Tn Vehicle Gift Form

Tn Vehicle Gift Form - Ÿ gift transfer or low selling price to person other than lineal relative (low selling price is considered to be 75% or less of the fair market value by reference to the most recent issue of an authoritative automo tive pricing manual, such as. Web gift, inheritance, name change, minor. Web gift, inheritance, name change, minor. Web tennessee motor vehicle commission forms and downloads forms and downloads tennessee motor vehicle commission eligibility eligibility verification for entitlements act attestation instructions [pdf] annual sales report annual sales report [online] consignment consignment form [pdf] fees fee schedule manufacturers For other gift transfers, the county clerk would examine the transaction at issue to determine whether sales tax is due. If the deceased left a will designating an executor or if an administrator has been appointed by the court, the existing certificate of title must be signed by this person in order to change the vehicle ownership record to reflect the new owner. Sales tax is not due on vehicle transfers where the vehicle is gifted from one individual to another. The company will submit the completed affidavit, along with a completed multipurpose use application, to the county clerk to complete title and registration in the company’s name. An individual can give a vehicle as a gift to another individual. Seller or transferor (please print)

For other gift transfers, the county clerk would examine the transaction at issue to determine whether sales tax is due. If the deceased left a will designating an executor or if an administrator has been appointed by the court, the existing certificate of title must be signed by this person in order to change the vehicle ownership record to reflect the new owner. University of tennessee alumni plate application: Seller or transferor (please print) Sales tax is not due on vehicle transfers where the vehicle is gifted from one individual to another. An individual can give a vehicle as a gift to another individual. Any entity can also gift a vehicle to an individual. Web gift, inheritance, name change, minor. Official used car guide, se edition. Registrants can complete a gift affidavit which certifies that the vehicle was gifted.

University of tennessee alumni plate application: If the deceased left a will designating an executor or if an administrator has been appointed by the court, the existing certificate of title must be signed by this person in order to change the vehicle ownership record to reflect the new owner. Sales tax is not due on vehicle transfers where the vehicle is gifted from one individual to another. Fair market value is determined by referencing the most recent issue of an authoritative automobile pricing manual, such as the n.a.d.a. A low selling price is 75% or less of the fair market value. Web order request for forms or license plates: Ÿ gift transfer or low selling price to person other than lineal relative (low selling price is considered to be 75% or less of the fair market value by reference to the most recent issue of an authoritative automo tive pricing manual, such as. An individual can give a vehicle as a gift to another individual. The company will submit the completed affidavit, along with a completed multipurpose use application, to the county clerk to complete title and registration in the company’s name. Power of attorney for vehicle transactions:

Free Tennessee Motor Vehicle Bill of Sale Form PDF Word (.doc)

The company will submit the completed affidavit, along with a completed multipurpose use application, to the county clerk to complete title and registration in the company’s name. An individual can give a vehicle as a gift to another individual. Seller or transferor (please print) If the deceased left a will designating an executor or if an administrator has been appointed.

