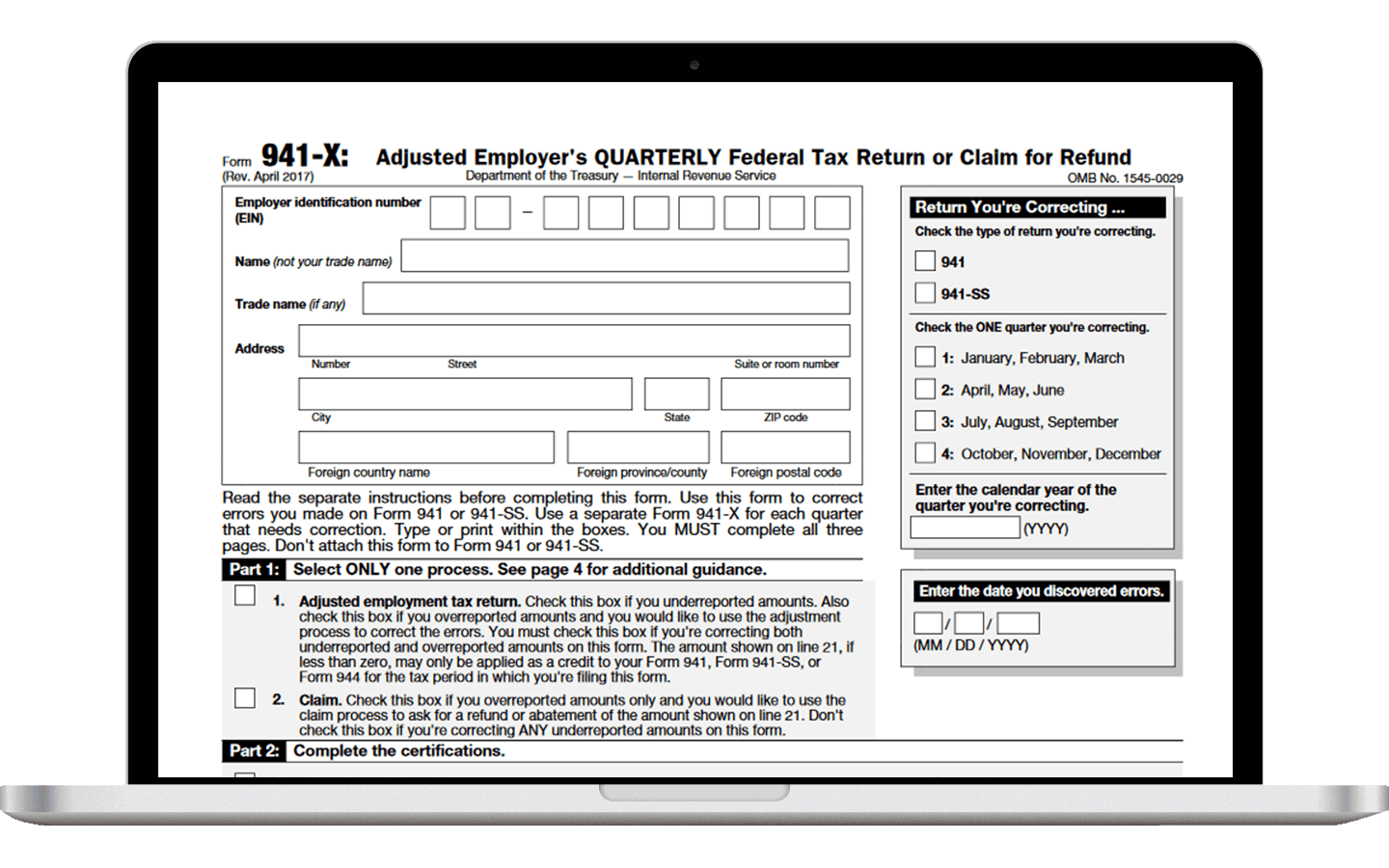

Where To Mail 941 X Form

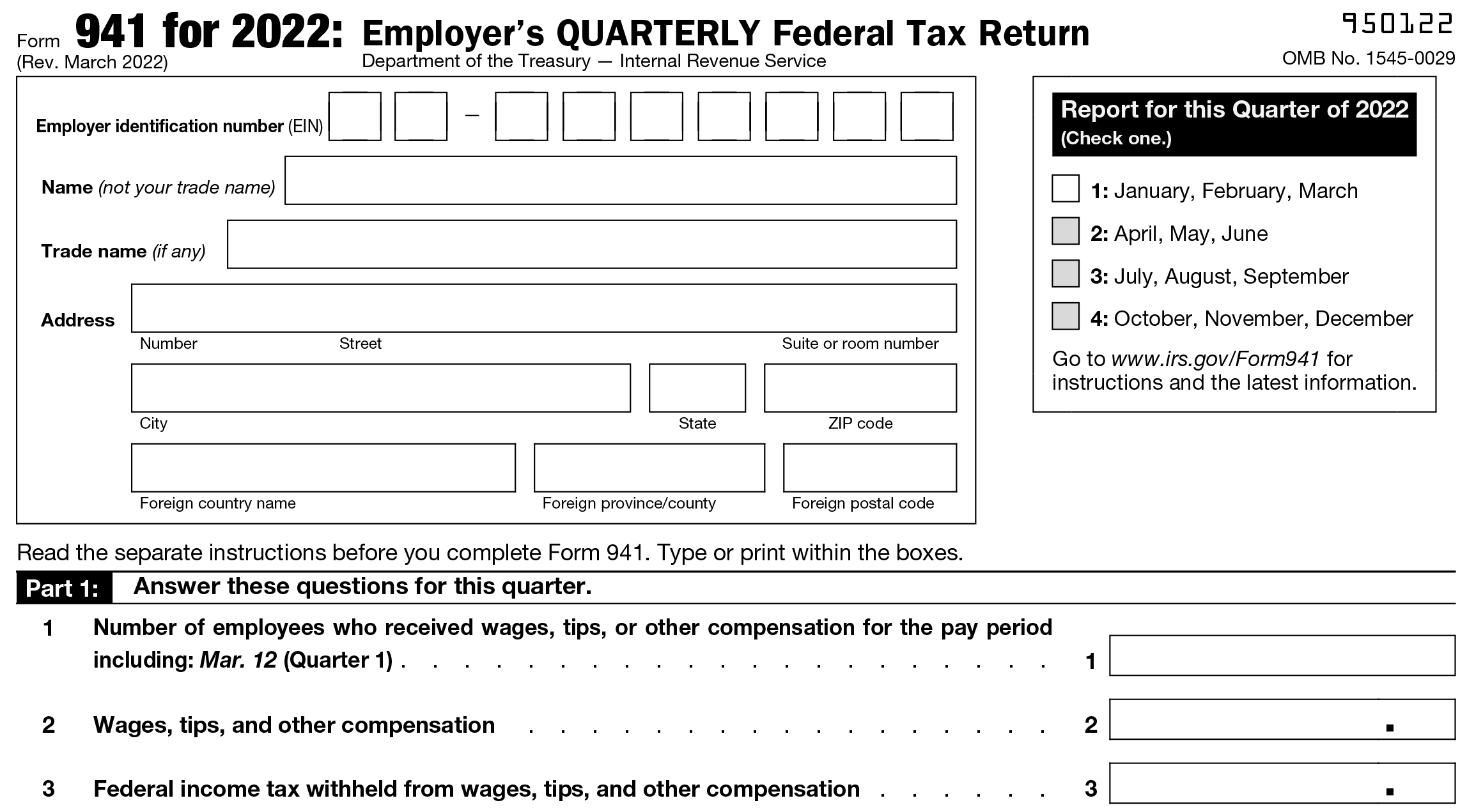

Where To Mail 941 X Form - Where to mail form 941? Employers who underreported payroll tax should correct errors in the period. The mailing address of your form 941. If you decide to paper file your form 941 return, you must mail a copy of the return to the irs. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web the irs announced that, effective immediately, the addresses where paper forms 941 are mailed have changed. The irs recommends checking any preprinted envelopes used to. Employer identification number ( ein) business name trade name, if applicable business address. Complete the company information on each page, the “return you’re. Web understanding tax credits and their impact on form 941.

