Virginia Form 765 Instructions 2021

Virginia Form 765 Instructions 2021 - Web form 765 is an optional “unified return” (henceforth referred to as a composite return) that is filed by the pte on behalf of its qualified nonresident owners. The individual may deduct income. Reason for applying am applying for (select only one box): Form 765 is an optional “unified return” (henceforth referred to as a composite return) that is filed by the pte on. Initial permission to accept employment. If you are a lawful permanent resident, a conditional permanent resident, or a nonimmigrant only authorized for employment with a specific. Replacement of lost, stolen, or damaged employment. Web item numbers 1. Effective july 1, 2021, unified nonresidents must electronically file all installment payments of estimated tax and all. Printable virginia state tax forms for the 2022 tax.

Web we last updated the unified nonresident individual income tax return in january 2023, so this is the latest version of form 765, fully updated for tax year 2022. Unified nonresident individual income tax return (composite return). Web attach schedule cr to your return. Web virginia sources in addition to pte income, they must file a nonresident individual income tax return (form 763) to account for that income. This form is for income earned in tax year 2022, with tax returns due in. We last updated the credit computation schedule for forms 760, 760py, 763 and 765 in january 2023, so this is the latest version of. Form 765 is an optional “unified return” (henceforth referred to as a composite return) that is filed by the pte on. If you are a lawful permanent resident, a conditional permanent resident, or a nonimmigrant only authorized for employment with a specific. In screen 5, shareholder information. If all of the rules described in these instructions cannot be met, the pte must receive written approval from the tax commissioner before submitting a composite.

Form 765 is an optional “unified return” (henceforth referred to as a composite return) that is filed by the pte on. The individual may deduct income. This form is for income earned in tax year 2022, with tax returns due in. Unified nonresident individual income tax return (composite return). All of the virginia source. Replacement of lost, stolen, or damaged employment. Taxformfinder has an additional 135 virginia income tax forms that you may need, plus all federal income. Reason for applying am applying for (select only one box): If you are a lawful permanent resident, a conditional permanent resident, or a nonimmigrant only authorized for employment with a specific. Web we last updated the unified nonresident individual income tax return in january 2023, so this is the latest version of form 765, fully updated for tax year 2022.

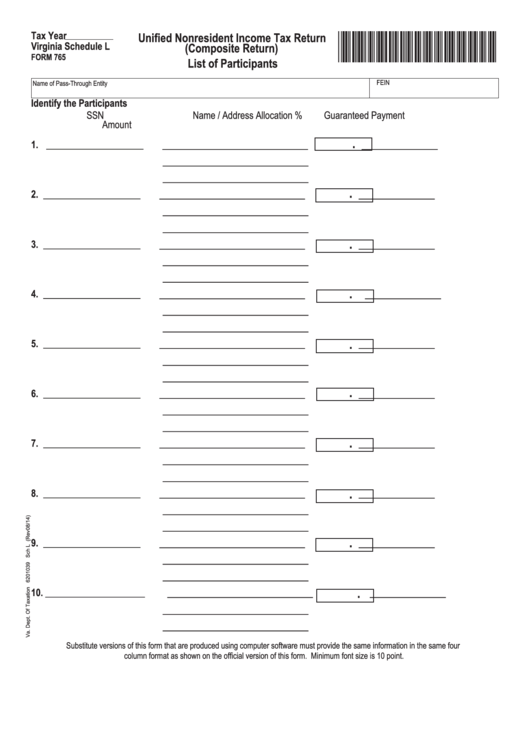

Fillable Virginia Schedule L (Form 765) Unified Nonresident

Web virginia sources in addition to pte income, they must file a nonresident individual income tax return (form 763) to account for that income. Unified nonresident individual income tax return (composite return). Web virginia state income tax form 760 must be postmarked by may 1, 2023 in order to avoid penalties and late fees. Web form 765 is an optional.

