What Is A 1088 Form

What Is A 1088 Form - Create professional documents with signnow. Web form 8810 2021 corporate passive activity loss and credit limitations department of the treasury internal revenue service attach to your tax return (personal service and. Each term is defined as follows: Web the dp 1088 is an electronic form and shall be completed and maintained electronically by both the provider and odp. Web personal service corporations and closely held corporations use this form to: Web enter the net income, if any, from form 8810, line 1d. Get your fillable template and complete it online using the instructions provided. This form is to be used to compare the borrower's business over a period of years. Individual income tax return,” is a form that taxpayers can file with the irs if. The 1088 tax form is used by businesses who have received payments from other companies in what's called barter transactions.

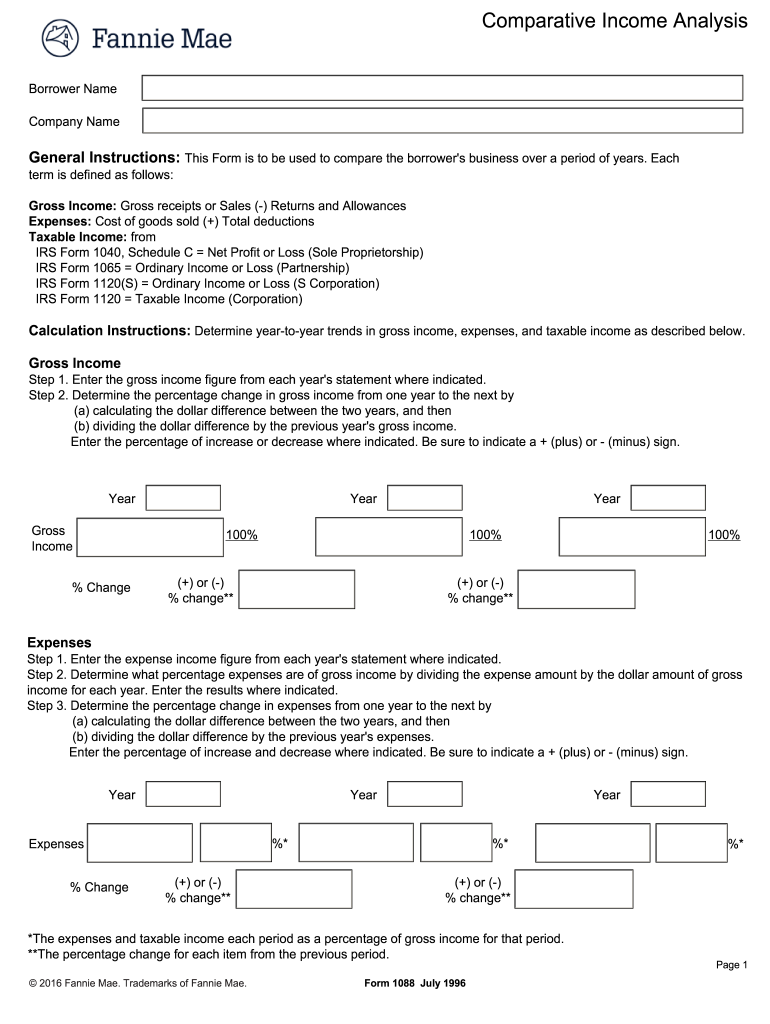

Web fair labor standards act (flsa) minimum wage poster. This form is to be used to compare the borrower's business over a period of years. Web what is a 1088 form? Sign it in a few clicks draw your signature, type it,. Web the dp 1088 is an electronic form and shall be completed and maintained electronically by both the provider and odp. Web quick guide on how to complete 1088 form irs. Web use this quick reference guide for fannie mae’s comparative analysis form (form 1088). Each term is defined as follows: These forms are provided for use in meeting our selling and servicing guides requirements. Fannie mae comparative analysis form 1088 calculate increases/decreases in gross.

