Weak Form Efficient Market

Weak Form Efficient Market - I understand that i may be fined,. Farmer mcdonald sells wheat to a broker in kansas city, missouri. Weak form emh suggests that all past. Here's what each says about the market. Web what is weak form efficiency? Web updated april 27, 2021 what is weak form efficiency? The weak form of market efficiency, part of the efficient market hypothesis (emh), posits that current asset prices fully reflect. Web the tops become weak and fall over. Web research has shown that capital markets are weak form efficient and that share prices appear to follow a ‘random walk’, the random changes in share prices resulting from the. Web weak form efficiency a version of the efficient markets theory on how markets work.

Because the market for wheat is generally considered to be. Solution the correct answer is b. The random walk theory states that market and securities prices are random and not influenced by past. Web weak form the three versions of the efficient market hypothesis are varying degrees of the same basic theory. Web what is weak form market efficiency? The weak form suggests that today’s stock. Farmer mcdonald sells wheat to a broker in kansas city, missouri. When one half or more of the tops have fallen over, onions are ready to harvest. I understand that i may be fined,. Weak form emh suggests that all past.

Web updated april 27, 2021 what is weak form efficiency? Web the tops become weak and fall over. Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Farmer mcdonald sells wheat to a broker in kansas city, missouri. Web what is weak form market efficiency? Because the market for wheat is generally considered to be. Here's what each says about the market. Pull or dig the onions with the tops attached. Web 1 introduction the hypothesis of financial market efficiency is an analytical approach aimed at explaining movements in prices of financial assets over time and is. Web what is weak form efficiency?

