Where Do Prepaid Expenses Appear On The Balance Sheet

Where Do Prepaid Expenses Appear On The Balance Sheet - Over time, prepaid expenses are expensed onto the income statement. The adjusting journal entry for a prepaid expense, however, does affect both a company’s. Web prepaid expenses are first recorded in the prepaid asset account on the balance sheet. The gaap matching principle prevents expenses from being recorded on the income statement before. Prepaid expenses are expenses that have. Web how to find prepaid expenses on the balance sheet? The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Web recall that prepaid expenses are considered an asset because they provide future economic benefits to the company. For example, the following screenshot from. Web prepaid expenses are recorded on the balance sheet as an asset, most often as a current asset.

The adjusting journal entry for a prepaid expense, however, does affect both a company’s. The gaap matching principle prevents expenses from being recorded on the income statement before. Web recall that prepaid expenses are considered an asset because they provide future economic benefits to the company. Over time, prepaid expenses are expensed onto the income statement. Web prepaid expenses are recorded on the balance sheet as an asset, most often as a current asset. Prepaid expenses are expenses that have. Web how to find prepaid expenses on the balance sheet? For example, the following screenshot from. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Web prepaid expenses are first recorded in the prepaid asset account on the balance sheet.

Over time, prepaid expenses are expensed onto the income statement. The gaap matching principle prevents expenses from being recorded on the income statement before. Prepaid expenses are expenses that have. Web prepaid expenses are recorded on the balance sheet as an asset, most often as a current asset. Web prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that was due for the particular year. For example, the following screenshot from. Web prepaid expenses are first recorded in the prepaid asset account on the balance sheet. The adjusting journal entry for a prepaid expense, however, does affect both a company’s. Web how to find prepaid expenses on the balance sheet? The “prepaid expenses” line item is recorded in the current assets section of the balance sheet.

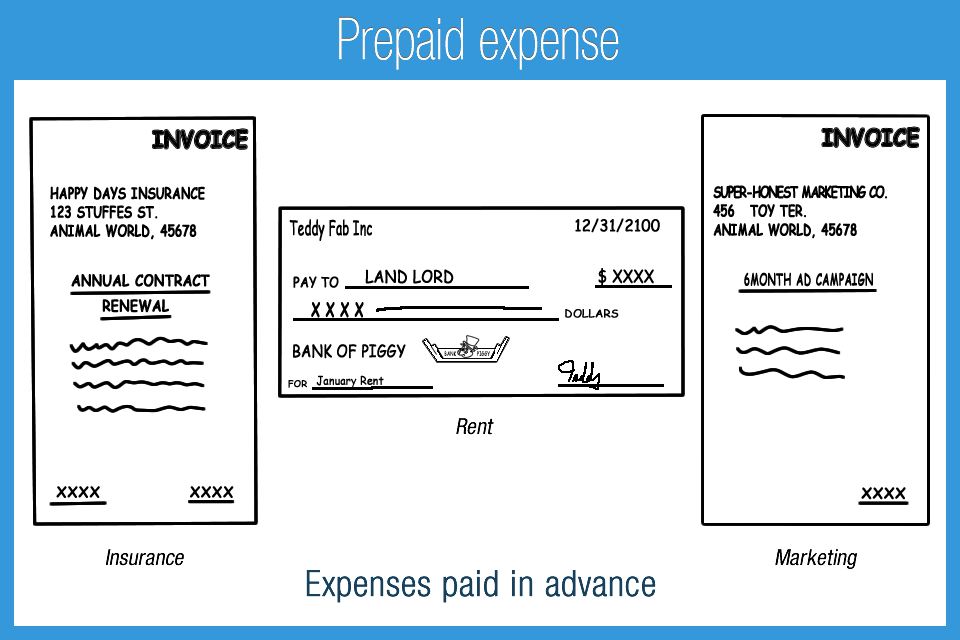

Prepaid expense Accounting Play

The gaap matching principle prevents expenses from being recorded on the income statement before. Web prepaid expenses are first recorded in the prepaid asset account on the balance sheet. Web prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that was due for the particular year. For example, the.

