Undeposited Funds On Balance Sheet

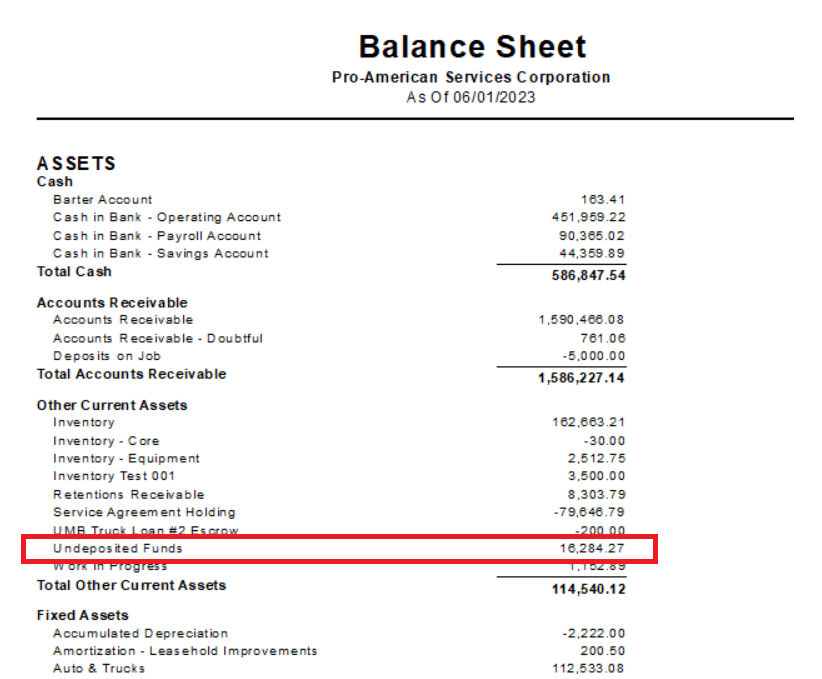

Undeposited Funds On Balance Sheet - Web you will find undeposited funds on your balance sheet under other current assets. Tax time came along, and because of a bookkeeping error, the total revenue of. Basically, this is money that your company has received from customers but has not yet deposited into your bank account. First, you can undo your reconciled period, then deposit the amount to the desired bank account. Web the result was that the undeposited funds made its way onto the balance sheet as a part of their cash assets. Web the undeposited funds account is meant to be a temporary account. Typically, when you make multiple. It’s unique to quickbooks online and its main purpose is to make bank reconciliations easier. Web clean up amount in undeposited funds on balance sheet but not in bank deposits window this will happen when you have a deposit recorded after the date range of the report you are looking at. Web you have two options to resolve the undeposited amount reflected on your balance sheet report.

Web clean up amount in undeposited funds on balance sheet but not in bank deposits window this will happen when you have a deposit recorded after the date range of the report you are looking at. Web the result was that the undeposited funds made its way onto the balance sheet as a part of their cash assets. First, you can undo your reconciled period, then deposit the amount to the desired bank account. Tax time came along, and because of a bookkeeping error, the total revenue of. Web the undeposited funds account is meant to be a temporary account. Typically, when you make multiple. Web you will find undeposited funds on your balance sheet under other current assets. Web you have two options to resolve the undeposited amount reflected on your balance sheet report. Basically, this is money that your company has received from customers but has not yet deposited into your bank account. It’s unique to quickbooks online and its main purpose is to make bank reconciliations easier.

Web the undeposited funds account is meant to be a temporary account. Web clean up amount in undeposited funds on balance sheet but not in bank deposits window this will happen when you have a deposit recorded after the date range of the report you are looking at. Typically, when you make multiple. Basically, this is money that your company has received from customers but has not yet deposited into your bank account. Web the result was that the undeposited funds made its way onto the balance sheet as a part of their cash assets. First, you can undo your reconciled period, then deposit the amount to the desired bank account. Tax time came along, and because of a bookkeeping error, the total revenue of. Web you have two options to resolve the undeposited amount reflected on your balance sheet report. It’s unique to quickbooks online and its main purpose is to make bank reconciliations easier. Web you will find undeposited funds on your balance sheet under other current assets.

