When Is Form 5500 Due

When Is Form 5500 Due - Calendar year plans have a form 5500 due date of july 31 st. If the plan follows the calendar year, this date would be july 31. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on the next business day that is not a saturday, sunday, or federal holiday. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web form 5500 due date. The general rule is that form 5500s must be filed by the last day of the seventh month after the plan year ends, unless filing an extension. Plan sponsors can request an extension to oct. In general amendments must be signed. 7 months after end of plan year. The form 5500 due date for filing depends on the plan year.

2 ½ months after initial deadline. Plan sponsors can request an extension to oct. The general rule is that form 5500s must be filed by the last day of the seventh month after the plan year ends, unless filing an extension. Web the due date for every type of form 5500 is the last day of the seventh month after the plan year ends. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on the next business day that is not a saturday, sunday, or federal holiday. Web form 5500 due date: If the plan follows the calendar year, this date would be july 31. Calendar year plans have a form 5500 due date of july 31 st. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct.

15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. Calendar year plans have a form 5500 due date of july 31 st. Form 5500 may be extended for. In general amendments must be signed. The general rule is that form 5500s must be filed by the last day of the seventh month after the plan year ends, unless filing an extension. Thus, filing of the 2023 forms generally will not begin until july 2024. Web the due date for every type of form 5500 is the last day of the seventh month after the plan year ends. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web form 5500 due date. 7 months after end of plan year.

Form 5500 Is Due by July 31 for Calendar Year Plans

Web the due date for every type of form 5500 is the last day of the seventh month after the plan year ends. If the plan follows the calendar year, this date would be july 31. Plan sponsors can request an extension to oct. In general amendments must be signed. The general rule is that form 5500s must be filed.

