What Is Tax Form 2439

What Is Tax Form 2439 - To enter the 2439 in the individual module: Web solved•by intuit•updated 5 hours ago. Web form 1139 within 12 months of the end of the tax year in which an nol, net capital loss, unused credit, or claim of right adjustment arose. These events might increase or decrease your basis. Web ask for the information on this form to carry out the internal revenue laws of the united states. Web everything you need to know about the internal revenue service (irs) forms required to pay your u.s. You are required to give us the information. From the incomesection, select dispositions (sch d,. Web form 2439 is a form used by the irs to request an extension of time to file a return. Web what is form 2439?

Web what is form 2439? You are required to give us the information. To enter the 2439 in the individual module: Web everything you need to know about the internal revenue service (irs) forms required to pay your u.s. From the dispositions section select form 2439. The corporation must file its income tax. Go to screen 17.1 dispositions (schedule d, 4797, etc.). From the incomesection, select dispositions (sch d,. Web if your mutual fund sends you a form 2439: These events might increase or decrease your basis.

Web solved•by intuit•updated 5 hours ago. From the incomesection, select dispositions (sch d,. Go to the input return. These events might increase or decrease your basis. Web form 1139 within 12 months of the end of the tax year in which an nol, net capital loss, unused credit, or claim of right adjustment arose. From the dispositions section select form 2439. Web adjusted basis is the original cost of an item adjusted for certain events. The form is typically given to shareholders by. Web to enter the 2439 in the individual module: Go to screen 17.1 dispositions (schedule d, 4797, etc.).

Breanna Form 2439 Instructions 2019

The form is typically given to shareholders by. Web to enter the 2439 in the individual module: Web if your mutual fund sends you a form 2439: From the incomesection, select dispositions (sch d,. These events might increase or decrease your basis.