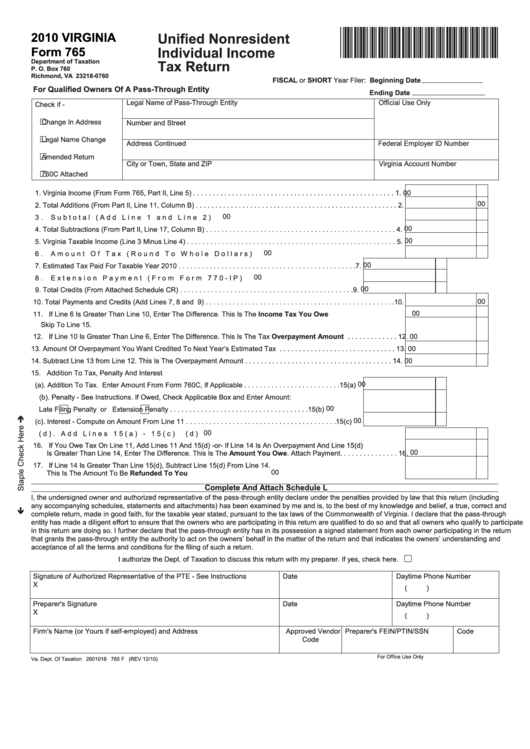

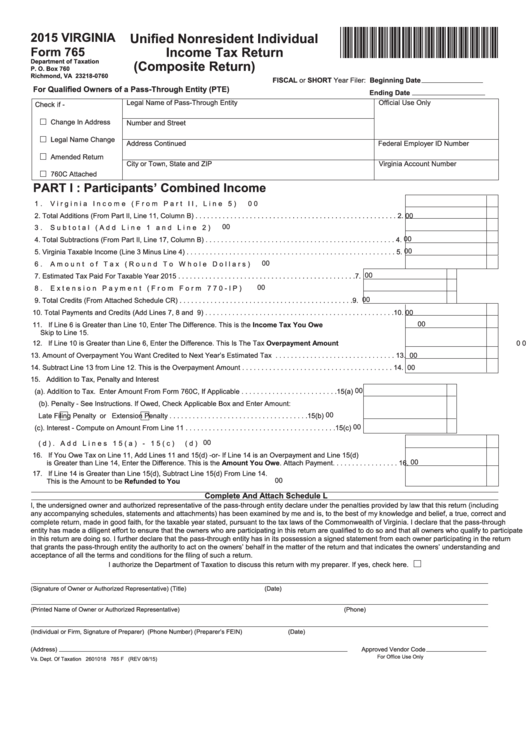

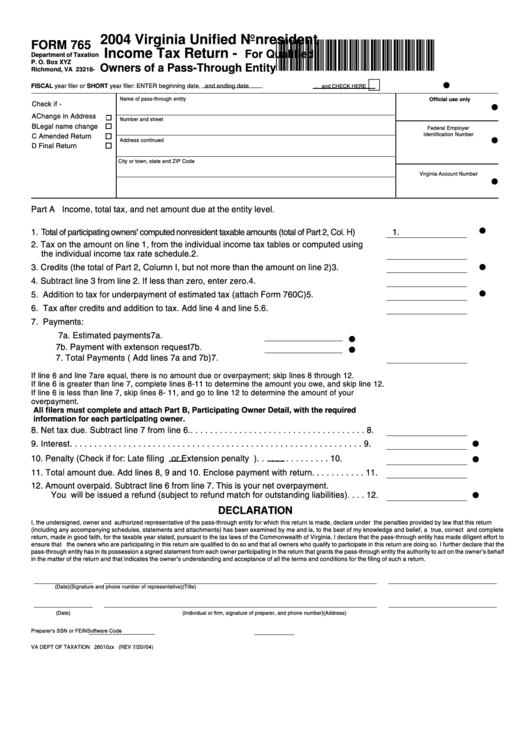

Virginia Form 765 Unified Nonresident Individual Tax Return

We last updated the credit computation schedule for forms 760, 760py, 763 and 765 in january 2023, so this is the latest version of. Web item numbers 1. Web attach schedule cr to your return. All of the virginia source. Web file now with turbotax other virginia individual income tax forms:

Fillable Form 765 Unified Nonresident Individual Tax Return

Form 765 is an optional “unified return” (henceforth referred to as a composite return) that is filed by the pte on. Web virginia sources in addition to pte income, they must file a nonresident individual income tax return (form 763) to account for that income. We last updated the credit computation schedule for forms 760, 760py, 763 and 765 in.