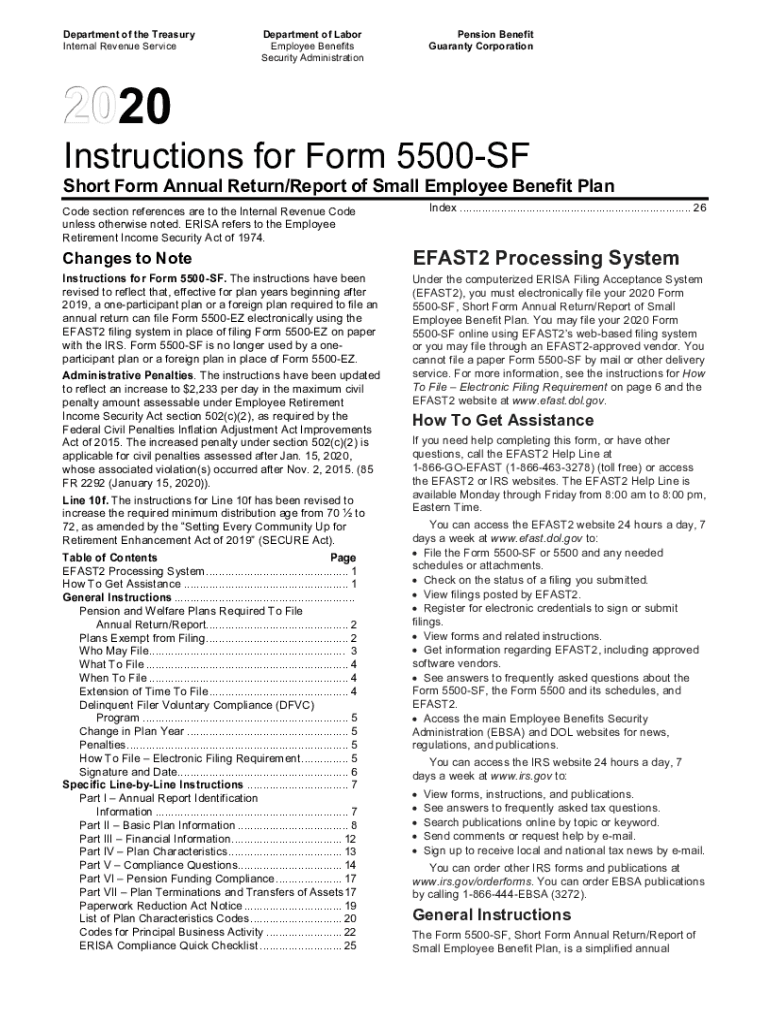

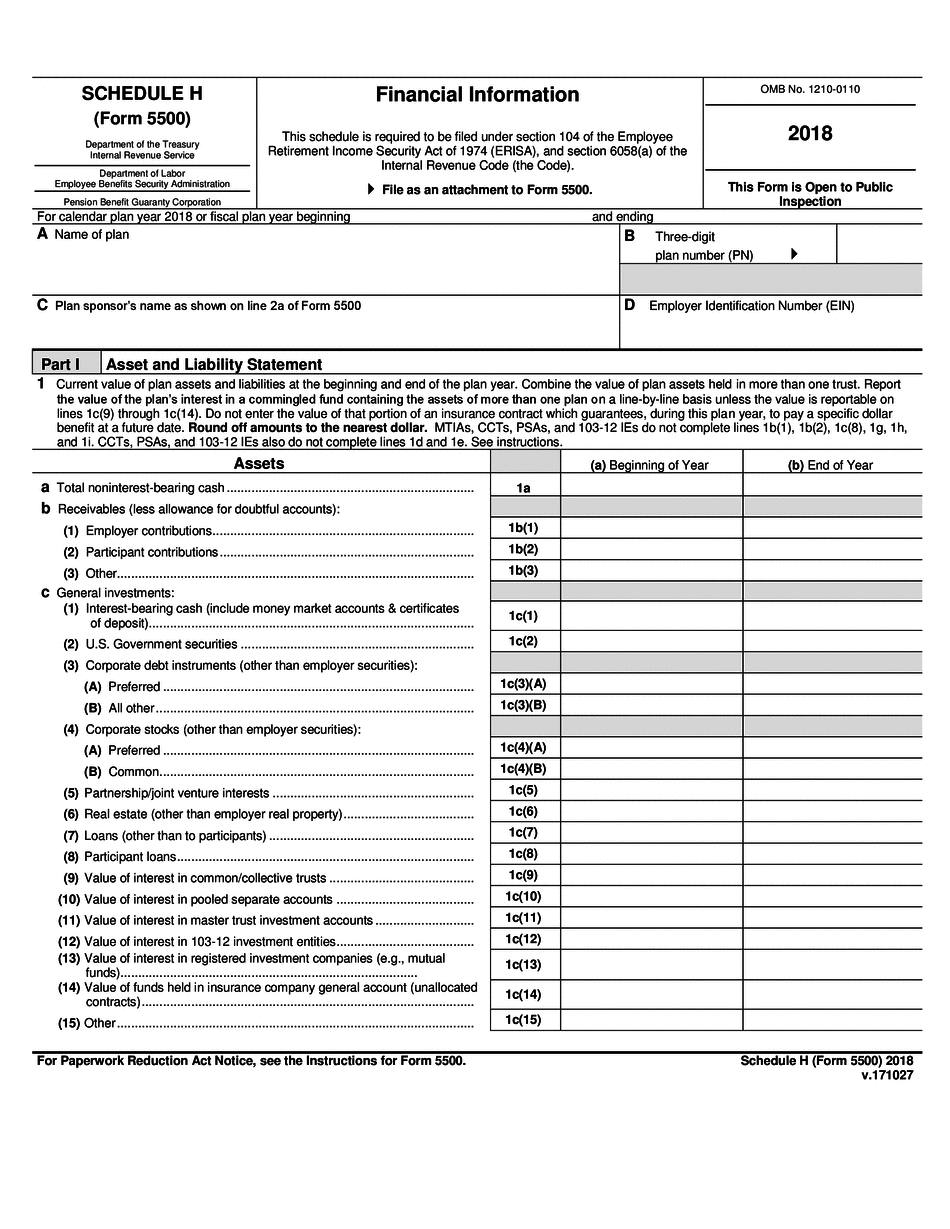

2018 Updated Form 5500EZ Guide Solo 401k

In general amendments must be signed. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on the next business day that is not a saturday, sunday, or federal holiday. The form 5500 due.

Form 5500 Annual Fill Out and Sign Printable PDF Template signNow

Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. If the plan follows the calendar year, this date would be july 31. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on the next business day that is not a saturday, sunday,.

Form 5500 Due Date Avoid Serious Late Filing Penalties BASIC

Thus, filing of the 2023 forms generally will not begin until july 2024. Form 5500 may be extended for. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. 2 ½ months after initial deadline. If the plan follows the calendar year, this date would be.

August 1st Form 5500 Due Matthews, Carter & Boyce

In general amendments must be signed. Plan sponsors can request an extension to oct. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. Web form 5500 due date. The form 5500 due date for filing depends on the plan year.

How to File Form 5500EZ Solo 401k

The form 5500 due date for filing depends on the plan year. The general rule is that form 5500s must be filed by the last day of the seventh month after the plan year ends, unless filing an extension. Plan sponsors can request an extension to oct. If the deadline falls on a saturday, sunday, or federal holiday, the filing.

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC

Plan sponsors can request an extension to oct. Web form 5500 due date: The form 5500 due date for filing depends on the plan year. 2 ½ months after initial deadline. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on the next business day that is not a saturday, sunday, or federal.

Form 5500 Search What You Need To Know Form 5500

Plan sponsors can request an extension to oct. Calendar year plans have a form 5500 due date of july 31 st. 7 months after end of plan year. In general amendments must be signed. Web form 5500 due date.

Form 5500 Deadline Is it Extended Due to COVID19? Yeo and Yeo

Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on the next business day that is not a saturday, sunday, or federal holiday. Web form 5500 due date. 7 months after end of.

Web Typically, The Form 5500 Is Due By July 31St For Calendar Year Plans, With An Extension Deadline Of Oct.

Form 5500 may be extended for. 2 ½ months after initial deadline. Web form 5500 due date. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on the next business day that is not a saturday, sunday, or federal holiday.

Web Form 5500 Due Date:

7 months after end of plan year. Plan sponsors can request an extension to oct. If the plan follows the calendar year, this date would be july 31. Web the due date for every type of form 5500 is the last day of the seventh month after the plan year ends.

In General Amendments Must Be Signed.

The form 5500 due date for filing depends on the plan year. Calendar year plans have a form 5500 due date of july 31 st. Thus, filing of the 2023 forms generally will not begin until july 2024. The general rule is that form 5500s must be filed by the last day of the seventh month after the plan year ends, unless filing an extension.