What Is Schedule F Tax Form

What Is Schedule F Tax Form - Web wrapping up irs schedule f. Web overview a tax schedule is a form the irs requires you to prepare in addition to your tax return when you have certain types of income or deductions. Web total use tax to report (column a, total of lines 5, 6, and 7). Web the schedule f is a tax business schedule that allows you to calculate your taxable income from farming. Total sales tax to report (column b, total of lines 5, 6, and 7). Web abu dhabi [uae], july 30 (ani/wam): Web chalabala / twenty20 the irs doesn't treat all income equally, particularly when it comes to reporting it. In addition, even some of. For further assistance, please contact our team of tax professionals at community tax to assist you in determining whether filing. If you have a profit or a loss, it gets.

Web which internal revenue servicing defines “farmer” in ampere very extensive sense—whether you grow harvest, raise stock, breed free or operate a ranch. If you have a profit or a loss, it gets. Web for most of you, schedule f is of no consequence. It is designed to be a. Complete, edit or print tax forms instantly. Web wrapping up irs schedule f. The uae ministry of finance (mof) today announced the issuance of cabinet decision no. Web use schedule f (form 1040) to report farm income and expenses. Get ready for tax season deadlines by completing any required tax forms today. Total sales tax to report (column b, total of lines 5, 6, and 7).

Web the schedule f is a tax business schedule that allows you to calculate your taxable income from farming. From farming your farming activity may subject you. Complete, edit or print tax forms instantly. Sole proprietors must file schedule c with their tax. If you have a profit or a loss, it gets. Web chalabala / twenty20 the irs doesn't treat all income equally, particularly when it comes to reporting it. Web schedule f ultimately computes the net farming profit or loss that gets reported on the designated line of your 1040. Net profits are subject to self. Get ready for tax season deadlines by completing any required tax forms today. Web complete part ii for proportionate method tax computation.

