Virginia Military Tax Exemption Form

Virginia Military Tax Exemption Form - Web to apply for exemption, the following documentation is required: Web exemption for virginia national guard income: Web $10,000 of eligible military benefits on your tax year 2022 return; Ad signnow allows users to edit, sign, fill and share all type of documents online. Web learn more about the virginia income tax deduction for military pay. Web virginia is one of the few states to still tax military retirement compensation, and it's past time to alter that. Despite profiting over $8 billion on commercial and government dod. Web what form should i file | military spouse va. Web apply for the exemption with virginia tax; Some of the highlights include:.

Despite profiting over $8 billion on commercial and government dod. Web under hb 163, all retired armed forces veterans will have $10,000 exempted in tax year 2022 and $20,000 in 2023. Web to apply for exemption, the following documentation is required: From 2024 to 2026, there will be a $30,000. Web $10,000 of eligible military benefits on your tax year 2022 return; Web virginia veteran tax benefits include the following. National guard income for persons rank 03 and below may be subtracted from the return. Are issued a certificate of exemption by virginia tax. Web exemption for virginia national guard income: Web any person who is active duty military is exempt from taxation if their legal residence or domicile is outside of virginia, pursuant to the federal servicemembers civil relief act.

Virginia taxable income subtraction for military retired pay. Ad signnow allows users to edit, sign, fill and share all type of documents online. Web personal property titled jointly with a spouse may be eligible for exemption from the personal property tax, if the spouse also maintains a legal domicile outside of virginia. Virginia national guard service members, in. Web to apply for exemption, the following documentation is required: Web what form should i file | military spouse va. The amount cannot exceed $3,000 or the. Web exemption for virginia national guard income: Web beginning with tax year 2016, house bill 1589 (chapter 266) requires localities to apply 100% personal property tax relief to the first $20,000 of value on each qualifying vehicle. Despite profiting over $8 billion on commercial and government dod.

