When Will Injured Spouse Form Be Released 2022

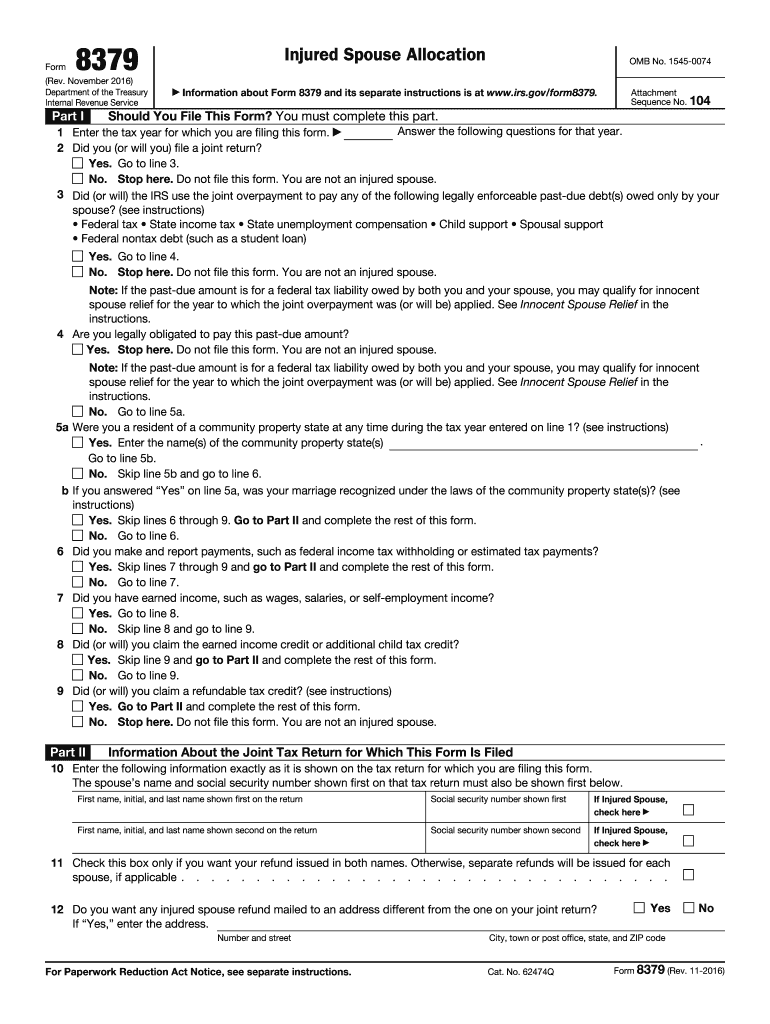

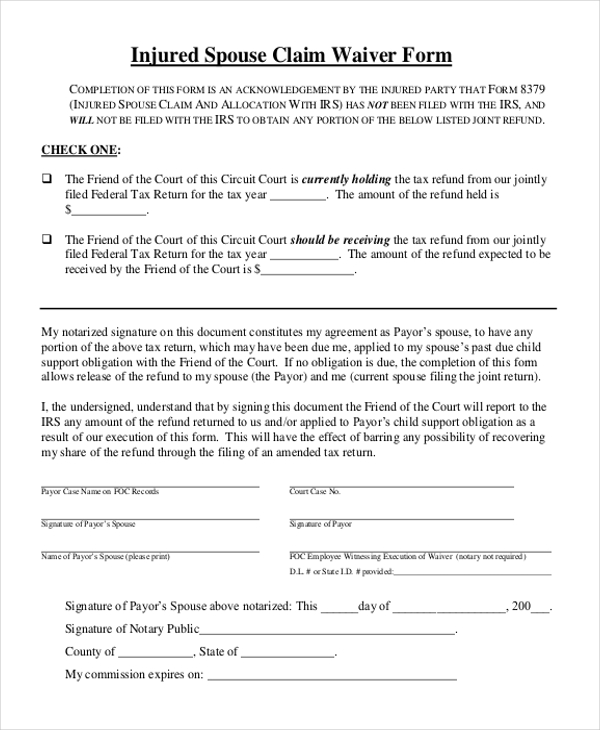

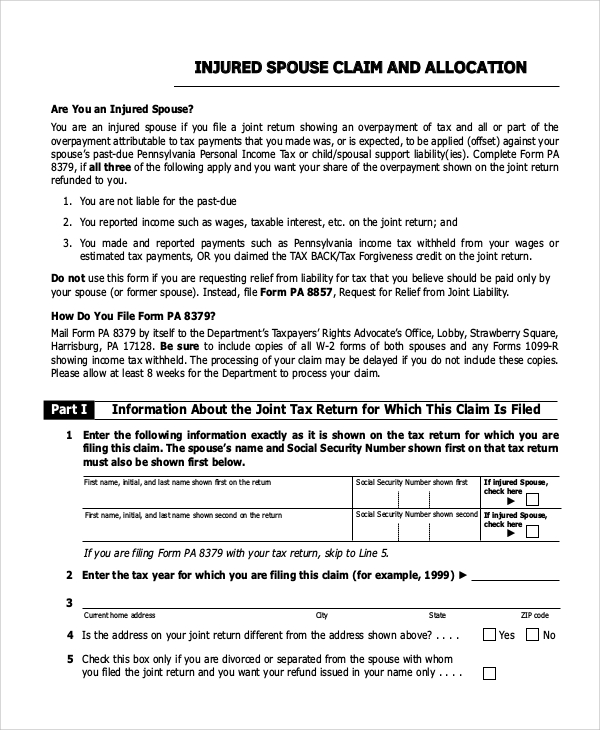

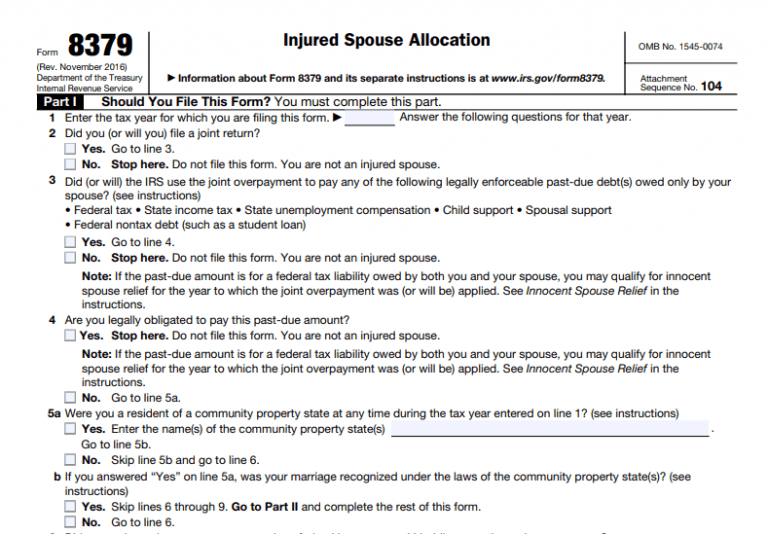

When Will Injured Spouse Form Be Released 2022 - You filed a joint return. If you file form 8379 with a joint return electronically, the time needed to. For example, if you send this tax form with your 2021 income tax return and the irs approves it, you won’t. If the form is sent by itself, it can take eight weeks. Web updated january 14, 2022 reviewed by lea d. Web updated on november 14, 2022 reviewed by ebony j. The injured spouse on a jointly filed tax return can. Once the form has been approved by the irs, you. Web español taxpayers file form 8857 to request relief from tax liability, plus related penalties and interest, when they believe only their spouse or former spouse. Form 8379 is used by injured.

