Where To Send Form 3520

Where To Send Form 3520 - Owner (under section 6048 (b)) internal revenue service. Go to ftb.ca.gov, log in to myftb, and select file a power of attorney. Form 3520 must have all required attachments to be considered complete. How do i file form 3520 after i e filed. Web form 3520 is a tax form used to report certain transactions involving foreign trusts. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to persuade the irs to even. Since turbotax does not have the form in the software, what shall i do? Ownership of foreign trusts under the rules of sections internal revenue code 671 through 679. Our expat tax experts are a few clicks away. Web at a glance not sure if you need to file form 3520?

Box 409101 ogden, ut 84409 form 3520 must have all required attachments to be considered complete. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to persuade the irs to even. Person to report certain transactions with foreign trusts [as defined in internal revenue code (irc) section 7701 (a) (31)] or to report the receipt of certain foreign gifts or bequests. Our expat tax experts are a few clicks away. Owner (under section 6048 (b)) internal revenue service. Citizen or resident and live outside the united states and puerto rico or if you are in the military or naval service on duty outside the united states and puerto rico, your form 3520 is due june 15, 2023. Form 3520 must have all required attachments to be considered complete. Depending on where you hold your foreign inheritance, you may have. The form provides information about the foreign trust, its u.s. Web send form 3520 to the following address.

Internal revenue service center p.o. How can i obtain a copy of irs form 3520? Web at a glance not sure if you need to file form 3520? Certain transactions with foreign trusts. Box 409101 ogden, ut 84409 form 3520 must have all required attachments to be considered complete. Our expat tax experts are a few clicks away. Web american citizens and resident aliens who receive a foreign inheritance valued at over $100,000 must report it using irs form 3520. The form provides information about the foreign trust, its u.s. Depending on where you hold your foreign inheritance, you may have. Box 409101 ogden, ut 84409.

US Taxes and Offshore Trusts Understanding Form 3520

A poa declaration revocation must be submitted using one of the following methods: A foreign gift is money or other property received by a u.s. Certain transactions with foreign trusts. Box 409101, ogden, ut 84409. Do i need to file irs form 3520?

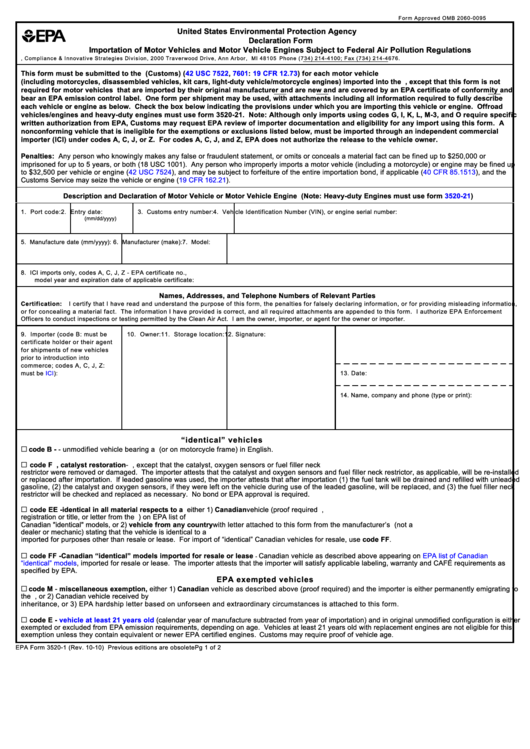

Top Epa Form 35201 Templates free to download in PDF format

Person to report certain transactions with foreign trusts [as defined in internal revenue code (irc) section 7701 (a) (31)] or to report the receipt of certain foreign gifts or bequests. Web at a glance not sure if you need to file form 3520? Box 409101, ogden, ut 84409, by the 15th day of the 3rd month after the end of.

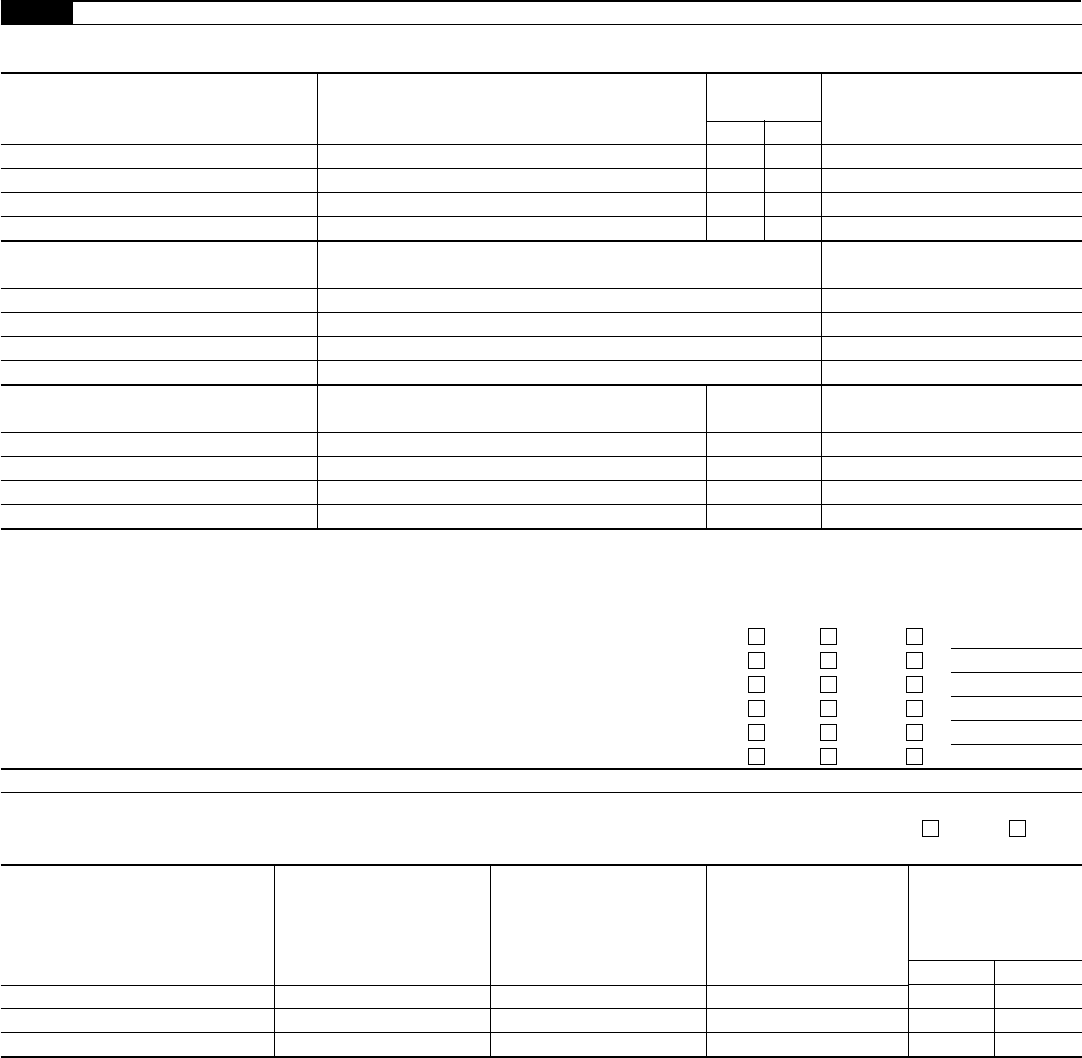

Form 3520 2012 Edit, Fill, Sign Online Handypdf

A poa declaration revocation must be submitted using one of the following methods: Web at a glance not sure if you need to file form 3520? Web form 3520 is an information return for a u.s. Completing this form requires the determining the fair market value of inherited foreign assets and property, which can be complicated. Web send form 3520.

Fillable Form 3520 Annual Return To Report Transactions With Foreign

Certain transactions with foreign trusts. Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Send form 3520 to the internal revenue service center, p.o. Completing this form requires the determining the fair market value of inherited foreign assets and property, which can be complicated. Web if you are a u.s.

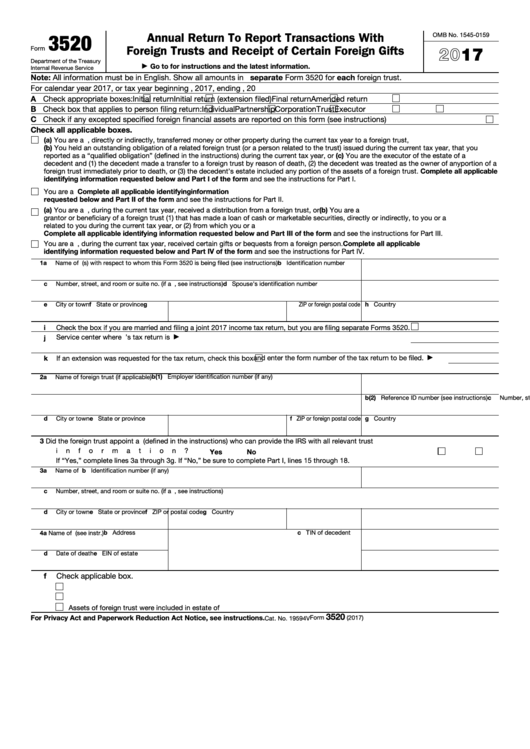

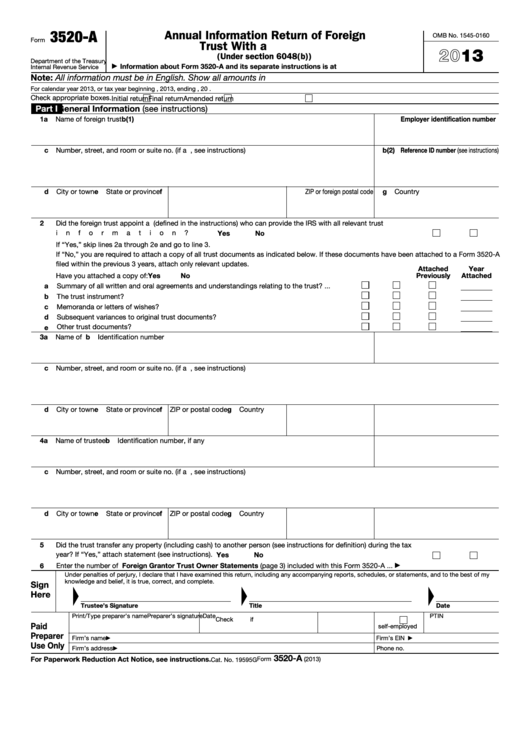

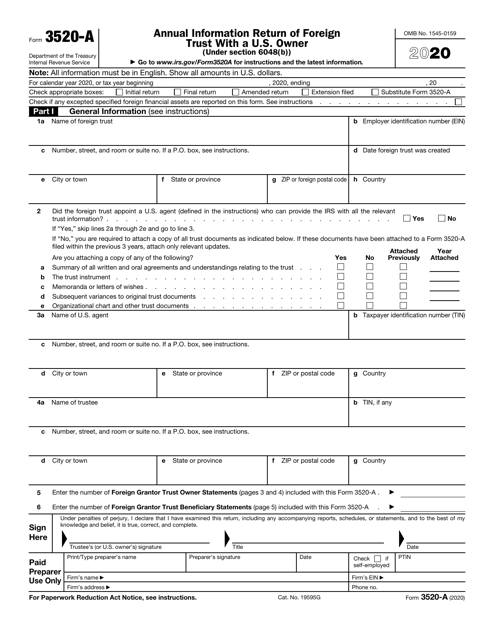

Fillable Form 3520A Annual Information Return Of Foreign Trust With

Certain transactions with foreign trusts. Ownership of foreign trusts under the rules of sections internal revenue code 671 through 679. Citizen or resident and live outside the united states and puerto rico or if you are in the military or naval service on duty outside the united states and puerto rico, your form 3520 is due june 15, 2023. The.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web what shall i do? Web american citizens and resident aliens who receive a foreign inheritance valued at over $100,000 must report it using irs form 3520. Web what is form 3520? Web the irs form 3520 reports annually information about us persons’ (a) ownership of foreign trusts, (b) contributions to foreign trusts, (c) distributions from foreign trusts and (d).

Form 3520A Annual Information Return of Foreign Trust with a U.S

Owner (under section 6048 (b)) internal revenue service. Certain transactions with foreign trusts. Form 3520 must have all required attachments to be considered complete. Web having ownership in a foreign trust and/or receiving a distribution from a foreign trust may require that the u.s. Web american citizens and resident aliens who receive a foreign inheritance valued at over $100,000 must.

IRS Form 3520A Download Fillable PDF or Fill Online Annual Information

Web the irs form 3520 reports annually information about us persons’ (a) ownership of foreign trusts, (b) contributions to foreign trusts, (c) distributions from foreign trusts and (d) major (usd $100,000+) gifts or inheritances from foreign individuals or foreign estates. Decedents) file form 3520 to report: Web what is form 3520? Box 409101, ogden, ut 84409. Go to ftb.ca.gov, log.

US Taxes and Offshore Trusts Understanding Form 3520

The form provides information about the foreign trust, its u.s. About our international tax law firm Receipt of certain large gifts or bequests from certain foreign persons. Certain transactions with foreign trusts. Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts.

Form 3520A Annual Information Return of Foreign Trust with a U.S

Form 3520 must have all required attachments to be considered complete. Internal revenue service center p.o. Web at a glance not sure if you need to file form 3520? Shall i send the irs with the amendment tax return as paper with form 3520 or can i just send form 3520 only to the irs? Ownership of foreign trusts under.

Send Form 3520 To The Internal Revenue Service Center, P.o.

Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Ownership of foreign trusts under the rules of sections internal revenue code 671 through 679. Internal revenue service center p.o. Web if you are a u.s.

The Form Provides Information About The Foreign Trust, Its U.s.

Web send form 3520 to the following address. How can i obtain a copy of irs form 3520? Web the irs form 3520 reports annually information about us persons’ (a) ownership of foreign trusts, (b) contributions to foreign trusts, (c) distributions from foreign trusts and (d) major (usd $100,000+) gifts or inheritances from foreign individuals or foreign estates. For more information, go to ftb.ca.gov/poa.

Send Form 3520 To The Following Address.

Web what is form 3520? I found out that i need to send form 3520 after finishing e filing. Shall i send the irs with the amendment tax return as paper with form 3520 or can i just send form 3520 only to the irs? Box 409101 ogden, ut 84409 form 3520 must have all required attachments to be considered complete.

Web American Citizens And Resident Aliens Who Receive A Foreign Inheritance Valued At Over $100,000 Must Report It Using Irs Form 3520.

Do i need to file irs form 3520? Our expat tax experts are a few clicks away. Web form 3115 mailing addresses. Web having ownership in a foreign trust and/or receiving a distribution from a foreign trust may require that the u.s.