Where To Mail 7004 Form

Where To Mail 7004 Form - Where to mail the paper form? Please print or type your answers. Web in plain terms, form 7004 is a tax form most business owners can use to request more time to file their business income tax returns. If you do not file electronically, file form 7004 with the internal revenue service center at the applicable address for your. Go to the irs where to file form 7004 webpage. Web this is where you need to mail your form 7004 this year. Check your state tax extension requirements. Find the applicable main form under the if the. Web certain addresses where form 7004 needs to be sent were changed in the states of illinois, georgia, kentucky, michigan, tennessee, and wisconsin. Web part ii includes questions for all filers.

Web follow these steps to determine which address the form 7004 should be sent to: Web where do i mail my tax form 7004? Web for details on electronic filing, visit irs.gov/efile7004. Web key takeaways what is form 7004? Check your state tax extension requirements. Web 13 rows address changes for filing form 7004. The irs is changing it’s mailing. Find the applicable main form under the if the. Where to mail the paper form? Please print or type your answers.

Find the applicable main form under the if the. The first step to finding out where to send your form 7004 to the irs is accessing the agency’s “. Web certain addresses where form 7004 needs to be sent were changed in the states of illinois, georgia, kentucky, michigan, tennessee, and wisconsin. Web this is where you need to mail your form 7004 this year. Web follow these steps to determine which address the form 7004 should be sent to: Check your state tax extension requirements. Web in this guide, we cover it all, including: What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make tax payments what is form. Please print or type your answers. (solution) then file form 7004 at:

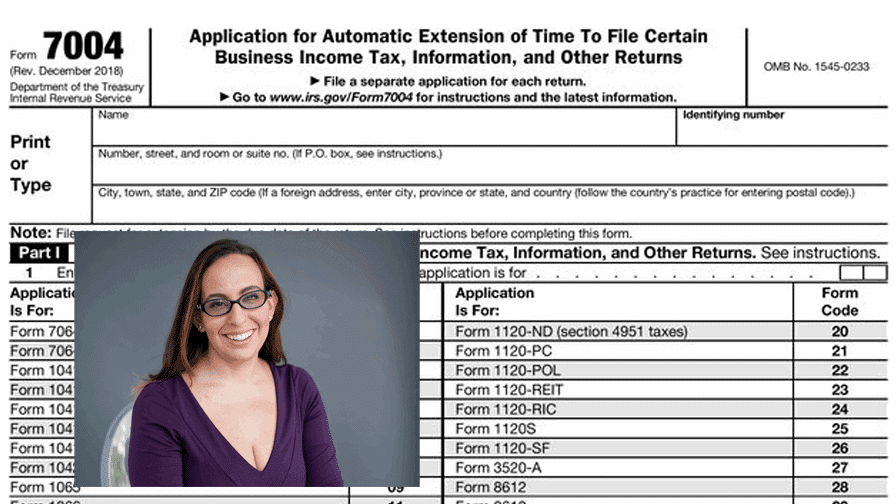

How to file an LLC extension Form 7004 YouTube

Web certain addresses where form 7004 needs to be sent were changed in the states of illinois, georgia, kentucky, michigan, tennessee, and wisconsin. The first step to finding out where to send your form 7004 to the irs is accessing the agency’s “. Web 13 rows address changes for filing form 7004. Web where do i mail my tax form.

This Is Where You Need To Mail Your Form 7004 This Year Blog

Web where do i mail my tax form 7004? The address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky,. Find the applicable main form under the if the. The address for filing form 7004 has changed for some. Web 13 rows address changes for filing form 7004.

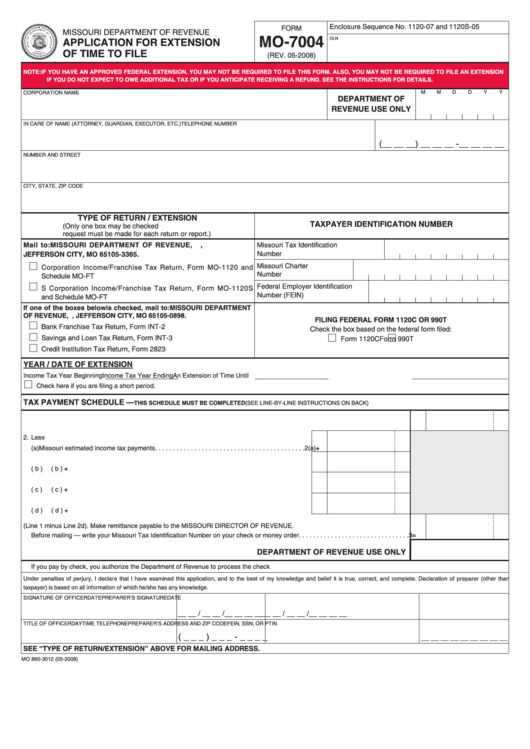

Fillable Form Mo7004 Application For Extension Of Time To File

What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make tax payments what is form. Web certain addresses where form 7004 needs to be sent were changed in the states of illinois, georgia, kentucky, michigan, tennessee, and wisconsin. The irs is changing it’s mailing. Where to mail the paper form?.

IRS Tax Extension Form 7004 and Form 4868 are Due this April 15

Web where do i mail my tax form 7004? Web certain addresses where form 7004 needs to be sent were changed in the states of illinois, georgia, kentucky, michigan, tennessee, and wisconsin. If you do not file electronically, file form 7004 with the internal revenue service center at the applicable address for your. Web irs form 7004 tax extension: Web.