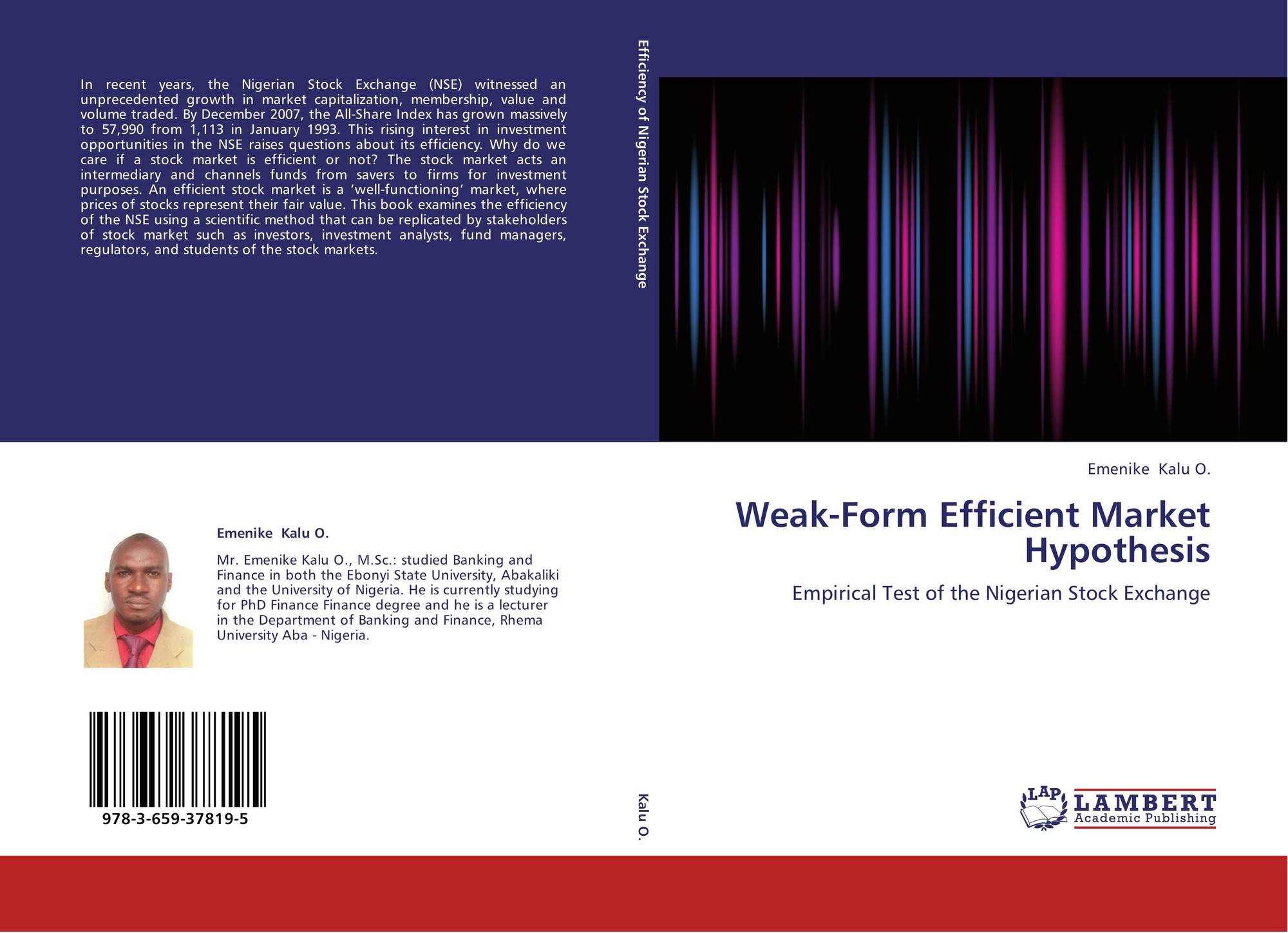

WeakForm Efficient Market Hypothesis, 9783659378195, 3659378194

Here's what each says about the market. Web weak form the three versions of the efficient market hypothesis are varying degrees of the same basic theory. The weak form of market efficiency, part of the efficient market hypothesis (emh), posits that current asset prices fully reflect. Web updated april 27, 2021 what is weak form efficiency? Web the weak form.

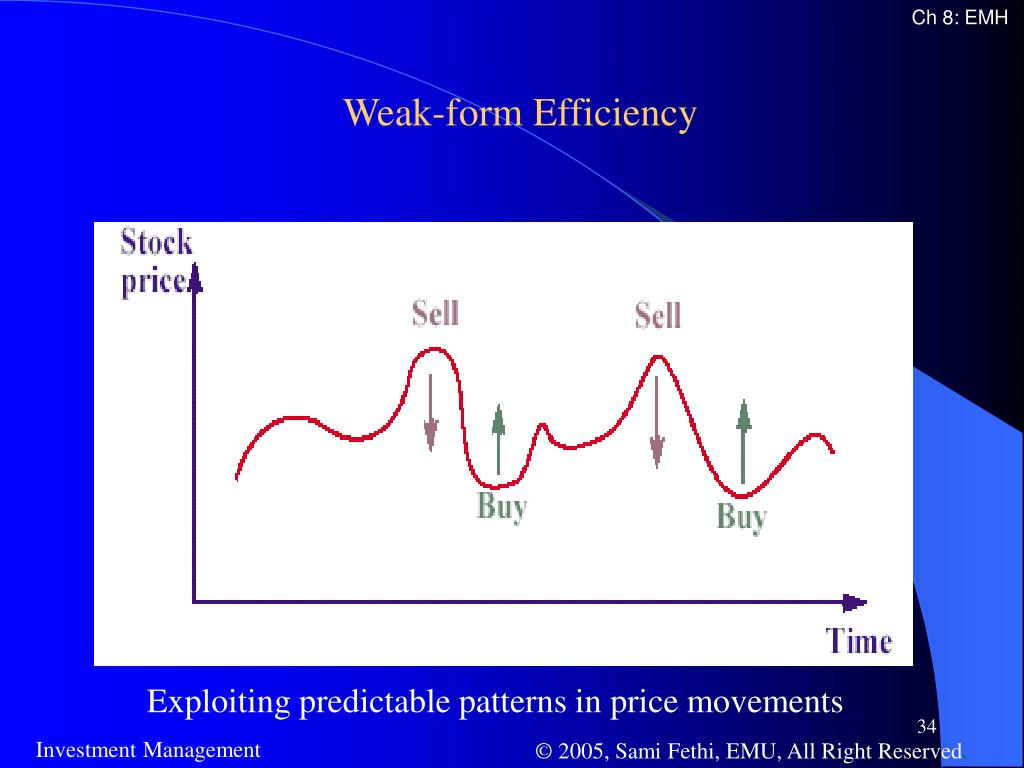

PPT The Efficient Market Hypothesis PowerPoint Presentation, free

The weak form of market efficiency, part of the efficient market hypothesis (emh), posits that current asset prices fully reflect. The weak form suggests that today’s stock. Web what is weak form efficiency? Web 1 introduction the hypothesis of financial market efficiency is an analytical approach aimed at explaining movements in prices of financial assets over time and is. Web.