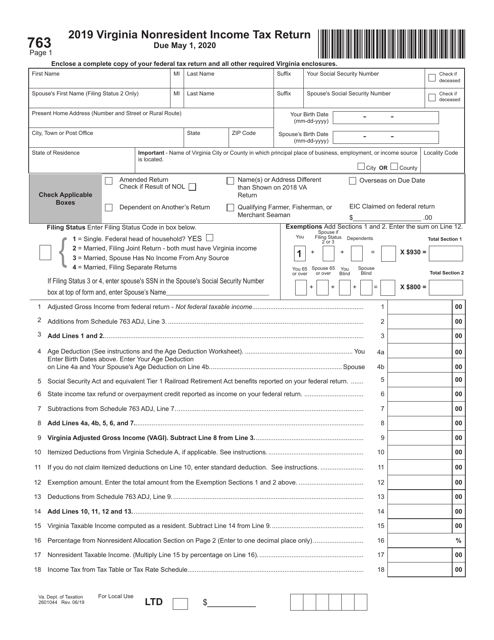

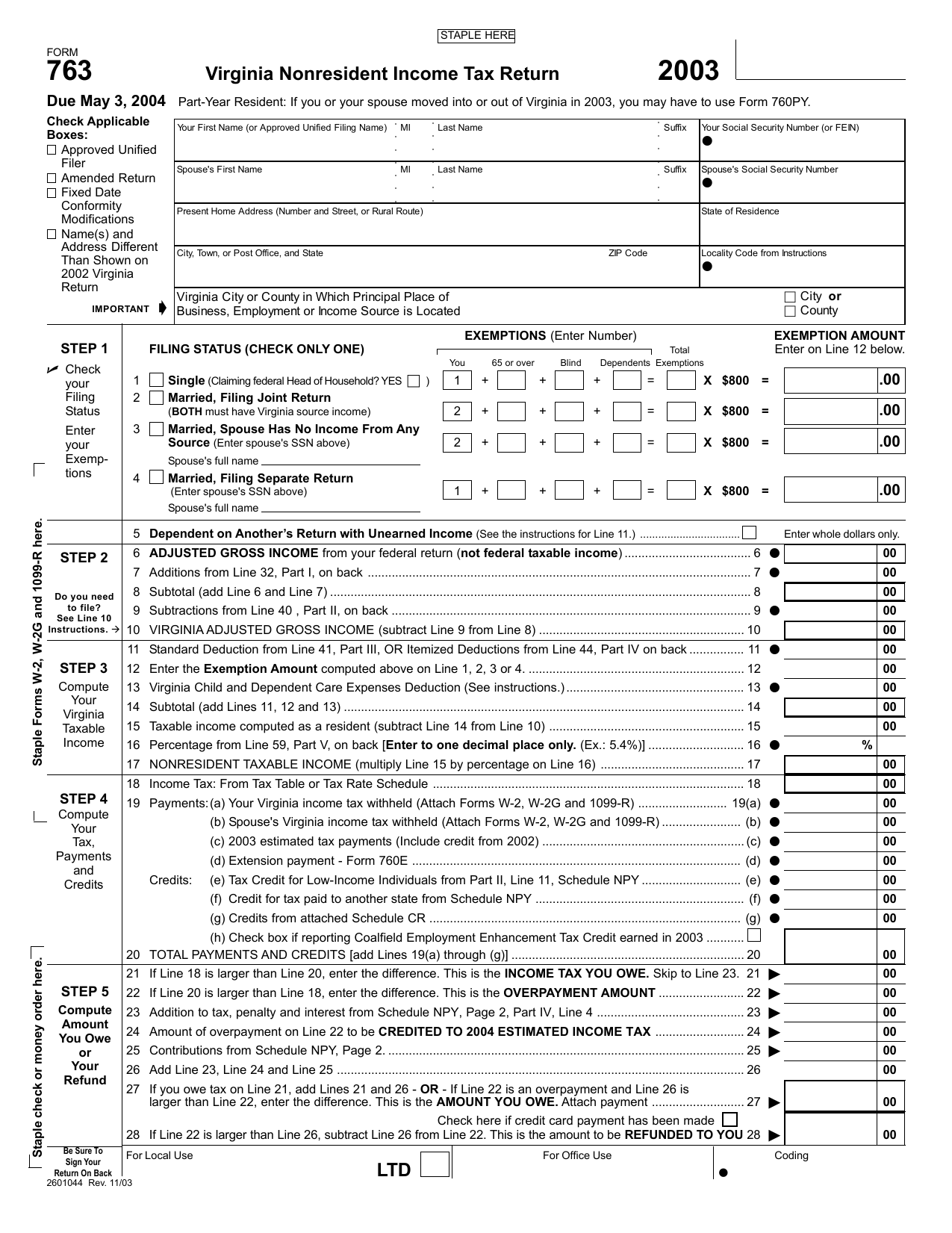

Form 763 Download Fillable PDF or Fill Online Virginia Nonresident

Web form 765 is an optional “unified return” (henceforth referred to as a composite return) that is filed by the pte on behalf of its qualified nonresident owners. Web virginia sources in addition to pte income, they must file a nonresident individual income tax return (form 763) to account for that income. Taxformfinder has an additional 135 virginia income tax.