Individual income tax return,” is a form that taxpayers can file with the irs if. Fannie mae comparative analysis form 1088 calculate increases/decreases in gross. The dp 1088 includes detailed instructions on how providers. These forms are provided for use in meeting our selling and servicing guides requirements. Web fair labor standards act (flsa) minimum wage poster. The 1088 tax form is used by businesses who have received payments from other companies in what's called barter transactions. Individual income tax return, is the only form used for personal (individual) federal income tax returns filed with the irs. Web use this quick reference guide for fannie mae’s comparative analysis form (form 1088). Use our detailed instructions to fill out and esign your documents online. Each term is defined as follows:

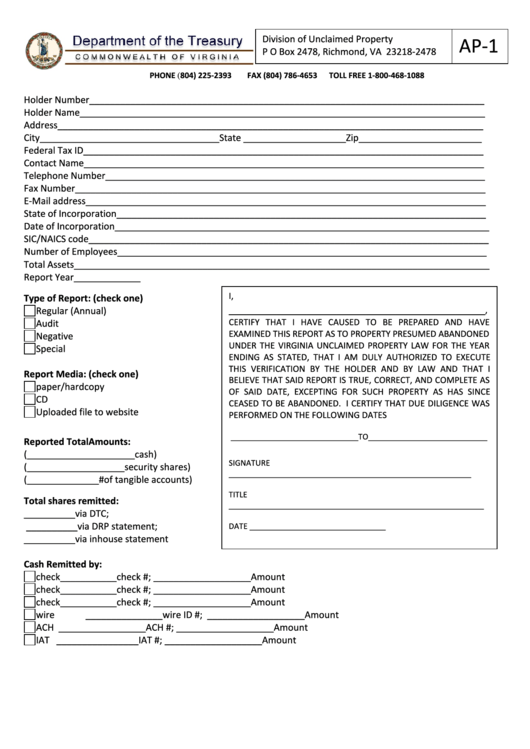

Fillable Form Ap1 Submission Of All Unclaimed Property Reports

Every employer of employees subject to the fair labor standards act's minimum wage provisions must post, and keep. Individual income tax return, is the only form used for personal (individual) federal income tax returns filed with the irs. Web use this quick reference guide for fannie mae’s comparative analysis form (form 1088). Web quick guide on how to complete 1088.

