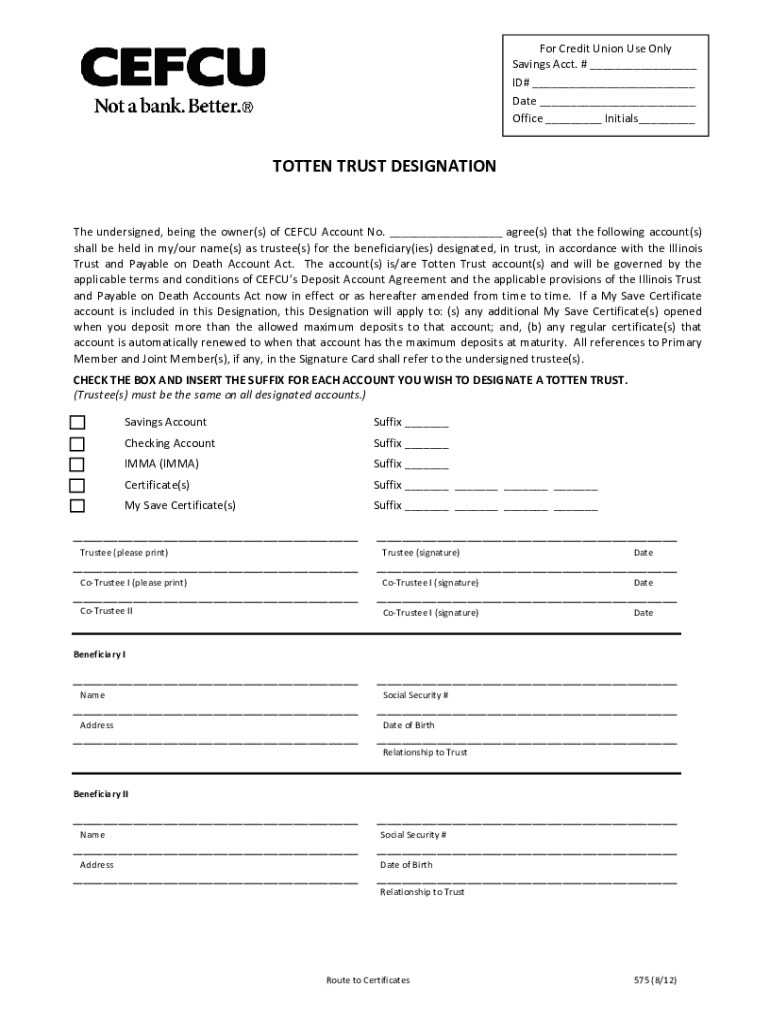

Totten Trust Form

Totten Trust Form - To create a totten trust, the title. Hit the get form button on this page. By signing below, i agree to the application process; (1) the withdrawal of all money. A totten trust provides a safer method to pass assets on to family than using joint ownership. A totten trust is a bank account in the depositor’s name “as trustee for” a named beneficiary. Not sure where to start? *only one share (account) per. A beneficiary cannot be added to a trust or a uniform. You will go to our pdf editor.

*only one share (account) per. A totten trust can be revoked by: Since the ownership of the account will. You will go to our pdf editor. Web 845.463.3011 i hvcu.org beneficiary information for totten trust ( in trust for ) add beneficiaries member number: A beneficiary cannot be added to a trust or a uniform. A totten trust provides a safer method to pass assets on to family than using joint ownership. If two or more beneficiaries are. Make some changes to your. Not sure where to start?

By signing below, i agree to the application process; To create a totten trust, the title. A totten trust is a bank account in the depositor’s name “as trustee for” a named beneficiary. A totten trust provides a safer method to pass assets on to family than using joint ownership. A totten trust (also referred to as a payable on death account) is a form of trust in the united states in which one party (the settlor or grantor of the trust) places money in. Web a totten trust (also called a bank account trust) is a tentative trust in which a grantor makes himself or herself trustee of his or her own funds for the benefit of. Web a totten trust cannot be used with real property. Please select one of the following forms: Web totten trust account application and agreement (payable on death) trust title: Web up to 25% cash back to set up a totten trust/pod account or to turn an existing savings or checking account into a pod account, all you have to do is fill out some paperwork provided.

Totten trust Understanding the Totten Trust

I agree that all of the. A totten trust (also referred to as a payable on death account) is a form of trust in the united states in which one party (the settlor or grantor of the trust) places money in. Please select one of the following forms: Make some changes to your. If two or more beneficiaries are.

Totten Trusts

Make some changes to your. Please select one of the following forms: I agree that all of the. A totten trust can be revoked by: Web a totten trust (also called a bank account trust) is a tentative trust in which a grantor makes himself or herself trustee of his or her own funds for the benefit of.

Totten trust Meaning YouTube

A totten trust can be revoked by: To create a totten trust, the title. Web a totten trust (also called a bank account trust) is a tentative trust in which a grantor makes himself or herself trustee of his or her own funds for the benefit of. Hit the get form button on this page. Web if you want to.