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web after reading this article, you’ll know how to fill out the forms correctly and the exact mailing address to use when filing your tax returns. Where to mail form 941? The mailing address of your form 941. Web understanding tax credits and their impact on form 941. Employer identification number ( ein) business name trade name, if applicable business address. Complete the company information on each page, the “return you’re. The irs recommends checking any preprinted envelopes used to. Web mailing addresses for forms 941. Employers who underreported payroll tax should correct errors in the period.

Where to mail form 941? Web understanding tax credits and their impact on form 941. Web the irs announced that, effective immediately, the addresses where paper forms 941 are mailed have changed. Web mailing addresses for forms 941. If you decide to paper file your form 941 return, you must mail a copy of the return to the irs. Employers who underreported payroll tax should correct errors in the period. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web after reading this article, you’ll know how to fill out the forms correctly and the exact mailing address to use when filing your tax returns. The mailing address of your form 941. Employer identification number ( ein) business name trade name, if applicable business address.

IRS Fillable Forms 2290, 941, 941X, W2 & 1099 Download & Print

Web mailing addresses for forms 941. Where to mail form 941? Employers who underreported payroll tax should correct errors in the period. Complete the company information on each page, the “return you’re. If you decide to paper file your form 941 return, you must mail a copy of the return to the irs.

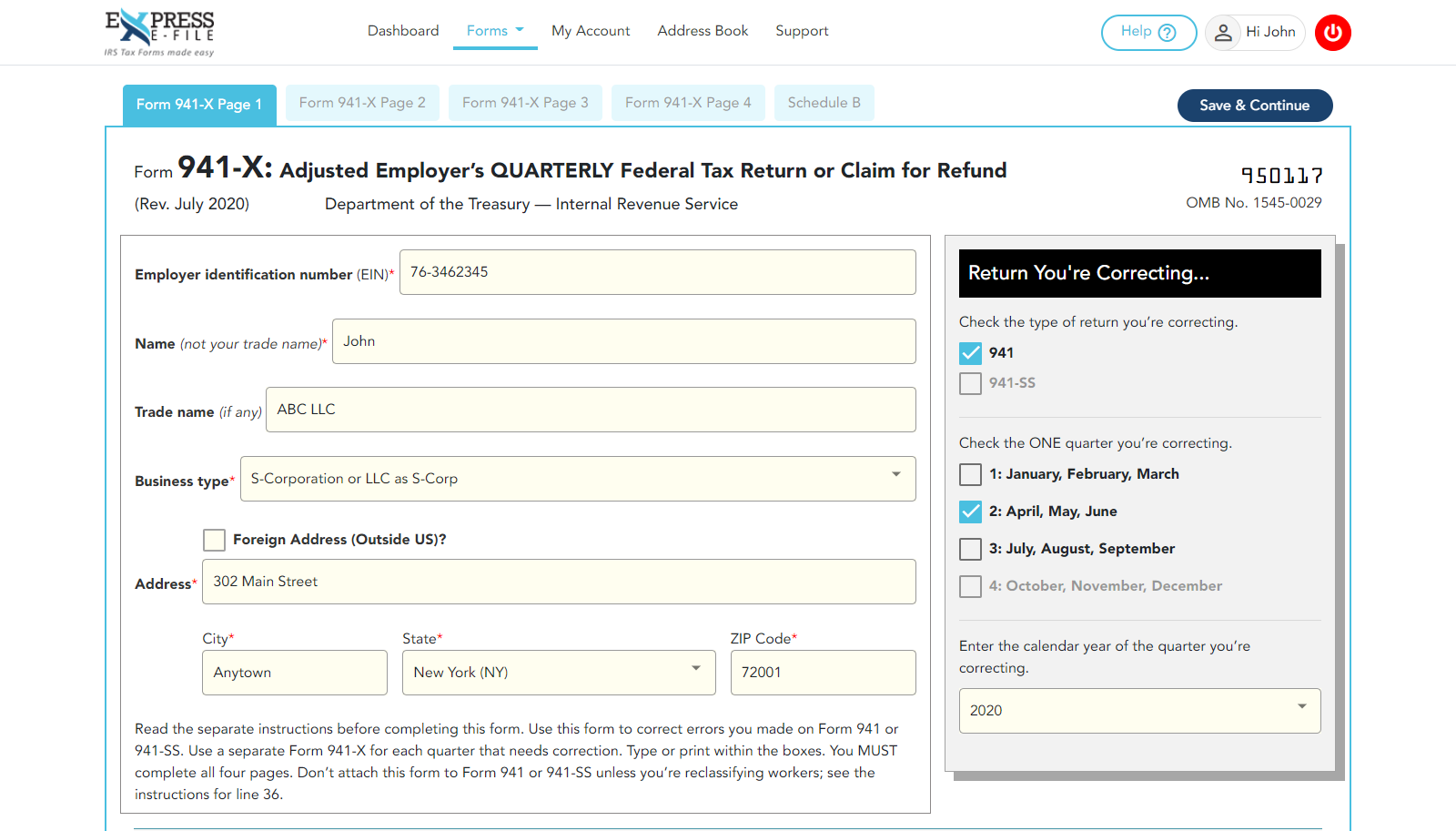

File 941 Online Efile 941 for 4.95 IRS Form 941 for 2022

Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. Employer identification number ( ein) business name trade name, if applicable business address. Web mailing addresses for forms 941. If you decide to paper file your form 941 return, you must mail a copy of the return to the irs. Web understanding tax credits and.