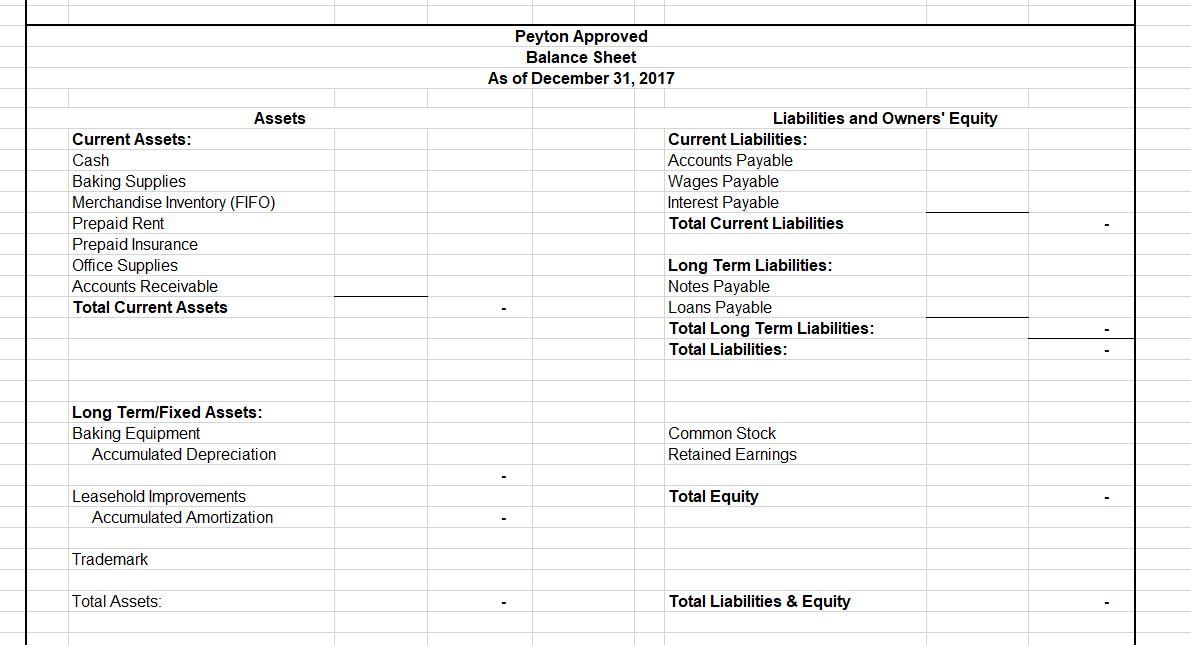

Solved Hyrkas Corporation's most recent balance sheet and

Web prepaid expenses are first recorded in the prepaid asset account on the balance sheet. Web recall that prepaid expenses are considered an asset because they provide future economic benefits to the company. Web prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that was due for the particular.

Solved Please help with these tables below. In your final

The adjusting journal entry for a prepaid expense, however, does affect both a company’s. Web recall that prepaid expenses are considered an asset because they provide future economic benefits to the company. Over time, prepaid expenses are expensed onto the income statement. Web prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or.

Prepaid Expenses Appear In The Section Of The Balance Sheet Key Ratios

Web how to find prepaid expenses on the balance sheet? Web prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that was due for the particular year. Over time, prepaid expenses are expensed onto the income statement. Prepaid expenses are expenses that have. Web recall that prepaid expenses are.

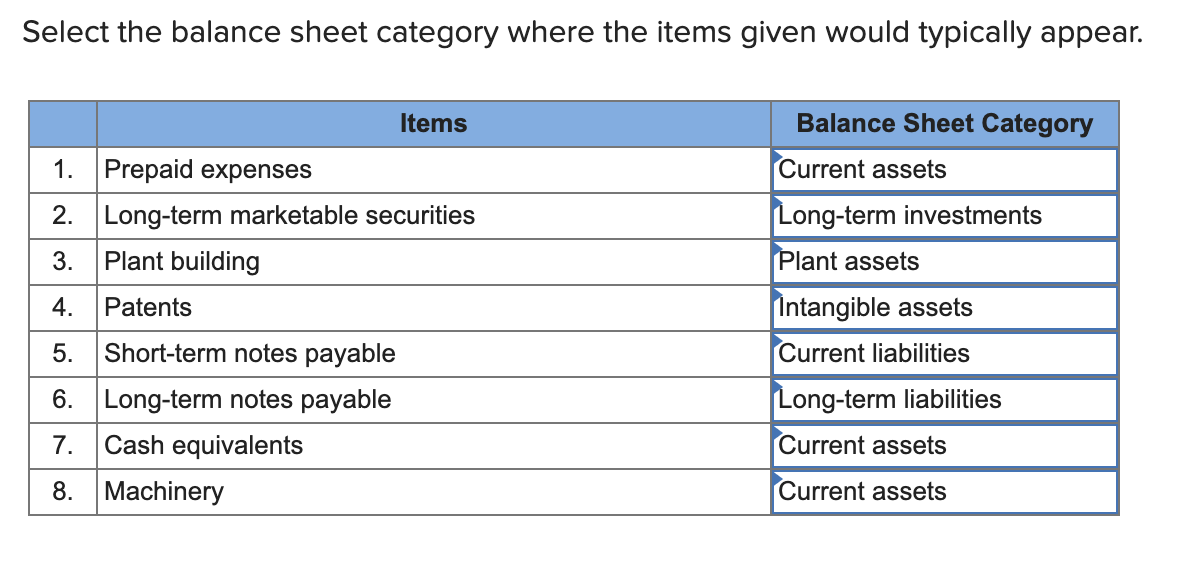

Solved Select the balance sheet category where the items

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Web prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that was due for the particular year. Over time, prepaid expenses are expensed onto the income statement. For example, the following screenshot from..

Why Prepaid Expenses Appear in the Current Asset Section of the Balance

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Over time, prepaid expenses are expensed onto the income statement. Web prepaid expenses are recorded on the balance sheet as an asset, most often as a current asset. Prepaid expenses are expenses that have. The adjusting journal entry for a prepaid expense, however, does.

Prepaid expenses definition, processes, and significance Kolleno

Web prepaid expenses are first recorded in the prepaid asset account on the balance sheet. The gaap matching principle prevents expenses from being recorded on the income statement before. Web prepaid expenses are recorded on the balance sheet as an asset, most often as a current asset. The adjusting journal entry for a prepaid expense, however, does affect both a.

Prepaid Expenses Definition + Examples

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. The gaap matching principle prevents expenses from being recorded on the income statement before. For example, the following screenshot from. Web prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that was due.

Prepaid Expenses and Balance Sheet YouTube

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Web prepaid expenses are first recorded in the prepaid asset account on the balance sheet. Web prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that was due for the particular year. Web.

Solved Hyrkas Corporation's most recent balance sheet and

Prepaid expenses are expenses that have. Web prepaid expenses are first recorded in the prepaid asset account on the balance sheet. The adjusting journal entry for a prepaid expense, however, does affect both a company’s. For example, the following screenshot from. Web how to find prepaid expenses on the balance sheet?

Web How To Find Prepaid Expenses On The Balance Sheet?

Over time, prepaid expenses are expensed onto the income statement. Web prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that was due for the particular year. For example, the following screenshot from. Web recall that prepaid expenses are considered an asset because they provide future economic benefits to the company.

Prepaid Expenses Are Expenses That Have.

Web prepaid expenses are first recorded in the prepaid asset account on the balance sheet. Web prepaid expenses are recorded on the balance sheet as an asset, most often as a current asset. The adjusting journal entry for a prepaid expense, however, does affect both a company’s. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet.