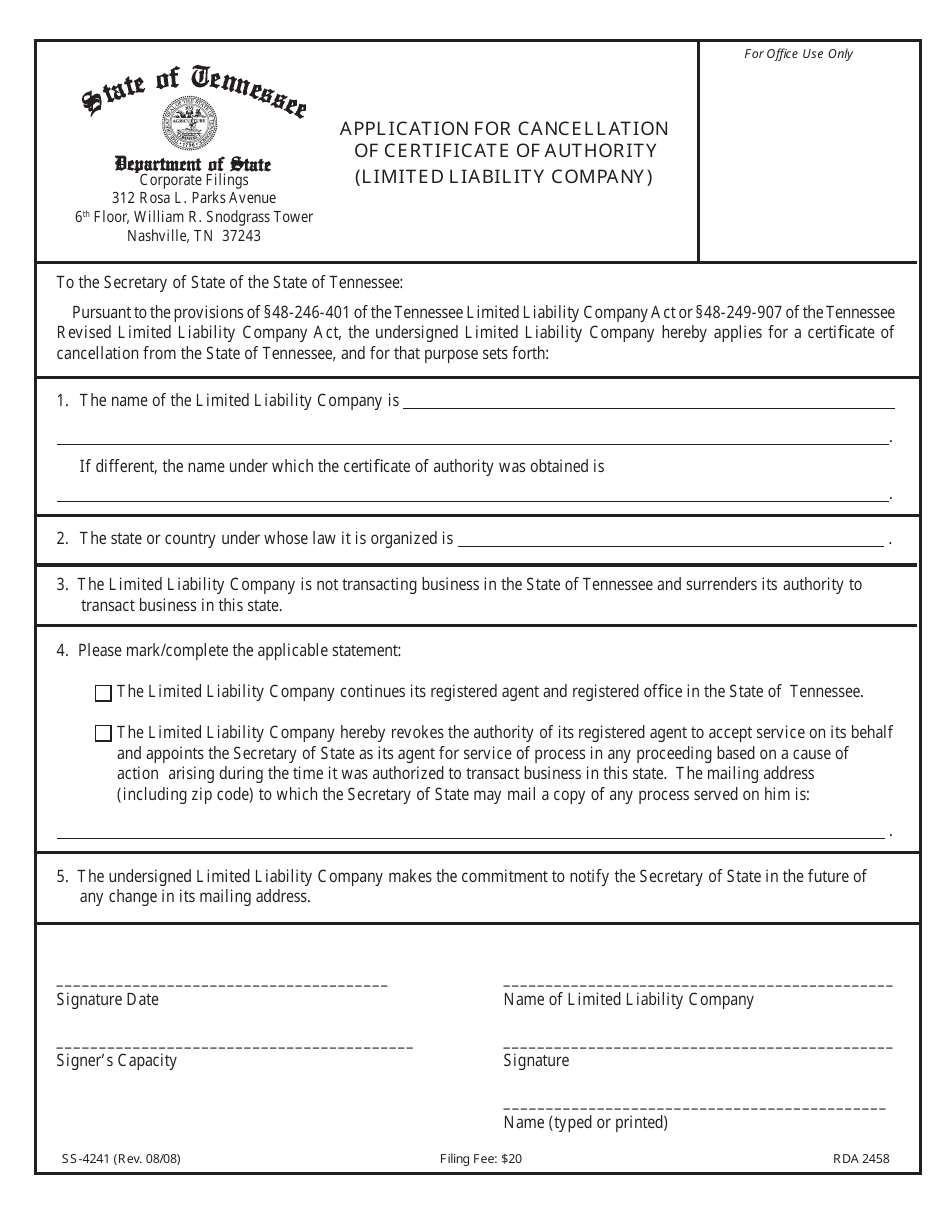

Form SS4241 Download Printable PDF or Fill Online Application for

Use the tips on how to fill out the tn dor fae 170: Multiply amounts on lines 11(a) through 14(a) by the multiples on lines 11(b) through 14(b), and enter each total on lines 11(c) through 14(c). File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax. This form includes 8 pages.

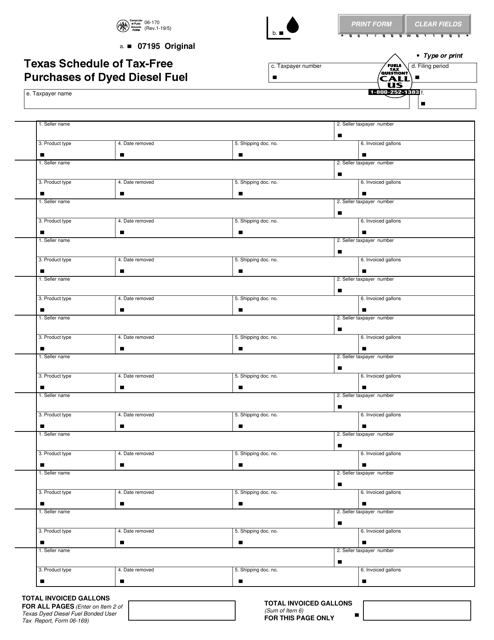

Form 06170 Download Fillable PDF or Fill Online Texas Schedule of Tax

Web thinking of filing tennessee form fae 170? To indicate that the return is amended, from the main menu of the tennessee return select heading information > amended return. Fae in the form index stands for franchise and excise. Web how do i generate tennessee form fae 170 sch m in individual tax using worksheet view? What is form fae.