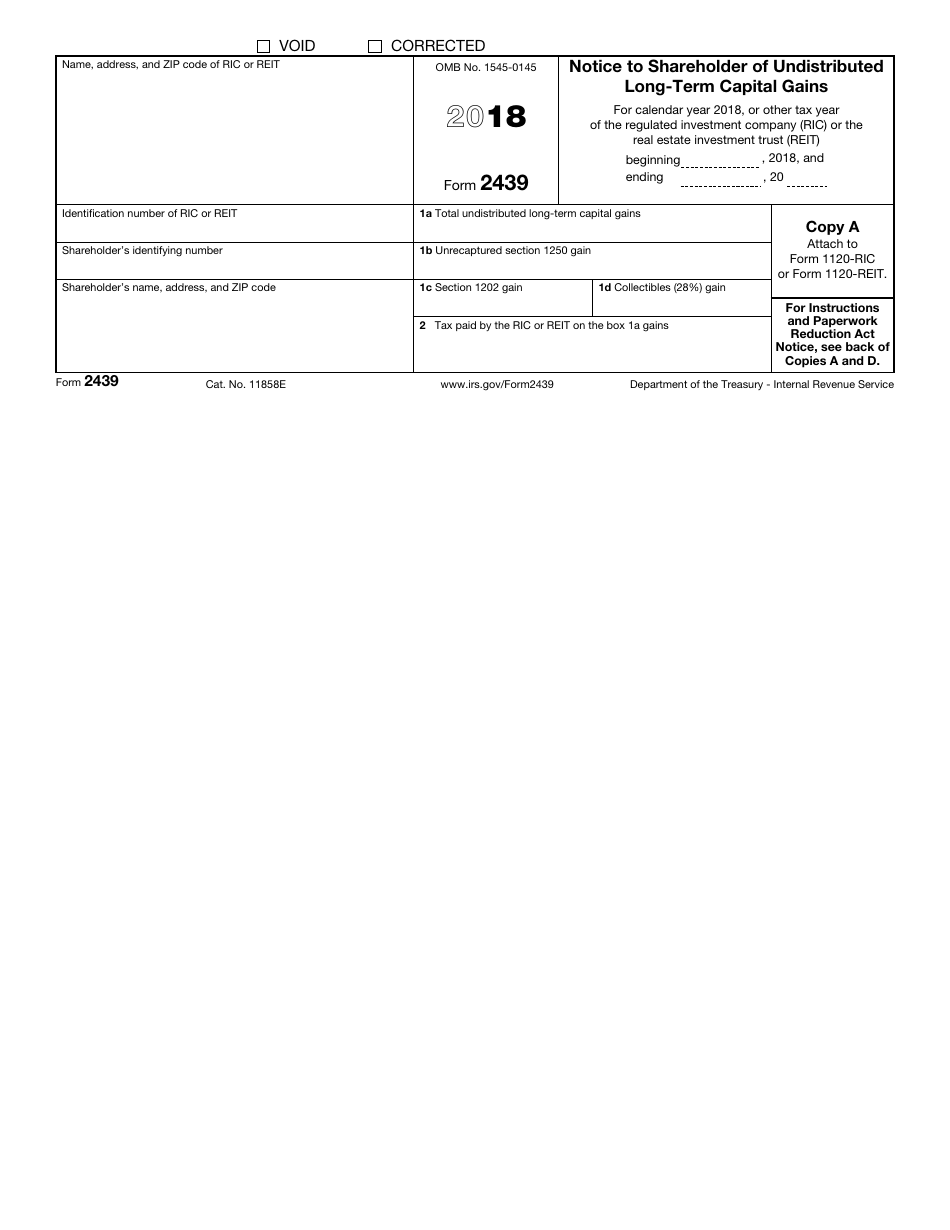

IRS Form 2439 Download Fillable PDF or Fill Online Notice to

Web to enter the 2439 in the individual module: Web what is form 2439? Web if your mutual fund sends you a form 2439: From the incomesection, select dispositions (sch d,. We need it to ensure that you are.

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

Web form 2439 is a form used by the irs to request an extension of time to file a return. Web ask for the information on this form to carry out the internal revenue laws of the united states. Web to enter the 2439 in the individual module: We need it to ensure that you are. The corporation must file.

Fill Free fillable IRS PDF forms

Web adjusted basis is the original cost of an item adjusted for certain events. Web ask for the information on this form to carry out the internal revenue laws of the united states. From the dispositions section select form 2439. Web what is form 2439? Web everything you need to know about the internal revenue service (irs) forms required to.

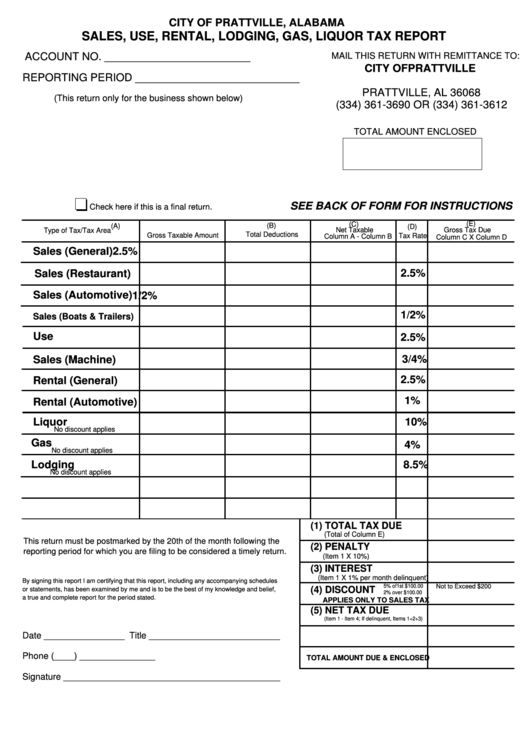

Sales, Use, Rental, Lodging, Gas, Liquor Tax Report Form City Of

Web everything you need to know about the internal revenue service (irs) forms required to pay your u.s. From the incomesection, select dispositions (sch d,. Web to enter the 2439 in the individual module: From the dispositions section select form 2439. Web form 2439 is a form used by the irs to request an extension of time to file a.

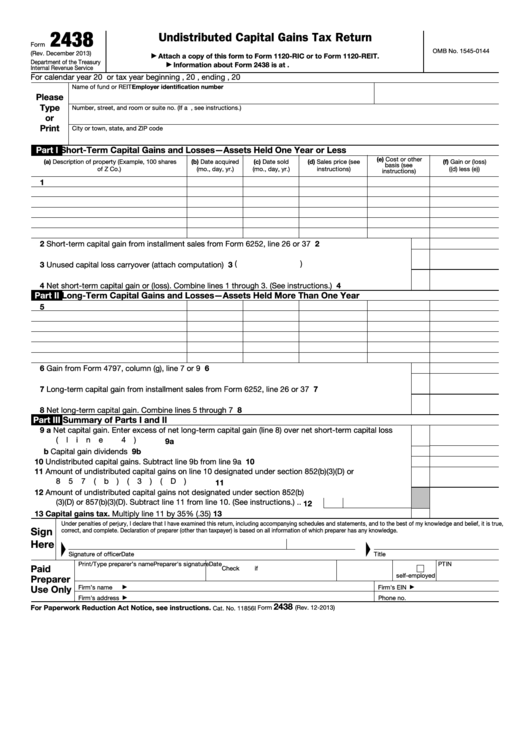

Fillable Form 2438 Undistributed Capital Gains Tax Return printable

These events might increase or decrease your basis. We need it to ensure that you are. You are required to give us the information. Web ask for the information on this form to carry out the internal revenue laws of the united states. Go to screen 17.1 dispositions (schedule d, 4797, etc.).

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

Web form 1139 within 12 months of the end of the tax year in which an nol, net capital loss, unused credit, or claim of right adjustment arose. To enter the 2439 in the individual module: From the dispositions section select form 2439. You are required to give us the information. Web adjusted basis is the original cost of an.

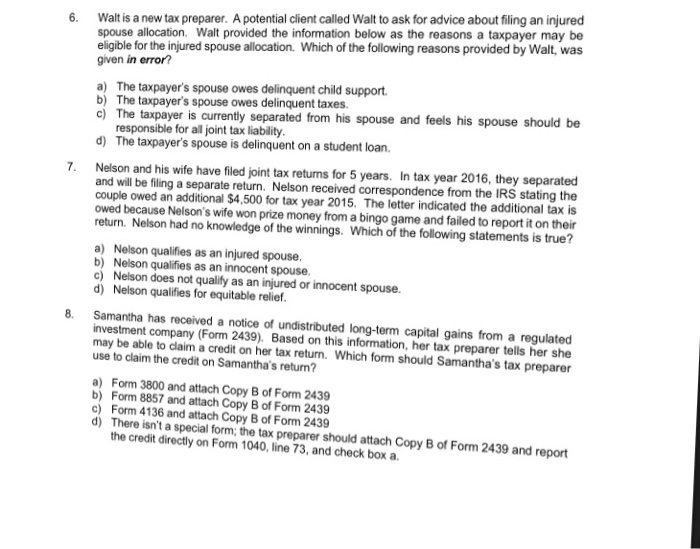

Solved 6 Walt is a new tax preparer. A potential client

Web ask for the information on this form to carry out the internal revenue laws of the united states. Go to screen 17.1 dispositions (schedule d, 4797, etc.). We need it to ensure that you are. From the dispositions section select form 2439. Web what is form 2439?

Fill Free fillable 2019 Form 1120REIT Tax Return for Real Estate

Web ask for the information on this form to carry out the internal revenue laws of the united states. The form is typically given to shareholders by. Web solved•by intuit•updated 5 hours ago. We need it to ensure that you are. From the incomesection, select dispositions (sch d,.

