Where Do I Mail Form 943

Where Do I Mail Form 943 - Web about form 943, employer's annual federal tax return for agricultural employees. The irs requires businesses with employees to. Web what is the mailing address of the irs for form 1040? The irs mailing address for form 1040 depends on what state you live in, as they have several different addresses. And the total assets at the end of the tax year. In other words, it is a tax form used to report federal income tax, social. Mail your return to the address listed for your location in the table that follows. Where you file depends on whether the. This form will be used by employers in the agricultural field. Web for the latest information about developments related to form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943.

Web simply follow the steps below to file your form 943: Where to mail form 943 for 2022? Mail your return to the address listed for your location in the table that follows. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. 1.877.683.3280 learn about the different federal payroll forms, and how our payroll products support them. Web efile now more salient features what is 943 form? In other words, it is a tax form used to report federal income tax, social. If you are filing form 843 to request a claim for refund in form 706/709 only tax matters, then mail the form to: Web the address is shown in the notice. Web where to file your taxes for form 1065.

Web what is the mailing address of the irs for form 1040? If you are filing form 843 to request a claim for refund in form 706/709 only tax matters, then mail the form to: If the partnership's principal business, office, or agency is located in: If you want to file online, you can either search for a tax professional to guide you through the. It is known as an employer’s annual federal tax return for agriculture employees. Form 9143 is a request for you to provide information that was missing from your tax return (it's most commonly used when a taxpayer fails to sign the return). This form will be used by employers in the agricultural field. When filing paper copies, agricultural employers must mail form 943 to the irs. Select form 943 and enter. Web simply follow the steps below to file your form 943:

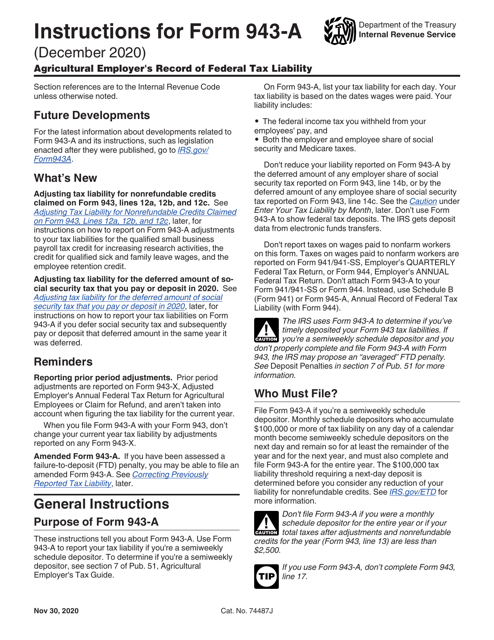

Download Instructions for IRS Form 943A Agricultural Employer's Record

Web for the latest information about developments related to form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. Web the address is shown in the notice. Web if you made deposits on time, in full payment of the taxes for the year, you may have time to file your form 943 until february.

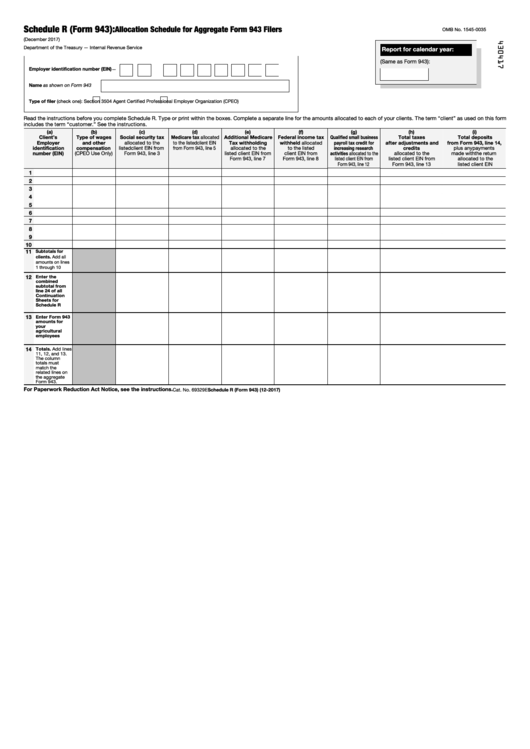

Fillable Schedule R (Form 943) Allocation Schedule For Aggregate Form

If you are filing form 843 to request a claim for refund in form 706/709 only tax matters, then mail the form to: Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. When to file form 943 943.