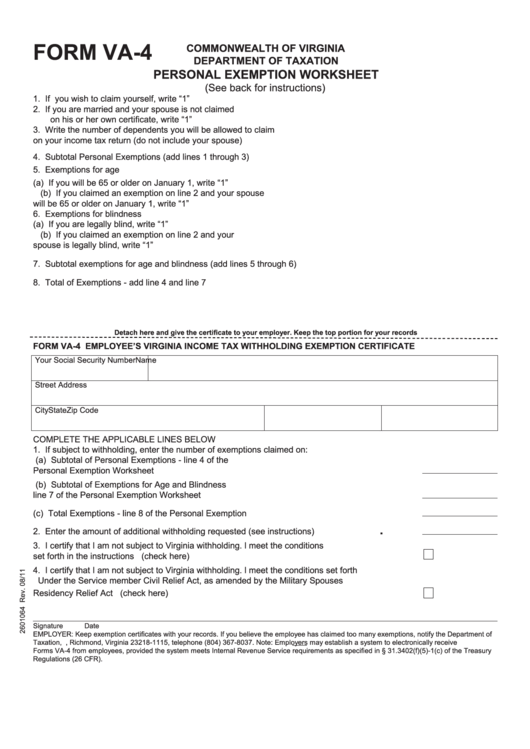

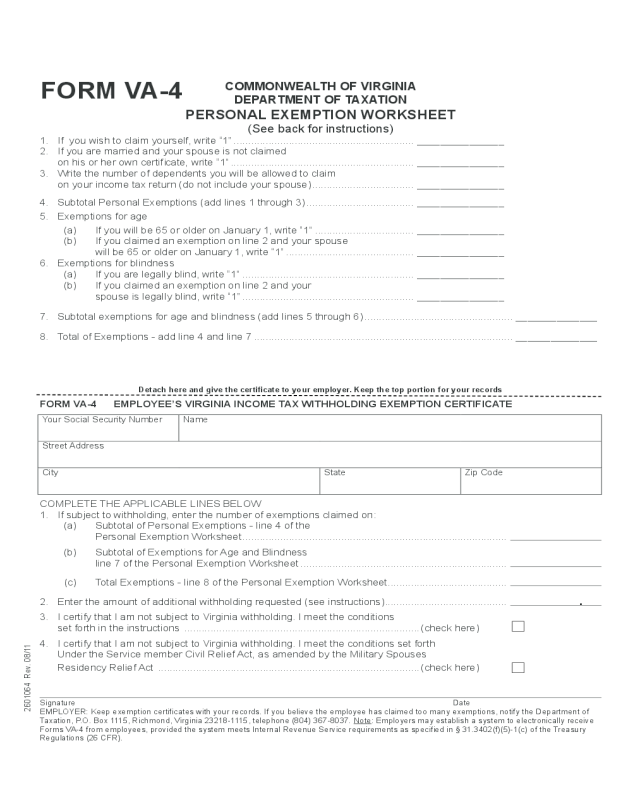

Fillable Form Va4 Personal Exemption Worksheet printable pdf download

Create legally binding electronic signatures on any device. Web to apply for an exemption, download and complete the application for vehicle tax exemption of military service member and/or spouse and submit along with the. Virginia national guard service members, in. The amount cannot exceed $3,000 or the. As a veteran over 55, you can deduct up to $40,000.

Employee's Withholding Exemption Certificate Virginia Edit, Fill

Some of the highlights include:. Are issued a certificate of exemption by virginia tax. Web any person who is active duty military is exempt from taxation if their legal residence or domicile is outside of virginia, pursuant to the federal servicemembers civil relief act. Web be exempt from virginia income tax on your wages if (i) your spouse is a.

Virginia Form VA4 Download Free & Premium Templates, Forms & Samples

National guard income for persons rank 03 and below may be subtracted from the return. Web learn more about the virginia income tax deduction for military pay. The amount cannot exceed $3,000 or the. Web beginning with tax year 2016, house bill 1589 (chapter 266) requires localities to apply 100% personal property tax relief to the first $20,000 of value.