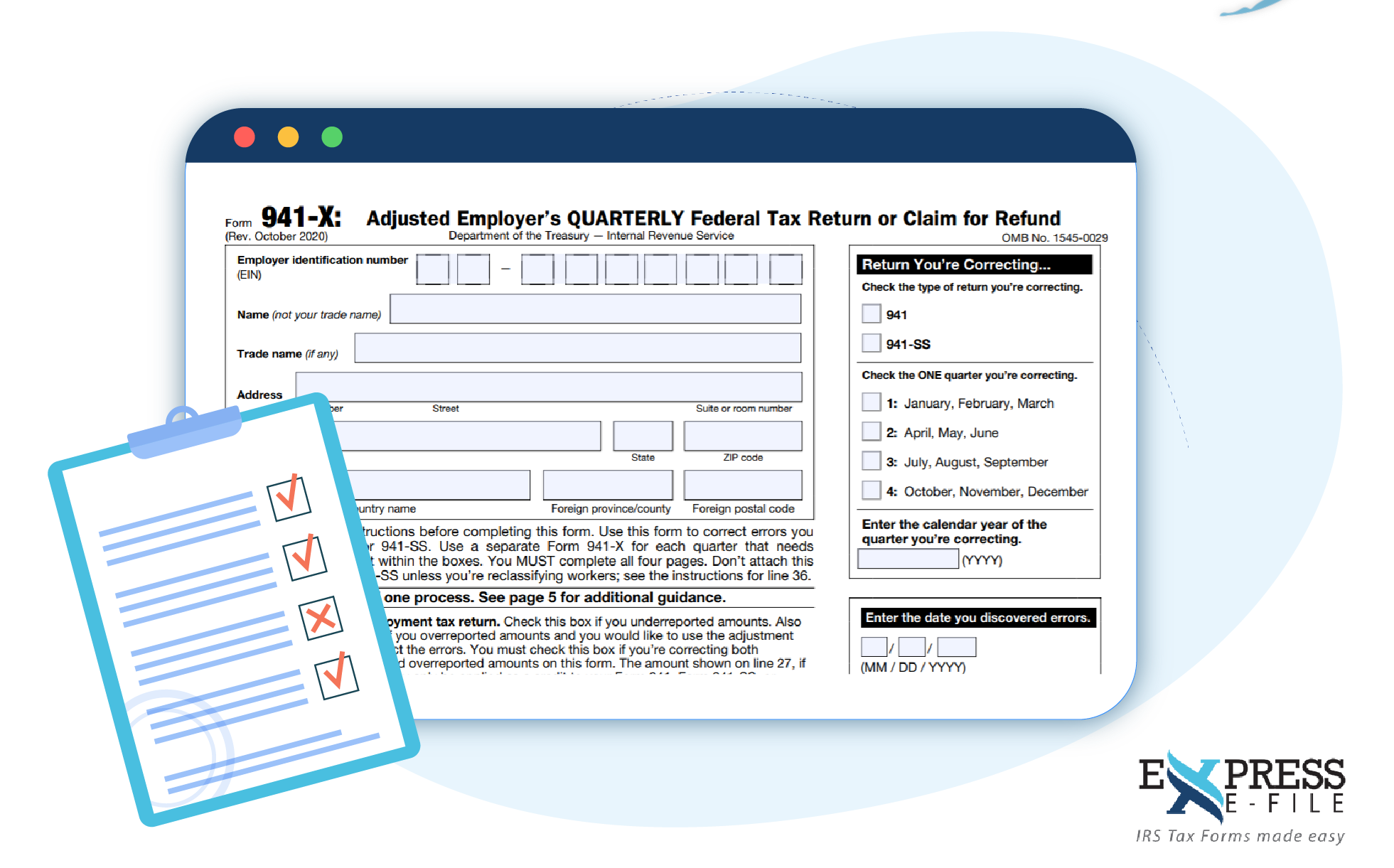

5 Facts About the Revised Draft of Form 941X Blog TaxBandits

Web mailing addresses for forms 941. Employers who underreported payroll tax should correct errors in the period. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. Complete the company information on each page, the “return you’re. Where to mail form 941?

