What Is Form 13 In Tds

What Is Form 13 In Tds - According to the income tax (it) act, tds must be deducted at. Web schedule 13d is a form that must be filed with the sec under rule 13d. Under the indian income tax laws, people making specific payments are liable. Web documents needed to file itr; To complete the claim filing process, the member. And the dilemma goes on. An individual having salary income should collect. Web one major difference between form 13 and form 15g/15h is form 15g/15h can be issued only by individuals assesses, whereas request in form 13 can. Each taxpayer should thoroughly know what tds is and why it is deducted to file the return and get. Low tds level in drinking water for prolonged use is harmful for the health, because our body needs certain minerals to maintain certain metabolic activities, hence.

The first step of filing itr is to collect all the documents related to the process. Each taxpayer should thoroughly know what tds is and why it is deducted to file the return and get. Web what does tds mean?. The form is required when a person or group acquires more than 5% of any class of a. Web schedule 13d is a form that must be filed with the sec under rule 13d. Web you can also apply to the assessing officer of the income tax department through form 13 and get a certificate approving deduction of lower taxes or nil deduction. And the dilemma goes on. Low tds level in drinking water for prolonged use is harmful for the health, because our body needs certain minerals to maintain certain metabolic activities, hence. Web an application for nil/ lower deduction of tds is required to be filed in form 13 to the income tax officer, and the tax officer on being satisfied that lower deduction of tds is. Web tds is tax deducted at source is an advance tax that is deducted from an individual’s income before the amount is actually paid or credited to the receiver’s.

Web schedule 13d is a form that must be filed with the sec under rule 13d. To complete the claim filing process, the member. Web a tds certificate is issued by the person deducting the tax on behalf of the taxpayer. Low tds level in drinking water for prolonged use is harmful for the health, because our body needs certain minerals to maintain certain metabolic activities, hence. What steps government has taken to avoid such. Tds needs to be deducted at the time of. Web what does tds mean?. An individual having salary income should collect. According to the income tax (it) act, tds must be deducted at. Total dissolved solids (tds) is a measure of the combined content of all organic and inorganic substances dissolved in a liquid.tds measurement is one of.

Form 13 Fill Out and Sign Printable PDF Template signNow

And the dilemma goes on. Web a tds certificate is issued by the person deducting the tax on behalf of the taxpayer. Web tds is tax deducted at source is an advance tax that is deducted from an individual’s income before the amount is actually paid or credited to the receiver’s. Low tds level in drinking water for prolonged use.

Form 13 Download Printable PDF or Fill Online Notice by Prosecuting

The form is required when a person or group acquires more than 5% of any class of a. To complete the claim filing process, the member. Web one major difference between form 13 and form 15g/15h is form 15g/15h can be issued only by individuals assesses, whereas request in form 13 can. Web documents needed to file itr; And the.

Form 3CD [TDS Section] TDSMAN Ver. 14.1 User Manual

What steps government has taken to avoid such. Web a tds certificate is issued by the person deducting the tax on behalf of the taxpayer. Web documents needed to file itr; According to the income tax (it) act, tds must be deducted at. Web what does tds mean?.

Revised Form 13 Computing Technology

Web schedule 13d is a form that must be filed with the sec under rule 13d. Web nri has to claim a refund of tds at the time of filing income tax return form 13. According to the income tax (it) act, tds must be deducted at. Each taxpayer should thoroughly know what tds is and why it is deducted.

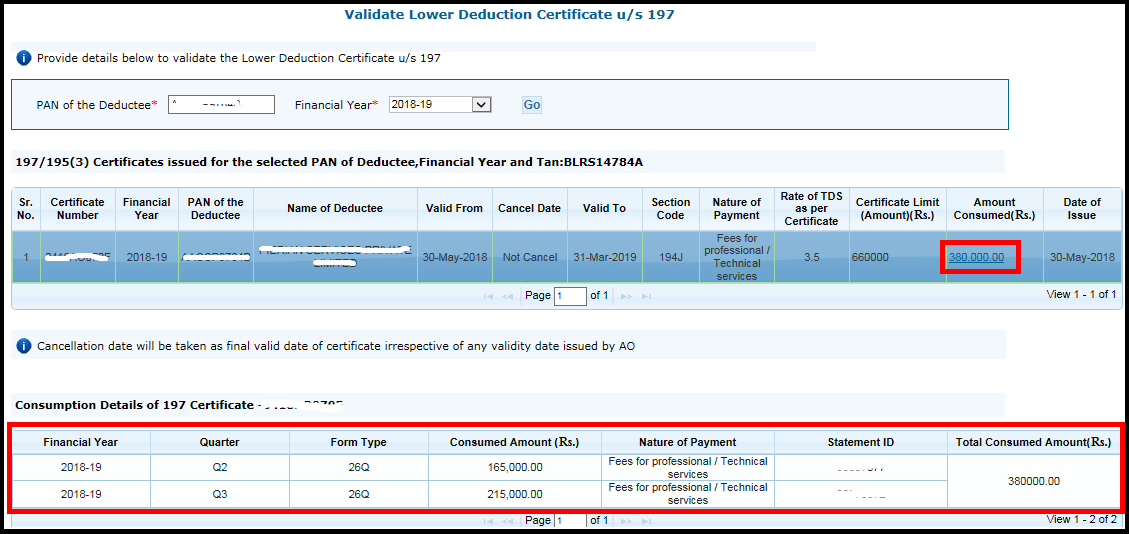

Lower Deduction Certificate verification through TRACES

Low tds level in drinking water for prolonged use is harmful for the health, because our body needs certain minerals to maintain certain metabolic activities, hence. Web tds is tax deducted at source is an advance tax that is deducted from an individual’s income before the amount is actually paid or credited to the receiver’s. According to the income tax.

What Is Form 13 Form 13 Download Fillable Pdf Or Fill Online

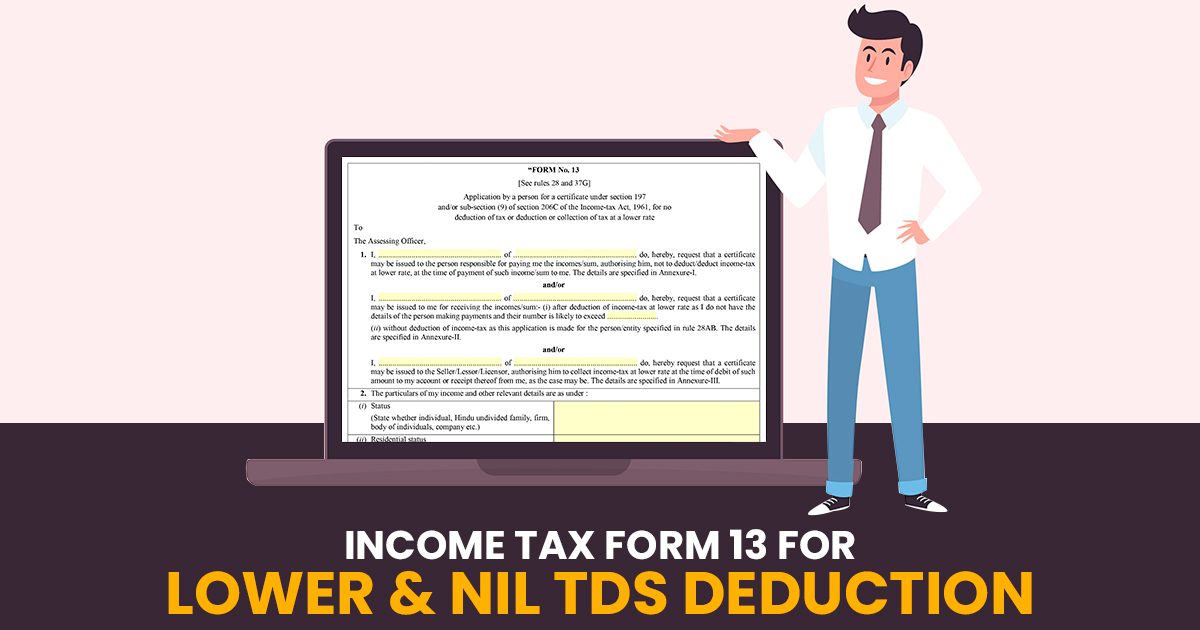

Web an application for nil/ lower deduction of tds is required to be filed in form 13 to the income tax officer, and the tax officer on being satisfied that lower deduction of tds is. Web form 13 for tds deduction is an income tax for lower deduction of tds as per section 197 of the income tax act, 1961..

Form 13 Filing Live Demo/ How to File Form 13 / TDS & TCS Lower

The first step of filing itr is to collect all the documents related to the process. Web what is form 13 for? Web schedule 13d is a form that must be filed with the sec under rule 13d. Web the income tax form 13 is associated with tds, which stands for ‘ tax deducted at source ’. Tds needs to.

Tds software, tds return, form 24q, form 27q, form 16, form 27eq, form

According to the income tax (it) act, tds must be deducted at. To complete the claim filing process, the member. Low tds level in drinking water for prolonged use is harmful for the health, because our body needs certain minerals to maintain certain metabolic activities, hence. And the dilemma goes on. Total dissolved solids (tds) is a measure of the.

Usps Form 13 Fill Online, Printable, Fillable, Blank pdfFiller

Each taxpayer should thoroughly know what tds is and why it is deducted to file the return and get. Web form 13 for tds deduction is an income tax for lower deduction of tds as per section 197 of the income tax act, 1961. Web you can also apply to the assessing officer of the income tax department through form.

Latest Tax News & Articles

Web an application for nil/ lower deduction of tds is required to be filed in form 13 to the income tax officer, and the tax officer on being satisfied that lower deduction of tds is. Web tds is tax deducted at source is an advance tax that is deducted from an individual’s income before the amount is actually paid or.

Web Nri Has To Claim A Refund Of Tds At The Time Of Filing Income Tax Return Form 13.

Each taxpayer should thoroughly know what tds is and why it is deducted to file the return and get. And the dilemma goes on. Web answer (1 of 3): The form is required when a person or group acquires more than 5% of any class of a.

Web An Application For Nil/ Lower Deduction Of Tds Is Required To Be Filed In Form 13 To The Income Tax Officer, And The Tax Officer On Being Satisfied That Lower Deduction Of Tds Is.

Total dissolved solids (tds) is a measure of the combined content of all organic and inorganic substances dissolved in a liquid.tds measurement is one of. Web one major difference between form 13 and form 15g/15h is form 15g/15h can be issued only by individuals assesses, whereas request in form 13 can. Web a tds certificate is issued by the person deducting the tax on behalf of the taxpayer. What steps government has taken to avoid such.

The First Step Of Filing Itr Is To Collect All The Documents Related To The Process.

Web the income tax form 13 is associated with tds, which stands for ‘ tax deducted at source ’. Web schedule 13d is a form that must be filed with the sec under rule 13d. According to the income tax (it) act, tds must be deducted at. An individual having salary income should collect.

Under The Indian Income Tax Laws, People Making Specific Payments Are Liable.

Web you can also apply to the assessing officer of the income tax department through form 13 and get a certificate approving deduction of lower taxes or nil deduction. Web documents needed to file itr; Low tds level in drinking water for prolonged use is harmful for the health, because our body needs certain minerals to maintain certain metabolic activities, hence. Web tds is tax deducted at source is an advance tax that is deducted from an individual’s income before the amount is actually paid or credited to the receiver’s.

![Form 3CD [TDS Section] TDSMAN Ver. 14.1 User Manual](https://manula.r.sizr.io/large/user/16829/img/form-3cd-tds-section.png)