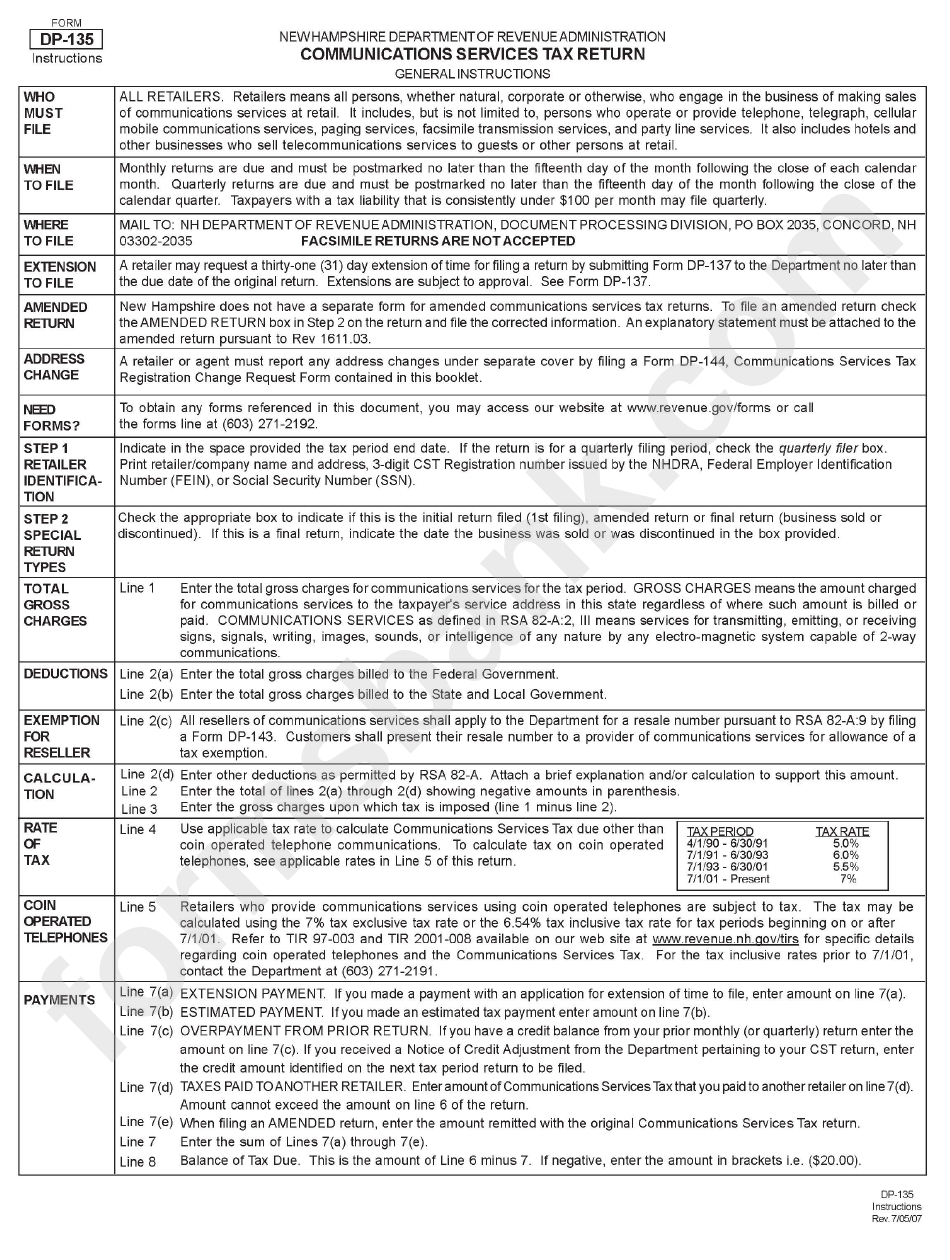

Form Dp135 Instructions Communications Services Tax Return printable

Web to enter the 2439 in the individual module: These events might increase or decrease your basis. Web adjusted basis is the original cost of an item adjusted for certain events. To enter the 2439 in the individual module: Go to the input return.

From The Dispositions Section Select Form 2439.

Web form 1139 within 12 months of the end of the tax year in which an nol, net capital loss, unused credit, or claim of right adjustment arose. These events might increase or decrease your basis. Web adjusted basis is the original cost of an item adjusted for certain events. Web ask for the information on this form to carry out the internal revenue laws of the united states.

Web What Is Form 2439?

To enter the 2439 in the individual module: The form is typically given to shareholders by. Web to enter the 2439 in the individual module: Web form 2439 is a form used by the irs to request an extension of time to file a return.

Go To Screen 17.1 Dispositions (Schedule D, 4797, Etc.).

You are required to give us the information. Go to the input return. Web everything you need to know about the internal revenue service (irs) forms required to pay your u.s. Web if your mutual fund sends you a form 2439:

The Corporation Must File Its Income Tax.

Web solved•by intuit•updated 5 hours ago. We need it to ensure that you are. From the incomesection, select dispositions (sch d,.