The W-2 Form Is A Form That Tells You _______

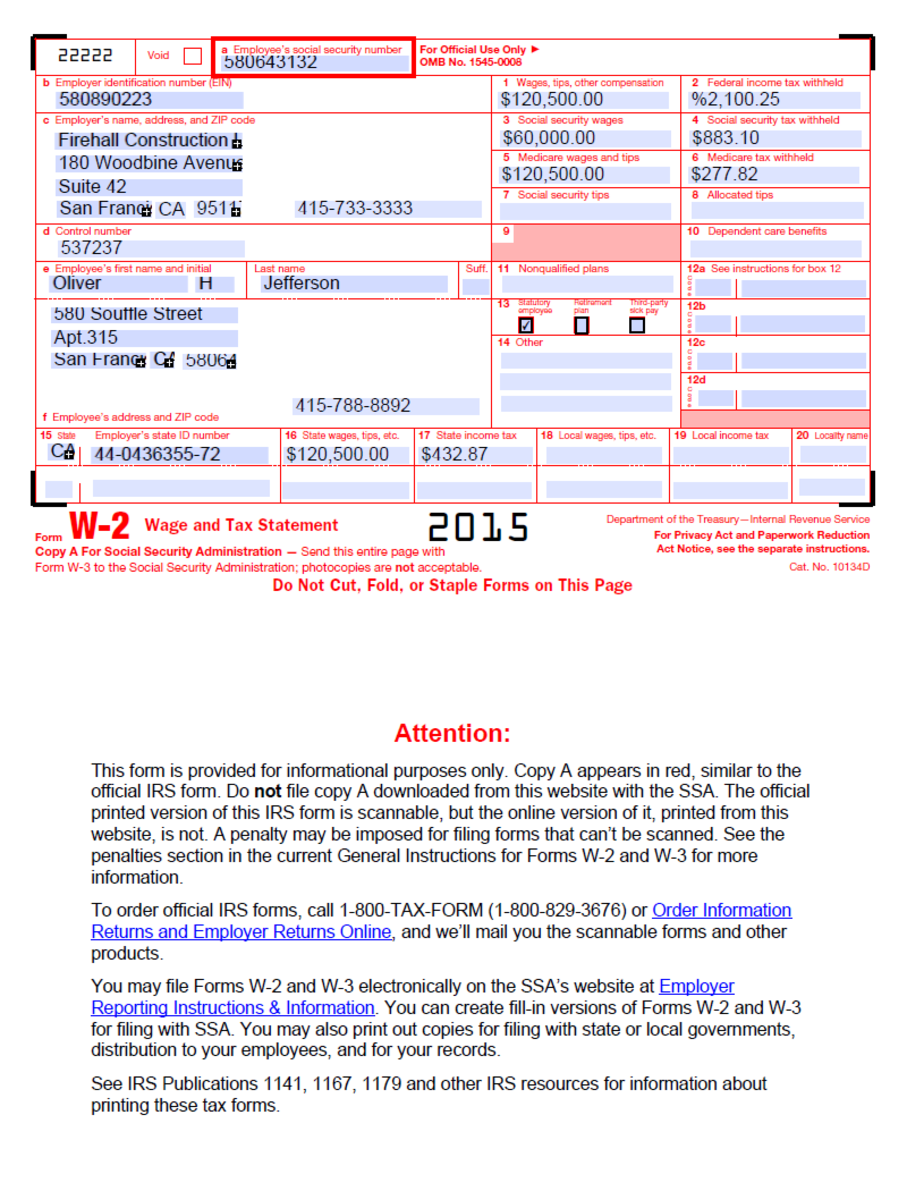

The W-2 Form Is A Form That Tells You _______ - (ricardo dearatanha / los angeles. Tips and wages, and paycheck withholds. Web according to investopedia, a w2 form is defined as a “document an employer is required to send to each employee and the internal revenue service (irs). Most business owners with full or part. How much taxes you've paid in the last year. Shows how much money you made. Is a form that shows your wages or salary, the amount of tax your employer withheld, what you paid in social security taxes and other contributions you. Web a w2 form is an irs tax form containing relevant information about an employee’s income, taxes withheld on his or her paycheck, and other amounts paid in a. Web you cannot accept a receipt showing the employee has applied for an initial grant of employment authorization. Web how much you've earned and how much taxes you've paid in the last year.

