W-8Eci Form

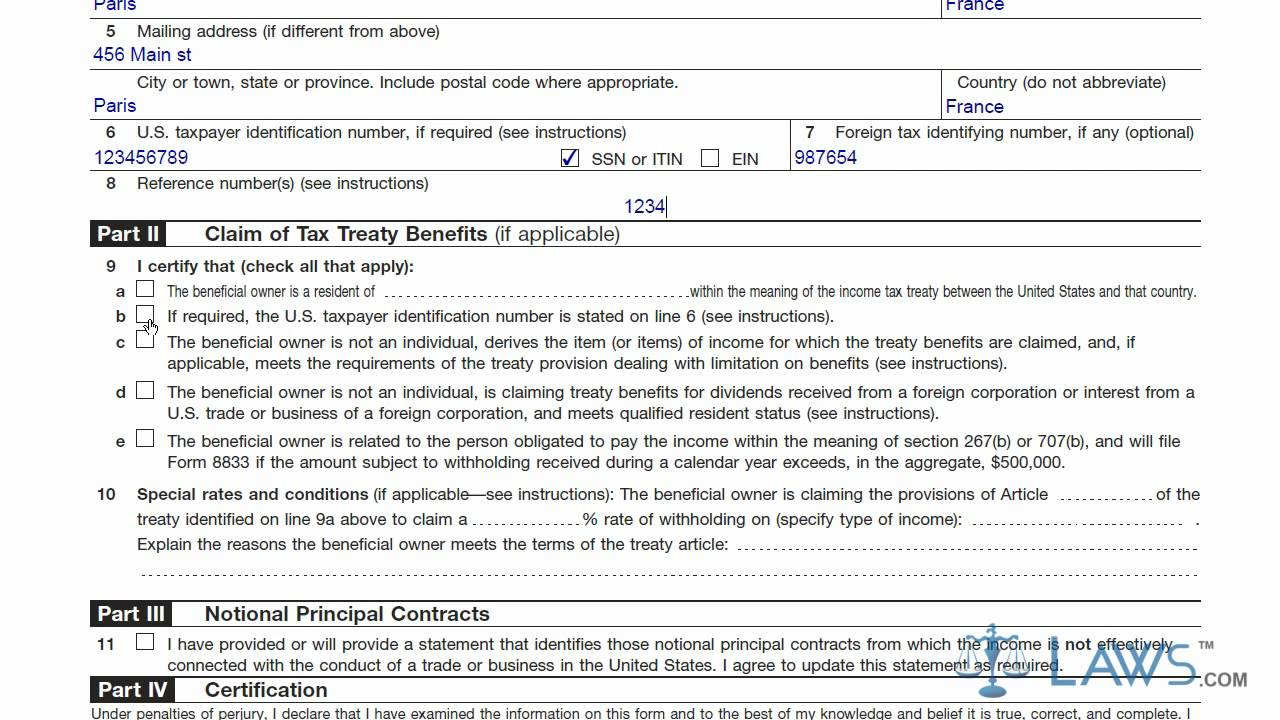

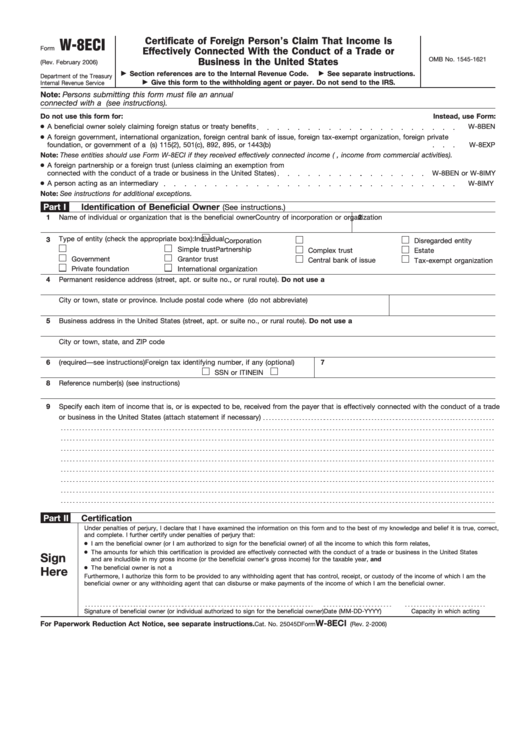

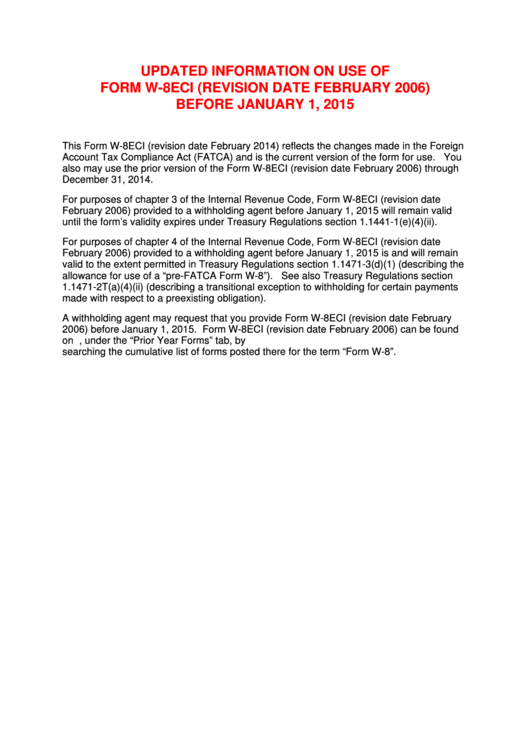

W-8Eci Form - October 2021) certificate of foreign person's claim that income is effectively connected with the conduct of a trade or business in the united states department of the treasury internal revenue service section references are to the internal revenue code. The type of income should be specified on line 11. Source income that is effectively connected with the conduct of a trade or business within the u.s. While these forms have a revision date of october 2021, the irs states that recipients of the form can accept a prior version of the form through. Go to www.irs.gov/formw8eci for instructions and the latest information. Income tax return to report income connected. The updates were necessary, in part, due to the 2017 tax law (pub.

The type of income should be specified on line 11. The updates were necessary, in part, due to the 2017 tax law (pub. Income tax return to report income connected. Source income that is effectively connected with the conduct of a trade or business within the u.s. Go to www.irs.gov/formw8eci for instructions and the latest information. October 2021) certificate of foreign person's claim that income is effectively connected with the conduct of a trade or business in the united states department of the treasury internal revenue service section references are to the internal revenue code. While these forms have a revision date of october 2021, the irs states that recipients of the form can accept a prior version of the form through.

While these forms have a revision date of october 2021, the irs states that recipients of the form can accept a prior version of the form through. October 2021) certificate of foreign person's claim that income is effectively connected with the conduct of a trade or business in the united states department of the treasury internal revenue service section references are to the internal revenue code. Income tax return to report income connected. The type of income should be specified on line 11. The updates were necessary, in part, due to the 2017 tax law (pub. Go to www.irs.gov/formw8eci for instructions and the latest information. Source income that is effectively connected with the conduct of a trade or business within the u.s.