Web updated on november 14, 2022 reviewed by ebony j. December 1, 2022 injured spouse you’re an injured spouse if your share of the refund on your joint tax return. Web you may qualify as an injured spouse, if you plan on filing a joint return with your spouse and your spouse owes a debt that you are not responsible for. For example, if you send this tax form with your 2021 income tax return and the irs approves it, you won’t. Web information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file. Form 8379 is used by injured. If the form is sent by itself, it can take eight weeks. Web by filing form 8379, the injured spouse may be able to get back his or her share of the joint refund. Web form 8379 is for the specific tax year in question. Web 2 min read the phrase “injured spouse” has nothing to do with being physically hurt.

Your refund was taken to pay an offset. If you file form 8379 with a joint return electronically, the time needed to. If the form is sent by itself, it can take eight weeks. Howard fact checked by yasmin ghahremani in this article view all qualifying as an injured. You filed a joint return. Web by completing the injured spouse allocation (form 8379), the injured spouse may be able to get back their portion of the refund. Web updated on november 14, 2022 reviewed by ebony j. Uradu what is irs form 8379: Web download or print the 2022 federal (injured spouse allocation) (2022) and other income tax forms from the federal internal revenue service. Web form 8379 is for the specific tax year in question.

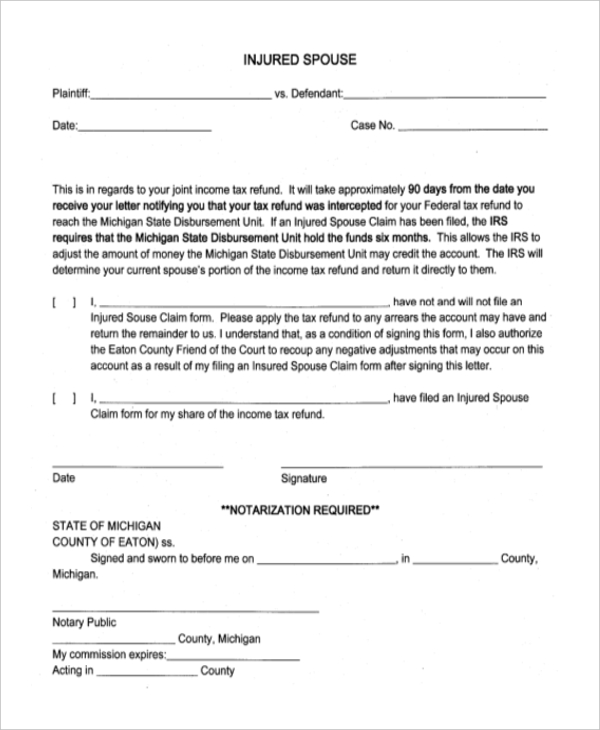

FREE 9+ Sample Injured Spouse Forms in PDF

If the form is sent by itself, it can take eight weeks. December 21, 2021 | last updated: Once the form has been approved by the irs, you. Web español taxpayers file form 8857 to request relief from tax liability, plus related penalties and interest, when they believe only their spouse or former spouse. Web by completing the injured spouse.

FREE 9+ Sample Injured Spouse Forms in PDF

Web by filing form 8379, the injured spouse may be able to get back his or her share of the joint refund. December 21, 2021 | last updated: Web form 8379 is for the specific tax year in question. Web information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file. Howard fact.

What’s Injured Spouse for Tax Purposes? Credit Karma

To qualify for the injured spouse allocation,. Uradu what is irs form 8379: Web 2 min read the phrase “injured spouse” has nothing to do with being physically hurt. Form 8379 is used by injured. December 21, 2021 | last updated:

FREE 9+ Sample Injured Spouse Forms in PDF

To qualify for the injured spouse allocation,. Web form 8379 is for the specific tax year in question. Web 2 min read the phrase “injured spouse” has nothing to do with being physically hurt. Web by completing the injured spouse allocation (form 8379), the injured spouse may be able to get back their portion of the refund. December 1, 2022.