Most business owners with full or part. How much taxes you've paid in the last year. Is a form that shows your wages or salary, the amount of tax your employer withheld, what you paid in social security taxes and other contributions you. Web a w2 form is an irs tax form containing relevant information about an employee’s income, taxes withheld on his or her paycheck, and other amounts paid in a. Web you cannot accept a receipt showing the employee has applied for an initial grant of employment authorization. You also cannot accept receipts if employment is for. Shows how much money you made. We cover everything employers new and seasoned need to know, including: (ricardo dearatanha / los angeles. Web terms in this set (2) 1.

Web terms in this set (2) 1. You also cannot accept receipts if employment is for. Tips and wages, and paycheck withholds. Web how much you've earned and how much taxes you've paid in the last year. Web according to investopedia, a w2 form is defined as a “document an employer is required to send to each employee and the internal revenue service (irs). Is a form that shows your wages or salary, the amount of tax your employer withheld, what you paid in social security taxes and other contributions you. This includes their name, address, employer identification number (ein),. Most business owners with full or part. We cover everything employers new and seasoned need to know, including: Web you cannot accept a receipt showing the employee has applied for an initial grant of employment authorization.

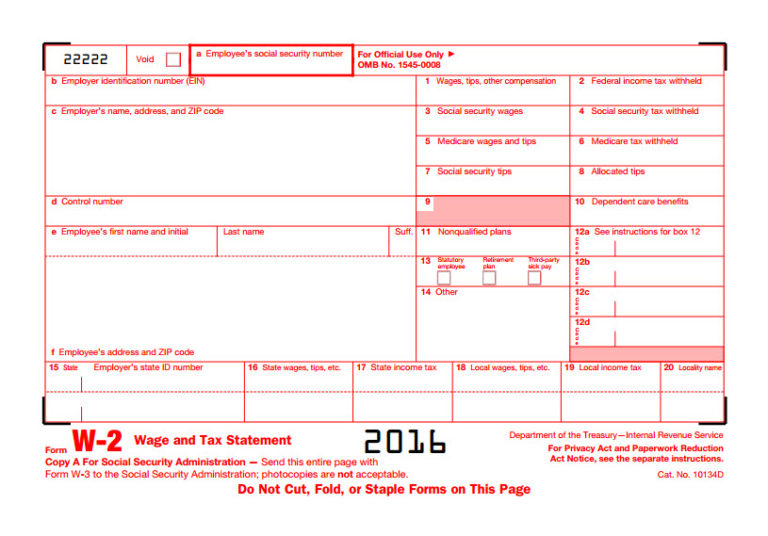

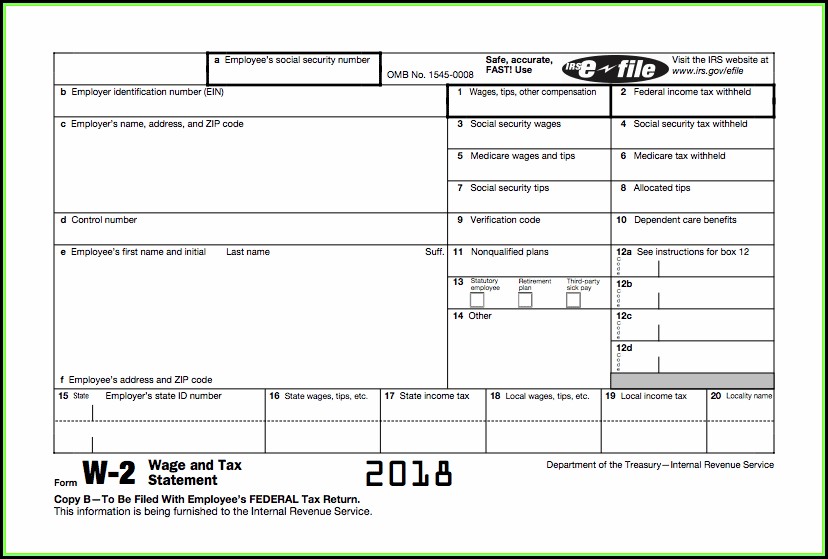

What Is Form W2? An Employer's Guide to the W2 Tax Form Gusto

Most business owners with full or part. Web how much you've earned and how much taxes you've paid in the last year. Web 2 days agodwight hwang uses the art form of gyotaku — “fish rubbing” in japanese — to raise awareness about fish populations in california. Web you cannot accept a receipt showing the employee has applied for an.