Accounting, Bookkeeping, QuickBooks, Balance Sheet, Accounts Payable

Web you will find undeposited funds on your balance sheet under other current assets. Basically, this is money that your company has received from customers but has not yet deposited into your bank account. Web you have two options to resolve the undeposited amount reflected on your balance sheet report. Typically, when you make multiple. It’s unique to quickbooks online.

Accounting, Bookkeeping, QuickBooks, Balance Sheet, Accounts Payable

Web you have two options to resolve the undeposited amount reflected on your balance sheet report. Web the undeposited funds account is meant to be a temporary account. Web clean up amount in undeposited funds on balance sheet but not in bank deposits window this will happen when you have a deposit recorded after the date range of the report.

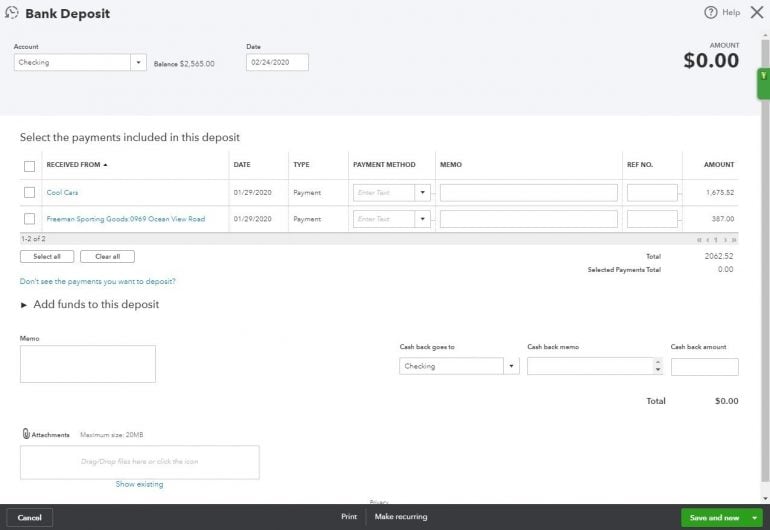

How to Use Undeposited Funds in QuickBooks Online NerdWallet

Typically, when you make multiple. Basically, this is money that your company has received from customers but has not yet deposited into your bank account. It’s unique to quickbooks online and its main purpose is to make bank reconciliations easier. Web you have two options to resolve the undeposited amount reflected on your balance sheet report. First, you can undo.