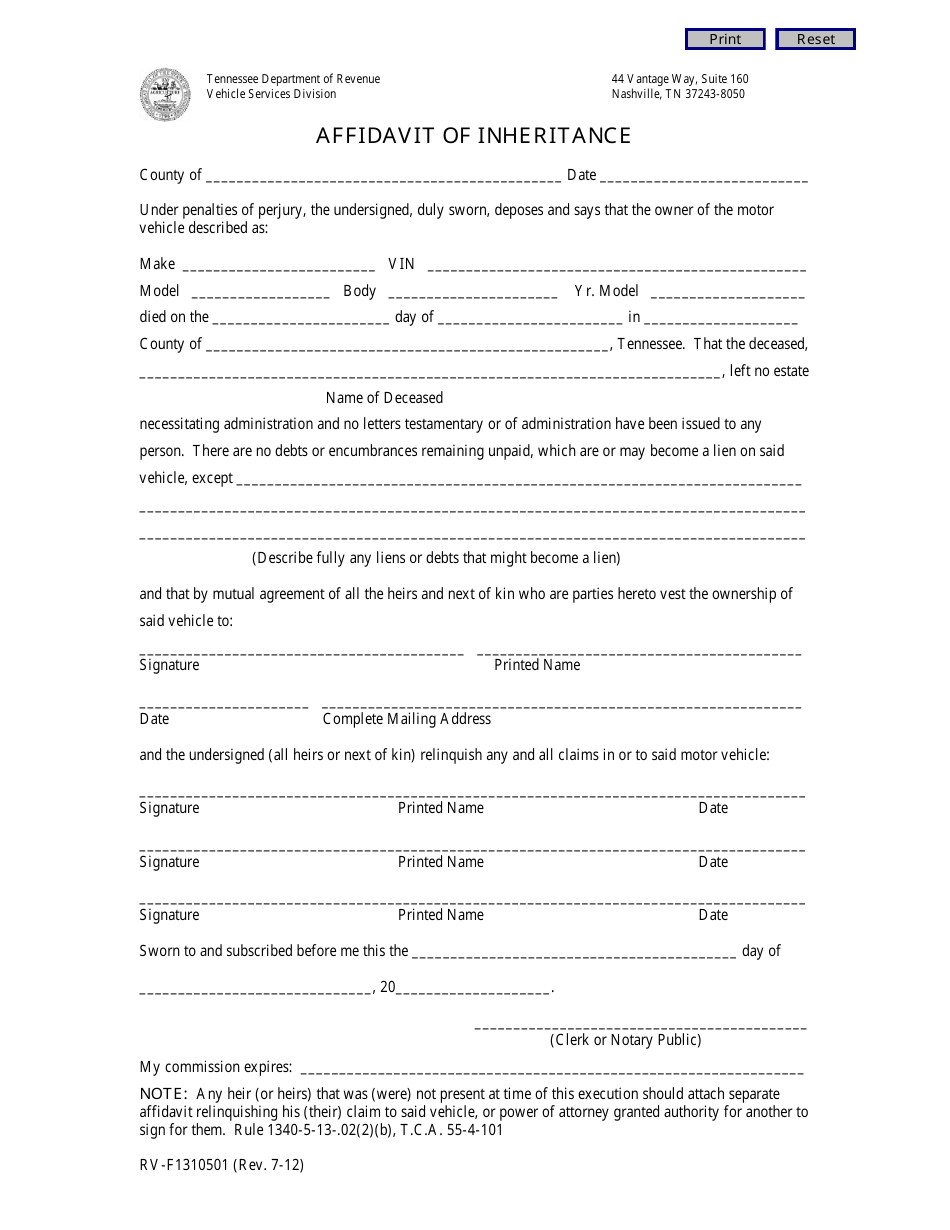

Form RVF1310501 Download Fillable PDF or Fill Online Affidavit of

University of tennessee alumni plate application: Any entity can also gift a vehicle to an individual. Sales tax is not due on vehicle transfers where the vehicle is gifted from one individual to another. Official used car guide, se edition. Seller or transferor (please print)

20142022 Form TN RVF1301201 Fill Online, Printable, Fillable, Blank

For other gift transfers, the county clerk would examine the transaction at issue to determine whether sales tax is due. Web tennessee motor vehicle commission forms and downloads forms and downloads tennessee motor vehicle commission eligibility eligibility verification for entitlements act attestation instructions [pdf] annual sales report annual sales report [online] consignment consignment form [pdf] fees fee schedule manufacturers Power.

mv13st Sales Tax Taxes

Sales tax is not due on vehicle transfers where the vehicle is gifted from one individual to another. The company will submit the completed affidavit, along with a completed multipurpose use application, to the county clerk to complete title and registration in the company’s name. Ÿ gift transfer or low selling price to person other than lineal relative (low selling.

Personal Property Tax Tennessee Car PRORFETY

If the deceased left a will designating an executor or if an administrator has been appointed by the court, the existing certificate of title must be signed by this person in order to change the vehicle ownership record to reflect the new owner. Sales tax is not due on vehicle transfers where the vehicle is gifted from one individual to.