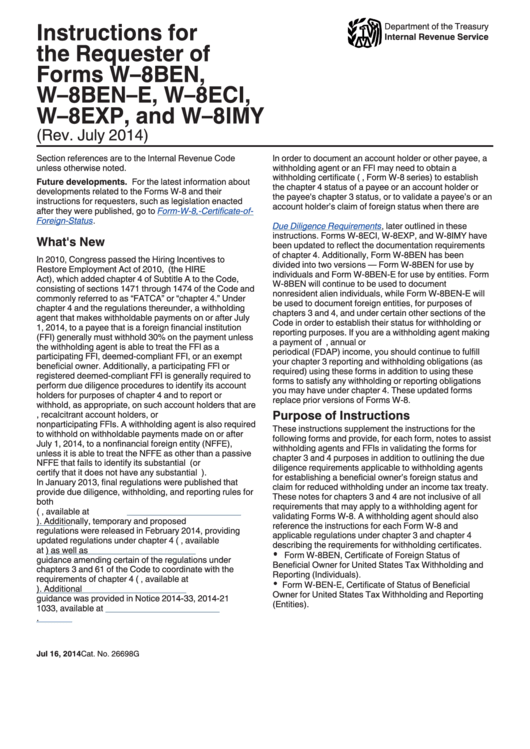

Form w 8eci instructions

October 2021) certificate of foreign person's claim that income is effectively connected with the conduct of a trade or business in the united states department of the treasury internal revenue service section references are to the internal revenue code. Income tax return to report income connected. Go to www.irs.gov/formw8eci for instructions and the latest information. Source income that is effectively.

Form W8ECI Certificate of Foreign Person's Claim That Is

While these forms have a revision date of october 2021, the irs states that recipients of the form can accept a prior version of the form through. Go to www.irs.gov/formw8eci for instructions and the latest information. Income tax return to report income connected. Source income that is effectively connected with the conduct of a trade or business within the u.s..

Fillable Form W8eci Certificate Of Foreign Person'S Claim That

The updates were necessary, in part, due to the 2017 tax law (pub. The type of income should be specified on line 11. Source income that is effectively connected with the conduct of a trade or business within the u.s. While these forms have a revision date of october 2021, the irs states that recipients of the form can accept.

W8 Forms Definition

October 2021) certificate of foreign person's claim that income is effectively connected with the conduct of a trade or business in the united states department of the treasury internal revenue service section references are to the internal revenue code. Source income that is effectively connected with the conduct of a trade or business within the u.s. The updates were necessary,.

Form W8BENE Certificate of Entities Status of Beneficial Owner for

The type of income should be specified on line 11. While these forms have a revision date of october 2021, the irs states that recipients of the form can accept a prior version of the form through. Source income that is effectively connected with the conduct of a trade or business within the u.s. Go to www.irs.gov/formw8eci for instructions and.

Irs Form W8 Printable Example Calendar Printable

The type of income should be specified on line 11. Go to www.irs.gov/formw8eci for instructions and the latest information. Source income that is effectively connected with the conduct of a trade or business within the u.s. While these forms have a revision date of october 2021, the irs states that recipients of the form can accept a prior version of.

Fillable Form W8eci Certificate Of Foreign Person'S Claim That

While these forms have a revision date of october 2021, the irs states that recipients of the form can accept a prior version of the form through. The type of income should be specified on line 11. Go to www.irs.gov/formw8eci for instructions and the latest information. October 2021) certificate of foreign person's claim that income is effectively connected with the.

Irs form 8288 b instructions

Income tax return to report income connected. October 2021) certificate of foreign person's claim that income is effectively connected with the conduct of a trade or business in the united states department of the treasury internal revenue service section references are to the internal revenue code. While these forms have a revision date of october 2021, the irs states that.

Form w 8eci instructions

Go to www.irs.gov/formw8eci for instructions and the latest information. The type of income should be specified on line 11. Source income that is effectively connected with the conduct of a trade or business within the u.s. While these forms have a revision date of october 2021, the irs states that recipients of the form can accept a prior version of.

Instructions For The Requester Of Forms W8ben, W8benE, W8eci, W

Source income that is effectively connected with the conduct of a trade or business within the u.s. October 2021) certificate of foreign person's claim that income is effectively connected with the conduct of a trade or business in the united states department of the treasury internal revenue service section references are to the internal revenue code. Income tax return to.

Source Income That Is Effectively Connected With The Conduct Of A Trade Or Business Within The U.s.

The updates were necessary, in part, due to the 2017 tax law (pub. The type of income should be specified on line 11. Go to www.irs.gov/formw8eci for instructions and the latest information. October 2021) certificate of foreign person's claim that income is effectively connected with the conduct of a trade or business in the united states department of the treasury internal revenue service section references are to the internal revenue code.

Income Tax Return To Report Income Connected.

While these forms have a revision date of october 2021, the irs states that recipients of the form can accept a prior version of the form through.

:max_bytes(150000):strip_icc()/W-8ECI-b53cb3dfa4714356b09222d307cbdcef.png)