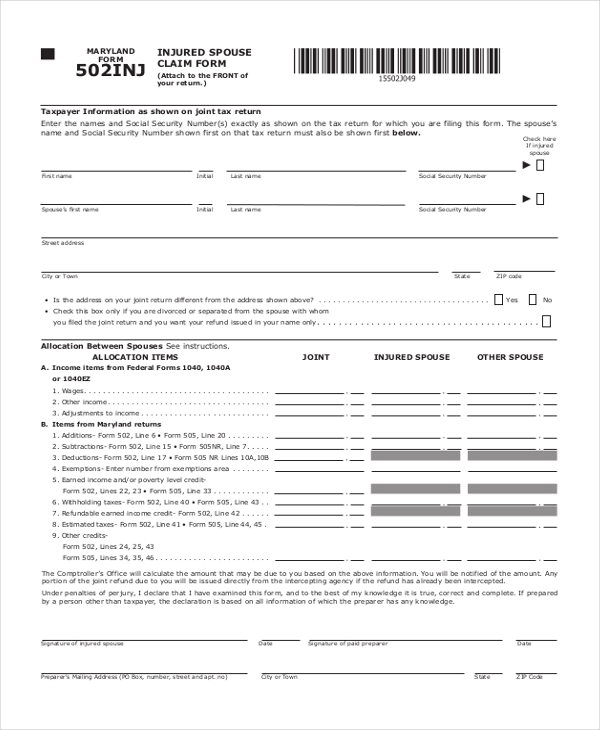

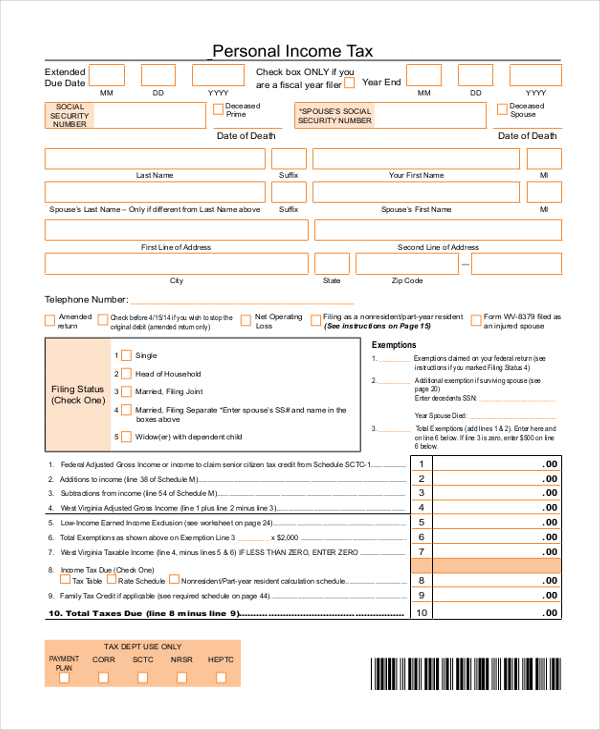

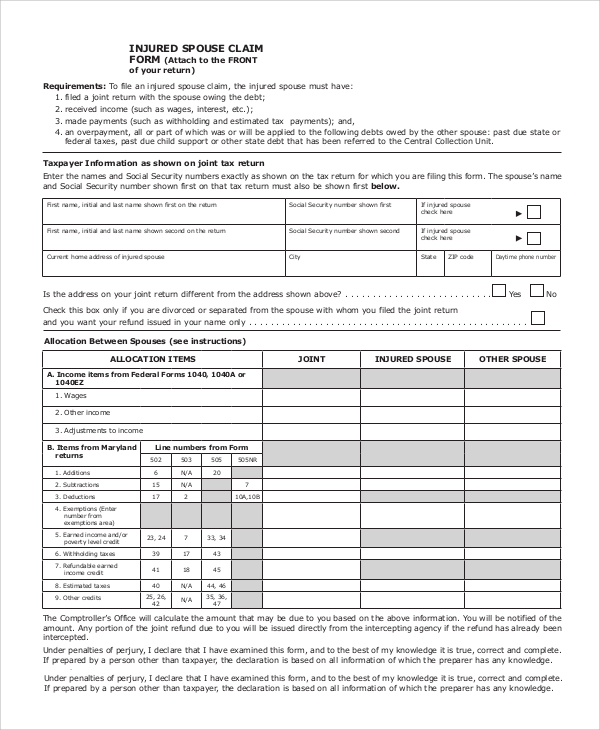

FREE 7+ Sample Injured Spouse Forms in PDF

For example, if you send this tax form with your 2021 income tax return and the irs approves it, you won’t. Web updated january 14, 2022 reviewed by lea d. The injured spouse on a jointly filed tax return can. December 21, 2021 | last updated: Web updated on november 14, 2022 reviewed by ebony j.

Irs form 8379 Fill out & sign online DocHub

Once the form has been approved by the irs, you. Web you may qualify as an injured spouse, if you plan on filing a joint return with your spouse and your spouse owes a debt that you are not responsible for. December 1, 2022 injured spouse you’re an injured spouse if your share of the refund on your joint tax.

FREE 9+ Sample Injured Spouse Forms in PDF

Web form 8379 is for the specific tax year in question. Web form 8379, injured spouse claim and allocation for tax year 2021 is estimated to be finalized and available in turbotax on 03/17/2022 go to this turbotax. Web español taxpayers file form 8857 to request relief from tax liability, plus related penalties and interest, when they believe only their.

FREE 7+ Sample Injured Spouse Forms in PDF

In taxes, you might be an injured spouse if you file a joint tax return when your spouse. Web español taxpayers file form 8857 to request relief from tax liability, plus related penalties and interest, when they believe only their spouse or former spouse. Uradu what is irs form 8379: Web you may qualify as an injured spouse, if you.

Everything You Need to Know about Injured Spouse Tax Relief (IRS Form

For example, if you send this tax form with your 2021 income tax return and the irs approves it, you won’t. You filed a joint return. Web form 8379, injured spouse claim and allocation for tax year 2021 is estimated to be finalized and available in turbotax on 03/17/2022 go to this turbotax. Howard fact checked by yasmin ghahremani in.

FREE 7+ Sample Injured Spouse Forms in PDF