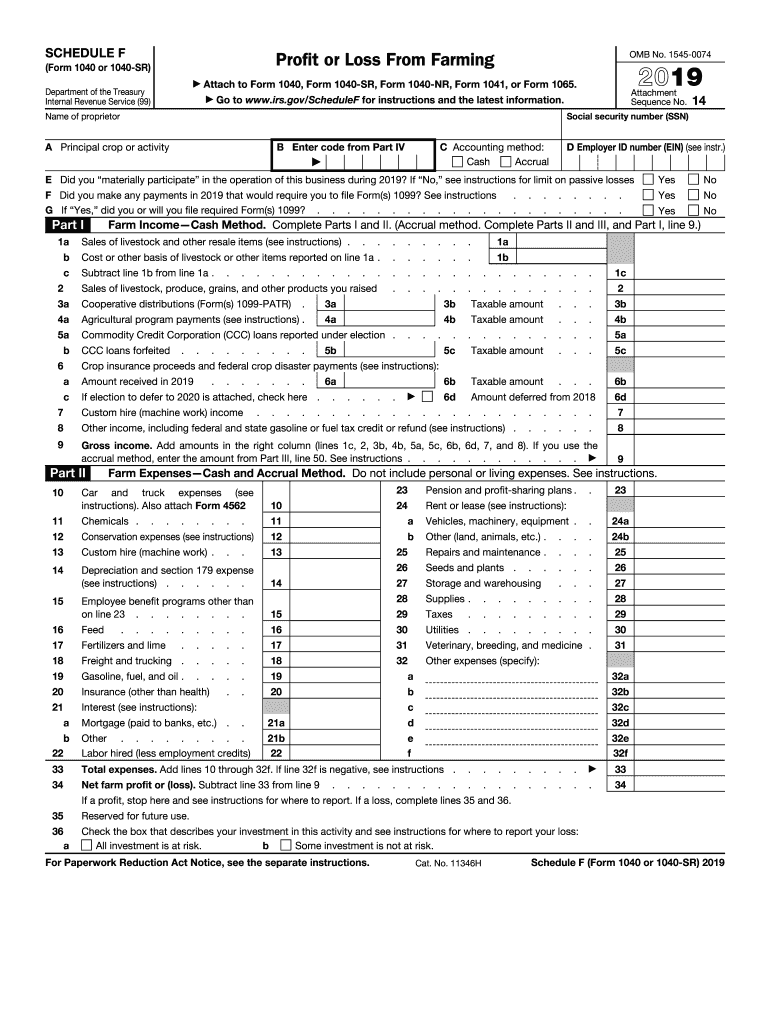

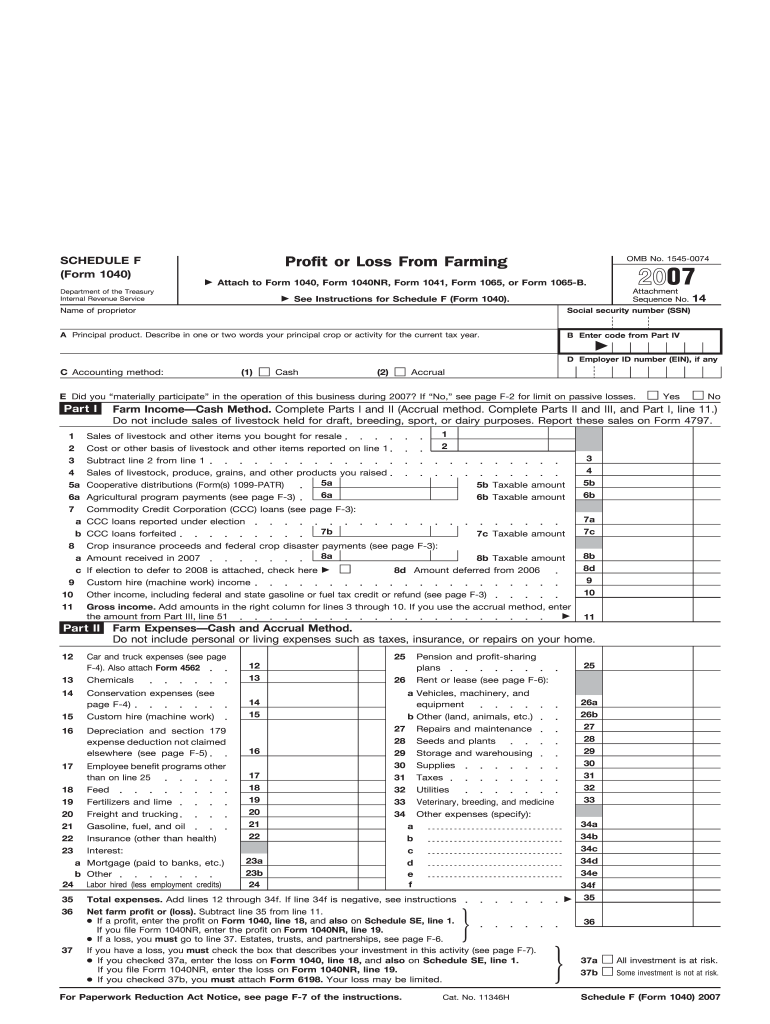

2019 Form IRS 1040 Schedule F Fill Online, Printable, Fillable, Blank

Web wrapping up irs schedule f. Net profits are subject to self. It is designed to be a. Web abu dhabi [uae], july 30 (ani/wam): The typical taxpayer need never worry about adding this schedule to their irs form 1040.

Schedule 1 For 2019 Form 1040 Taxation Government Finances

Web complete part ii for proportionate method tax computation. From farming your farming activity may subject you. Web which internal revenue servicing defines “farmer” in ampere very extensive sense—whether you grow harvest, raise stock, breed free or operate a ranch. Web total use tax to report (column a, total of lines 5, 6, and 7). For further assistance, please contact.