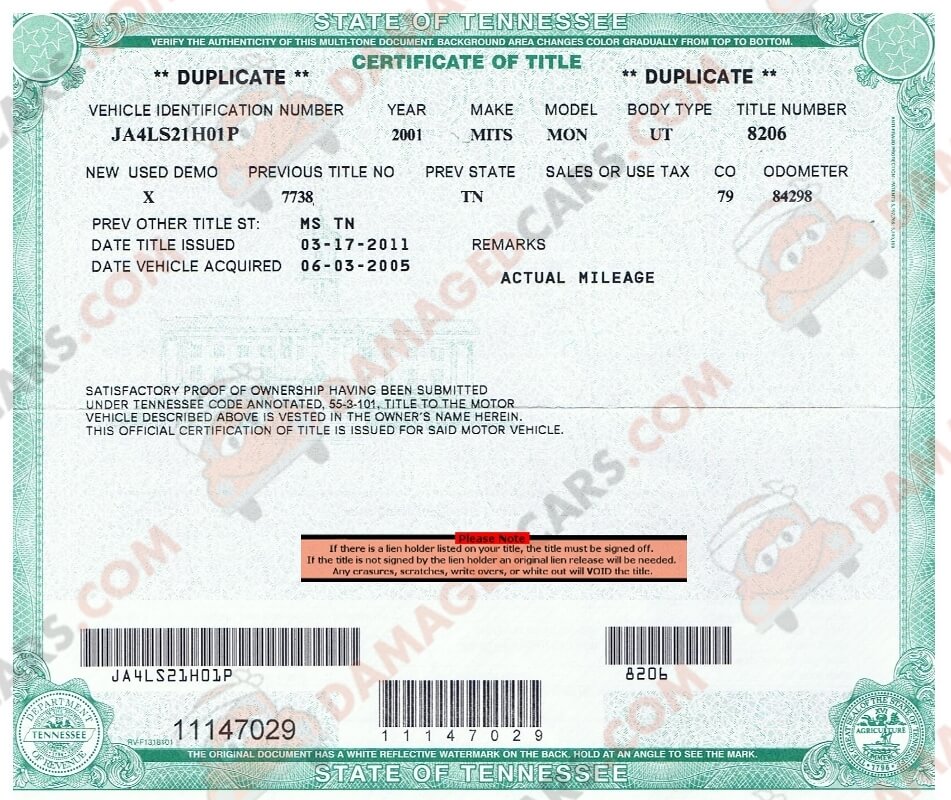

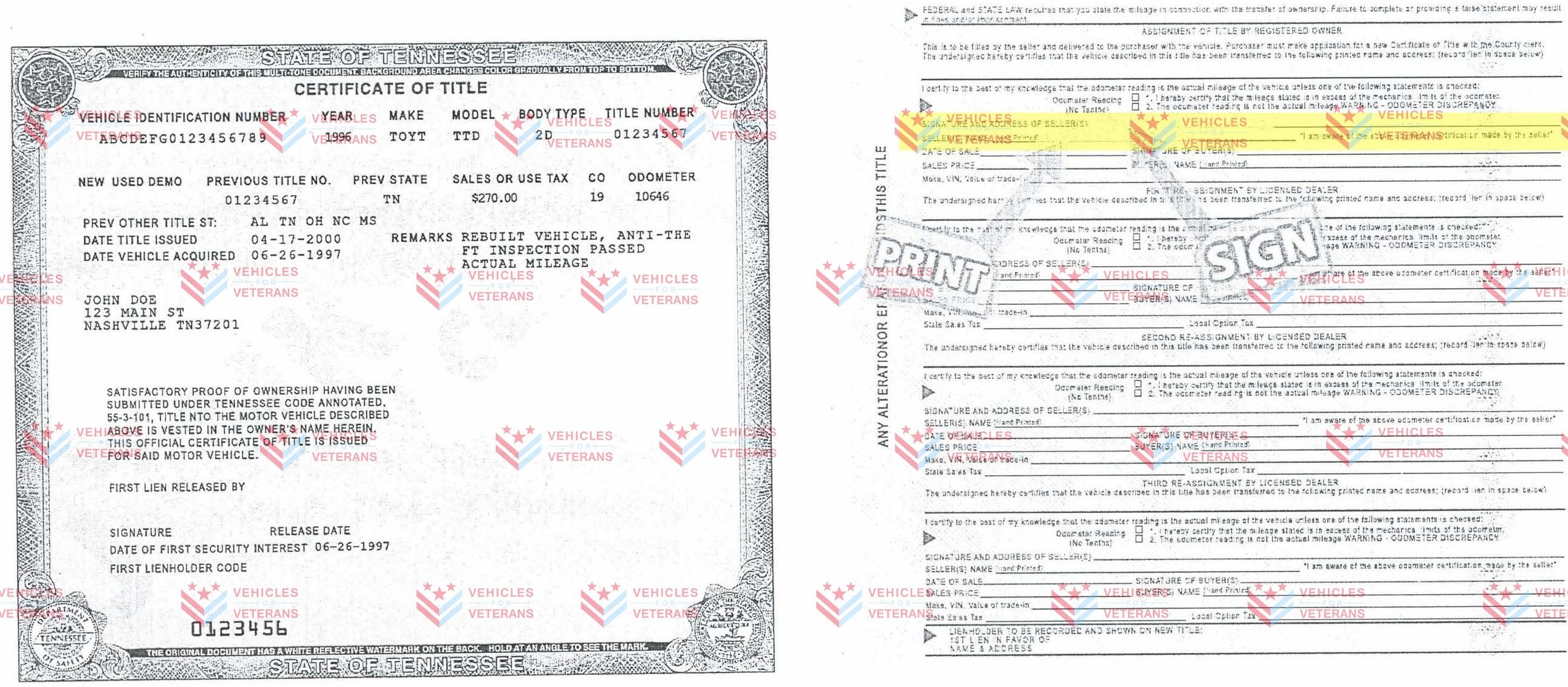

Tennessee Car Title How to transfer a vehicle, rebuilt or lost titles.

Web order request for forms or license plates: Power of attorney for vehicle transactions: Any entity can also gift a vehicle to an individual. For other gift transfers, the county clerk would examine the transaction at issue to determine whether sales tax is due. Web tennessee motor vehicle commission forms and downloads forms and downloads tennessee motor vehicle commission eligibility.