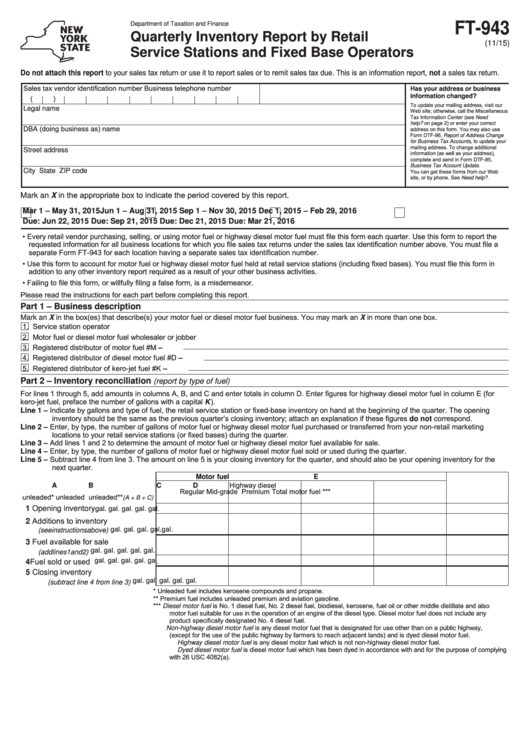

Form Ft943 Quarterly Inventory Report By Retail Service Stations And

Web efile now more salient features what is 943 form? Mail your return to the address listed for your location in the table that follows. Web for the latest information about developments related to form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. If you want to file online, you can either search.

Form 943 Employer's Annual Federal Tax Return for Agricultural

Web what is the mailing address of the irs for form 1040? Web form 943, is the employer’s annual federal tax return for agricultural employees. Web for the latest information about developments related to form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. If you want to file online, you can either search.

IRS Form 943 Online Efile 943 for 4.95 Form 943 for 2020

Web about form 943, employer's annual federal tax return for agricultural employees. If you are filing form 843 to request a claim for refund in form 706/709 only tax matters, then mail the form to: Where you file depends on whether the. Form 9143 is a request for you to provide information that was missing from your tax return (it's.

Form 943 What You Need to Know About Agricultural Withholding

If you are filing form 843 to request a claim for refund in form 706/709 only tax matters, then mail the form to: Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Mail your return to the address listed for your location in the table.

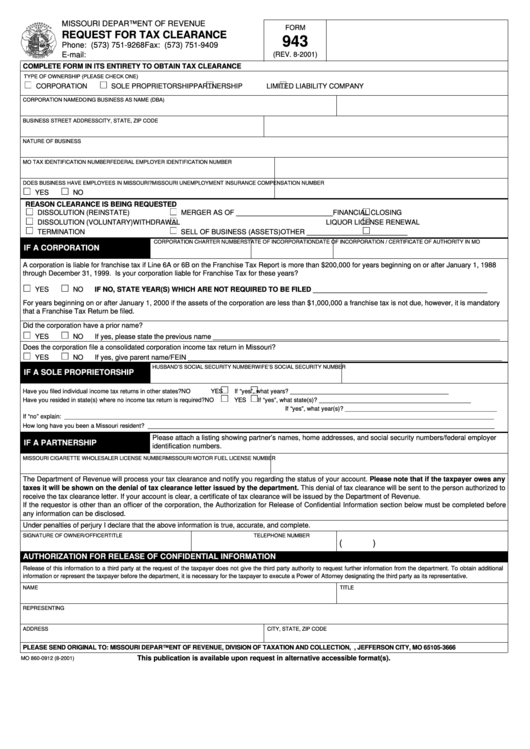

Form 943 Request For Tax Clearance printable pdf download

Select form 943 and enter. And the total assets at the end of the tax year. Web if you made deposits on time, in full payment of the taxes for the year, you may have time to file your form 943 until february 10, 2023. Web efile now more salient features what is 943 form? This form will be used.