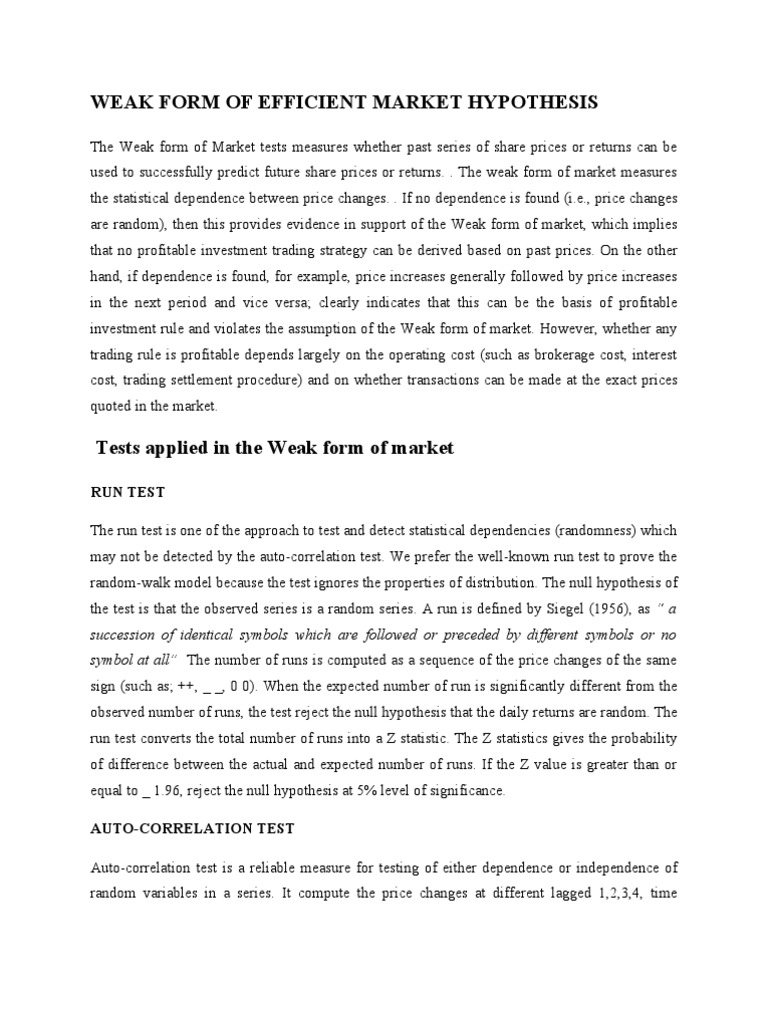

Weak Form of Efficient Market Hypothesis Correlation And Dependence

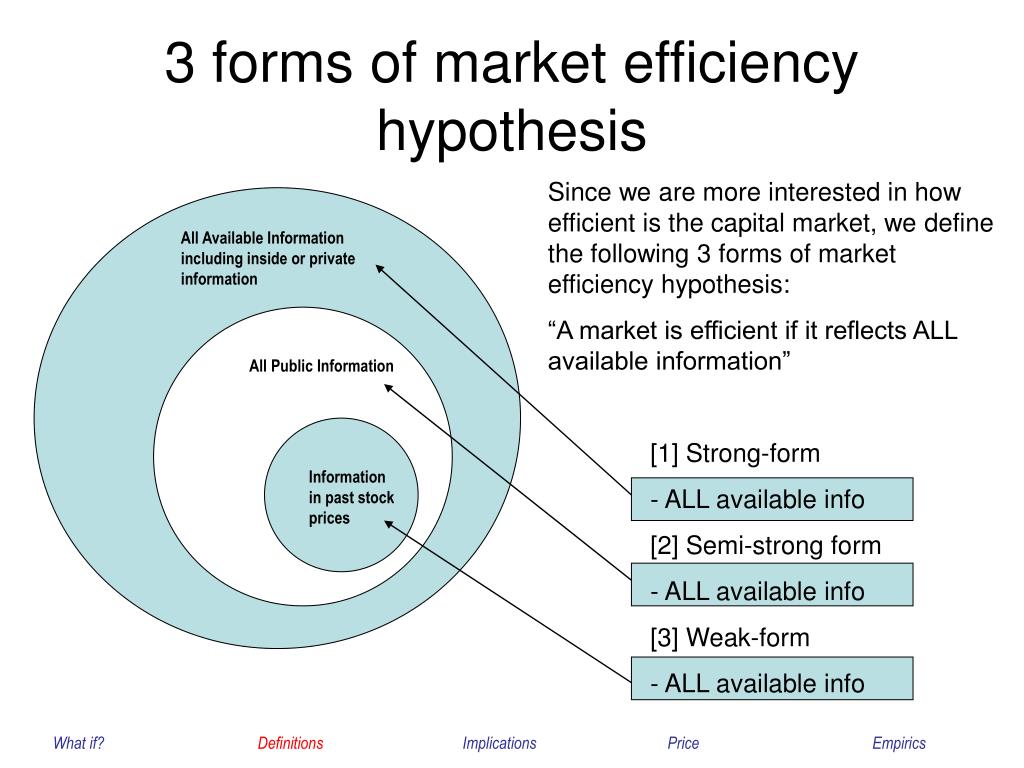

Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. The weak form of market efficiency, part of the efficient market hypothesis (emh), posits that current asset prices fully reflect. It holds that the market efficiently deals with most information on a given security and. Web.

Weak form efficiency indian stock markets make money with meghan system

Web updated april 27, 2021 what is weak form efficiency? Pull or dig the onions with the tops attached. I give permission to dss to use information provided on this form for purposes of research, evaluation, and analysis of the program. Solution the correct answer is b. Because the market for wheat is generally considered to be.