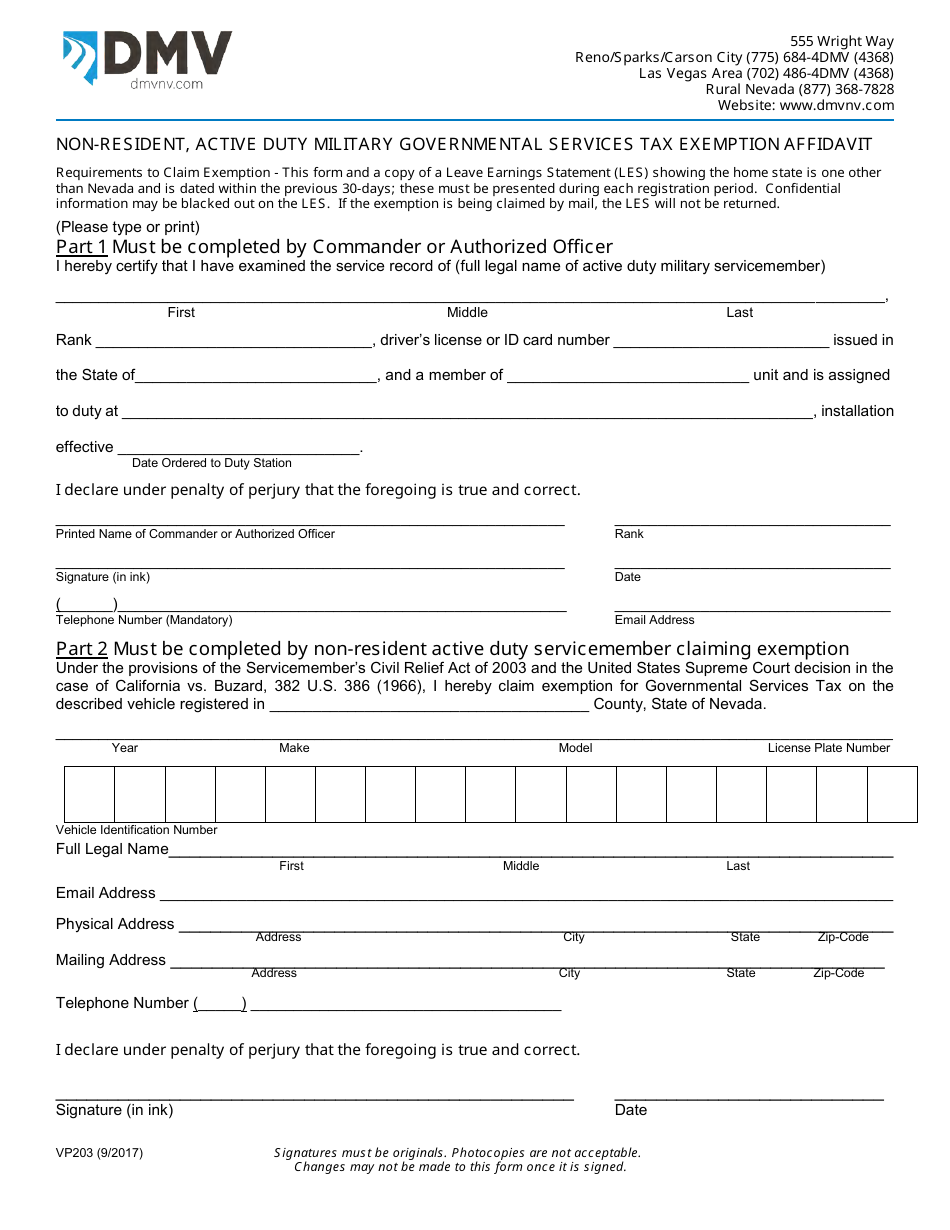

Form VP203 Download Fillable PDF or Fill Online Nonresident, Active

Ad signnow allows users to edit, sign, fill and share all type of documents online. National guard income for persons rank 03 and below may be subtracted from the return. Web beginning with tax year 2016, house bill 1589 (chapter 266) requires localities to apply 100% personal property tax relief to the first $20,000 of value on each qualifying vehicle..

Military Tax Exempt form Wonderful Arkansas State Tax software

Purchases of prepared or catered meals and. Web new virginia tax laws for july 1, 2022 starting july 1, 2022, a number of new state and local tax laws go into effect in virginia. Web to apply for an exemption, download and complete the application for vehicle tax exemption of military service member and/or spouse and submit along with the..

VA Application for Real Property Tax Relief for Veterans with Rated 100

From 2024 to 2026, there will be a $30,000. $20,000 of eligible military benefits on your tax year 2023 return; Web a vehicle purchased by the spouse of a qualifying veteran is also eligible for a sut exemption, provided the vehicle is used primarily by or for the qualifying veteran. As a veteran over 55, you can deduct up to.

2015 Form VA DoT ST11 Fill Online, Printable, Fillable, Blank pdfFiller

Web beginning with tax year 2016, house bill 1589 (chapter 266) requires localities to apply 100% personal property tax relief to the first $20,000 of value on each qualifying vehicle. Web exemption for virginia national guard income: Web virginia is one of the few states to still tax military retirement compensation, and it's past time to alter that. Web apply.