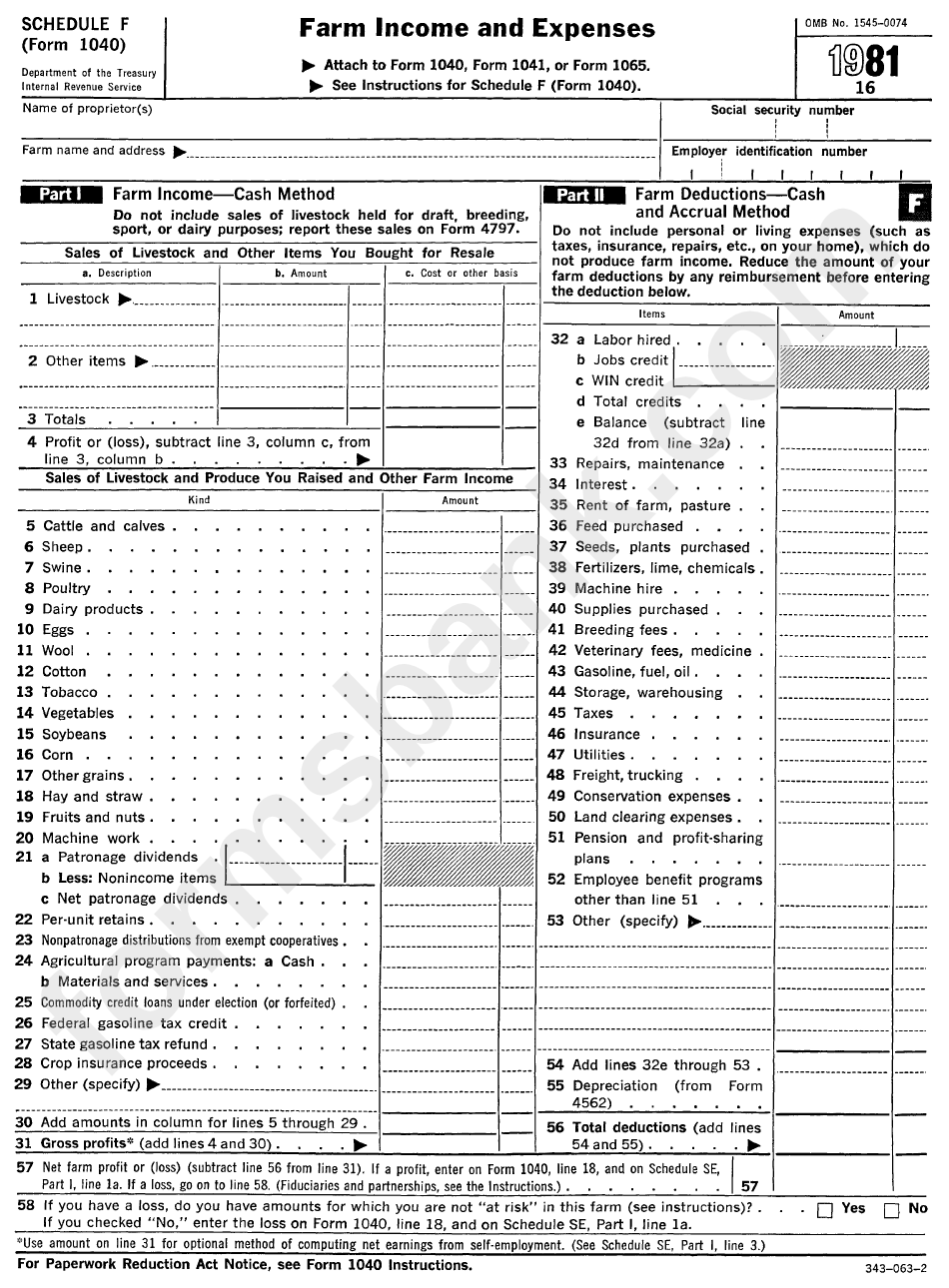

Schedule F (Form 1040) Farm Tax Expenses 1981 printable pdf

It is designed to be a. Web schedule f ultimately computes the net farming profit or loss that gets reported on the designated line of your 1040. If you have a profit or a loss, it gets. Web overview a tax schedule is a form the irs requires you to prepare in addition to your tax return when you have.

Irs 1040 Form Line 14 FAFSA Tutorial

It is designed to be a. If you have a profit or a loss, it gets. Get ready for tax season deadlines by completing any required tax forms today. For further assistance, please contact our team of tax professionals at community tax to assist you in determining whether filing. Sole proprietors must file schedule c with their tax.

