3921 Tax Form

3921 Tax Form - Web form 3921 is a form that companies have to file with the irs when an existing or former employee exercises an iso. Web a foreign country, u.s. Web when you receive form 3921, this means that your employer transferred stock to you because you exercised an incentive stock option (iso). It does not need to be entered into. Complete, edit or print tax forms instantly. One form needs to be filed for each transfer of stock that. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. To help figure any amt on the. Web form 3921 is an irs form that is used by companies to report when a specific employee exercises an incentive stock option (iso). It does not need to be entered into.

California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. To learn more, see form 6251 instructions at www.irs.gov. Web form 3921exercise of an incentive stock option under section 422(b), is for informational purposes only and should be kept with your records. Don't miss this 50% discount. Web see the following for more information: Although this information is not taxable unless. We're in your corner to help you navigate your taxes this year. Publication 525, taxable and nontaxable income: The irs uses this form to ensure. Web ogden, ut 84201.

The form is filed with the internal. Web form 3921 is a form that companies have to file with the irs when an existing or former employee exercises an iso. Ad access irs tax forms. Web form 3921 is an informational report, similar to 1099s, that lets the irs know that certain individuals/entities received compensation. Publication 525, taxable and nontaxable income: Web form 3921 is a tax form used to report that a shareholder has exercised the incentive stock that the company has granted. Web a foreign country, u.s. Here are the steps you can take now to. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Don't miss this 50% discount.