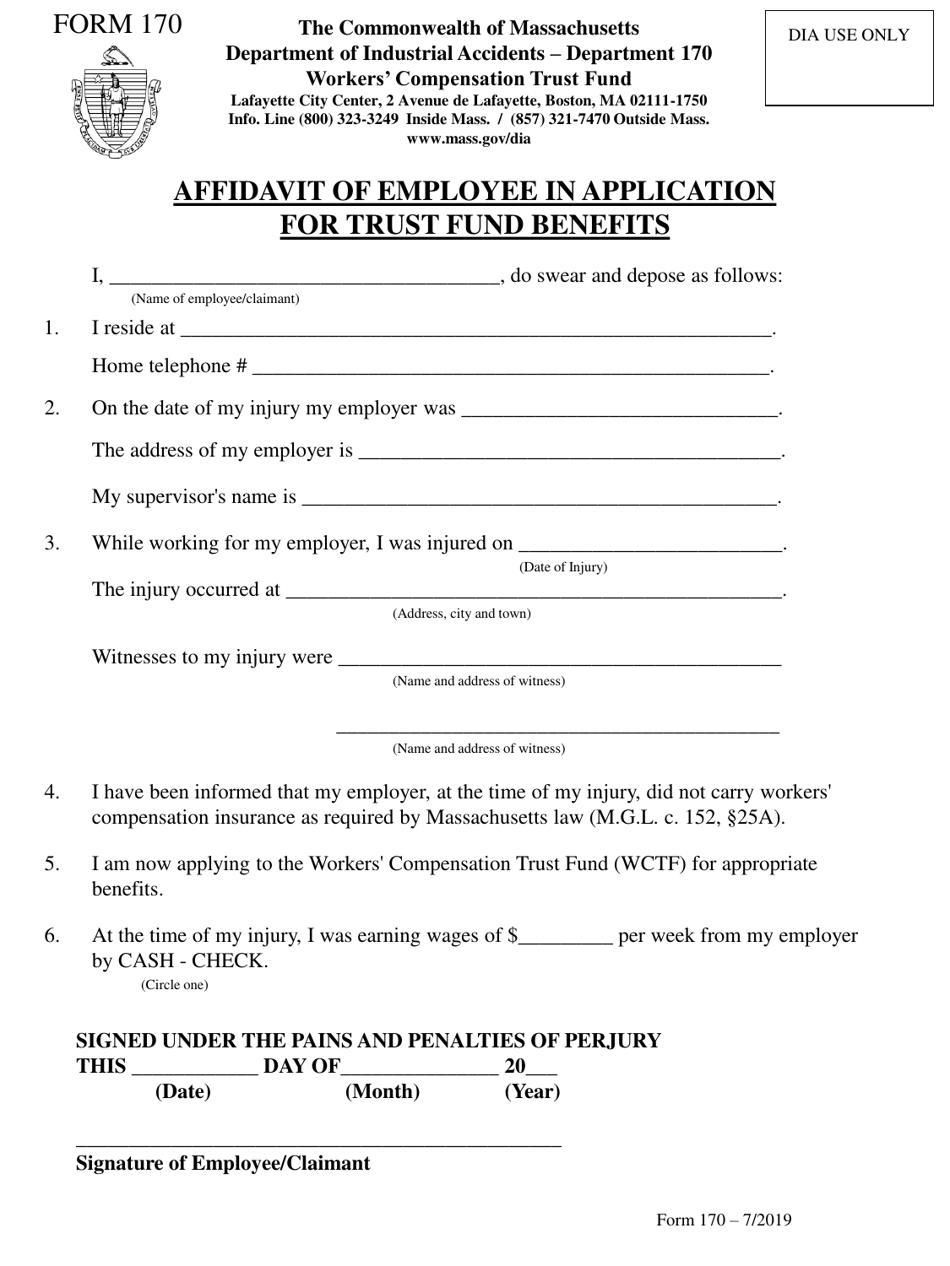

Form 170 Download Fillable PDF or Fill Online Affidavit of Employee in

This form is for income earned in tax year 2022, with tax returns due in april 2023. The link below will provide everything you need for filing the form. Get ready for tax season deadlines by completing any required tax forms today. Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the.

TN DoR FAE 170 2017 Fill out Tax Template Online US Legal Forms

Tax blank completion can become a serious challenge and serious headache if no correct assistance provided. Web annual rental paid for property located in tennessee. Get ready for tax season deadlines by completing any required tax forms today. Taxpayers incorporated or otherwise formed Web fae 170if this is an amended return, please} check the box at right.

Taxpayers Incorporated Or Otherwise Formed In Tennessee Must Prorate The Franchise Tax On The Initial Return From The Date Formed Or The Date Tennessee Operations Began, Whichever Occurred First.

Web form fae170 returns, schedules and instructions for prior years. Complete, edit or print tax forms instantly. Web fae 170if this is an amended return, please} check the box at right. Get ready for tax season deadlines by completing any required tax forms today.

What Is Form Fae 170 For?

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web how do i generate tennessee form fae 170 sch m in individual tax using worksheet view? Web file a franchise and excise tax return (form fae170). Web form fae 170, consolidated net worth election registration application tennessee franchise, excise fae 170 tax return if the partnership is inactive in tennessee, enter an x on the tennessee > general > basic data > taxpayer is inactive in tn field.

For Determination Of Rental Value Of Property Used But Not Owned, Please Note That For Returns Covering A

Web up to $40 cash back this form in particular is designed for entrepreneurs in the state of tennessee. Web the franchise & excise tax return (fae 170) can be filed as an amended return. Web use our detailed instructions to fill out and esign your documents online. You can print other tennessee tax forms here.

On Filler, You Can Find Forms For The 2008, 2010 And 2014 Taxable Years.

For tax years beginning on or after 1/1/20, and ending on or before 12/31/20. For tax years beginning on or after 1/1/21, and ending on or before 12/31/21. Tennessee franchise & excise tax form fae 170 franchise and excise tax return. Web annual rental paid for property located in tennessee.