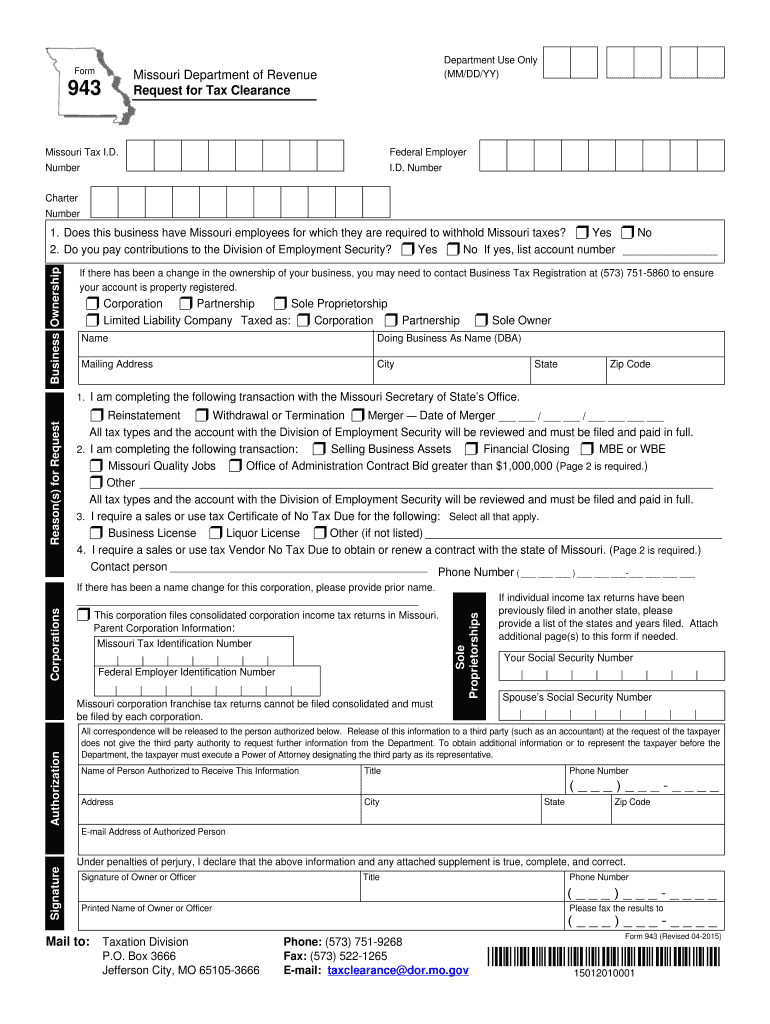

20152020 Form MO DoR 943 Fill Online, Printable, Fillable, Blank

Where you file depends on whether the. It is known as an employer’s annual federal tax return for agriculture employees. When to file form 943 943 important dates 943 efile info 943 online service pricing 943 fee calculator Where to mail form 943 for 2022? Web about form 943, employer's annual federal tax return for agricultural employees.

IRS Form 943 Complete PDF Tenplate Online in PDF

In other words, it is a tax form used to report federal income tax, social. Web for the latest information about developments related to form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. And the total assets at the end of the tax year. This form will be used by employers in the.

Fill Free fillable F943apr Form 943 APR (Rev. October 2017) PDF form

Web form 943, is the employer’s annual federal tax return for agricultural employees. And the total assets at the end of the tax year. Form 9143 is a request for you to provide information that was missing from your tax return (it's most commonly used when a taxpayer fails to sign the return). Create a free taxbandits account or login.

Web Form 943, Is The Employer’s Annual Federal Tax Return For Agricultural Employees.

Web simply follow the steps below to file your form 943: If you are filing form 843 to request a claim for refund in form 706/709 only tax matters, then mail the form to: Where you file depends on whether the. Form 9143 is a request for you to provide information that was missing from your tax return (it's most commonly used when a taxpayer fails to sign the return).

Mail Your Return To The Address Listed For Your Location In The Table That Follows.

If you want to file online, you can either search for a tax professional to guide you through the. In other words, it is a tax form used to report federal income tax, social. When to file form 943 943 important dates 943 efile info 943 online service pricing 943 fee calculator Web if you file a paper return, where you file depends on whether you include a payment with form 943.

Web We Last Updated The Employer's Annual Federal Tax Return For Agricultural Employees In February 2023, So This Is The Latest Version Of Form 943, Fully Updated For Tax Year 2022.

Web the address is shown in the notice. Web if you made deposits on time, in full payment of the taxes for the year, you may have time to file your form 943 until february 10, 2023. The irs mailing address for form 1040 depends on what state you live in, as they have several different addresses. Web about form 943, employer's annual federal tax return for agricultural employees.

If The Partnership's Principal Business, Office, Or Agency Is Located In:

Web what is a form 943? Where to mail form 943 for 2022? Create a free taxbandits account or login if you have one already step 2: Web for the latest information about developments related to form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943.