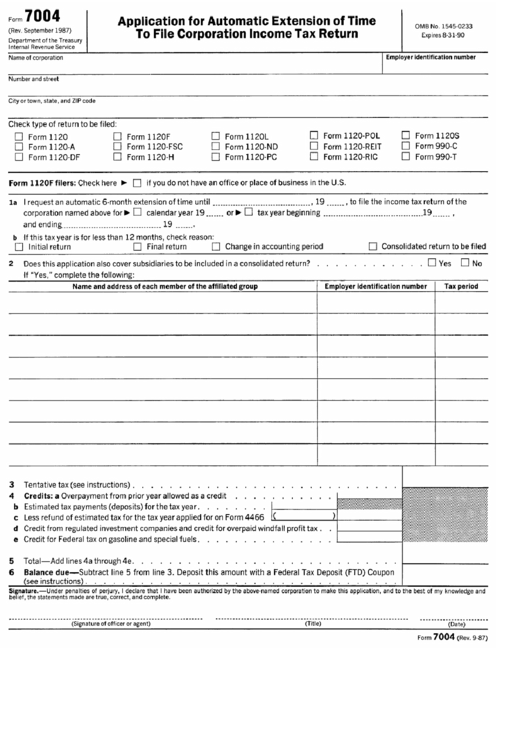

Form 7004 Application For Automatic Extension Of Time To File

The irs is changing it’s mailing. Web certain addresses where form 7004 needs to be sent were changed in the states of illinois, georgia, kentucky, michigan, tennessee, and wisconsin. Web in plain terms, form 7004 is a tax form most business owners can use to request more time to file their business income tax returns. Web 13 rows address changes.

How to file an LLC Tax extension Form 7004 Bette Hochberger, CPA, CGMA

Web in plain terms, form 7004 is a tax form most business owners can use to request more time to file their business income tax returns. Web where do i mail my tax form 7004? Web follow these steps to determine which address the form 7004 should be sent to: Web irs form 7004 tax extension: Please print or type.

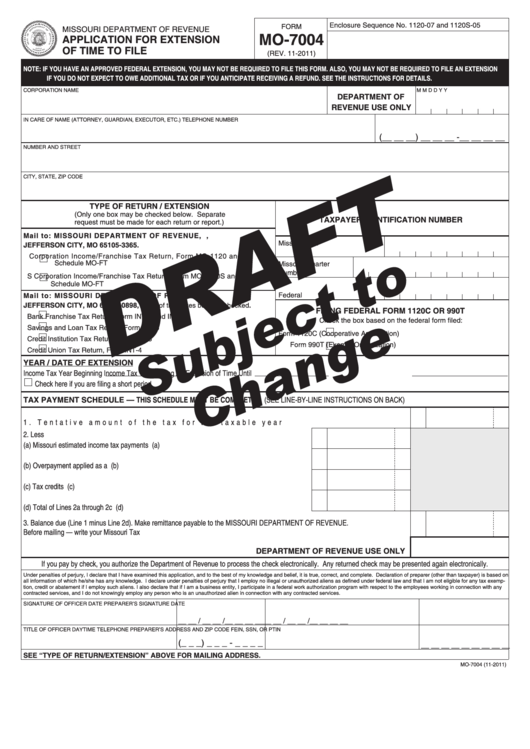

This Is Where You Need To Mail Your Form 7004 This Year Blog

Go to the irs where to file form 7004 webpage. If you do not file electronically, file form 7004 with the internal revenue service center at the applicable address for your. Web 13 rows address changes for filing form 7004. Web part ii includes questions for all filers. Web in plain terms, form 7004 is a tax form most business.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

The address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky,. If you do not file electronically, file form 7004 with the internal revenue service center at the applicable address for your. Check your state tax extension requirements. Web part ii includes questions for all filers. Web for details on electronic filing, visit irs.gov/efile7004.

Form Mo7004 Draft Application For Extension Of Time To File

Where to mail the paper form? Beginning january 1, 2013, for certain filers with a principal business, office, or agency located in florida, the address to mail form 7004 has changed. Find the applicable main form under the if the. What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make.

Irs Form 7004 amulette

Address changes for filing form 7004: The address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky,. Web for details on electronic filing, visit irs.gov/efile7004. Web 13 rows address changes for filing form 7004. Web irs form 7004 tax extension:

Web 13 Rows Address Changes For Filing Form 7004.

Web irs form 7004 tax extension: Web in this guide, we cover it all, including: Web follow these steps to determine which address the form 7004 should be sent to: Web key takeaways what is form 7004?

Address Changes For Filing Form 7004:

Web for details on electronic filing, visit irs.gov/efile7004. Find the applicable main form under the if the. Please print or type your answers. The first step to finding out where to send your form 7004 to the irs is accessing the agency’s “.

Beginning January 1, 2013, For Certain Filers With A Principal Business, Office, Or Agency Located In Florida, The Address To Mail Form 7004 Has Changed.

Web hans jasperson in this article view all what is form 7004? Go to the irs where to file form 7004 webpage. Web certain addresses where form 7004 needs to be sent were changed in the states of illinois, georgia, kentucky, michigan, tennessee, and wisconsin. The irs is changing it’s mailing.

Box 409101, Ogden, Ut 84409.

(solution) then file form 7004 at: Check your state tax extension requirements. Where to mail the paper form? If you do not file electronically, file form 7004 with the internal revenue service center at the applicable address for your.