Form W2 Everything You Ever Wanted To Know

Shows how much money you made. (ricardo dearatanha / los angeles. Web you cannot accept a receipt showing the employee has applied for an initial grant of employment authorization. We cover everything employers new and seasoned need to know, including: Web how much you've earned and how much taxes you've paid in the last year.

Error in 2017 W2 Form IT Services

This includes their name, address, employer identification number (ein),. Web terms in this set (2) 1. Web a w2 form is an irs tax form containing relevant information about an employee’s income, taxes withheld on his or her paycheck, and other amounts paid in a. You also cannot accept receipts if employment is for. Web according to investopedia, a w2.

W2 Form W2 Tax Forms, Wage and Tax Statements for Businesses

Tips and wages, and paycheck withholds. Web 2 days agodwight hwang uses the art form of gyotaku — “fish rubbing” in japanese — to raise awareness about fish populations in california. We cover everything employers new and seasoned need to know, including: (ricardo dearatanha / los angeles. Web according to investopedia, a w2 form is defined as a “document an.

Form W2 Easy to Understand Tax Guidelines 2020

Web you cannot accept a receipt showing the employee has applied for an initial grant of employment authorization. Tips and wages, and paycheck withholds. Web a w2 form is an irs tax form containing relevant information about an employee’s income, taxes withheld on his or her paycheck, and other amounts paid in a. We cover everything employers new and seasoned.

Form W2 Explained William & Mary

Most business owners with full or part. How much taxes you've paid in the last year. Shows how much money you made. You also cannot accept receipts if employment is for. This includes their name, address, employer identification number (ein),.

What is an IRS Form W2 Federal W2 Form for 2022 Tax Year

Web how much you've earned and how much taxes you've paid in the last year. You also cannot accept receipts if employment is for. How much taxes you've paid in the last year. Web 2 days agodwight hwang uses the art form of gyotaku — “fish rubbing” in japanese — to raise awareness about fish populations in california. Tips and.

Va Hardship Form 5655 Form Resume Examples goVLjeZ9va

Tips and wages, and paycheck withholds. We cover everything employers new and seasoned need to know, including: Shows how much money you made. You also cannot accept receipts if employment is for. Web you cannot accept a receipt showing the employee has applied for an initial grant of employment authorization.

w2 form definition Fill Online, Printable, Fillable Blank formw

This includes their name, address, employer identification number (ein),. We cover everything employers new and seasoned need to know, including: Web how much you've earned and how much taxes you've paid in the last year. Web terms in this set (2) 1. Web according to investopedia, a w2 form is defined as a “document an employer is required to send.

Form W2 Template. Create A Free Form W2 Form.

Web terms in this set (2) 1. Web 2 days agodwight hwang uses the art form of gyotaku — “fish rubbing” in japanese — to raise awareness about fish populations in california. We cover everything employers new and seasoned need to know, including: Web how much you've earned and how much taxes you've paid in the last year. Web you.

We Cover Everything Employers New And Seasoned Need To Know, Including:

(ricardo dearatanha / los angeles. Web a w2 form is an irs tax form containing relevant information about an employee’s income, taxes withheld on his or her paycheck, and other amounts paid in a. Web how much you've earned and how much taxes you've paid in the last year. Web terms in this set (2) 1.

Web According To Investopedia, A W2 Form Is Defined As A “Document An Employer Is Required To Send To Each Employee And The Internal Revenue Service (Irs).

How much taxes you've paid in the last year. Shows how much money you made. Is a form that shows your wages or salary, the amount of tax your employer withheld, what you paid in social security taxes and other contributions you. You also cannot accept receipts if employment is for.

Web 2 Days Agodwight Hwang Uses The Art Form Of Gyotaku — “Fish Rubbing” In Japanese — To Raise Awareness About Fish Populations In California.

This includes their name, address, employer identification number (ein),. Web you cannot accept a receipt showing the employee has applied for an initial grant of employment authorization. Tips and wages, and paycheck withholds. Most business owners with full or part.