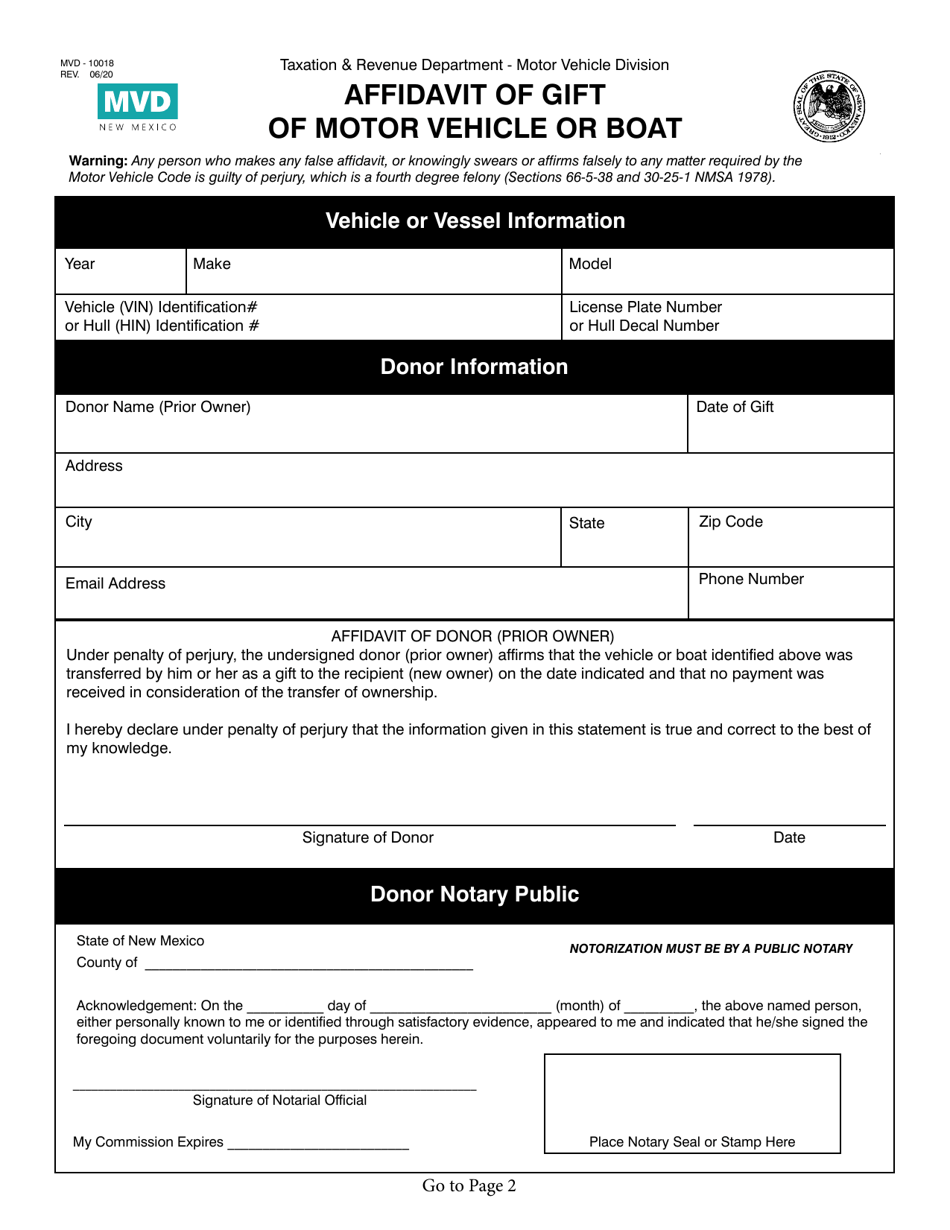

Affidavit Of Gift Motor Vehicle Missouri

Ÿ gift transfer or low selling price to person other than lineal relative (low selling price is considered to be 75% or less of the fair market value by reference to the most recent issue of an authoritative automo tive pricing manual, such as. Registrants can complete a gift affidavit which certifies that the vehicle was gifted. Fair market value.

Tennessee Vehicle Title Donation Questions

Web gift, inheritance, name change, minor. University of tennessee alumni plate application: Power of attorney for vehicle transactions: Ÿ gift transfer or low selling price to person other than lineal relative (low selling price is considered to be 75% or less of the fair market value by reference to the most recent issue of an authoritative automo tive pricing manual,.