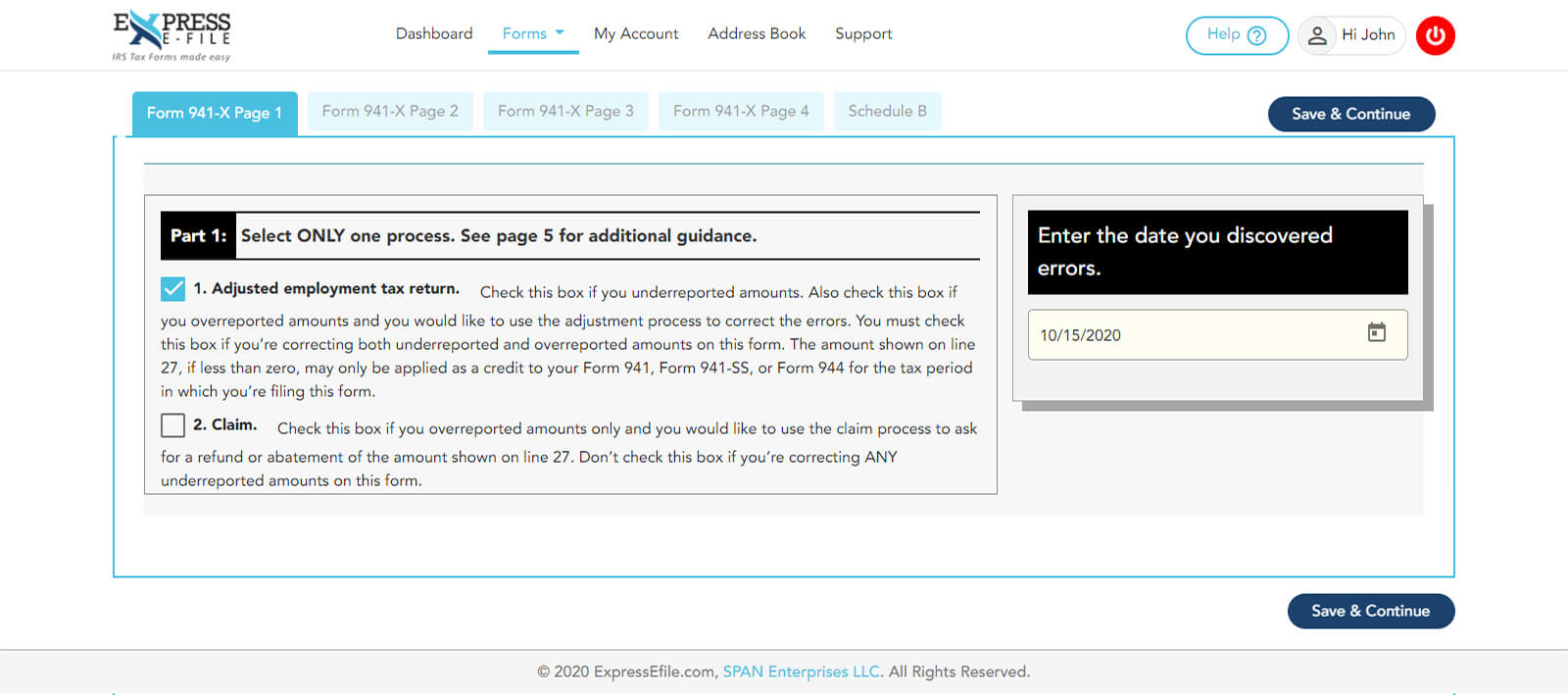

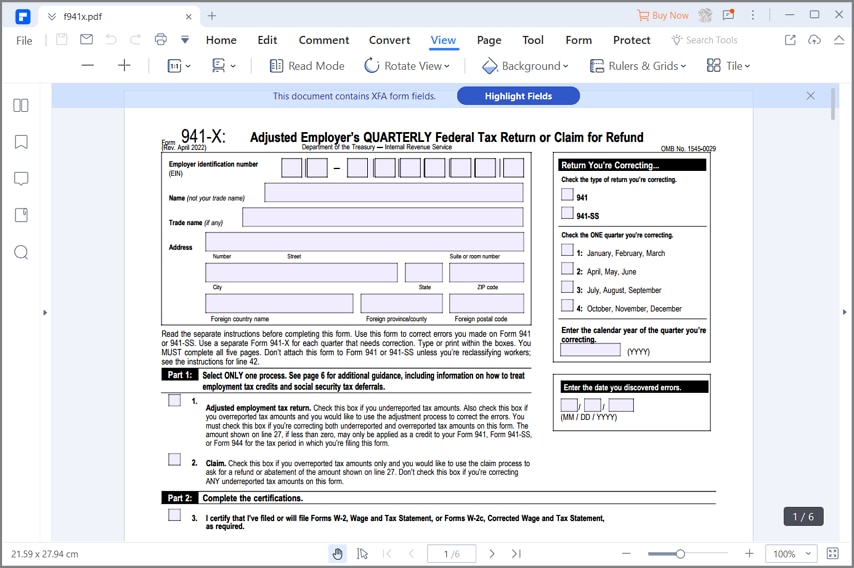

Create and Download Form 941 X Fillable and Printable 2022 941X

The irs recommends checking any preprinted envelopes used to. Employer identification number ( ein) business name trade name, if applicable business address. The mailing address of your form 941. Web mailing addresses for forms 941. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,.

IRS Form 941X Learn How to Fill it Easily

Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. Web after reading this article, you’ll know how to fill out the forms correctly and the exact mailing address to use when filing your tax returns. Web mailing addresses for forms 941. Employee wages, income tax withheld from wages, taxable social security wages, taxable social.

What You Need to Know About Just Released IRS Form 941X Blog

Web the irs announced that, effective immediately, the addresses where paper forms 941 are mailed have changed. Complete the company information on each page, the “return you’re. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. Employer identification number ( ein) business name trade name, if applicable business address. Employers who underreported payroll tax.

Create and Download Form 941 X Fillable and Printable 2022 941X

Employer identification number ( ein) business name trade name, if applicable business address. Web the irs announced that, effective immediately, the addresses where paper forms 941 are mailed have changed. Complete the company information on each page, the “return you’re. Web understanding tax credits and their impact on form 941. Employee wages, income tax withheld from wages, taxable social security.

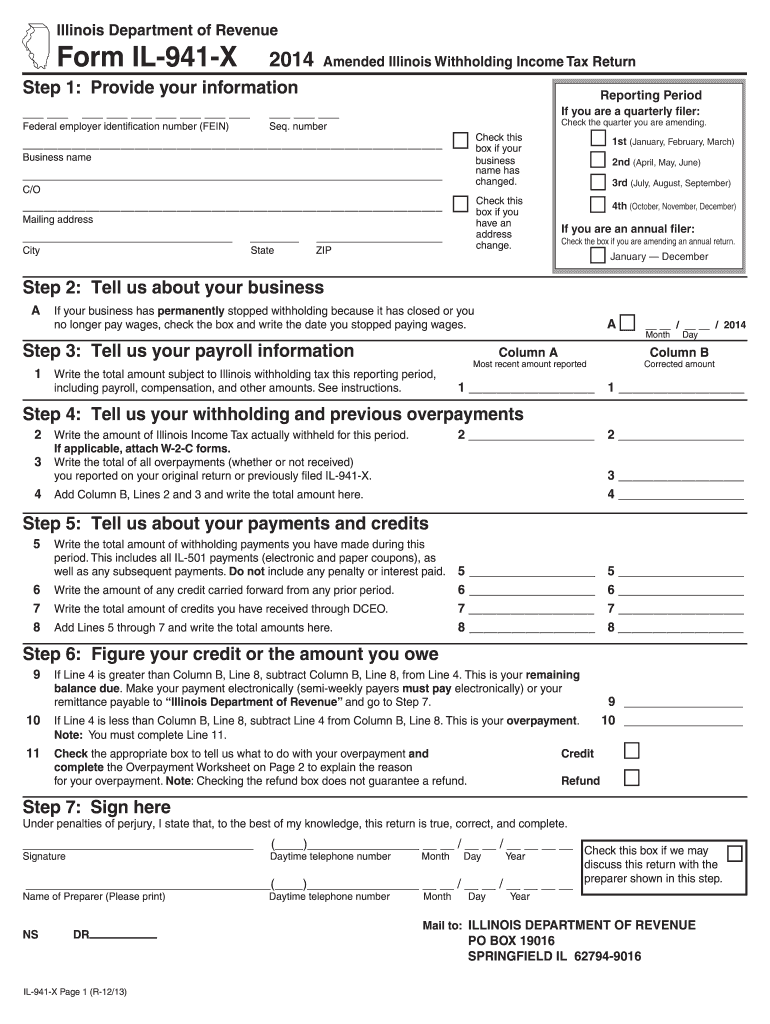

Il 941 X Form Fill Out and Sign Printable PDF Template signNow

Employer identification number ( ein) business name trade name, if applicable business address. Web the irs announced that, effective immediately, the addresses where paper forms 941 are mailed have changed. Web mailing addresses for forms 941. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. The irs recommends checking any preprinted envelopes used to.

