What Is A Reaffirmation Agreement In A Chapter 7

What Is A Reaffirmation Agreement In A Chapter 7 - Web reaffirmation is a process that allows a debtor to keep certain assets they might otherwise lose under chapter 7 by reaffirming their commitment to make payments on the loan secured by the. A reaffirmation agreement holds the. Under a reaffirmation agreement, you agree to pay a debt even though you could have eliminated the debt in your bankruptcy case. It establishes the terms and conditions of. When the debtor signs the reaffirmation agreement, they agree to. Web the purpose of a bankruptcy reaffirmation agreement is to protect all parties with a financial and legal interest in the chapter 7 bankruptcy proceedings. Web certain debts can not be discharged in a chapter 7 or a chapter 13 bankruptcy case. After your debts are erased by a chapter 7 discharge, you can't file another chapter 7. Web a reaffirmation agreement is a written contract between the debtor filing chapter 7 bankruptcy and the lender or creditor. A reaffirmation agreement can lead to new debt problems if you later default on your loan payments.

“reaffirm,” essentially means “puts you back on the hook.” a reaffirmed debt is not discharged at the end of the chapter 7. Web the purpose of a bankruptcy reaffirmation agreement is to protect all parties with a financial and legal interest in the chapter 7 bankruptcy proceedings. Web a reaffirmation agreement is a new contract between you and your car lender that reinstates your liability to pay the loan again. Web a reaffirmation agreement allows you keep any recently purchased property if you can keep up with the payments, essentially reaffirming in a contract that you will continue to be responsible for the debt. Most people need a car to travel to work, school, and medical appointments. Web you have options for what to do with a car loan when filing a chapter 7 bankruptcy case. Some bankruptcy courts don't like debtors to reaffirm loans because it requires them to. Web a chapter 7 case begins with the debtor filing a petition with the bankruptcy court serving the area where the individual lives or where the business debtor is organized or has its principal place of business or principal. A reaffirmation agreement can lead to new debt problems if you later default on your loan payments. Usually, the debt is secured b

Most people need a car to travel to work, school, and medical appointments. You are not required to reaffirm any debt or sign any agreement regarding a. Web in chapter 7 bankruptcy, a reaffirmation agreement provides a way to keep collateral, as long as payments and conditions of the reaffirmation agreement are met. A reaffirmation agreement holds the. Web a chapter 7 case begins with the debtor filing a petition with the bankruptcy court serving the area where the individual lives or where the business debtor is organized or has its principal place of business or principal. Web reaffirmation agreements are a special feature of chapter 7 bankruptcy. Web a reaffirmation agreement is an agreement between a chapter 7 debtor and a creditor that the debtor will pay all or a portion of the money owed, even though the debtor has filed bankruptcy. If they lost their vehicle, many wouldn't have a way to buy another. It establishes the terms and conditions of. Some bankruptcy courts don't like debtors to reaffirm loans because it requires them to.

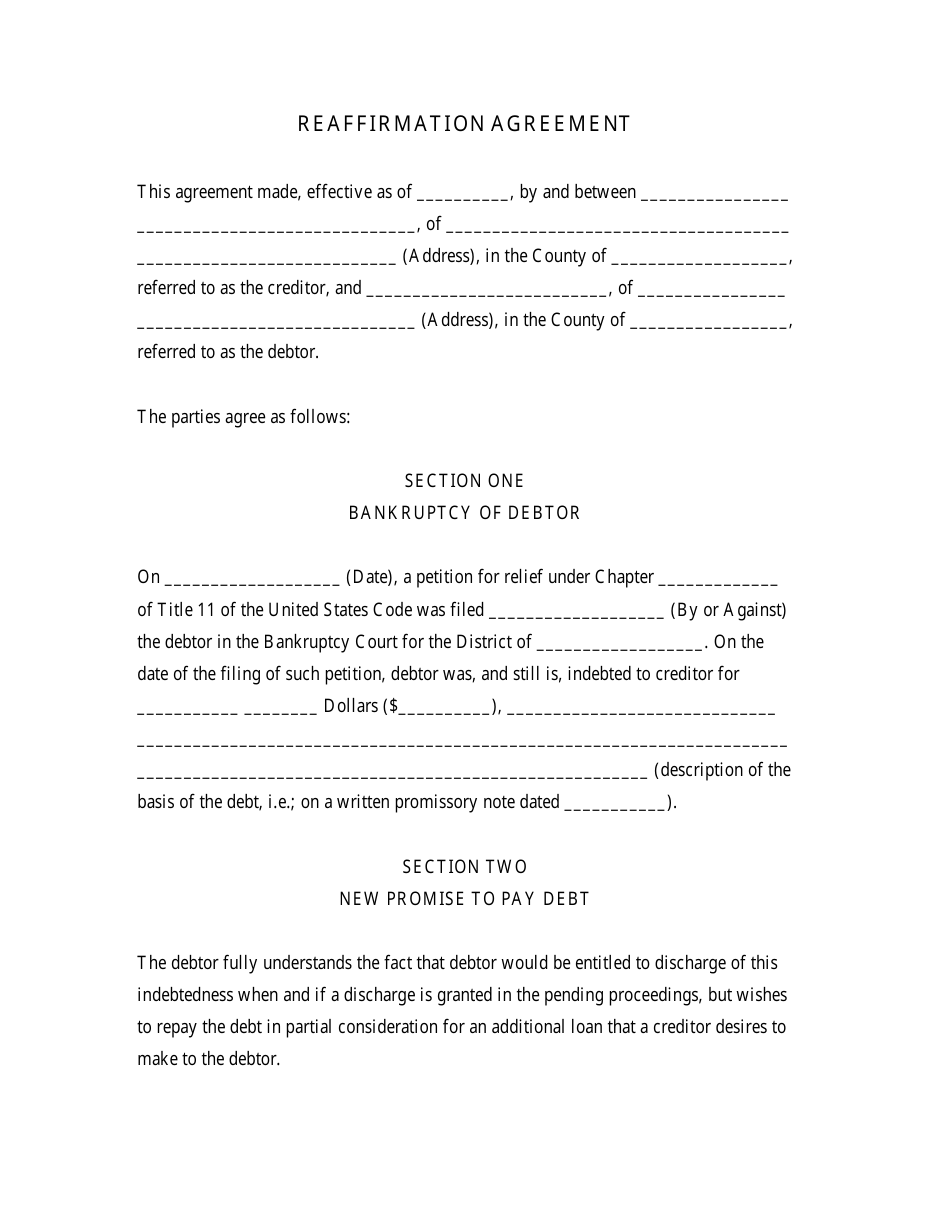

Reaffirmation Agreement Form Download Printable PDF Templateroller

Some bankruptcy courts don't like debtors to reaffirm loans because it requires them to. Web the purpose of a bankruptcy reaffirmation agreement is to protect all parties with a financial and legal interest in the chapter 7 bankruptcy proceedings. “reaffirm,” essentially means “puts you back on the hook.” a reaffirmed debt is not discharged at the end of the chapter.

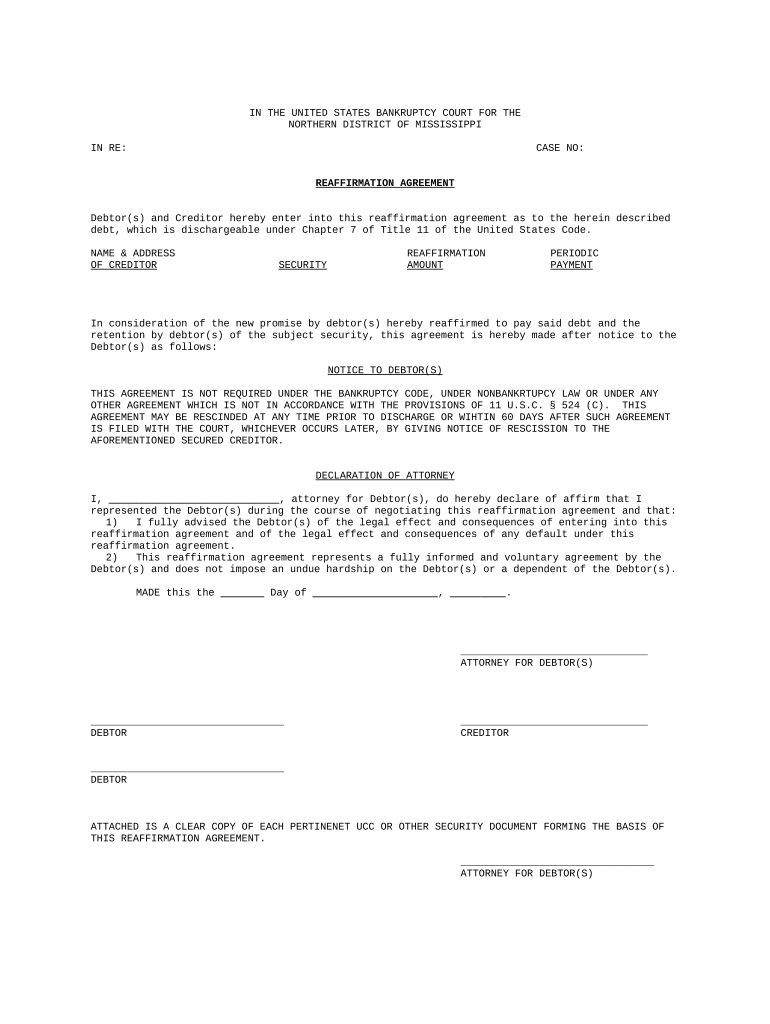

Reaffirmation Agreement for Chapter 7 DeLuca & Associates

Web the purpose of a bankruptcy reaffirmation agreement is to protect all parties with a financial and legal interest in the chapter 7 bankruptcy proceedings. Web reaffirmation agreements are a special feature of chapter 7 bankruptcy. Web a reaffirmation agreement is an agreement between a chapter 7 debtor and a creditor that the debtor will pay all or a portion.