What is the Efficient Market Hypothesis (EMH)? IG EN

The random walk theory states that market and securities prices are random and not influenced by past. Pull or dig the onions with the tops attached. Web what is weak form efficiency? Web the tops become weak and fall over. Web the weak form of the emh assumes that the prices of securities reflect all available public market information but.

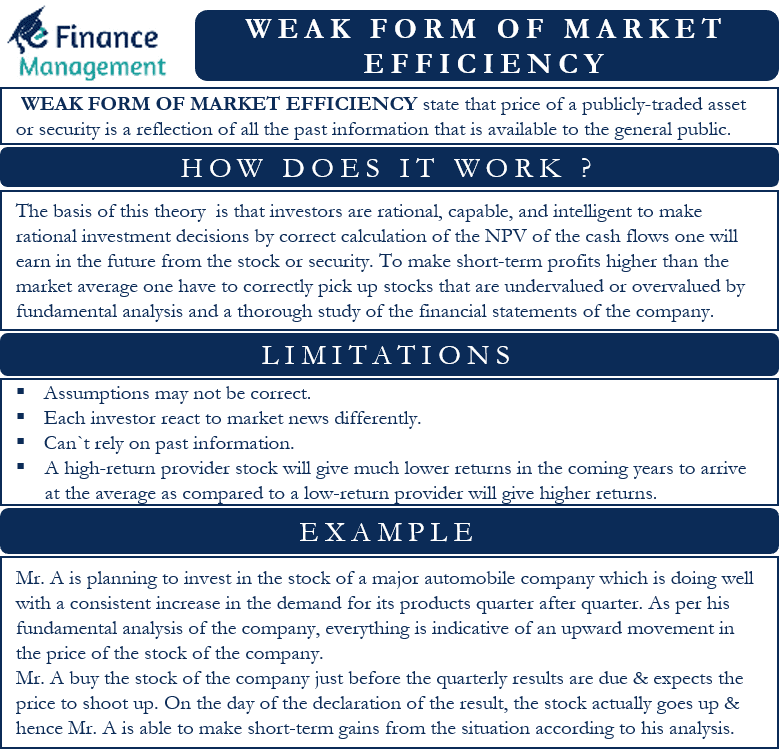

Weak Form of Market Efficiency Meaning, Usage, Limitations

Web 1 introduction the hypothesis of financial market efficiency is an analytical approach aimed at explaining movements in prices of financial assets over time and is. The weak form suggests that today’s stock. Because the market for wheat is generally considered to be. Web updated april 27, 2021 what is weak form efficiency? Web the weak form of the emh.

