What Is Form 8895

What Is Form 8895 - Form 8995 is a simplified. Web july 5, 2011 by nova401k. Web form 8995 qualified business income deduction simplified computation is used to figure your qualified business income (qbi) deduction. Private employers who sponsor any type of qualified retirement plan such as a 401 (k) plan, profit sharing plan, defined benefit. Web in 2021, you made a repayment of $4,500. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Use separate schedules a, b, c, and/or d, as. S corporations are not eligible for the deduction, but must pass through to their shareholders the necessary information on an attachment. Top 13mm (1⁄ 2 ), center sides. The excess repayment of $1,500 can be carried.

Use separate schedules a, b, c, and/or d, as. Top 13mm (1⁄ 2 ), center sides. Web how do i get to form 8895? Web form 8995 is the simplified form and is used if all of the following are true: The excess repayment of $1,500 can be carried. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web july 5, 2011 by nova401k. Private employers who sponsor any type of qualified retirement plan such as a 401 (k) plan, profit sharing plan, defined benefit. Use this form to figure your qualified business income deduction. Web in 2021, you made a repayment of $4,500.

Form 8995 is a simplified. Web how do i get to form 8895? The excess repayment of $1,500 can be carried. Web in 2021, you made a repayment of $4,500. Top 13mm (1⁄ 2 ), center sides. Private employers who sponsor any type of qualified retirement plan such as a 401 (k) plan, profit sharing plan, defined benefit. Web form 8995 is the simplified form and is used if all of the following are true: S corporations are not eligible for the deduction, but must pass through to their shareholders the necessary information on an attachment. Web july 5, 2011 by nova401k. The previous deadline for the.

Travel Charts From CL12 Operating Manual (Form 8895) PDF Screw Drill

Form 8995 is a simplified. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web how do i get to form 8895? Web july 5, 2011 by nova401k. The previous deadline for the.

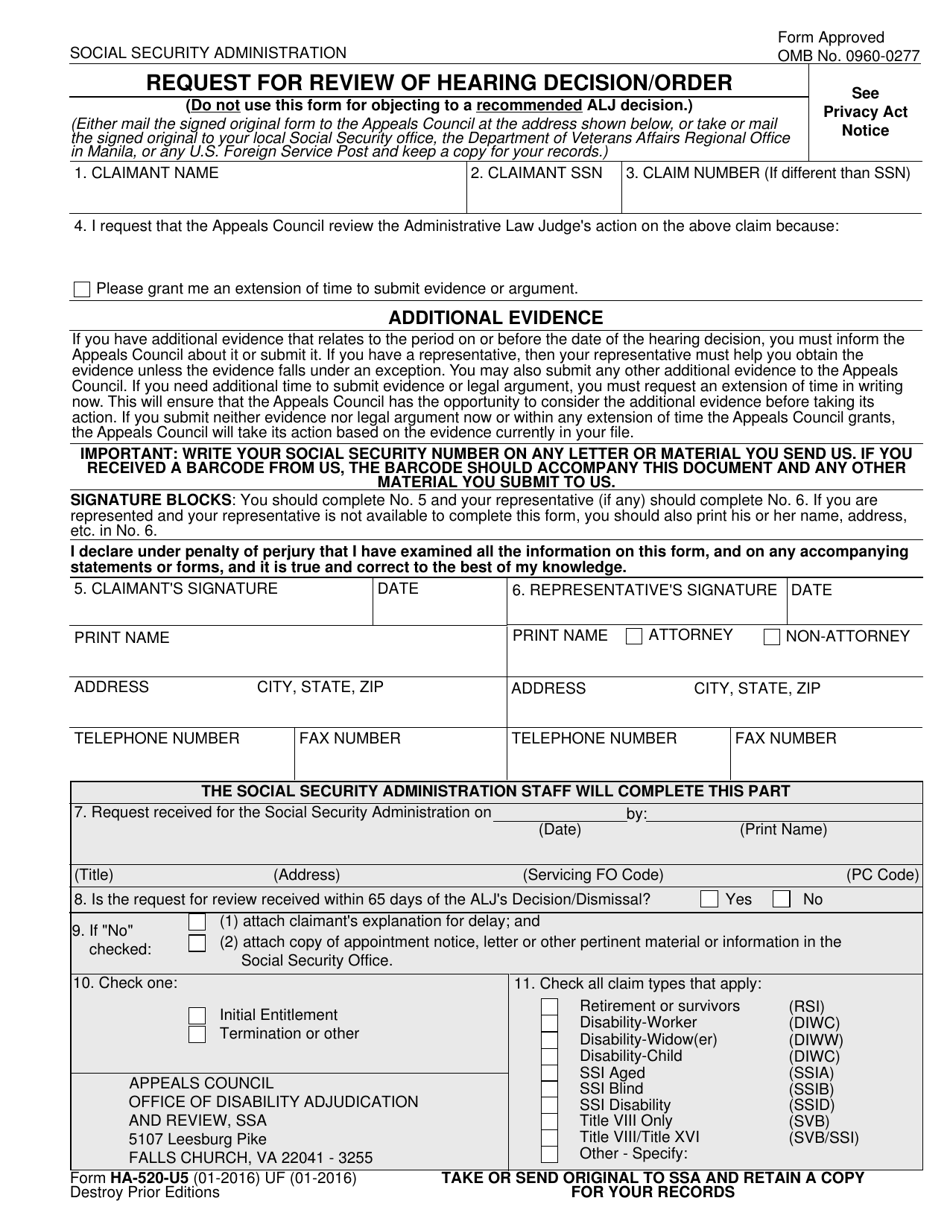

Form HA520U5 Download Fillable PDF or Fill Online Request for Review

The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web july 5, 2011 by nova401k. The previous deadline for the. Web form 8995 qualified business income deduction simplified computation is used to figure your qualified business income (qbi) deduction. Private employers who sponsor any type of qualified retirement plan such as a 401 (k).

Magic Form 8895 Tül Dantelli Sütyenli Korse Gecelik Fiyatı

Web how do i get to form 8895? Web form 8995 qualified business income deduction simplified computation is used to figure your qualified business income (qbi) deduction. Web july 5, 2011 by nova401k. Web in 2021, you made a repayment of $4,500. S corporations are not eligible for the deduction, but must pass through to their shareholders the necessary information.

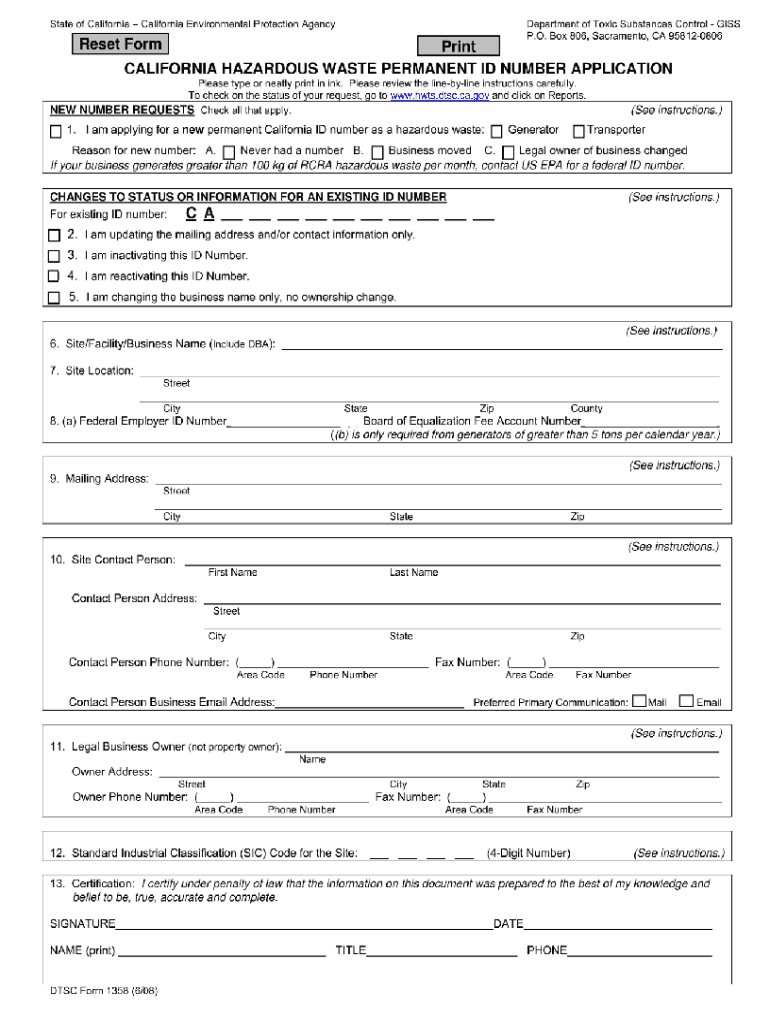

Dtsc Form 1358 Fill Out and Sign Printable PDF Template signNow

Web form 8995 is the simplified form and is used if all of the following are true: Top 13mm (1⁄ 2 ), center sides. The previous deadline for the. Private employers who sponsor any type of qualified retirement plan such as a 401 (k) plan, profit sharing plan, defined benefit. Form 8995 is a simplified.

Irs Form 8892 Fill Online, Printable, Fillable, Blank pdfFiller

The excess repayment of $1,500 can be carried. Web how do i get to form 8895? Web form 8995 qualified business income deduction simplified computation is used to figure your qualified business income (qbi) deduction. The previous deadline for the. Use this form to figure your qualified business income deduction.

8895

Web form 8995 qualified business income deduction simplified computation is used to figure your qualified business income (qbi) deduction. Web in 2021, you made a repayment of $4,500. The previous deadline for the. Web july 5, 2011 by nova401k. Use this form to figure your qualified business income deduction.

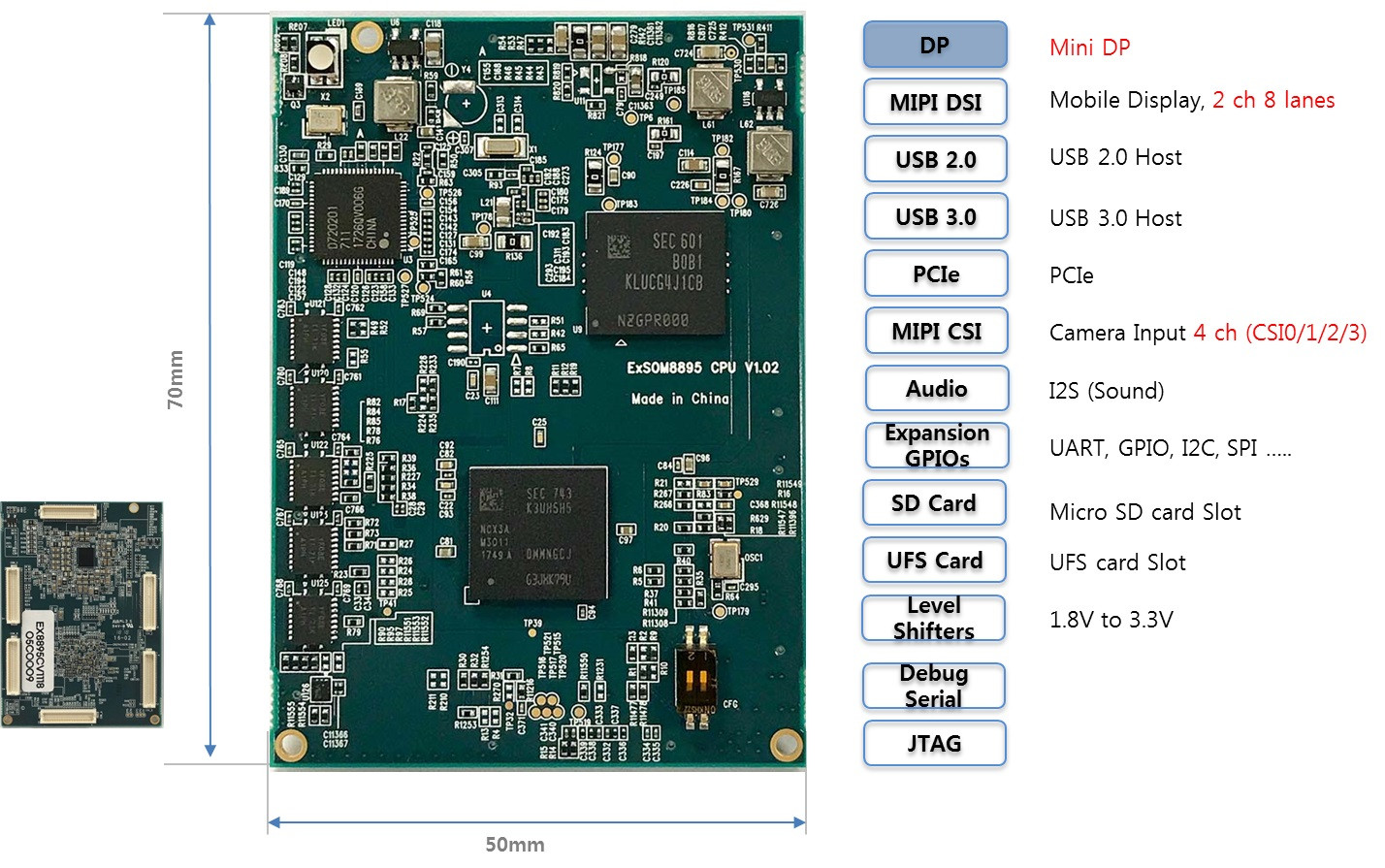

Howchip ExSOM8895 Exynos 8895 Board is Designed for Android Development

Web form 8995 qualified business income deduction simplified computation is used to figure your qualified business income (qbi) deduction. Web july 5, 2011 by nova401k. Web in 2021, you made a repayment of $4,500. The excess repayment of $1,500 can be carried. S corporations are not eligible for the deduction, but must pass through to their shareholders the necessary information.

Ssa 8240 Fill out & sign online DocHub

Private employers who sponsor any type of qualified retirement plan such as a 401 (k) plan, profit sharing plan, defined benefit. Web form 8995 qualified business income deduction simplified computation is used to figure your qualified business income (qbi) deduction. Web in 2021, you made a repayment of $4,500. Use separate schedules a, b, c, and/or d, as. The excess.

IMG_8895 Holy Spirit Catholic Church

Web july 5, 2011 by nova401k. Web form 8995 qualified business income deduction simplified computation is used to figure your qualified business income (qbi) deduction. Top 13mm (1⁄ 2 ), center sides. The previous deadline for the. Private employers who sponsor any type of qualified retirement plan such as a 401 (k) plan, profit sharing plan, defined benefit.

Magic Form 8895 Tül Dantelli Sütyenli Korse Gecelik 4488420 Morhipo

Web form 8995 is the simplified form and is used if all of the following are true: Use this form to figure your qualified business income deduction. Top 13mm (1⁄ 2 ), center sides. Private employers who sponsor any type of qualified retirement plan such as a 401 (k) plan, profit sharing plan, defined benefit. Form 8995 is a simplified.

Web July 5, 2011 By Nova401K.

Use this form to figure your qualified business income deduction. Form 8995 is a simplified. The excess repayment of $1,500 can be carried. Web how do i get to form 8895?

Use Separate Schedules A, B, C, And/Or D, As.

Web in 2021, you made a repayment of $4,500. The previous deadline for the. Top 13mm (1⁄ 2 ), center sides. Private employers who sponsor any type of qualified retirement plan such as a 401 (k) plan, profit sharing plan, defined benefit.

The Individual Has Qualified Business Income (Qbi), Qualified Reit Dividends, Or Qualified Ptp Income Or.

Web form 8995 qualified business income deduction simplified computation is used to figure your qualified business income (qbi) deduction. Web form 8995 is the simplified form and is used if all of the following are true: S corporations are not eligible for the deduction, but must pass through to their shareholders the necessary information on an attachment.