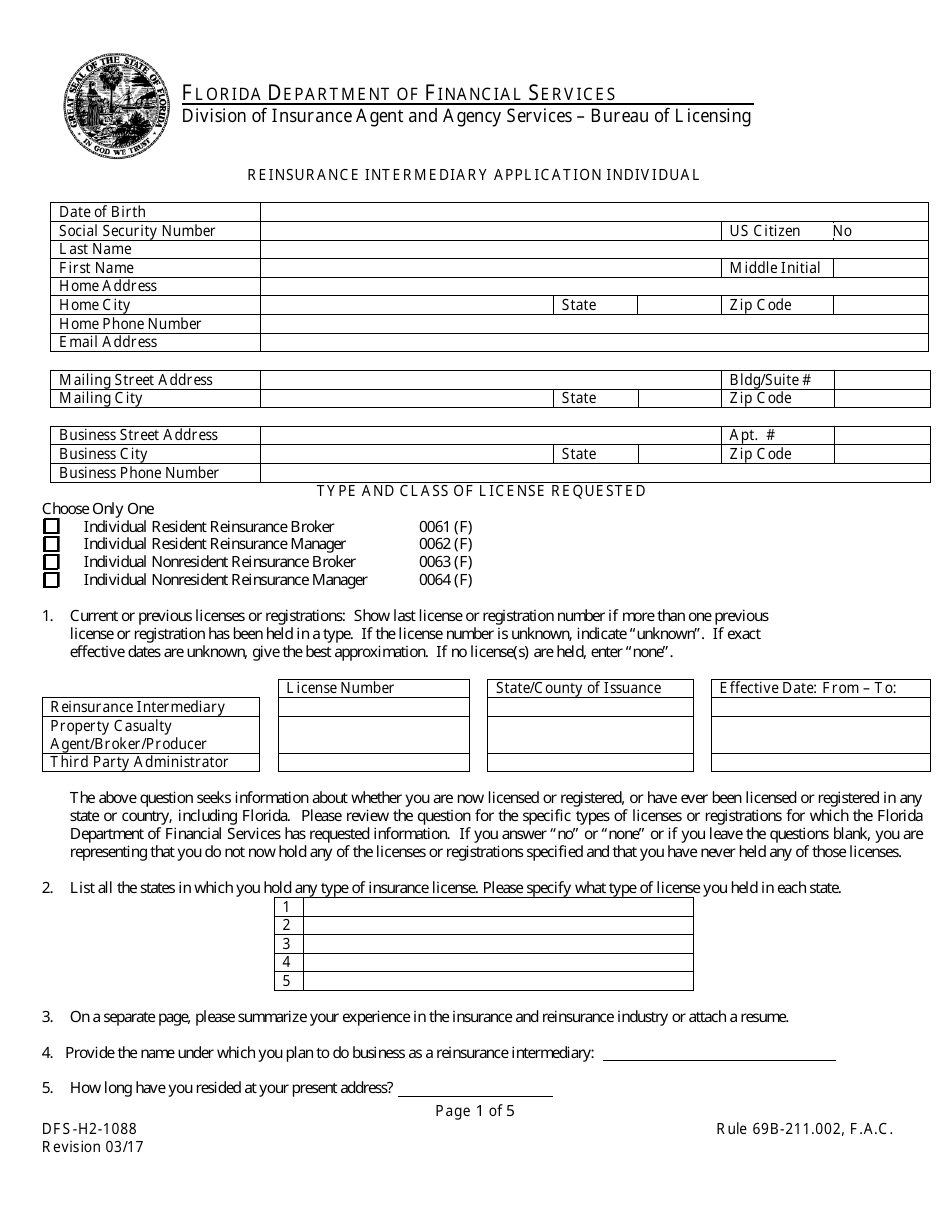

Form DFSH21088 Download Fillable PDF or Fill Online Reinsurance

Individual income tax return,” is a form that taxpayers can file with the irs if. Web quick guide on how to complete 1088 form irs. These forms are provided for use in meeting our selling and servicing guides requirements. Web fair labor standards act (flsa) minimum wage poster. Web as of the 2018 tax year, form 1040, u.s.