The subtle difference between a Totten Trust and a PayableonDeath

Web 845.463.3011 i hvcu.org beneficiary information for totten trust ( in trust for ) add beneficiaries member number: (1) the withdrawal of all money. Web up to 25% cash back to set up a totten trust/pod account or to turn an existing savings or checking account into a pod account, all you have to do is fill out some paperwork.

What is a Totten Trust? Cashman Law Firm

I agree that all of the. Web a totten trust (also called a bank account trust) is a tentative trust in which a grantor makes himself or herself trustee of his or her own funds for the benefit of. Web a totten trust cannot be used with real property. If two or more beneficiaries are. Web totten trust account application.

What is a Totten Trust?

(1) the withdrawal of all money. Web a totten trust cannot be used with real property. Not sure where to start? I agree that all of the. Web forms of id include birth certificate, state id, social security card, transcripts, medical records, etc.

Totten Trust Form Fill Online, Printable, Fillable, Blank pdfFiller

If two or more beneficiaries are. Web a totten trust (also called a bank account trust) is a tentative trust in which a grantor makes himself or herself trustee of his or her own funds for the benefit of. By signing below, i agree to the application process; To create a totten trust, the title. A beneficiary cannot be added.

What is Totten Trust

A totten trust (also referred to as a payable on death account) is a form of trust in the united states in which one party (the settlor or grantor of the trust) places money in. You will go to our pdf editor. Make some changes to your. Since the ownership of the account will. Not sure where to start?

Arizona Estate Planning Attorneys A Totten Trust in Arizona

*only one share (account) per. By signing below, i agree to the application process; A beneficiary cannot be added to a trust or a uniform. Web totten trust account application and agreement (payable on death) trust title: Not sure where to start?

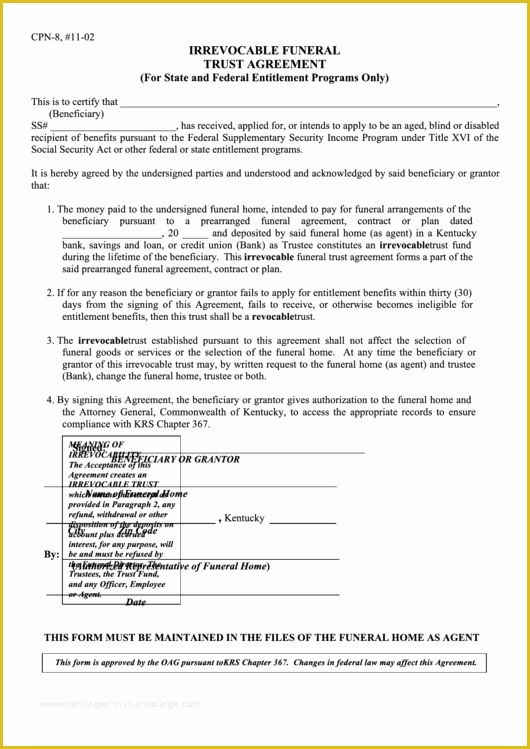

Free Declaration Of Trust Template Of top 5 Irrevocable Trust form

The form 2848 or form 8821 will be used solely to release the ein to the representative authorized on the form. A totten trust can be revoked by: Hit the get form button on this page. *only one share (account) per. Web forms of id include birth certificate, state id, social security card, transcripts, medical records, etc.

Web If You Want To Create A Totten Trust, You’ll Need To Locate Your Bank’s Specific Pod Form, Fill It Out, And Submit It Properly.

A beneficiary cannot be added to a trust or a uniform. I agree that all of the. Web a totten trust cannot be used with real property. Web up to 25% cash back to set up a totten trust/pod account or to turn an existing savings or checking account into a pod account, all you have to do is fill out some paperwork provided.

A Totten Trust Is A Bank Account In The Depositor’s Name “As Trustee For” A Named Beneficiary.

Not sure where to start? A totten trust can be revoked by: Web a totten trust (also called a bank account trust) is a tentative trust in which a grantor makes himself or herself trustee of his or her own funds for the benefit of. Web totten trust account application and agreement (payable on death) trust title:

If Two Or More Beneficiaries Are.

Web 845.463.3011 i hvcu.org beneficiary information for totten trust ( in trust for ) add beneficiaries member number: Web forms of id include birth certificate, state id, social security card, transcripts, medical records, etc. By signing below, i agree to the application process; Web in trust for (itf), totten trust, beneficiary(ies) will own the designated account listed above in the event of the death of all account holders.

To Create A Totten Trust, The Title.

A totten trust provides a safer method to pass assets on to family than using joint ownership. A totten trust (also referred to as a payable on death account) is a form of trust in the united states in which one party (the settlor or grantor of the trust) places money in. (1) the withdrawal of all money. *only one share (account) per.