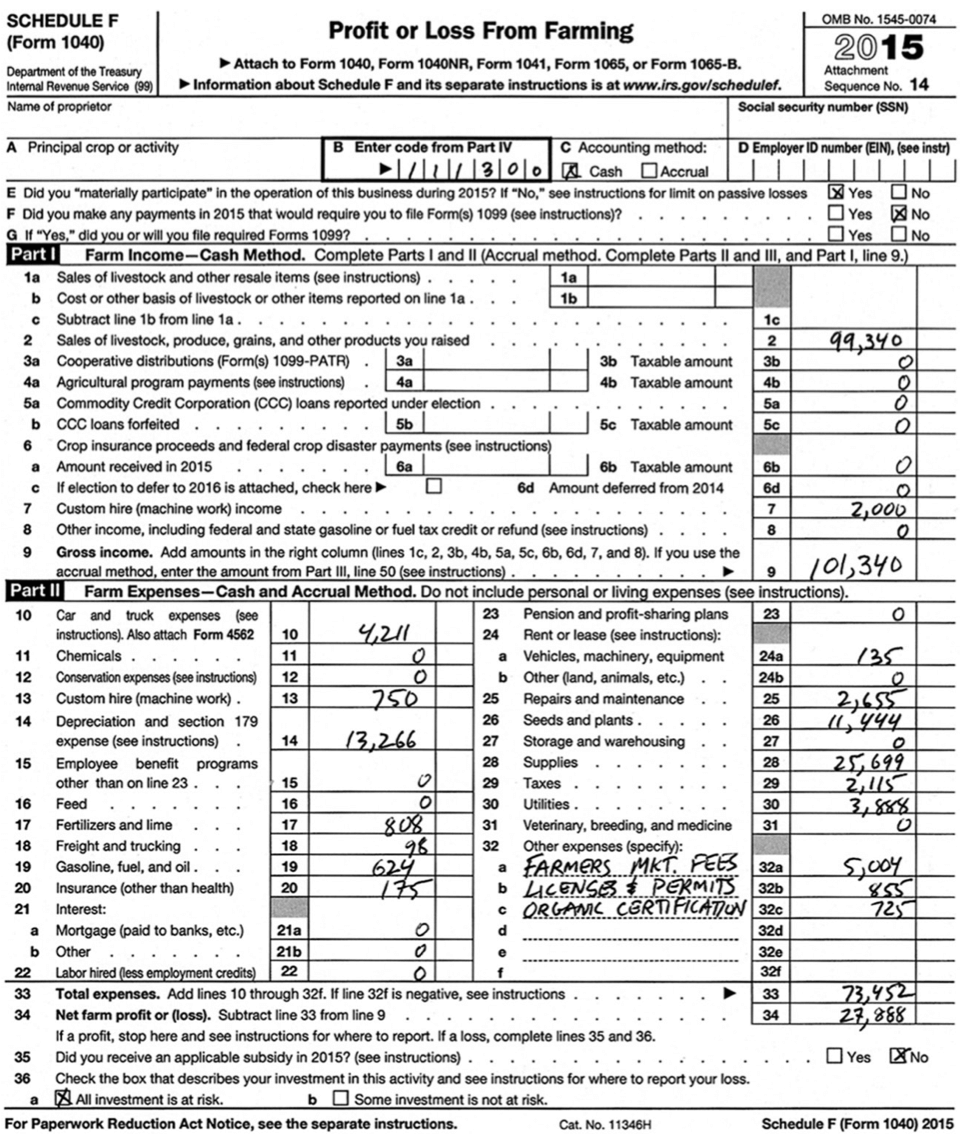

Profit or Loss from Farming Chelsea Green Publishing

Web abu dhabi [uae], july 30 (ani/wam): Web who files a schedule f? Net profits are subject to self. Web chalabala / twenty20 the irs doesn't treat all income equally, particularly when it comes to reporting it. Web use schedule f (form 1040) to report farm income and expenses.

Profit or Loss from Farming Schedule F YouTube

If you have a profit or a loss, it gets. Web use schedule f (form 1040) to report farm income and expenses. Web total use tax to report (column a, total of lines 5, 6, and 7). Web overview a tax schedule is a form the irs requires you to prepare in addition to your tax return when you have.

Tax Form 1040 Schedule E Who is this Form for & How to Fill It

Sole proprietors must file schedule c with their tax. The uae ministry of finance (mof) today announced the issuance of cabinet decision no. Web the schedule f is a tax business schedule that allows you to calculate your taxable income from farming. Web abu dhabi [uae], july 30 (ani/wam): It is designed to be a.

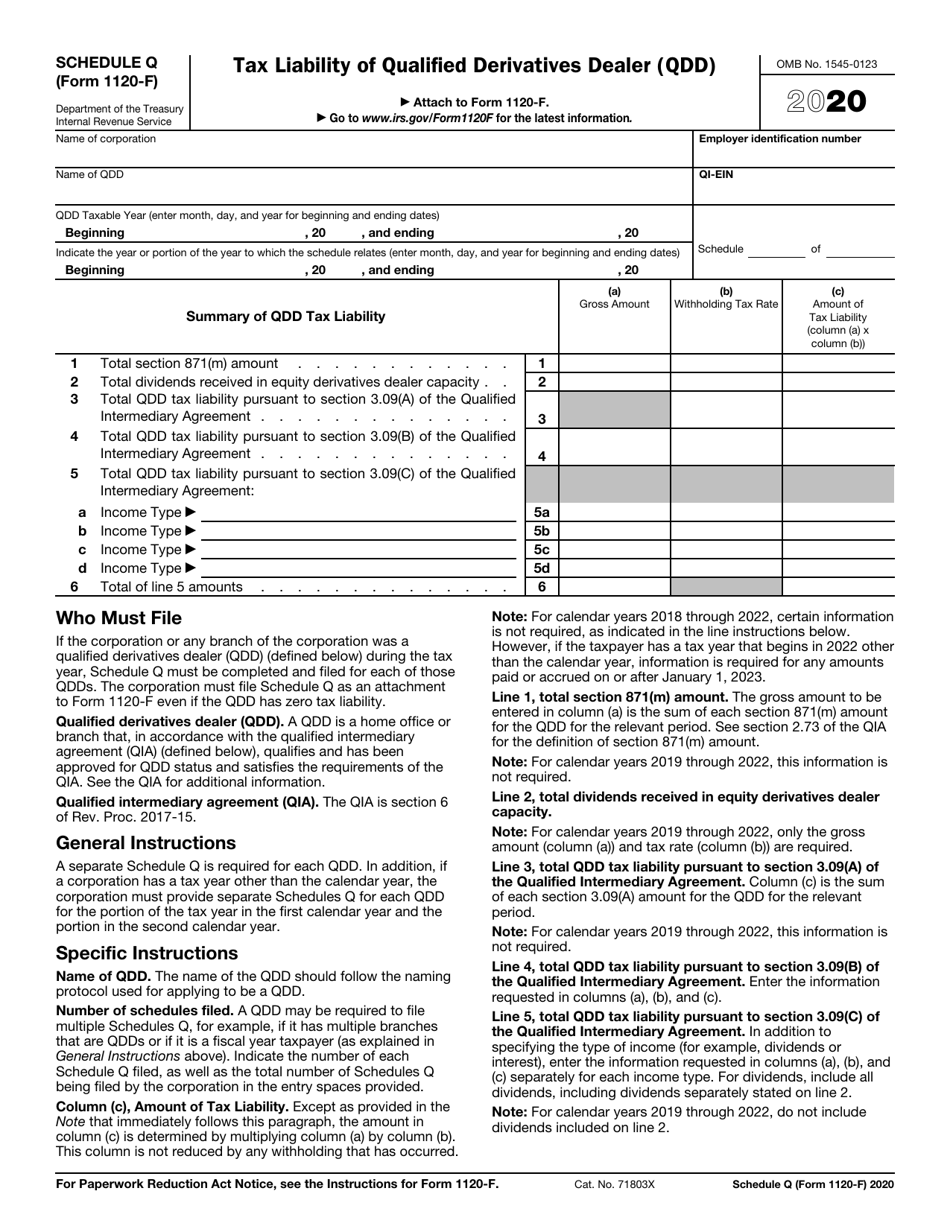

IRS Form 1120F Schedule Q Download Fillable PDF or Fill Online Tax

Complete, edit or print tax forms instantly. Web total use tax to report (column a, total of lines 5, 6, and 7). Web an executive order will move federal employees to a new “schedule f” position and become essentially “at will” employees who may be fired at any time. Sole proprietors must file schedule c with their tax. Web overview.

Form 1040 Schedule F Fill in Capable Profit or Loss from Farming Fill

Web which internal revenue servicing defines “farmer” in ampere very extensive sense—whether you grow harvest, raise stock, breed free or operate a ranch. For further assistance, please contact our team of tax professionals at community tax to assist you in determining whether filing. It is designed to be a. Web who files a schedule f? The uae ministry of finance.

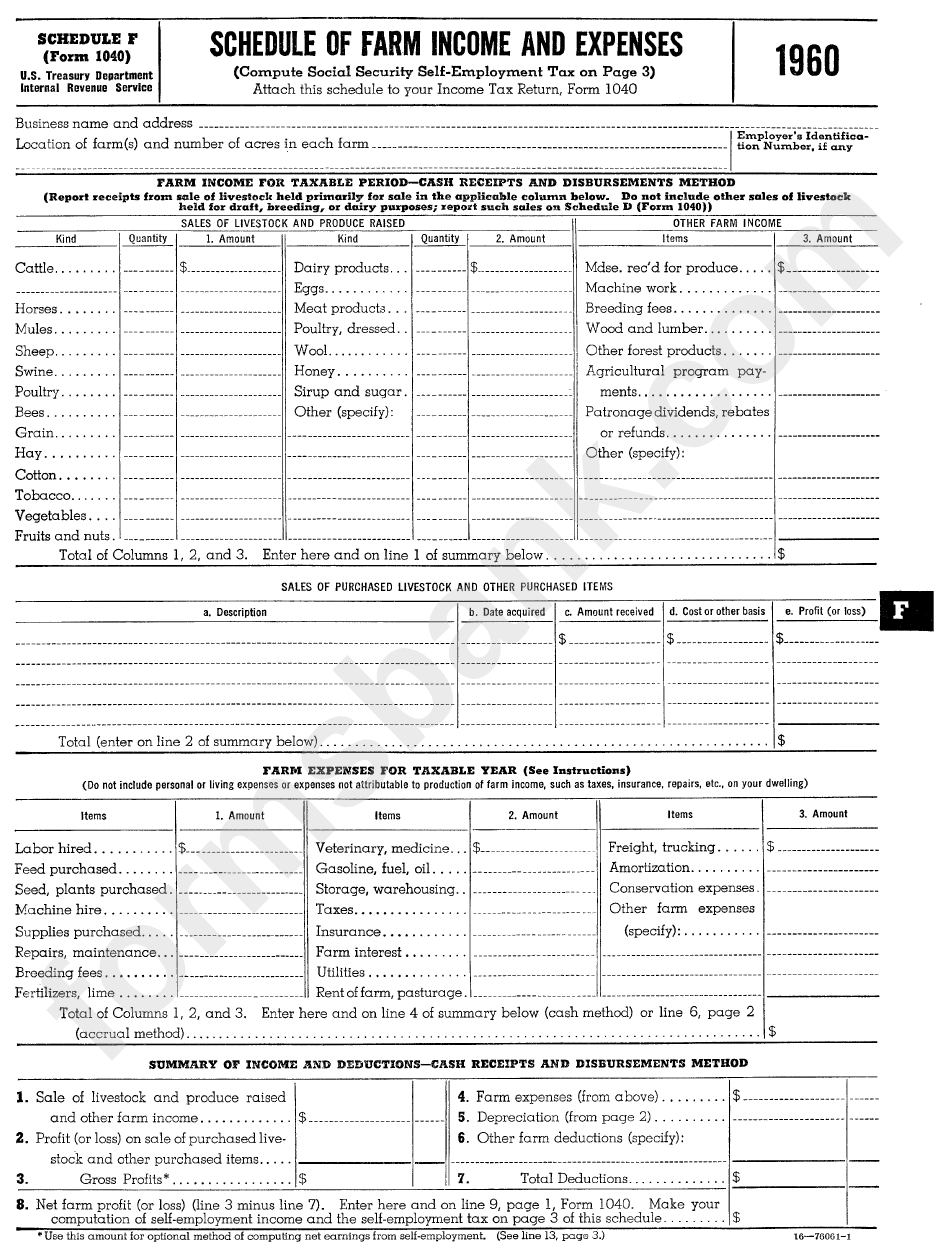

Schedule F (Form 1040) Schedule Of Farm And Expenses 1960

Web use schedule f (form 1040) to report farm income and expenses. Ad irs schedule f form 1040 & more fillable forms, register and subscribe now! Web who files a schedule f? Web overview a tax schedule is a form the irs requires you to prepare in addition to your tax return when you have certain types of income or.

Complete, Edit Or Print Tax Forms Instantly.

Total sales tax to report (column b, total of lines 5, 6, and 7). Get ready for tax season deadlines by completing any required tax forms today. The uae ministry of finance (mof) today announced the issuance of cabinet decision no. Web use schedule f (form 1040) to report farm income and expenses.

Ad Access Irs Tax Forms.

From farming your farming activity may subject you. Sole proprietors must file schedule c with their tax. Web schedule f ultimately computes the net farming profit or loss that gets reported on the designated line of your 1040. Web wrapping up irs schedule f.

Enter Here And On Line 5, Form 10.

Web overview a tax schedule is a form the irs requires you to prepare in addition to your tax return when you have certain types of income or deductions. The typical taxpayer need never worry about adding this schedule to their irs form 1040. For further assistance, please contact our team of tax professionals at community tax to assist you in determining whether filing. Web for most of you, schedule f is of no consequence.

It Is Designed To Be A.

Web abu dhabi [uae], july 30 (ani/wam): Net profits are subject to self. Web complete part ii for proportionate method tax computation. Web total use tax to report (column a, total of lines 5, 6, and 7).