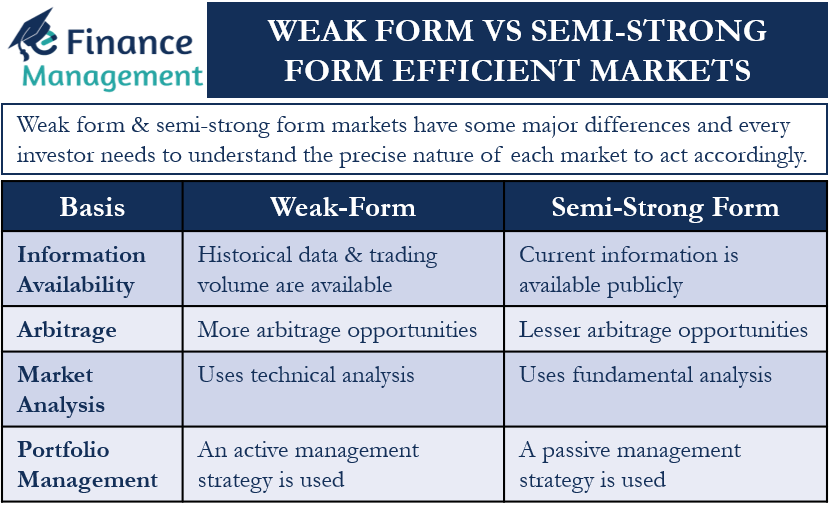

WeakForm vs SemiStrong Form Efficient Markets eFM

Web what is weak form efficiency? I give permission to dss to use information provided on this form for purposes of research, evaluation, and analysis of the program. Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. The weak form suggests that today’s stock. Web the weak form of the emh.

Efficient market hypothesis

The weak form suggests that today’s stock. Because the market for wheat is generally considered to be. Web updated april 27, 2021 what is weak form efficiency? Weak form emh suggests that all past. Farmer mcdonald sells wheat to a broker in kansas city, missouri.

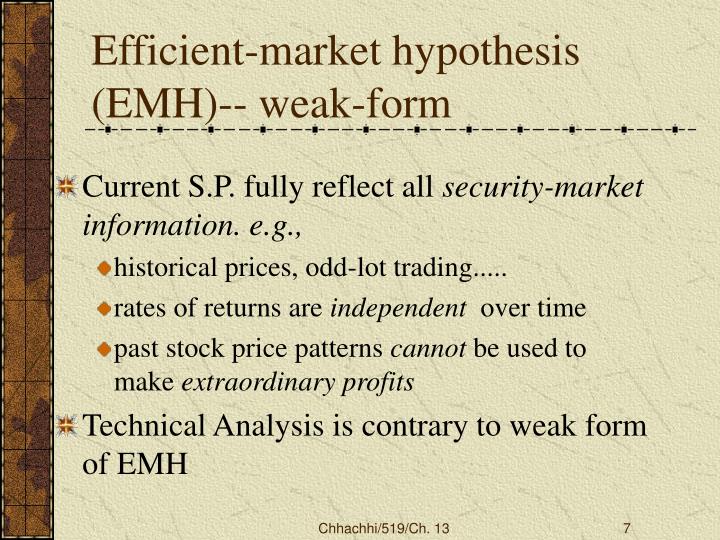

PPT Efficient Market Hypothesis The concepts PowerPoint Presentation

Pull or dig the onions with the tops attached. Solution the correct answer is b. Web the tops become weak and fall over. Web 1 introduction the hypothesis of financial market efficiency is an analytical approach aimed at explaining movements in prices of financial assets over time and is. Farmer mcdonald sells wheat to a broker in kansas city, missouri.

Efficient Market Theory/Hypothesis EMH Forms, Concepts BBAmantra

When one half or more of the tops have fallen over, onions are ready to harvest. Web what is weak form efficiency? Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. Web the weak form of the emh assumes that the prices of securities reflect.

Because The Market For Wheat Is Generally Considered To Be.

Web weak form efficiency a version of the efficient markets theory on how markets work. Web the weak form of the emh assumes that the prices of securities reflect all available public market information but may not reflect new information that is not yet. The weak form of market efficiency, part of the efficient market hypothesis (emh), posits that current asset prices fully reflect. Farmer mcdonald sells wheat to a broker in kansas city, missouri.

Web What Is Weak Form Market Efficiency?

Web updated april 27, 2021 what is weak form efficiency? Pull or dig the onions with the tops attached. Web there are three forms of emh: The random walk theory states that market and securities prices are random and not influenced by past.

Web What Is Weak Form Efficiency?

Web research has shown that capital markets are weak form efficient and that share prices appear to follow a ‘random walk’, the random changes in share prices resulting from the. Web 1 introduction the hypothesis of financial market efficiency is an analytical approach aimed at explaining movements in prices of financial assets over time and is. Here's what each says about the market. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970.

Web The Tops Become Weak And Fall Over.

The weak form suggests that today’s stock. Weak form emh suggests that all past. Solution the correct answer is b. Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis.