What Is Form 8919

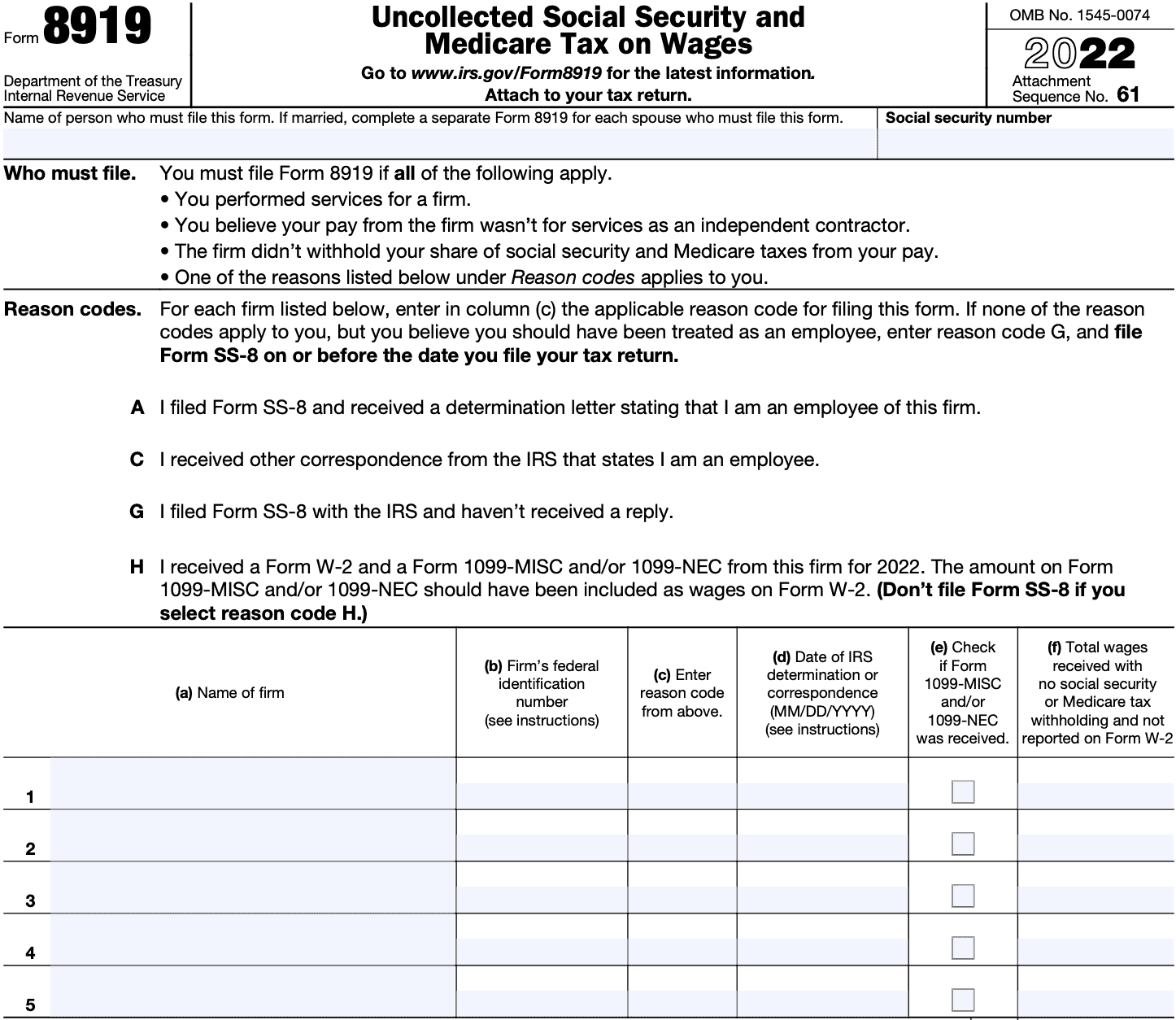

What Is Form 8919 - The taxpayer performed services for an individual or a firm. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: If married, complete a separate form 8919 for each spouse who must file this form. Web form 8919 is a solution for independent contractors who have suffered from an employer’s misclassification and now face uncollected social security and medicare. Community discussions taxes get your taxes done still need to file? Web 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Form 8919 is used to calculate and report your share of the uncollected social security and medicare taxes due on your compensation if you. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. Web what is irs form 8919?

Web name of person who must file this form. Our experts can get your taxes done right. Web 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Web what is irs form 8919? Community discussions taxes get your taxes done still need to file? Use form 8919 to figure and. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Form 8919 is used to calculate and report your share of the uncollected social security and medicare taxes due on your compensation if you. You performed services for a firm. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation.

Use form 8919 to figure and. Web why am i being asked to fill out form 8919? Our experts can get your taxes done right. Web what is irs form 8919? Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were. Web 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Form 8919 is used to calculate and report your share of the uncollected social security and medicare taxes due on your compensation if you. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation.

Form 8919 2021 Fill Online, Printable, Fillable, Blank pdfFiller

Web why am i being asked to fill out form 8919? Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Use form 8919 to figure and. Web 8919 department of the treasury internal revenue service uncollected social security.

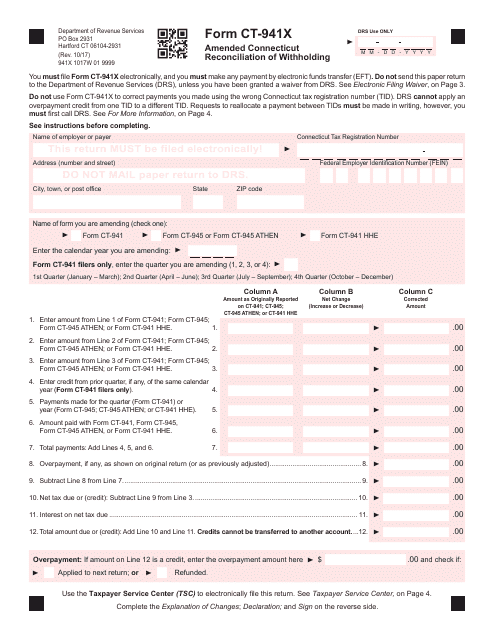

Form CT941X Download Printable PDF or Fill Online Amended Connecticut

Web name of person who must file this form. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their. Community discussions taxes get your taxes done still need to file? Web use form 8919 to figure and report your share of the uncollected.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Use form 8919 to figure and. The taxpayer performed services for an individual or a firm. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then.

Fill Free fillable F8919 Accessible 2019 Form 8919 PDF form

Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Form 8919 is used to calculate and report your share of the uncollected social security and medicare taxes due on your compensation if you. Web what is irs form 8919? Community discussions taxes get your taxes done.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

You performed services for a firm. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web what is irs form 8919? Form 8919 is used to calculate and report your share of the uncollected social security and medicare.

IRS Form 8919 Uncollected Social Security & Medicare Taxes

Web name of person who must file this form. Web form 8919 is a solution for independent contractors who have suffered from an employer’s misclassification and now face uncollected social security and medicare. Web form 8919 is a form that employees treated as independent contractors can use to report their share of uncollected social security and medicare taxes. Web department.

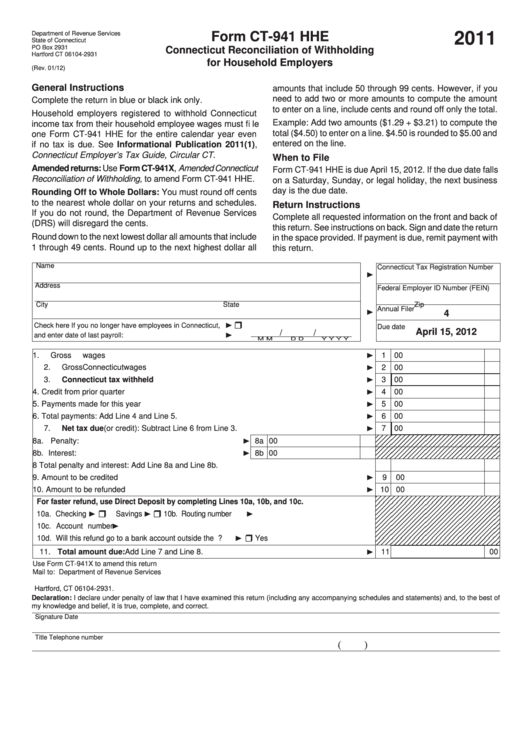

Form Ct941 Hhe Connecticut Reconciliation Of Withholding For

Web form 8919 is a form that employees treated as independent contractors can use to report their share of uncollected social security and medicare taxes. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. If married, complete a separate form 8919 for each spouse who must file this form. Irs.

1099 Form Independent Contractor Pdf / Do You Need a W2 Employee or a

Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Use form 8919 to figure and. Web use form 8919.

8919 Cobalt Glass Print Ltd.

Irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. Web form 8919 is a form that employees treated as independent contractors can use to report their share.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

If married, complete a separate form 8919 for each spouse who must file this form. Web form 8919 is a form that employees treated as independent contractors can use to report their share of uncollected social security and medicare taxes. Web name of person who must file this form. Our experts can get your taxes done right. The taxpayer performed.

Web Department Of The Treasury Internal Revenue Service Uncollected Social Security And Medicare Tax On Wages Go To Www.irs.gov/Form8919 For The Latest Information Attach.

Web name of person who must file this form. Our experts can get your taxes done right. Form 8919 is used to calculate and report your share of the uncollected social security and medicare taxes due on your compensation if you. Web what is irs form 8919?

The Taxpayer Performed Services For An Individual Or A Firm.

Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. You performed services for a firm. Irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like. Web why am i being asked to fill out form 8919?

Web Form 8919, Uncollected Social Security And Medicare Tax On Wages, Will Need To Be Filed If All Of The Following Are True:

Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their. Web form 8919 is a solution for independent contractors who have suffered from an employer’s misclassification and now face uncollected social security and medicare. Use form 8919 to figure and. Community discussions taxes get your taxes done still need to file?

If Married, Complete A Separate Form 8919 For Each Spouse Who Must File This Form.

Web 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web form 8919 is a form that employees treated as independent contractors can use to report their share of uncollected social security and medicare taxes. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were.