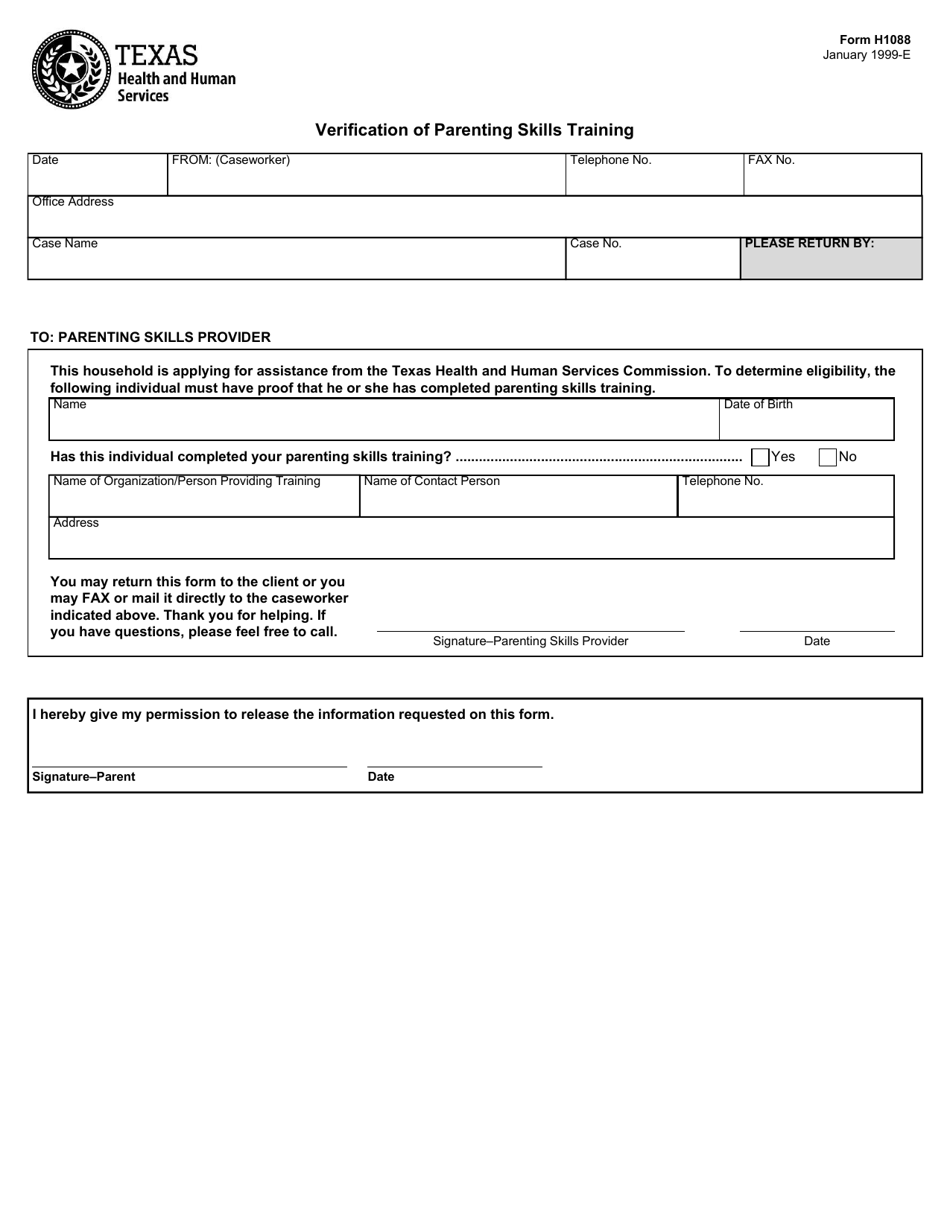

Hhsc Form H1088 Download Fillable Pdf Or Fill Online Verification Of

The internal revenue service uses the information on this form to. These forms are provided for use in meeting our selling and servicing guides requirements. The 1088 tax form is used by businesses who have received payments from other companies in what's called barter transactions. Web what is a 1088 form? Forget about scanning and printing out forms.

Form 1088 Comparative Analysis Blueprint

Web quick guide on how to complete 1088 form irs. Use our detailed instructions to fill out and esign your documents online. Gross receipts or sales (. Web fair labor standards act (flsa) minimum wage poster. Each term is defined as follows:

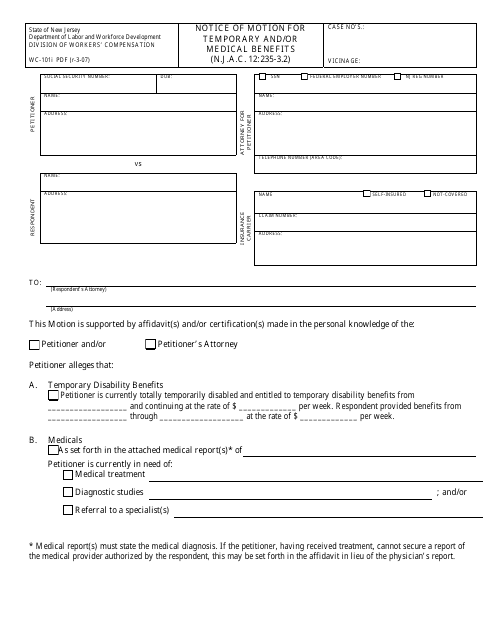

Form WC101I Download Fillable PDF or Fill Online Notice of Motion for

This form is to be used to compare the borrower's business over a period of years. Forget about scanning and printing out forms. Specifically, the form requires information about the mortgage lender,. These forms are provided for use in meeting our selling and servicing guides requirements. Use our detailed instructions to fill out and esign your documents online.