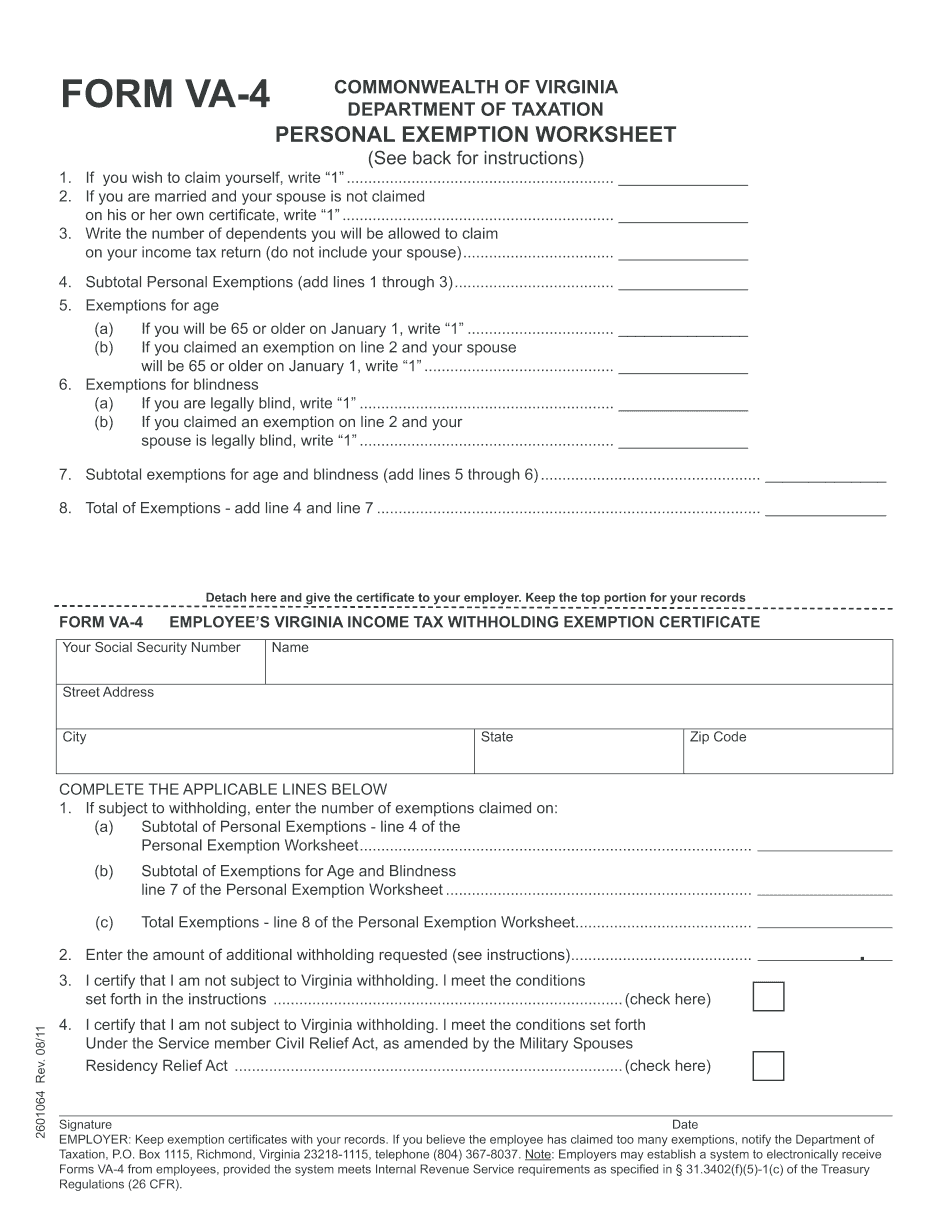

Virginia Form VA4 Printable (Employee's Withholding Exemption Certificate)

The individual may deduct income. We last updated the credit computation schedule for forms 760, 760py, 763 and 765 in january 2023, so this is the latest version of. Effective july 1, 2021, unified nonresidents must electronically file all installment payments of estimated tax and all. Replacement of lost, stolen, or damaged employment. Reason for applying am applying for (select.

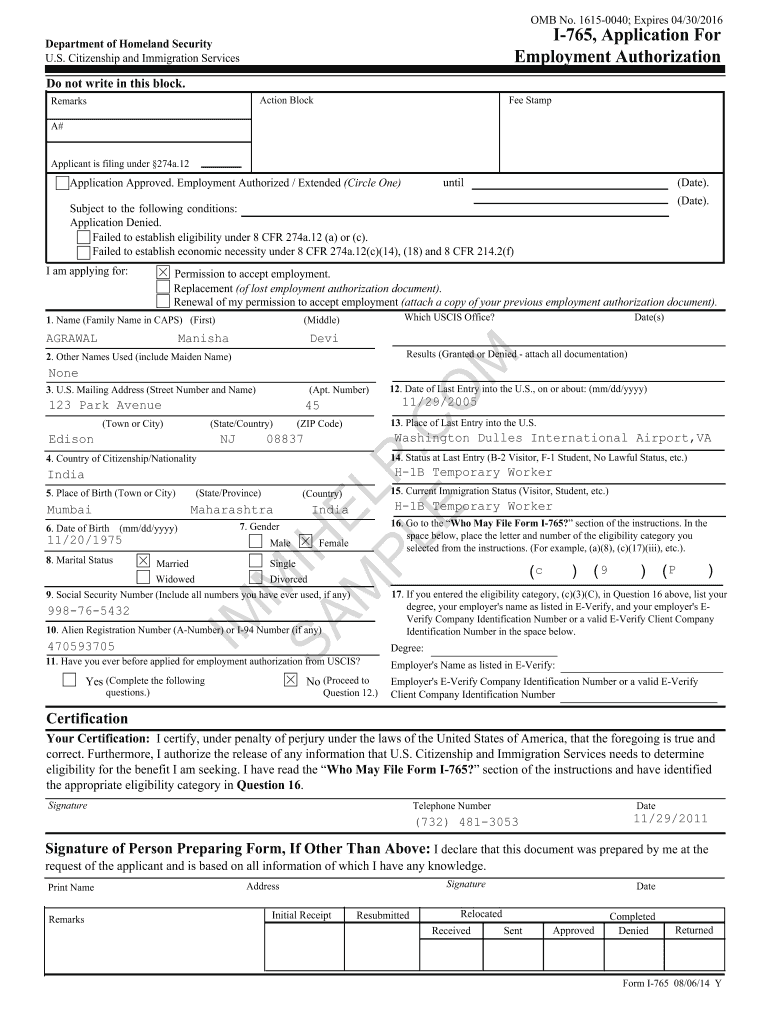

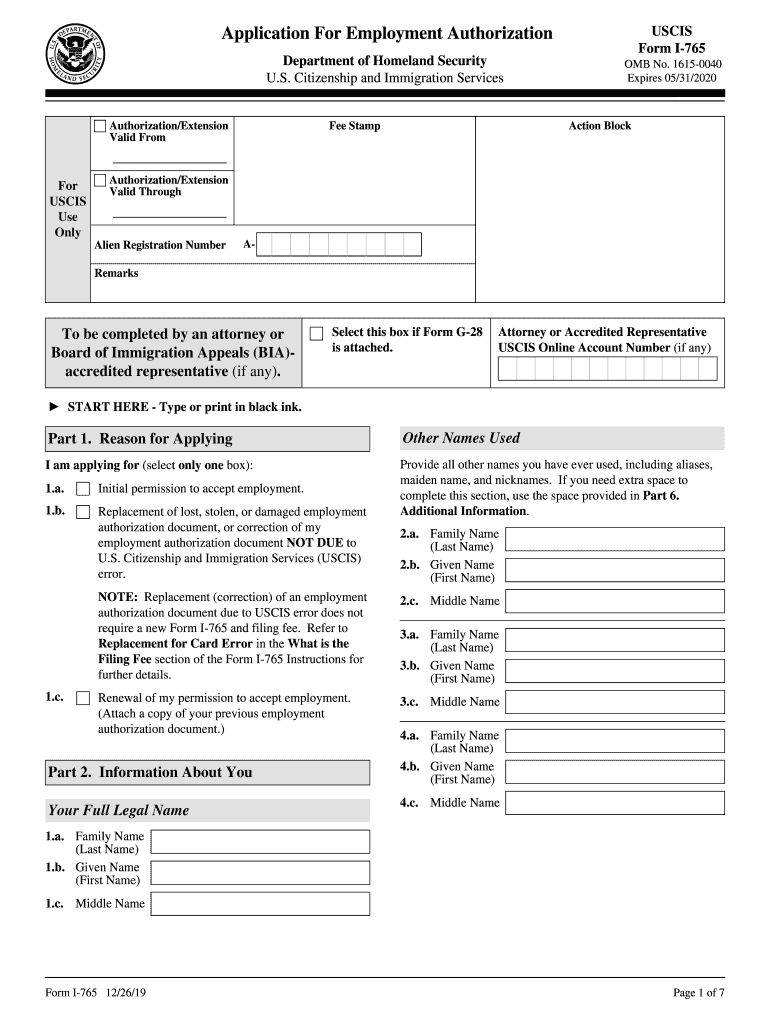

i 765 form sample Fill out & sign online DocHub

We last updated the credit computation schedule for forms 760, 760py, 763 and 765 in january 2023, so this is the latest version of. Web virginia sources in addition to pte income, they must file a nonresident individual income tax return (form 763) to account for that income. Effective july 1, 2021, unified nonresidents must electronically file all installment payments.

Virginia Form 763 designingreflections

Unified nonresident individual income tax return (composite return). The individual may deduct income. If all of the rules described in these instructions cannot be met, the pte must receive written approval from the tax commissioner before submitting a composite. Web form 765 is an optional “unified return” (henceforth referred to as a composite return) that is filed by the pte.

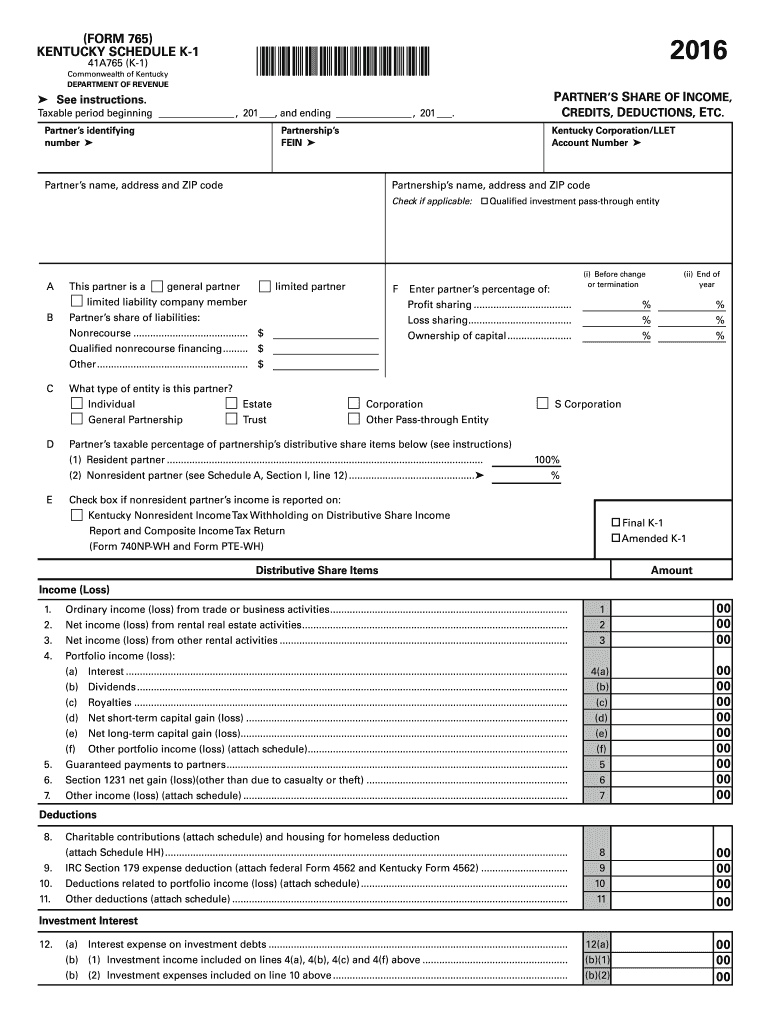

Kentucky Form 765 Fill Out and Sign Printable PDF Template signNow

We last updated the credit computation schedule for forms 760, 760py, 763 and 765 in january 2023, so this is the latest version of. Web file now with turbotax other virginia individual income tax forms: Replacement of lost, stolen, or damaged employment. All of the virginia source. Effective july 1, 2021, unified nonresidents must electronically file all installment payments of.

20192021 Form USCIS I765 Fill Online, Printable, Fillable, Blank

This form is for income earned in tax year 2022, with tax returns due in. Form 765 is an optional “unified return” (henceforth referred to as a composite return) that is filed by the pte on. If you are a lawful permanent resident, a conditional permanent resident, or a nonimmigrant only authorized for employment with a specific. Web virginia state.

Form 7652004 Virginia Unified Nonresident Tax Return

If all of the rules described in these instructions cannot be met, the pte must receive written approval from the tax commissioner before submitting a composite. All of the virginia source. Printable virginia state tax forms for the 2022 tax. Reason for applying am applying for (select only one box): Web virginia, filing may be simplified through the use of.

Initial Permission To Accept Employment.

We last updated the credit computation schedule for forms 760, 760py, 763 and 765 in january 2023, so this is the latest version of. Unified nonresident individual income tax return (composite return). Replacement of lost, stolen, or damaged employment. This form is for income earned in tax year 2022, with tax returns due in.

Web We Last Updated The Unified Nonresident Individual Income Tax Return In January 2023, So This Is The Latest Version Of Form 765, Fully Updated For Tax Year 2022.

Form 765 is an optional “unified return” (henceforth referred to as a composite return) that is filed by the pte on. Reason for applying am applying for (select only one box): Web virginia state income tax form 760 must be postmarked by may 1, 2023 in order to avoid penalties and late fees. If all of the rules described in these instructions cannot be met, the pte must receive written approval from the tax commissioner before submitting a composite.

Web We Last Updated Virginia Form 765 In January 2023 From The Virginia Department Of Taxation.

Web file now with turbotax other virginia individual income tax forms: The individual may deduct income. Taxformfinder has an additional 135 virginia income tax forms that you may need, plus all federal income. Effective july 1, 2021, unified nonresidents must electronically file all installment payments of estimated tax and all.

Web Item Numbers 1.

Web virginia sources in addition to pte income, they must file a nonresident individual income tax return (form 763) to account for that income. Web virginia, filing may be simplified through the use of the form 765. Printable virginia state tax forms for the 2022 tax. Web attach schedule cr to your return.