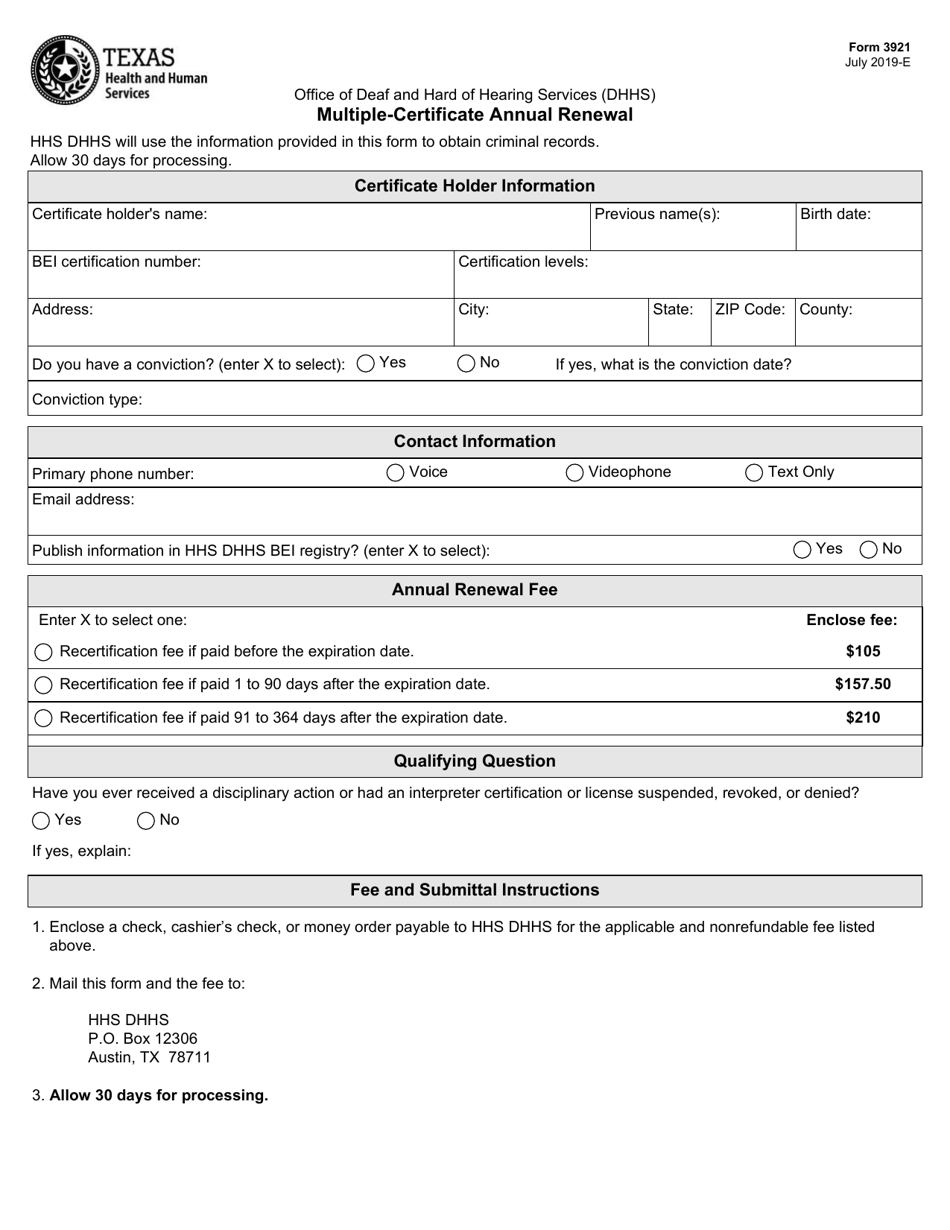

Form 3921 Download Fillable PDF or Fill Online MultipleCertificate

The form is filed with the internal. If using a private delivery service, send your returns to the street address above for the submission processing center (austin, kansas city, or. Web when you receive form 3921, this means that your employer transferred stock to you because you exercised an incentive stock option (iso). Web form 3921 is generally informational unless.

3921, Tax Reporting Instructions & Filing Requirements for Form 3921

One form needs to be filed for each transfer of stock that. Web form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes only and should be kept with your records. Don't miss this 50% discount. Web solved • by turbotax • 29255 • updated april 12, 2023. Although this information is not taxable.

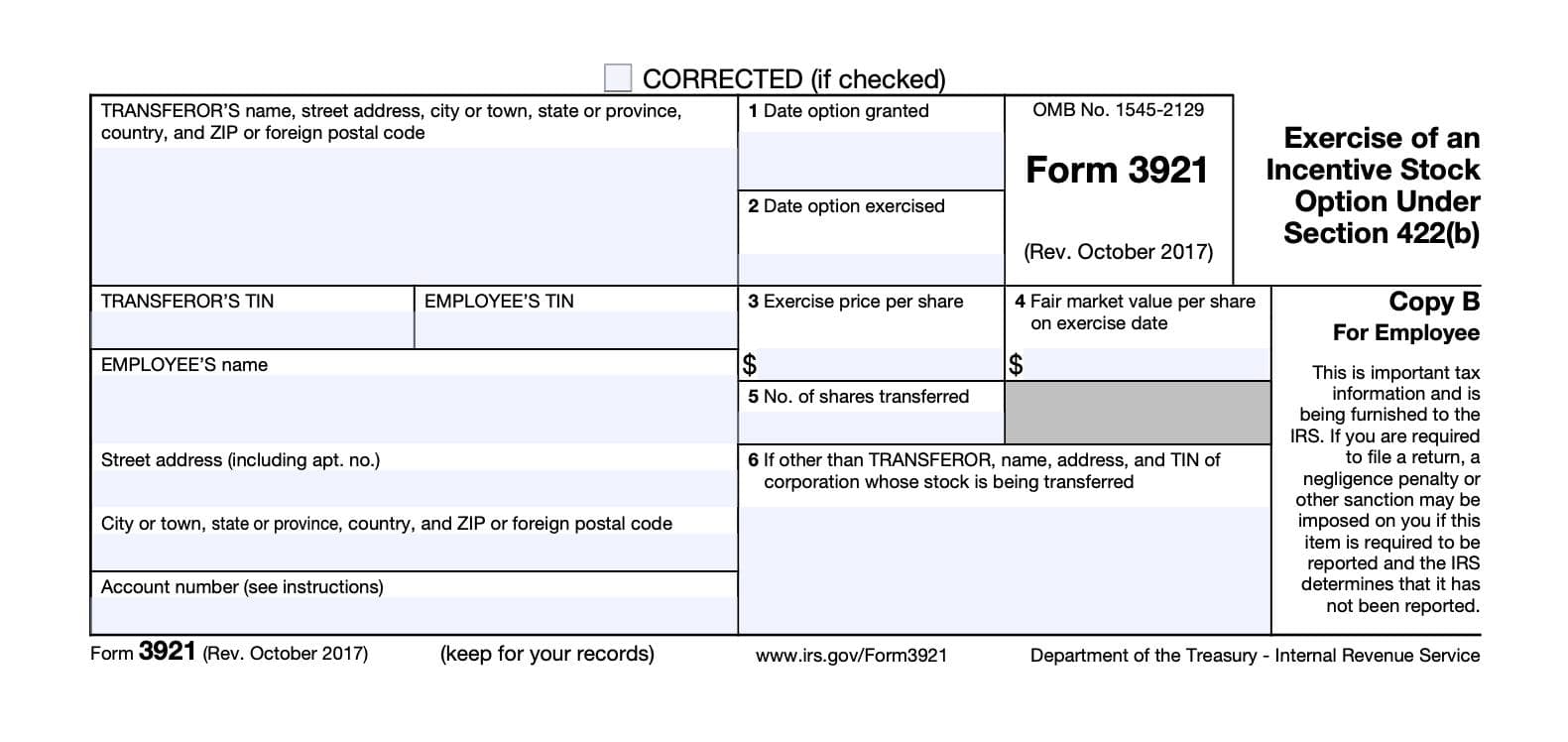

Form 3921 Exercise of an Incentive Stock Option under Section 422(b

Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Web ogden, ut 84201. Web see the following for more information: Web form 3921exercise of an incentive stock option under section 422(b), is for informational purposes only and should be kept with your records. If using a private delivery service, send your returns to the street address.