FIA Historic Database

Forget about scanning and printing out forms. Sign it in a few clicks draw your signature, type it,. Web personal service corporations and closely held corporations use this form to: Web what is a 1088 form? Edit your irs form 1088 online type text, add images, blackout confidential details, add comments, highlights and more.

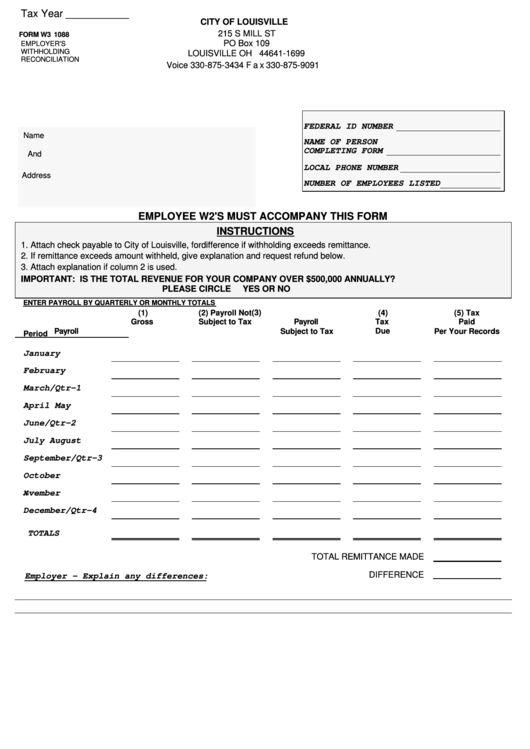

Fillable Form W3 1088 Employer'S Withholding Reconciliation City Of

Sign it in a few clicks draw your signature, type it,. Gross receipts or sales (. Forget about scanning and printing out forms. Each term is defined as follows: Specifically, the form requires information about the mortgage lender,.

1088 Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

Individual income tax return,” is a form that taxpayers can file with the irs if. Web use this quick reference guide for fannie mae’s comparative analysis form (form 1088). Figure the amount of any passive activity loss (pal) or credit for the current tax year and. Web form 6088 is used to report the 25 highest participants of a deferred.

IRS Form 8868 Download Fillable PDF or Fill Online Application for

Gross receipts or sales (. Get your fillable template and complete it online using the instructions provided. Use our detailed instructions to fill out and esign your documents online. Individual income tax return, is the only form used for personal (individual) federal income tax returns filed with the irs. Web fair labor standards act (flsa) minimum wage poster.

1088 Tax Form ≡ Fill Out Printable PDF Forms Online

Individual income tax return,” is a form that taxpayers can file with the irs if. Gross receipts or sales (. The internal revenue service uses the information on this form to. Create professional documents with signnow. Get your fillable template and complete it online using the instructions provided.

Individual Income Tax Return, Is The Only Form Used For Personal (Individual) Federal Income Tax Returns Filed With The Irs.

Web what is a 1088 form? Web enter the net income, if any, from form 8810, line 1d. The 1088 tax form is used by businesses who have received payments from other companies in what's called barter transactions. This form is to be used to compare the borrower's business over a period of years.

Web Use This Quick Reference Guide For Fannie Mae’s Comparative Analysis Form (Form 1088).

Gross receipts or sales (. Use our detailed instructions to fill out and esign your documents online. Specifically, the form requires information about the mortgage lender,. Individual income tax return,” is a form that taxpayers can file with the irs if.

Forget About Scanning And Printing Out Forms.

Web form 8810 2021 corporate passive activity loss and credit limitations department of the treasury internal revenue service attach to your tax return (personal service and. Get your fillable template and complete it online using the instructions provided. Fannie mae comparative analysis form 1088 calculate increases/decreases in gross. Web what is a 1088 form?

The Internal Revenue Service Uses The Information On This Form To.

If the corporation has an overall loss from the entire disposition of a passive activity, the amount to enter on line c is the net. Every employer of employees subject to the fair labor standards act's minimum wage provisions must post, and keep. Figure the amount of any passive activity loss (pal) or credit for the current tax year and. Web fair labor standards act (flsa) minimum wage poster.