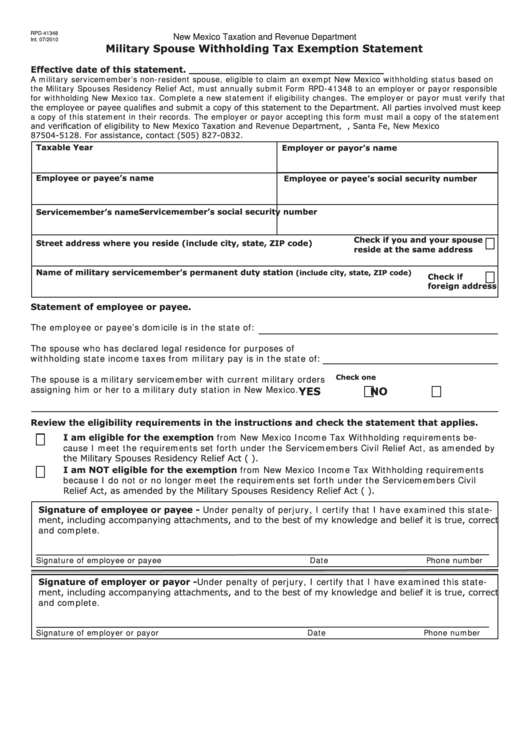

Military Spouse Withholding Tax Exemption Statement printable pdf download

Web virginia veteran tax benefits include the following. Virginia tax exemption for national guard income: Virginia taxable income subtraction for military retired pay. Web to apply for exemption, the following documentation is required: Web learn more about the virginia income tax deduction for military pay.

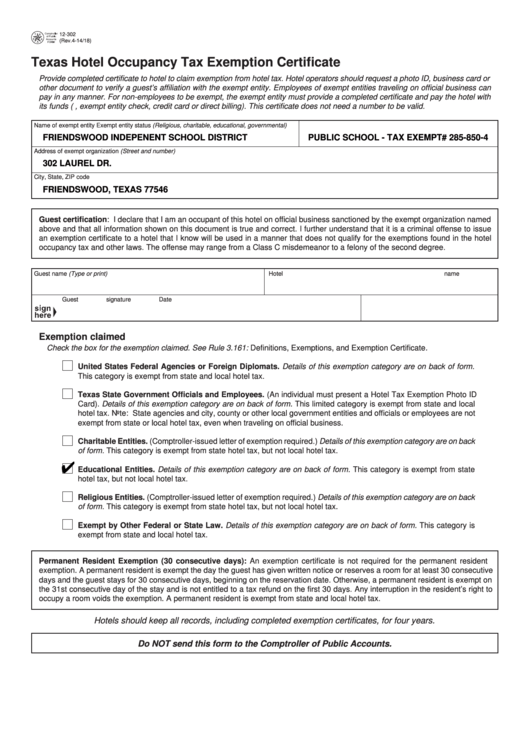

Fillable Form 12302, Hotel Occupancy Tax Exemption Certificate

Web virginia veteran tax benefits include the following. Web who reside in fairfax county solely on military orders may qualify for exemption from the local vehicle personal property tax based on certain qualifying conditions provided by the. Web new virginia tax laws for july 1, 2022 starting july 1, 2022, a number of new state and local tax laws go.