Web español taxpayers file form 8857 to request relief from tax liability, plus related penalties and interest, when they believe only their spouse or former spouse. Web form 8379 is for the specific tax year in question. Web if you meet these criteria, you may be able to file form 8379, injured spouse allocation: Web updated on november 14, 2022.

Which Revision To Use Use The November 2021 Revision Of.

Web form 8379 is for the specific tax year in question. Web information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file. Your refund was taken to pay an offset. Form 8379 is used by injured.

To Qualify For The Injured Spouse Allocation,.

If you file form 8379 with a joint return electronically, the time needed to. Web updated on november 14, 2022 reviewed by ebony j. Web by completing the injured spouse allocation (form 8379), the injured spouse may be able to get back their portion of the refund. In taxes, you might be an injured spouse if you file a joint tax return when your spouse.

Web 2 Min Read The Phrase “Injured Spouse” Has Nothing To Do With Being Physically Hurt.

Web download or print the 2022 federal (injured spouse allocation) (2022) and other income tax forms from the federal internal revenue service. Web by filing form 8379, the injured spouse may be able to get back his or her share of the joint refund. Web updated january 14, 2022 reviewed by lea d. If the form is sent by itself, it can take eight weeks.

Web You May Qualify As An Injured Spouse, If You Plan On Filing A Joint Return With Your Spouse And Your Spouse Owes A Debt That You Are Not Responsible For.

Web if you meet these criteria, you may be able to file form 8379, injured spouse allocation: For example, if you send this tax form with your 2021 income tax return and the irs approves it, you won’t. Web answer yes, you can file form 8379 electronically with your tax return. Web form 8379, injured spouse claim and allocation for tax year 2021 is estimated to be finalized and available in turbotax on 03/17/2022 go to this turbotax.