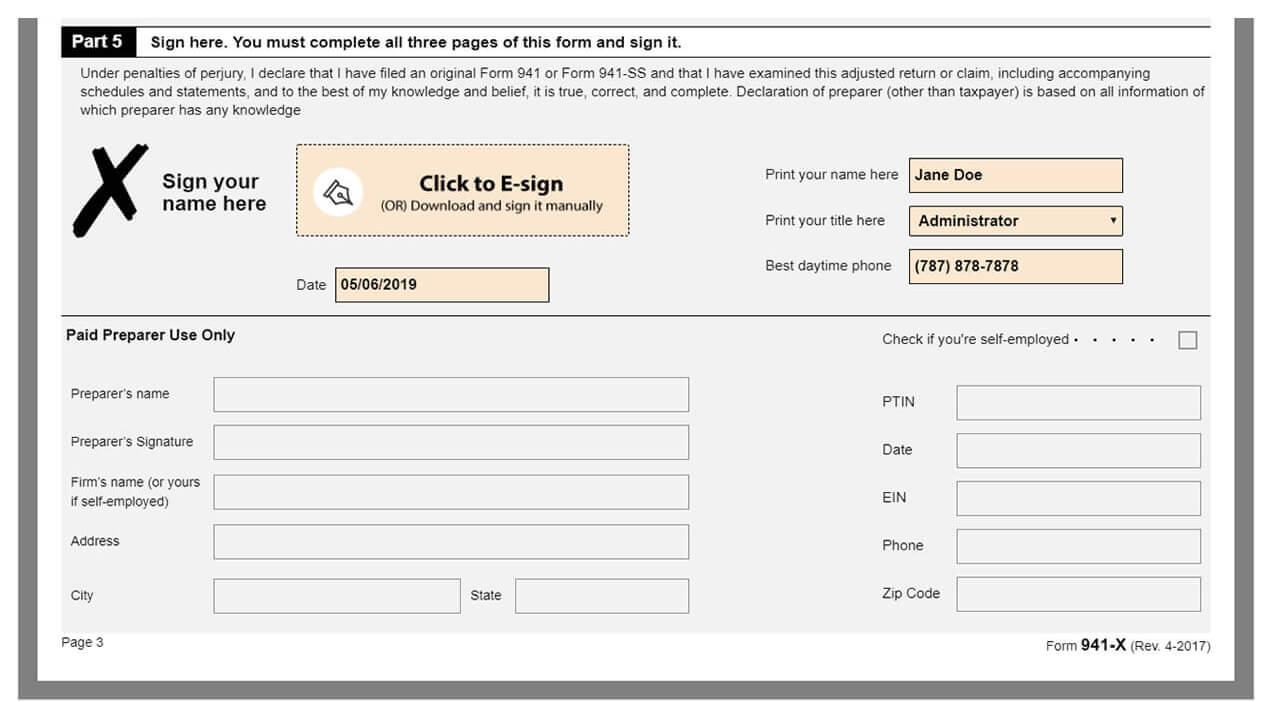

How to Complete & Download Form 941X (Amended Form 941)?

Web understanding tax credits and their impact on form 941. Web the irs announced that, effective immediately, the addresses where paper forms 941 are mailed have changed. The mailing address of your form 941. Web after reading this article, you’ll know how to fill out the forms correctly and the exact mailing address to use when filing your tax returns..

Form 941 X mailing address Fill online, Printable, Fillable Blank

Web mailing addresses for forms 941. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. Web the irs announced that, effective immediately, the addresses where paper forms 941 are mailed have changed. Where to mail form 941? Web after reading this article, you’ll know how to fill out the forms correctly and the exact.

If You Decide To Paper File Your Form 941 Return, You Must Mail A Copy Of The Return To The Irs.

Web the irs announced that, effective immediately, the addresses where paper forms 941 are mailed have changed. Web after reading this article, you’ll know how to fill out the forms correctly and the exact mailing address to use when filing your tax returns. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Where to mail form 941?

Employer Identification Number ( Ein) Business Name Trade Name, If Applicable Business Address.

Complete the company information on each page, the “return you’re. Web mailing addresses for forms 941. Web understanding tax credits and their impact on form 941. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability.

Employers Who Underreported Payroll Tax Should Correct Errors In The Period.

The irs recommends checking any preprinted envelopes used to. The mailing address of your form 941.