What Happens When I File Form 8919

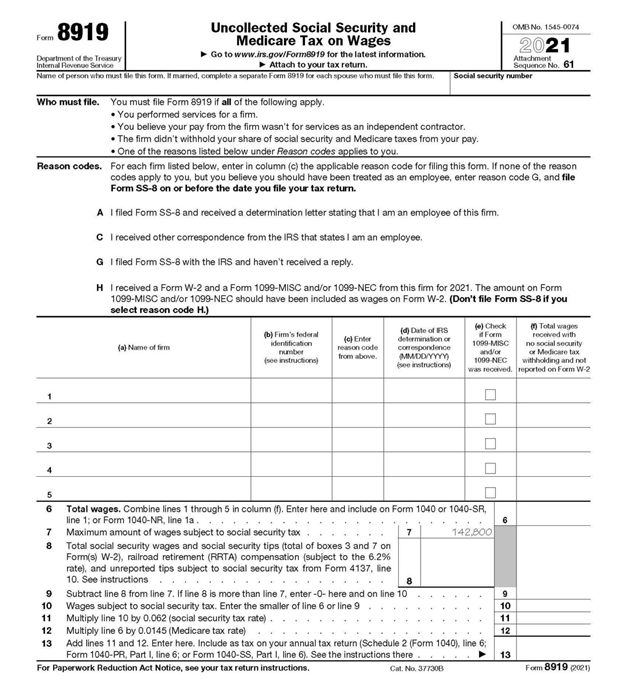

What Happens When I File Form 8919 - Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. If married, complete a separate form 8919 for each spouse who must file this form. By using form 8919, the worker’s social security and medicare taxes will be credited to their. Web up to 25% cash back by filing this form, your social security and medicare taxes will be credited to your social security record. Web the deadline for filing form 8919 is typically the same as the deadline for filing your income tax return, which is usually april 15th. The internal revenue service (irs) is more likely to consider you an employee if: Web taxpayers must file irs form 8919 if a firm paid them for services provided, the taxpayer believes that the work conducted for the organization was not in line with the services of. Web name of person who must file this form. • you believe your pay from the firm wasn’t for services as an independent contractor. You may be eligible for the foreign earned income exclusion.

• you believe your pay from the firm wasn’t for services as an independent contractor. Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social security and medicare taxes due on their. You may be eligible for the foreign earned income exclusion. Web form 8919 reports how much social security and medicare tax that you, the employer, should have paid to the worker while they were misclassified. Web who has the right to control your behavior at work? The internal revenue service (irs) is more likely to consider you an employee if: Web what is form 8919? If married, complete a separate form 8919 for each spouse who must file this form. • you performed services for a firm. 61 name of person who must file this form.

• you believe your pay from the firm wasn’t for services as an independent contractor. You believe your pay from the firm wasn’t for services as an. 61 name of person who must file this form. However, you must be able to claim one of the reasons. Web who has the right to control your behavior at work? Web the deadline for filing form 8919 is typically the same as the deadline for filing your income tax return, which is usually april 15th. Web up to 25% cash back by filing this form, your social security and medicare taxes will be credited to your social security record. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. You may be eligible for the foreign earned income exclusion.

IRS expands crypto question on draft version of 1040 Accounting Today

I strongly suggest you use a tax pro in the. Web name of person who must file this form. The business owner gives you. You believe your pay from the firm wasn’t for services as an. Web up to 25% cash back by filing this form, your social security and medicare taxes will be credited to your social security record.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

• you performed services for a firm. However, you must be able to claim one of the reasons. Web you must file form 8919 if all of the following apply. Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social security and medicare taxes due on their. 61 name.

Form 8919 Uncollected Social Security and Medicare Tax on Wages

Web taxpayers must file irs form 8919 if a firm paid them for services provided, the taxpayer believes that the work conducted for the organization was not in line with the services of. However, you must be able to claim one of the reasons. Web when filing a tax return, the worker uses form 8919 to calculate and report the.

Form 8919 on Tumblr

• you performed services for a firm. Web taxpayers must file irs form 8919 if a firm paid them for services provided, the taxpayer believes that the work conducted for the organization was not in line with the services of. You performed services for a firm. By using form 8919, the worker’s social security and medicare taxes will be credited.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web 2019 attachment sequence no. The internal revenue service (irs) is more likely to consider you an employee if: By using form 8919, the worker’s social security and medicare taxes will be credited to their. You performed services for a firm. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

When to Use IRS Form 8919 Uncollected Social Security and Medicare Tax

The internal revenue service (irs) is more likely to consider you an employee if: Workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and. The business owner gives you. By using form 8919, the worker’s social security and medicare taxes will be credited to their. If married, complete a.

Form 8809 Application for Extension of Time to File Information

Web taxpayers must file irs form 8919 if a firm paid them for services provided, the taxpayer believes that the work conducted for the organization was not in line with the services of. You believe your pay from the firm wasn’t for services as an. Web use form 8919 to figure and report your share of the uncollected social security.

Tl;dr OP camped in cabin innawoods in winter, encounter mysterious

Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social security and medicare taxes due on their. Web the deadline for filing form 8919 is typically the same as the deadline for filing your income tax return, which is usually april 15th. I strongly suggest you use a tax.

It Happens Professional Lice Services in Hockley, TX

Web 2019 attachment sequence no. Web who has the right to control your behavior at work? The internal revenue service (irs) is more likely to consider you an employee if: Web taxpayers must file irs form 8919 if a firm paid them for services provided, the taxpayer believes that the work conducted for the organization was not in line with.

Form 8919 2021 Fill Online, Printable, Fillable, Blank pdfFiller

However, you must be able to claim one of the reasons. You are likely preparing your return incorrectly. Web form 8919 reports how much social security and medicare tax that you, the employer, should have paid to the worker while they were misclassified. Web name of person who must file this form. I strongly suggest you use a tax pro.

Web Per Irs Form 8919, You Must File This Form If All Of The Following Apply.

If married, complete a separate form 8919 for each spouse who must file this form. Web who has the right to control your behavior at work? Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social security and medicare taxes due on their. Web what is form 8919?

Web Taxpayers Must File Irs Form 8919 If A Firm Paid Them For Services Provided, The Taxpayer Believes That The Work Conducted For The Organization Was Not In Line With The Services Of.

However, you must be able to claim one of the reasons. The business owner gives you. Workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as.

• You Performed Services For A Firm.

Web the deadline for filing form 8919 is typically the same as the deadline for filing your income tax return, which is usually april 15th. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. If married, complete a separate form 8919 for each spouse who must file this form. You are likely preparing your return incorrectly.

Web Form 8919 Reports How Much Social Security And Medicare Tax That You, The Employer, Should Have Paid To The Worker While They Were Misclassified.

If you fail to file on time, you may face. You may be eligible for the foreign earned income exclusion. By using form 8919, the worker’s social security and medicare taxes will be credited to their. Web name of person who must file this form.