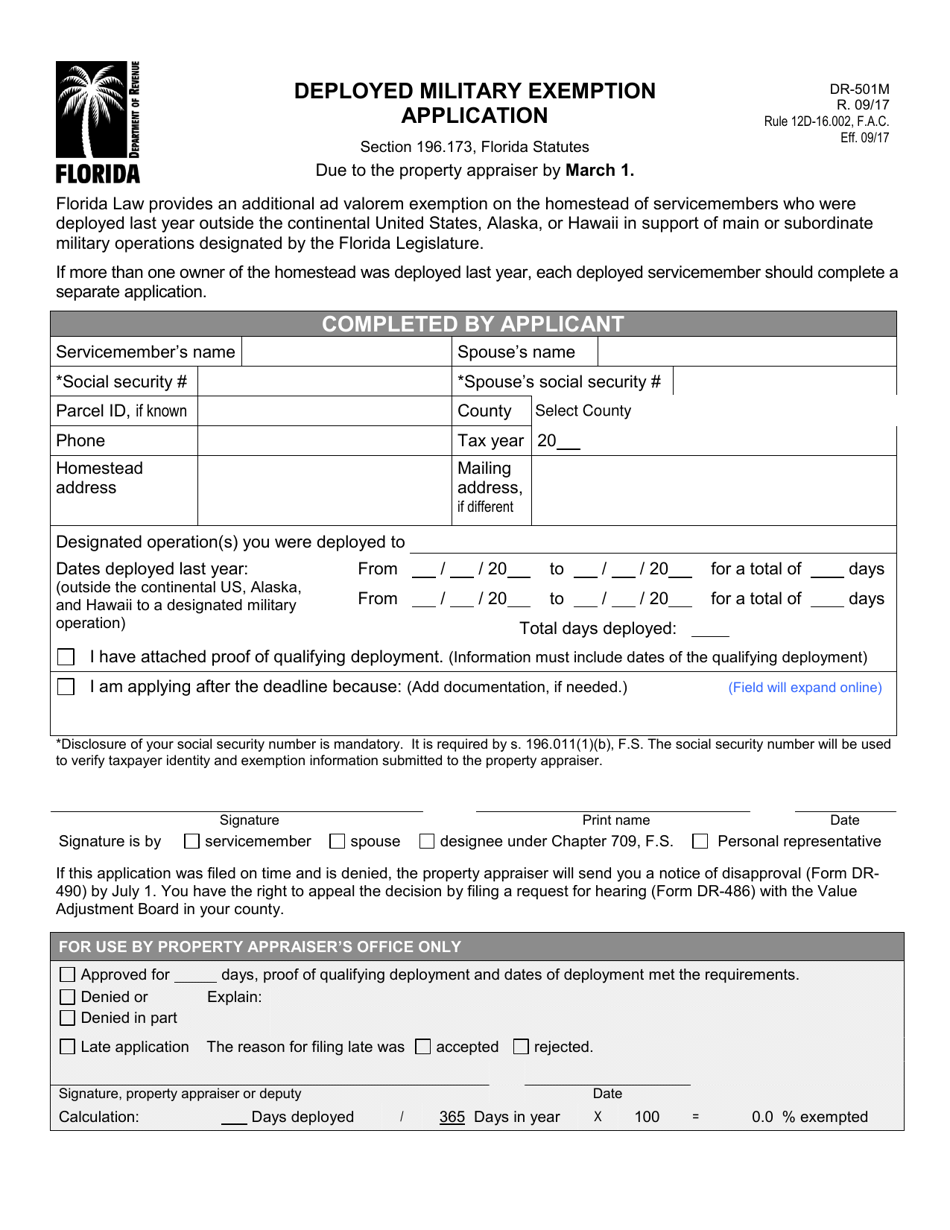

Form DR501M Download Fillable PDF or Fill Online Deployed Military

Web exemption for virginia national guard income: Despite profiting over $8 billion on commercial and government dod. $30,000 of eligible military benefits on. Web what form should i file | military spouse va. Web be exempt from virginia income tax on your wages if (i) your spouse is a member of the armed forces present in virginia in compliance with.

Web Virginia Is One Of The Few States To Still Tax Military Retirement Compensation, And It's Past Time To Alter That.

Web new virginia tax laws for july 1, 2022 starting july 1, 2022, a number of new state and local tax laws go into effect in virginia. Web a vehicle purchased by the spouse of a qualifying veteran is also eligible for a sut exemption, provided the vehicle is used primarily by or for the qualifying veteran. Web virginia veteran tax benefits include the following. Web any person who is active duty military is exempt from taxation if their legal residence or domicile is outside of virginia, pursuant to the federal servicemembers civil relief act.

Web An Active Duty Service Member Here On Military Orders Who Maintains Domicile Outside Of Virginia Is Exempt From Fairfax County's Personal Property Tax, Regardless Of Whether A.

Virginia national guard service members, in. $30,000 of eligible military benefits on. Web who reside in fairfax county solely on military orders may qualify for exemption from the local vehicle personal property tax based on certain qualifying conditions provided by the. Web be exempt from virginia income tax on your wages if (i) your spouse is a member of the armed forces present in virginia in compliance with military orders;

Ad Signnow Allows Users To Edit, Sign, Fill And Share All Type Of Documents Online.

From 2024 to 2026, there will be a $30,000. Some of the highlights include:. Web what form should i file | military spouse va. Purchases of prepared or catered meals and.

Web Learn More About The Virginia Income Tax Deduction For Military Pay.

Web to apply for an exemption, download and complete the application for vehicle tax exemption of military service member and/or spouse and submit along with the. Virginia taxable income subtraction for military retired pay. Web to apply for exemption, the following documentation is required: As a veteran over 55, you can deduct up to $40,000.