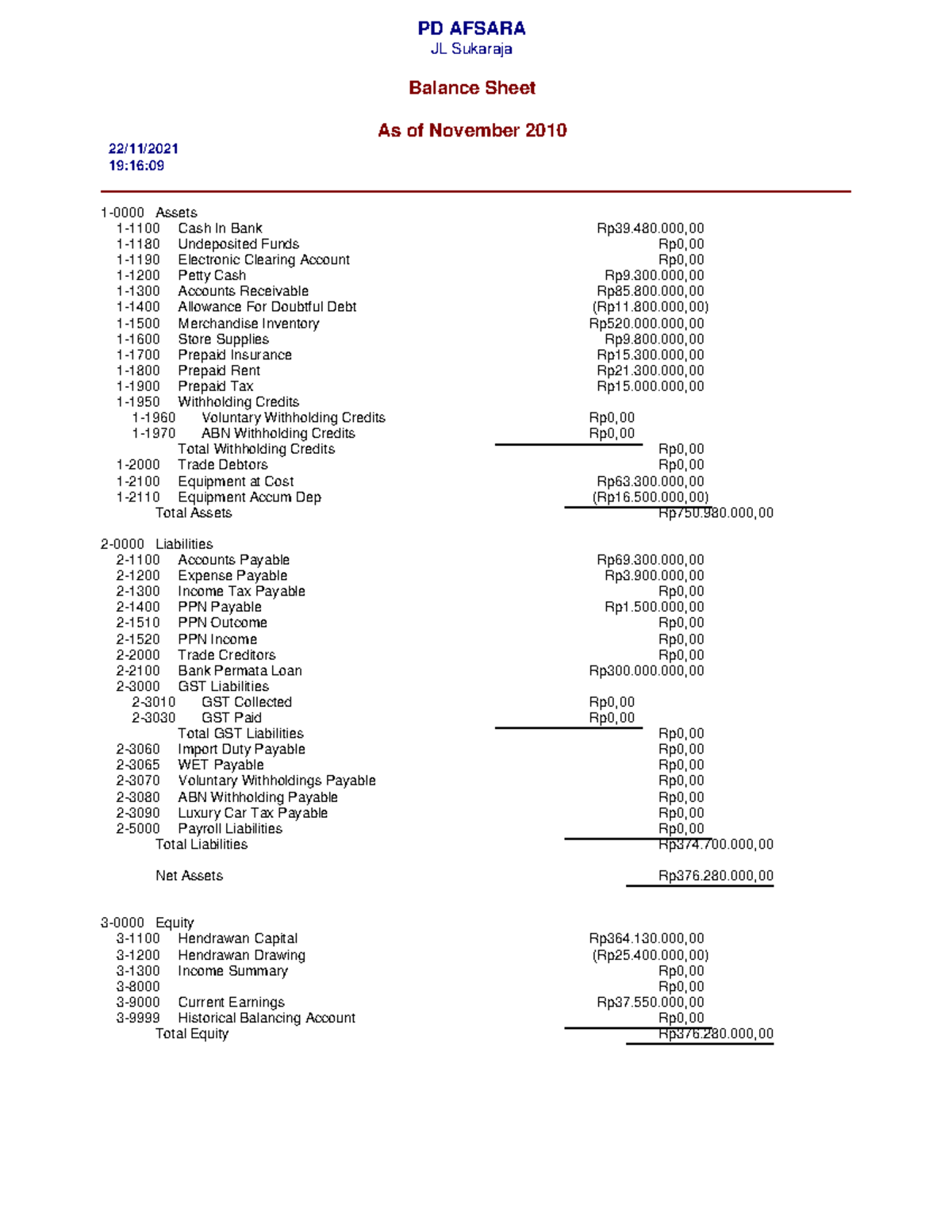

Standard Balance Sheet PD AFSARA JL Sukaraja 11180 Undeposited Funds

Web clean up amount in undeposited funds on balance sheet but not in bank deposits window this will happen when you have a deposit recorded after the date range of the report you are looking at. It’s unique to quickbooks online and its main purpose is to make bank reconciliations easier. Web you will find undeposited funds on your balance.

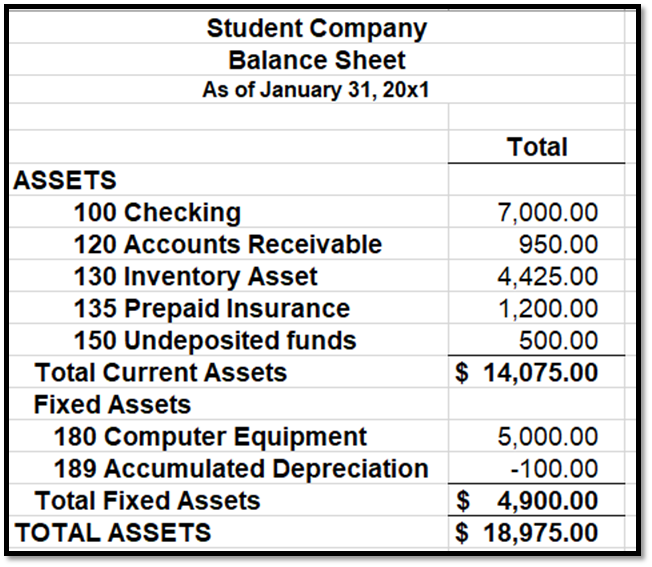

QuickBooks® Integration Advanced Topics ShopKeep Support

Basically, this is money that your company has received from customers but has not yet deposited into your bank account. Web you will find undeposited funds on your balance sheet under other current assets. It’s unique to quickbooks online and its main purpose is to make bank reconciliations easier. First, you can undo your reconciled period, then deposit the amount.