Reaffirmation agreement form Fill out & sign online DocHub

Web the reaffirmation agreement is, then, a separate contract entered into during a chapter 7 bankruptcy that “reaffirms” a secured debt. Web a reaffirmation agreement is a new contract between you and your car lender that reinstates your liability to pay the loan again. Web you have options for what to do with a car loan when filing a chapter.

Arnold Law Offices

Web in chapter 7 bankruptcy, a reaffirmation agreement provides a way to keep collateral, as long as payments and conditions of the reaffirmation agreement are met. Under a reaffirmation agreement, you agree to pay a debt even though you could have eliminated the debt in your bankruptcy case. Usually, the debt is secured b If they lost their vehicle, many.

Reaffirmation Agreement Form Fill Out and Sign Printable PDF Template

Web a reaffirmation agreement is a new contract between you and your car lender that reinstates your liability to pay the loan again. Web a chapter 7 case begins with the debtor filing a petition with the bankruptcy court serving the area where the individual lives or where the business debtor is organized or has its principal place of business.

Reaffirmation Agreement Chapter 7 Inspirational New Earth July August

Web a reaffirmation agreement is a new contract between you and your car lender that reinstates your liability to pay the loan again. Web reaffirmation agreements are a special feature of chapter 7 bankruptcy. Web a chapter 7 case begins with the debtor filing a petition with the bankruptcy court serving the area where the individual lives or where the.

ACP Non methane hydrocarbon C2C8 sources and sinks

When the debtor signs the reaffirmation agreement, they agree to. They give your creditors a chance to get you back on the hook for debt you would have otherwise discharged in the bankruptcy by allowing. Under a reaffirmation agreement, you agree to pay a debt even though you could have eliminated the debt in your bankruptcy case. Some bankruptcy courts.

What Is a Reaffirmation Agreement in Chapter 7 Bankruptcy? Bankruptcy

Under a reaffirmation agreement, you agree to pay a debt even though you could have eliminated the debt in your bankruptcy case. You are not required to reaffirm any debt or sign any agreement regarding a. A reaffirmation agreement holds the. If they lost their vehicle, many wouldn't have a way to buy another. Web reaffirmation is a process that.

Can I rescind or cancel my reaffirmation agreement after my chapter 7

Web a reaffirmation agreement is an agreement that chapter 7 debtors may sign to reassume personal liability for secured debt and keep the collateral. Some bankruptcy courts don't like debtors to reaffirm loans because it requires them to. When the debtor signs the reaffirmation agreement, they agree to. Web in chapter 7 bankruptcy, a reaffirmation agreement provides a way to.

PDF Pushing Austerity State Failure Municipal Bankruptcy

Web a reaffirmation agreement allows you keep any recently purchased property if you can keep up with the payments, essentially reaffirming in a contract that you will continue to be responsible for the debt. They give your creditors a chance to get you back on the hook for debt you would have otherwise discharged in the bankruptcy by allowing. Web.

Web The Purpose Of A Bankruptcy Reaffirmation Agreement Is To Protect All Parties With A Financial And Legal Interest In The Chapter 7 Bankruptcy Proceedings.

Under a reaffirmation agreement, you agree to pay a debt even though you could have eliminated the debt in your bankruptcy case. A reaffirmation agreement can lead to new debt problems if you later default on your loan payments. Some bankruptcy courts don't like debtors to reaffirm loans because it requires them to. Web a reaffirmation agreement is an agreement that chapter 7 debtors may sign to reassume personal liability for secured debt and keep the collateral.

Web A Reaffirmation Agreement Allows You Keep Any Recently Purchased Property If You Can Keep Up With The Payments, Essentially Reaffirming In A Contract That You Will Continue To Be Responsible For The Debt.

It establishes the terms and conditions of. You are not required to reaffirm any debt or sign any agreement regarding a. Web a reaffirmation agreement is an agreement by a debtor and a creditor about how to treat a particular debt that would otherwise be discharged in the debtor’s bankruptcy. Web certain debts can not be discharged in a chapter 7 or a chapter 13 bankruptcy case.

Web A Reaffirmation Agreement Is An Agreement Between A Chapter 7 Debtor And A Creditor That The Debtor Will Pay All Or A Portion Of The Money Owed, Even Though The Debtor Has Filed Bankruptcy.

Web you have options for what to do with a car loan when filing a chapter 7 bankruptcy case. A reaffirmation agreement can help you maintain transportation after chapter 7. Most people need a car to travel to work, school, and medical appointments. They give your creditors a chance to get you back on the hook for debt you would have otherwise discharged in the bankruptcy by allowing.

If They Lost Their Vehicle, Many Wouldn't Have A Way To Buy Another.

“reaffirm,” essentially means “puts you back on the hook.” a reaffirmed debt is not discharged at the end of the chapter 7. Usually, the debt is secured b Web the reaffirmation agreement is, then, a separate contract entered into during a chapter 7 bankruptcy that “reaffirms” a secured debt. Web a reaffirmation agreement is a new contract between you and your car lender that reinstates your liability to pay the loan again.