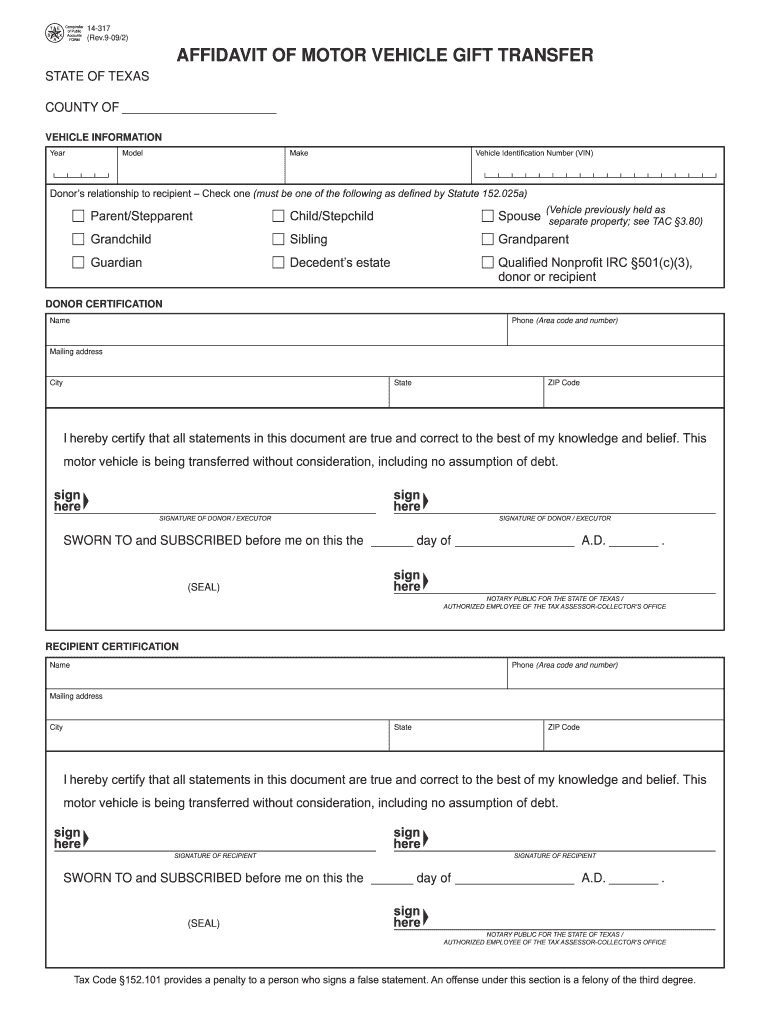

2009 Form TX 14317 Fill Online, Printable, Fillable, Blank pdfFiller

A low selling price is 75% or less of the fair market value. Registrants can complete a gift affidavit which certifies that the vehicle was gifted. Web tennessee motor vehicle commission forms and downloads forms and downloads tennessee motor vehicle commission eligibility eligibility verification for entitlements act attestation instructions [pdf] annual sales report annual sales report [online] consignment consignment form.

Tennessee Car Title How to transfer a vehicle, rebuilt or lost titles.

A low selling price is 75% or less of the fair market value. Sales tax is not due on vehicle transfers where the vehicle is gifted from one individual to another. University of tennessee alumni plate application: The company will submit the completed affidavit, along with a completed multipurpose use application, to the county clerk to complete title and registration.

Registrants Can Complete A Gift Affidavit Which Certifies That The Vehicle Was Gifted.

University of tennessee alumni plate application: Sales tax is not due on vehicle transfers where the vehicle is gifted from one individual to another. For other gift transfers, the county clerk would examine the transaction at issue to determine whether sales tax is due. The company will submit the completed affidavit, along with a completed multipurpose use application, to the county clerk to complete title and registration in the company’s name.

Seller Or Transferor (Please Print)

Power of attorney for vehicle transactions: Any entity can also gift a vehicle to an individual. Ÿ gift transfer or low selling price to person other than lineal relative (low selling price is considered to be 75% or less of the fair market value by reference to the most recent issue of an authoritative automo tive pricing manual, such as. Web tennessee motor vehicle commission forms and downloads forms and downloads tennessee motor vehicle commission eligibility eligibility verification for entitlements act attestation instructions [pdf] annual sales report annual sales report [online] consignment consignment form [pdf] fees fee schedule manufacturers

Web Gift, Inheritance, Name Change, Minor.

If the deceased left a will designating an executor or if an administrator has been appointed by the court, the existing certificate of title must be signed by this person in order to change the vehicle ownership record to reflect the new owner. Fair market value is determined by referencing the most recent issue of an authoritative automobile pricing manual, such as the n.a.d.a. A low selling price is 75% or less of the fair market value. Web order request for forms or license plates:

Web Gift, Inheritance, Name Change, Minor.

An individual can give a vehicle as a gift to another individual. Official used car guide, se edition.