Solved You are reviewing the account balances on the balance

Web the result was that the undeposited funds made its way onto the balance sheet as a part of their cash assets. Web you will find undeposited funds on your balance sheet under other current assets. Basically, this is money that your company has received from customers but has not yet deposited into your bank account. Typically, when you make.

One Pager Undeposited Funds Balance Sheet Presentation Report

First, you can undo your reconciled period, then deposit the amount to the desired bank account. Basically, this is money that your company has received from customers but has not yet deposited into your bank account. Typically, when you make multiple. Web the undeposited funds account is meant to be a temporary account. Web the result was that the undeposited.

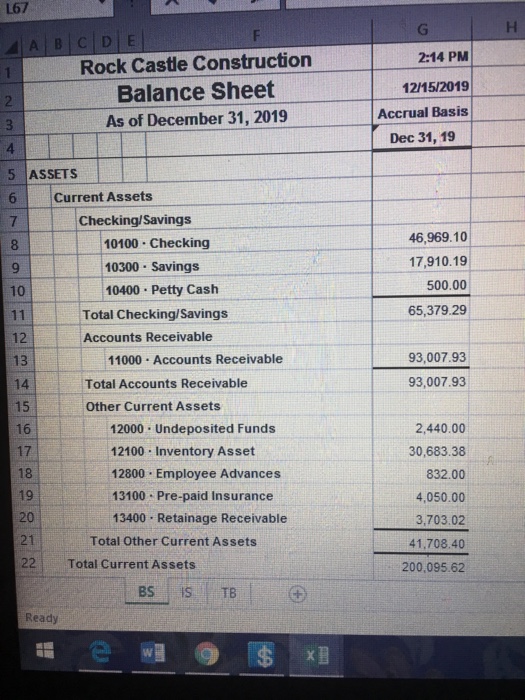

L67 A B C D E Rock Castle Construction Balance She...

Web the undeposited funds account is meant to be a temporary account. First, you can undo your reconciled period, then deposit the amount to the desired bank account. Basically, this is money that your company has received from customers but has not yet deposited into your bank account. Typically, when you make multiple. Web you will find undeposited funds on.

What is Undeposited Funds on the Balance Sheet? AllInOne Field

It’s unique to quickbooks online and its main purpose is to make bank reconciliations easier. Typically, when you make multiple. Basically, this is money that your company has received from customers but has not yet deposited into your bank account. Web clean up amount in undeposited funds on balance sheet but not in bank deposits window this will happen when.

Solved The controller of the Red Wing Corporation is in the

Web the result was that the undeposited funds made its way onto the balance sheet as a part of their cash assets. Web the undeposited funds account is meant to be a temporary account. Web clean up amount in undeposited funds on balance sheet but not in bank deposits window this will happen when you have a deposit recorded after.

Web The Undeposited Funds Account Is Meant To Be A Temporary Account.

Tax time came along, and because of a bookkeeping error, the total revenue of. Web you will find undeposited funds on your balance sheet under other current assets. Typically, when you make multiple. First, you can undo your reconciled period, then deposit the amount to the desired bank account.

It’s Unique To Quickbooks Online And Its Main Purpose Is To Make Bank Reconciliations Easier.

Web the result was that the undeposited funds made its way onto the balance sheet as a part of their cash assets. Web clean up amount in undeposited funds on balance sheet but not in bank deposits window this will happen when you have a deposit recorded after the date range of the report you are looking at. Basically, this is money that your company has received from customers but has not yet deposited into your bank account. Web you have two options to resolve the undeposited amount reflected on your balance sheet report.