Form 3921 Everything you need to know

Web see the following for more information: Web entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 283 • updated july 19, 2022 this article will help you enter amounts. Form 3921 instructions for employee: Web form 3921 is an informational form that helps the irs (as well as the employee exercising the.

Form 3921 Exercise of an Incentive Stock Option under Section 422(b

It does not need to be entered into. One form needs to be filed for each transfer of stock that. Publication 525, taxable and nontaxable income: Web entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 283 • updated july 19, 2022 this article will help you enter amounts. It does not need.

Irs.gov Form Ssa 1099 Universal Network

Because this is a statutory. If using a private delivery service, send your returns to the street address above for the submission processing center (austin, kansas city, or. Web see the following for more information: The form is filed with the internal. Web ogden, ut 84201.

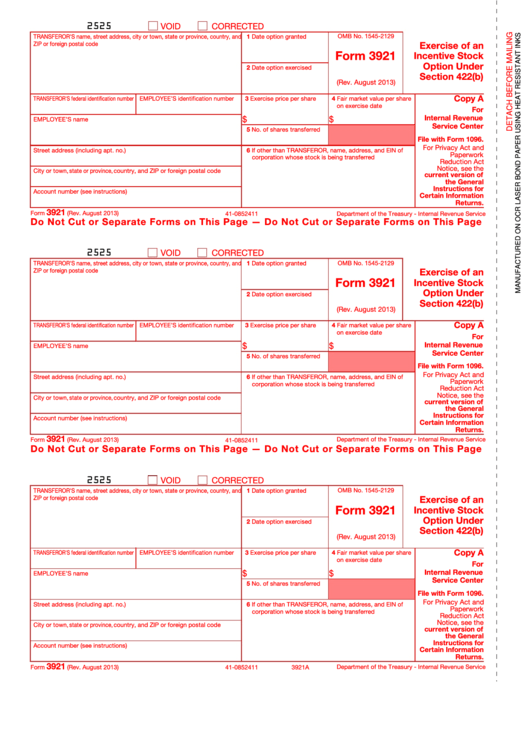

3921 IRS Tax Form Copy A Free Shipping

It does not need to be entered into. This makes it easier for the irs to hold. Web form 3921 is an informational form that helps the irs (as well as the employee exercising the options) verify what those implications might be. Web see the following for more information: Web form 3921 is generally informational unless stock acquired through an.

Form 3921 Exercise Of An Incentive Stock Option Under Section 422b

Get ready for tax season deadlines by completing any required tax forms today. Web form 3921 is an informational form that helps the irs (as well as the employee exercising the options) verify what those implications might be. Web solved • by turbotax • 29255 • updated april 12, 2023. It does not need to be entered into. Web when.

What is Form 3921? Instructions on When & How to File Form 3921 Carta

The irs uses this form to ensure. This form has to be filled. Complete, edit or print tax forms instantly. To learn more, see form 6251 instructions at www.irs.gov. Web when you receive form 3921, this means that your employer transferred stock to you because you exercised an incentive stock option (iso).

Form 3921 Exercise of an Incentive Stock Option under Section 422(b

The form is filed with the internal. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. To help figure any amt on the. If using a private delivery service, send your returns to the street address above for the submission processing center (austin, kansas city, or. Although this information is not taxable unless.

Web Ogden, Ut 84201.

The irs uses this form to ensure. Although this information is not taxable unless. One form needs to be filed for each transfer of stock that. Here are the steps you can take now to.

Because This Is A Statutory.

Web solved • by turbotax • 29255 • updated april 12, 2023. Web a foreign country, u.s. Web form 3921 is an informational report, similar to 1099s, that lets the irs know that certain individuals/entities received compensation. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes.

File Your 2290 Tax Now And Receive Schedule 1 In Minutes.

It does not need to be entered into. Web form 3921 is a tax form used to report that a shareholder has exercised the incentive stock that the company has granted. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web see the following for more information:

This Makes It Easier For The Irs To Hold.

Web entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 283 • updated july 19, 2022 this article will help you enter amounts. Ad access irs tax forms. It does not need to be entered into. Web form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes only and should be kept with your records.